Chicago and Illinois Update: Summer 2019 Catch-Up Edition

by meep

I’ve not been blogging about Chicago/Illinois pensions much this summer… mainly because I’ve been very busy and been having pain issues. (I’m trying a new treatment next Thursday…here’s hoping it works!)

But it seems like a good time to do a summer wrap-up over what’s been going on. Especially since summer ends on Sunday.

I started this post back in the beginning of July, to give you an idea (I have 20 other posts in draft, too).

But first… a darkly amusing cartoon.

NOT A FINE BOI, THAT’S FOR SURE

Eric Allie at the Illinois Policy Institute:

If you are not familiar with the meme, here’s some background.

THE STORY, IN SHORT: CHICAGO AND ILLINOIS FINANCES ARE SCREWED

Let me set the scene. I’ve blogged extensively about both Chicago and Illinois finances since the beginning of this blog.

These finances are not appreciably better than the last time I blogged about it. Both Chicago and Illinois have amassed ginormous pension obligations, not to mention that they’ve been having to issue bonds to cover other operational costs (people keep forgetting pension contributions are operational, not capital, costs).

While both the city and state look to increase taxes to cover some of these legacy costs, as well as to feed whatever goodies-packed agenda the new mayor of Chicago (Lori Lightfoot) and new governor of Illinois (JB Pritzker) have in mind. While they are attempting to tax, the Illinois taxpayers are increasingly becoming ex-Illinois taxpayers.

The following things have happened this summer:

- New mayor Lightfoot took a look at Chicago finances, “hinted” at a state bailout, and new-ish governor Pritzker said no. She has tried this a couple times.

- Downstate (aka not Cook County or Chicago) pensions are not in much better condition than Chicago’s. Some have been touting a consolidation of these loads-of-little-plans… and maybe a state bailout.

- During Rauner’s term, a bill limiting teacher pension spiking was passed. This has been undone under Pritzker.

- Chicago teachers are threatening a strike. Because money. Which we know Chicago is flowing in.

- Both the city and state CAFRs were late. The city’s was late by about a week or so. The state’s… I believe it was over a month.

- There has been a minor brou-ha-ha over one of the items in the Illinois CAFR, as a liability that had not been explicitly counted for is now on the balance sheet. And officials act like it’s nothing important.

- A lawsuit over Illinois bonds was thrown out of court. The lawsuits were based on the point that the bonds weren’t legitimately issued due to a number of conditions (exceeding state debt limit, not a specified purpose)

- There is no way in hell Chicago can cover the pension contribution schedule that Rahm Emanuel had agreed to when he was mayor. Nor pay whatever the teachers want. Forget about the other public employee groups.

- Pritzker has been hawking a progressive income tax for the state, which requires amending the Illinois state constitution. The state income tax is currently flat rate, as per the constitution.

- Some have noted that if you’re going to open up the state constitution for amendment, why not amend the pension protection clause? As things stand, even COLAs and co-pays can’t be adjusted, even decades before someone retires.

I believe that covers most of the finance-related bases.

Below, I am going to group Chicago & Illinois stories since July, based on the threads I have at the Actuarial Outpost (it’s just easier, and I’ll provide you with the thread link for each one). These will be in no particular order. Some items may have popped up in Taxing Tuesday in prior weeks, but it does help to have everything in one place to look at.

CHICAGO DEBT WATCH

Chicago debt watch thread at the Actuarial Outpost. It started in 2013, and I have never lacked for stories to fill it.

- No Good Options as Chicago Seeks Revenue

- Lightfoot turns to service tax after Pritzker rules out state takeover of city pension funds

- Chicago’s annual financial report is late – again

- Greising: Can Mayor Lightfoot’s Growing Team Dig Chicago Out of its Financial Mess? – remember Betteridge’s Law

- Chicago’s 2018 CAFR — fwiw, it had an end-of-June date, but the Truth in Accounting guys were looking every day, and it wasn’t posted until July 5.

