Taxing Tuesday (on Monday): Trump Taxes! Surprise Money! Or Not!

by meep

Yes, I know it’s Monday, but I have big news coming out tomorrow, and I do not want to step on it.

Ok, let’s talk about those old Trump tax returns (that I think Trump leaked himself)

MSN: 5 Takeaways From 10 Years of Trump Tax Figures

1. Mr. Trump was deep in the red even as he peddled deal-making advice

“Trump: The Art of the Deal” came out in 1987. It became a best seller — and a powerful vehicle for the self-spun myth of the self-made billionaire that would ultimately help propel him to the presidency.

Mr. Trump has long attributed his first run of business reversals and bankruptcies to the recession that hit three years later, in 1990. But the new tax information reveals that he was already in deep financial distress when his master-of-the-universe memoir hit the shelves.

….

2. In multiple years, he appears to have lost more money than nearly any other individual taxpayerThe tax results for the years that followed trace an arc of continued empire building — and gathering loss.

He bought the Eastern Airlines shuttle for $365 million; it never made a profit, and he spent more than $7 million a month to keep it flying. His new Trump Taj Mahal Hotel and Casino, opened in 1990 with more than $800 million in debt, sucked revenue from his other casinos, pulling them along into the red.

And so, year after year, Mr. Trump appears to have lost more money than nearly any other individual taxpayer, according to the I.R.S. information on high earners — a publicly available database with taxpayers’ identifying details removed. Indeed, in 1990 and 1991, his core businesses lost more than $250 million each year — more than double those of the nearest taxpayers in the sampling for those years.

…..

3. He paid no federal income taxes for eight of the 10 yearsBusiness owners like Mr. Trump may also use their losses to avoid paying taxes on future income. Over the years, those losses rolled into a $915.7 million free pass, known as a net operating loss, that appeared on his 1995 tax returns, pages of which were mailed anonymously to The Times during the 2016 campaign.

…..

4. He made millions posing as a corporate raider — until investors realized he never followed through

…..

5. His interest income spiked in 1989 at $52.9 million, but the source is a mysteryAmid the hundreds of figures on 10 years of tax transcripts, one number is particularly striking: $52.9 million in interest income that Mr. Trump reported in 1989.

In the three previous years, Mr. Trump had reported $460,566, then $5.5 million, then $11.8 million in interest.

The source of that outlier $52.9 million is something of a mystery.

…..

Mr. Trump’s interest income fell almost as quickly as it rose. By 1992, he was reporting only $3.6 million.

I’m not sure that the specific outlier really tells us anything. Many people have extremely volatile incomes when you’re in that stratosphere.

But let’s ignore that for a moment: why are all these people hyperventilating over Trump’s tax returns?

They are highly unlikely to find the level of detail needed to indicate pay-offs, etc. I’ve had non-wage income sources, and the IRS mainly cares that I don’t under-report, and that I don’t classify a certain type of income in a way that’s tax-advantaged when it’s not. It doesn’t care enough for me to indicate that I made my side money, for example, on a webcast on graphing versus a spreadsheet I made to project annuities.

I can think of several potential motives, from trying to humiliate and/or expose Trump as a liar re: his supposed riches to trying to catch potential illegalities (that one is highly unlikely, I think, but I have different prior probabilities than the people seeking the returns) to just hoping that, after the Mueller report deflation, they can find that pony in the pile of horseshit.

Good luck with that.

The people who are asking for this info are not tax professionals, and they wouldn’t know how to conduct an audit of anything, much less of tax returns. I don’t even wish them well on their journey of trying to come up with a reason Hillary Clinton lost an election, because they’re not looking in the most likely place. No, not her emails. Her.