- No surprise: pension woes weigh heavily on Chicago’s balance sheet

- Truth in Accounting report paints grim picture of Chicago’s finances, increasing taxpayers’ burden

- Truth in Accounting: Chicago Earns ‘F’ Grade for Fiscal Health

- Wirepoints: Chicago’s Lightfoot demands a state taxpayer bailout, then offers CTU a 5-year contract, 14% raise?

- Chicago inviting buy side to town in September

- Wirepoints: Denied pension bailout, Lightfoot makes generous offer to Chicago Teachers Union

- Chicago Public Schools plans up to $432 million of refunding bonds

- Chicago mayor lays out grim budget picture

- Lori Lightfoot’s team says ‘nothing off the table’ in addressing $838M budget deficit

- Chicago mayor sends signals to the muni market, without details

- Will Chicago Be the Largest U.S. City to Declare Bankruptcy?

- Bankruptcy: Pain With Gain for Chicago

- Chicago’s new administration will take fiscal message directly to investors

- Lightfoot’s end-of-August state of the city speech

From that last, I will excerpt:

We have also started looking at our borrowing practices

and making changes there to save money. For example,

we will be replacing high-cost debt – kind of like how

homeowners refinance their mortgages – which we expect

will generate $100 million in savings alone.

Sigh. Okay, if you switch out higher-coupon bonds with lower-coupon/-yield ones, fine. That is a refinancing.

When I started as Mayor on May 20th, we walked into a

projected deficit for next year of $1 billion. Yes, that’s

Billion with a B.As a result of all of the efforts we have made to date, and

changes in our forecasting, that number has decreased by

almost $200 million dollars. But that still means that the

budget gap for 2020 is $838 million.…..

A third of the gap comes from increased pension costs.Another third increased labor costs

So… you’re looking at increasing those costs?

To put this into perspective, folks, for every dollar you

pay to the city, 80 cents goes to pay for the cost of

personnel and benefits, along with pensions.

So, how much of that 80 cents goes to the old pension liabilities?

But let me be clear: I don’t see the provision of pensions

or city workers as the problem. The key problem is the

decades’ long failure to meet our pension obligations and

fix the structural problems that have led to this crisis.…..

While we are working toward balancing this year’s

revenue with this year’s costs, two years from now – in

2021 – we will have to figure out how to pay for the

increased annual cost of over $200 million for public

safety services.Followed by another increase of $400 million for our

municipal and labor pensions the year after that.

In other words, no matter what we do for this coming

budget, Chicago will be on the hook for over half-a-billion

in new pension obligations over the next three

years.But as I made clear many times, pension obligations are a

challenge we must meet. Dedicated city workers have

fulfilled their careers with the agreement that they will

retire with the dignity and the certainty pensions afford.Our obligations are not optional.

And I will take every action necessary to fulfill the

promise we made.

Including declaring bankruptcy? Oh wait, that would mean cutting promises.

But it will inevitably occur, because Chicago can’t actually afford the pensions.

She does go on to talking about the other Illinois towns having pension problems. Yep, I would say almost all of them are. So you can all be bankrupts together.

ILLINOIS DEBT WATCH

Illinois debt watch thread at the Actuarial Outpost. That has been going on since 2010.

- Ralph Martire: To resolve Illinois’ fiscal shortcomings, state needs tax reform

- Illinois last state in nation to file official budget report – that was JUNE.

- Illinois CAFR – has the date August 22 inside.

- The press release on the CAFR: August 29

- Illinois governor disregards state actuaries to claim “balanced” budget

- Moody’s weighs in on Illinois budget, spending, but says pension woes still harm local government

- Illinois landed a balanced budget this year. But hold the phone. There’s more to it.