Other coverage of the Trump tax returns, so it doesn’t muddy up my lovely tax stories below:

- WaPo: New York legislature advances bill that would allow release of Trump’s state tax returns

- Twitchy: FAIL: Rep. Ocasio-Cortez wondering if this makes Trump ‘vulnerable to shady activity’ backfired just a little – AOC says we gotta look at the tax returns of Trump to see if he got bribed, etc…. without thinking that the Congresspeople who have become millionaires while in office… how did that happen, exactly? Where’s their tax returns? (hey, Pelosi…)

- Washington Examiner: New York Times story on Trump’s billion-dollar tax write off was told by Trump 15 years ago on ‘The Apprentice’

- NY Times: Decade in the Red: Trump Tax Figures Show Over $1 Billion in Business Losses

- Losing Money and Paying No Tax

- Grewal: The President’s Tax Returns

- HuffPo: Trump Responds To New York Times Report On His Taxes

- HuffPo: ‘Fox & Friends’ Hosts Laud Trump Losing $1 Billion: ‘Wow, It’s Pretty Impressive’

- Politico: Dems to decide Thursday whether to go to court for Trump’s taxes

- Politico: What we know — and don’t know — about Trump’s taxes

- Babylon Bee: Nation’s Politicians Mock Trump For Only Wasting A Mere Billion Dollars

- The Hill: Trump labels New York Times report on business losses a ‘highly inaccurate Fake News hit job’

- Forbes: Why We Took Trump Off The Forbes 400 During His Decade Of Tax Losses

- Mish: House Issues Subpoena for Trump’s Tax Returns: Another Witch Hunt?

- Ace of Spades: New York Times Bombshell Nothingburger: During the Period When Four of Trump’s Businesses Notoriously Declared Bankruptcy, Trump Himself Suffered Losses and Paid Little Income Tax on the Money He Was Not Actually Making (Due to the Bankruptcies)

- Althouse: I’m not interested in Trump’s tax returns because I don’t trust anyone to understand and explain them accurately.

- Jane the Actuary: Why I don’t care about Trump’s tax return

The last two linked items reflect my attitude the most.

Jumping off from Althouse, the kind of people who do understand that type of tax returns do not explain these things for free. They generally do not need to go on TV to get clients. They do not work for newspapers or TV news programs (because they can make more money doing actual tax work), and they certainly aren’t going to do an analysis for free.

Maybe there are a couple such people. But it’s going to be not very interesting, I bet.

Jumping off from Jane the Actuary, I find it highly unlikely there is anything of obvious illegality in there. It’s not like Trump filed his own taxes. He paid people to put that stuff together. It’s not easy to get away with elaborate tax fraud for decades, if that’s what you’re looking for. If you’re trying to find evidence for bribery by foreign agents… what level of detail do you think you’ll find?

I think it would be very illuminating if all members of government were required to publish their tax returns while they were elected officials. I would love to see Nancy Pelosi’s and Bernie Sanders’s returns, for example. How, exactly, did they get so rich on their politicians’ pay?

SURPRISE MONEY IN ILLINOIS

I am highly skeptical about an “extra” $1.5 billion showing up in the middle of a contentious fight over budget and taxes.

Let’s go with the press release, which has a pensions hook:

May 7, 2019

Dear Leaders, Appropriations Chairpersons and Appropriations Spokespersons:

We write to share the good news that Illinois received significantly stronger-than-expected revenues in April.

More than $4.1 billion in individual and corporate income tax revenues were deposited into the General Funds in the month of April 2019, up $1.14 billion or 38% from April 2018 income tax deposits of $2.999 billion. This is also more than $1.5 billion more than internally projected for April 2019.

A number of factors likely contributed to this increase, including the performance of the stock market, better federal reimbursement for Medicaid, the elimination of the federal state and local tax deduction and additional changes in the federal tax law that meant many taxpayers didn’t withhold sufficient taxes through payroll deductions, backloading their end-of-year tax payments. Anecdotally, strong revenue collections occurred in many other states in April. Additional data and analysis are required to present a comprehensive explanation for the revenue shift, and our staffs are working to provide the General Assembly with a more detailed analysis.

As an immediate result of the strong April performance, coupled with revenue collections year-to-date, the State of Illinois will be able to address most of the $1.6 billion shortfall in the enacted FY19 budget because of the April revenues alone. GOMB and the Department of Revenue will be increasing the forecast of general funds individual income taxes by $1.249 billion and general funds corporate income taxes by $186 million, for a total revision of $1.435 billion, a revision of approximately 7% from February 2019 income tax estimates.

Additionally, based on this strong performance, the Department of Revenue has also re-evaluated its FY20 projections. DOR is also projecting that income tax revenue for the FY20 general funds budget will be roughly $800 million higher than initially projected, or nearly $22 billion instead of $21.18 billion. This represents income tax collections roughly 4% higher than the initial base projections.

…..

Governor Pritzker remains committed to a financially responsible budget that addresses Illinois’ outstanding obligations, and recommends that these additional revenues can be dedicated to the state’s statutory FY20 pension payment.

……Sincerely,

David Harris

Director

Department of RevenueAlexis Sturm

Director

Governor’s Office of Management & Budget

[Emphasis added]

So…. what does federal under-withholding have to do with state under-withholding?

— Mary Pat Campbell (@meepbobeep) May 9, 2019

Still not understanding it.

Again, I have to determine my state withholding independently of the federal.

Do we have any tax prep people here who can explain that?

Look, I’m not a personal tax expert, but I know how I’ve done my own withholding, and that I had to do federal, NY, and CT all separately. My understanding is that state income taxes generally don’t let you deduct for federal taxes (unlike federal allowing it the other way, even with the SALT cap (SALT CAP ZERO! NOW!))

And my confusion stemmed from me primarily being a wage earner — as opposed to owning a business and having business income. I forgot that the TCJA changed the definition of taxable income!

Ah, thank you. Obviously, I mainly work for other people, so these aren't things in my own income.

— Mary Pat Campbell (@meepbobeep) May 10, 2019

I remember various groups pointing out that perhaps states should decouple their defn of income from federal, so they don't get whipsawed by fed tax changes

The tax code is very complicated, and I forgot that there were issues with the states simply taking the federal definition of taxable income … because the specific technical details I dipped into were for regular wage-earners and (for my day job) the effects on life insurers (and let me tell you, I got a lot of mileage on the changes to insurance companies).

Now, here’s a different response:

In response to the

— Hannah Meisel (@hannahmeisel) May 7, 2019GovPritzker</a> administration’s news on a $1.5B windfall in income tax revenue, <a href="https://twitter.com/ILComptroller?ref_src=twsrc%5Etfw">ILComptroller sends out one of the odder press releases I’ve even seen saying she “can’t confirm or deny” the revenue figure and “urges caution.” pic.twitter.com/ZUOnTTaJ3o

Let’s look at that press release:

“Last week in testimony before the House and Senate Appropriations Committees, I was pleased to announce that our April revenues were $1.5 billion higher than expected. However, I also sounded an important note of caution about those revenues. It is important to keep in mind that we still face a $6-to-$8 billion backlog of pending bills with no dedicated revenue stream to pay them. We have aggressively targeted the state’s highest-interest-accruing bills with those receipts, bringing the backlog lower than it would otherwise be, to $6.07 billion as of today.

First, let’s stop right there. What do bills and revenues have to do with each other? (I’m not joking about this). The bills do not create the revenues, nor vice-versa. Not in government.

So, I want to know what the cause of higher-than-expected revenues. Not about the bill backlog, which we already know about.

“While we cannot confirm or deny the Dept. of Revenue’s projection of $800 million more than expected for Fiscal Year 2020 at this time, we are hopeful and will continue to research this possibility thoroughly. My office has prioritized pension payments and debt service since I took office and that will be our policy going forward. “

And that’s the full press release. My takeaway is that they don’t know why there was more in revenues, and whether that will extend to the full year. I can respect that.

GRADUATED TAX STUFF

I was going to put this in the tax stories below, but I want to do a quick refutation here.

CTBA at Medium: States with graduated income taxes are more than twice as likely to cut taxes as to raise them

So, here is a pie chart.

Notice something missing?

What’s missing is whether level tax states increased or decreased taxes.

I’ll explain why in a moment.

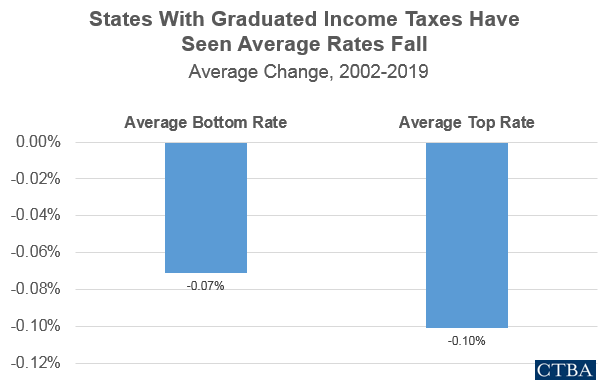

Here’s another graph:

The reason I’m asking this is if all states, whether with graduated income taxes, or with level income tax rates, generally decreased their tax rates… then it may be something more specific to the time period being investigated, as opposed to something indicative of graduated tax rates.

Now, if those level tax states were much more likely to lower their tax rates than the graduated tax places, or at least were less likely to raise tax rates, then you’d actually be proving something closer to the cause-and-effect case.

I leave it to somebody else to explain to the CTBA about how this sort of inductive reasoning works. They’re not at all showing whether graduated rates make it more or less likely to increase or decrease tax rates.

The other issue is that there are rates going back to 2000 that are covered…and I thought maybe there was something untoward that the two prior years were excluded from the analysis. However, I went to look, and the way the Tax Foundation presented the info for 2000-2001 was different from that of 2002 and after. So that seems fair.

TAX STORIES

- Dem Candidates Are Generous — But Only With Other People’s Money

- HuffPo: Gavin Newsom Introduces Tax Breaks For Tampons, Diapers In Revised Budget

- Wirepoints: The CTBA’s Latest Deception To Promote The Graduated Income Tax – Quicktake

- Property tax freeze ‘a lame, transparent and phony attempt’ to hoodwink Illinoisans, Glennon says

- Governing: New York AG Sues Trump Administration and IRS

- Illinois Policy Institute: ILLINOIS SENATE DEMOCRATS PASS PROGRESSIVE INCOME TAX PLAN, PRETEND PROPERTY TAX FREEZE

- NYT: They Got Rich Off Uber and Lyft. Then They Moved to Low-Tax States.

- Chicago Tribune: Gas taxes and driver’s license fees would go up dramatically under Illinois Senate proposal

- Crain’s Chicago: Emanuel’s new pension Rx: tax high-end retirement income

- Chicago Tribune: Is a graduated income tax a Trojan horse to soak the middle class? Neigh!

- Illinois Policy Institute: PRITZKER TAKES 1 STEP FORWARD, 2 STEPS BACK ON TAX HIKE PUSH

- Illinois News Network: Lawmakers at odds over surprise $1.5 billion surplus

- Bill would more than double state gas tax (yes, this is also Illinois)

- Emanuel Supports Retirement Income Tax, But is it Too Taxing on Seniors?

- Second Illinois policy group pushes to tax retirement, AARP pushes back

- Florida Watchdog: Report: Tax relief one of reasons Florida tax revenue growth is lower than other states

- Tax Foundation: Connecticut Payroll Tax Proposal Raises Difficult Questions — ugh, this “cleverness” to try to avoid the SALT cap for people even richer than me is going to screw me, I know.

- NPR: House Democrats Subpoena Trump Tax Returns

I don’t think Trump’s tax returns are really going to do much for the 2020 election, but y’all waste your time, Dems.

TAX TWEETS

Reporter to Sarah Sanders: "Where is President Trump hiding his tax returns"? Sarah: In a very secure place where they won't be found". Reporter: "Where"? Sarah: Underneath Obama's college records, passport application, grad school records,& selective service registration"

— Dr.Darrell Scott (@PastorDScott) May 11, 2019

So Democrats want to see the tax returns of a billionaire that became a politician?

— Charlie Kirk (@charliekirk11) May 12, 2019

Wouldn’t a smart person want to see the tax returns of politicians who became millionaires in office?

How the 6-year-old son of a deceased service member ended up in the highest tax bracket https://t.co/aaVfX8lmaU

— The Wall Street Journal (@WSJ) May 12, 2019

LOL

— Raw Story (@RawStory) May 12, 2019

Trump’s nickname #Brokeahontas trends worldwide on Twitter after his tax returns revealed he’s a lousy businessmanhttps://t.co/t1o5EUZg5o

Or you could just release your taxes.

— Rick Wilson (@TheRickWilson) May 11, 2019

But we know you won't, #Brokeahontas. https://t.co/zNHXExtTUV

New York is my heart and my home. Never considered living anywhere else. But the taxes and the rain are pushing it.

— Mike Francesa (@MikeFrancesa) May 12, 2019

Here is Hillary Clinton's hypothetical about a candidate calling on China to hack Trump's taxes, and why Republicans putting partisanship over national security is a dangerous thing. pic.twitter.com/p1TIH6kCMx

— Tomthunkit(@TomthunkitsMind) May 12, 2019

When we say “tax the rich,” we mean nesting-doll yacht rich. For-profit prison rich. Betsy DeVos, student-loan-shark rich.

— Alexandria Ocasio-Cortez (@AOC) May 11, 2019

Trick-the-country-into-war rich. Subsidizing-workforce-w-food-stamps rich.

Because THAT kind of rich is simply not good for society, & it’s like 10 people.

Wouldn’t you think someone who personally lost over a BILLION dollars (“more than nearly any other taxpayer in America”) be vulnerable to shady activity to get out of that hole?

— Alexandria Ocasio-Cortez (@AOC) May 8, 2019

If they became the most powerful public servant in America, wouldn’t you want to see their taxes? https://t.co/h22XNU1bl4

Dear lord, I do not find cluelessness cute once one is above 10 years old.

You mean the same Betsy DeVos that has given more money to charity, & school choice causes for minority kids, than you have made in your entire lifetime? That Betsy DeVos?

— Dan Bongino (@dbongino) May 12, 2019

Your ability to humiliate yourself and your supporters on this platform is absolutely peerless. What a joke https://t.co/S1twZQEBTY

Everyone knows increasing cigarette taxes reduces smoking right? Wrong. PA increased the cigarette tax from $1.60 to $2.60 in 10/16 (38% increase). Smoking rate increased in adults by almost 1% the next year. Maybe it was the 40% ecig tax that enacted at the same time? Ya think? pic.twitter.com/9XhKEy5h2A

— Dead Vape Shop (@fatcatvapor) May 12, 2019

when you forget the taxes are due and you have to go to H&R Block pic.twitter.com/3zHX8qrmUq

— all killer no philler (@VeryFakePhil) May 12, 2019

SACKED FOR ASKING A QUESTION

— MikeSpikes Shaddow (@MikeSpikeSS) May 12, 2019

Engineer: “It would be good to see higher-wage earners given a tax break.’’

Shorten: “We’re going to look at that”

Next Day his company, QLD Ports gives him the sack for breach of contract.#FreedOfSpeech Much?https://t.co/pWgFCwtIz6

And CT just wants to add MANY more taxes and tolls. People are fleeing this state because of the clueless politicians in CT!

— John Powers (@jmrcom) May 12, 2019

A tariff is a tax on imports that Americans pay, not the Chinese.

— Kay Zed (@KayZed14) May 12, 2019

You are raising taxes and you don't even realize it.

Or do you…

GOOD F—KING RIDDANCE! and bar them from returning UNTIL THEY PAY EVERY PENNY BACK OF THEIR TAX AVOIDANCE that has robbed ordinary decent humans of their quality of life… pic.twitter.com/mLvhEWtiFI

— MISS WEST TO YOU (@MISSWESTTOYOU1) May 12, 2019

Hey now, the UK could do as the US does and make it really tough to escape US taxes. Best wishes.

Related Posts

On the Bailouts That Didn't Happen, Part 2: State and Local Governments

Not With a Bang, But a Whimper: Demographic Decline Undermines Public Finance

Meep Quicktake: Congressional Bailout Bill Status and Positioning