- Illinois fails to recognize the importance of the CAFR

- Hedge fund, IPI chief sue Pritzker to void $14 billion of state debt

- Hedge fund and Illinois Policy Institute head claim $16 billion of GOs illegally issued

- Hedge Fund Sues Pritzker to Void $14 Billion of State Debt

- Court battle could decide how Illinois governments can spend gas tax money

- Late financial document could further hurt Illinois’ bond rating – Illinois’s actual fiscal situation is a bigger factor, of course

- Muni analysts unfazed by legal challenge to Illinois bonds

- The case of the missing Illinois CAFR

- Is the Lawsuit To Invalidate Certain Illinois Bonds Frivolous? An Education is at Hand. – Wirepoints Original

- Spending cuts have been made; state must keep focus on revenue

- Delays from State on Budget Spending Details

- One item to look at when Illinois’ (late) financial report finally appears

- Illinois has path to fiscal stability, says deputy governor

- Public finance watchdog warns Illinois taxpayers about reports from credit rating agencies

- Tillman’s lawyer actually claims lawsuit to invalidate bonds “will help the state and its ability to borrow” and Wirepoints agrees – sounds good to me. They need to stop borrowing.

- Some Harvey city phone lines, including non-emergency police and fire numbers, cut off after missed payments

- ‘I would be shocked’: $14 billion Illinois bond fight a longshot

- Editorial: Pension, bond lawsuit should get its day in court

- Illinois’ credit rating still a notch above junk status, but Fitch says state’s outlook now stable

- Judge denies suit over IL debt, says court can’t rule if lawmakers violated state constitution’s ‘specific purpose’ rule

- Illinois Debt Boosted After $14 Billion Bond Challenge Dismissed

- Judge slams petition challenging Illinois bonds as political

- Illinois CAFR arrives, late and covered in red ink

- Illinois’ financial decay spreads to cities across the state

- A case for Illinois to test the primary market after GO ruling

- Illinois Hit By Record $47 Billion Loss, Ignored by Regular Media. Why? – Wirepoints Original

- Jim Dey | Sharing just portion of state’s finance numbers is fully misleading

- Letter to the Editor | Columnist didn’t check all facts

- Jim Dey | Going to the mattresses with manipulator Mendoza

- Illinois Comptroller’s Office Doubles Down, Calls Wirepoints’ Critique “Fringe, Apocalyptic Ranting”: Our Response.

- Gov To Agencies: Prepare For Budget Cuts

By the way, in the CAFR press release, we get this:

A primary reason for delay in the release of the fiscal year 2018 CAFR was the need for the new administration to try to piece together data lost by an IT vendor working for the previous administration’s departments of Healthcare and Family Services and Human Services.

This text looks odd on the press release page, on my browser:

I don’t think it means anything, other than some sort of clumsy copy & paste or something. It popped out in the page while I read it.

As for something more substantive: I find the OPEB brou-ha-ha interesting. The PR person for the state comptroller wrote:

Had your columnist Jim Dey called the Illinois Office of Comptroller for comment before accusing us of “an intentional misdirection play” in his Sept. 10 column, we might have been able to save him from getting his facts wrong and misleading News-Gazette readers.

He bought hook, line and sinker the (Dey’s word) “apocalyptic” rantings of a fringe website that our office highlighted only rosy economic news from the Comprehensive Annual Financial Report (CAFR) because we wanted to make Gov. J.B. Pritzker look good and former Gov. Bruce Rauner look bad.

….

“The state’s total assets were approximately $53.9 billion on June 30, 2018, a decrease of $400 million from June 30, 2017. The state’s total liabilities were approximately $248.1 billion on June 30, 2018, an increase of $33.3 billion from June 30, 2017. The state’s largest liability balances are the net pension liability of $133.6 billion and the other post-employment benefits (OPEB) liability of $55.2 billion.”That $55.2 billion OPEB number is a new calculation required to be included in every state’s CAFR’s this year, which made most states’ numbers jump, as did most states’ pension debt projections. That was all in our news release and extensively detailed in the CAFR itself.

Comptroller Mendoza has been outspoken about Illinois’ need to address its pension shortfall.

So I do want to point this out to everybody: all states are likely to see jumps in their officially reported liabilities this year. Before this year, most states would record the payments for retiree health benefits for that year, but not record the value of the retiree health care promises made.

Now, some states have not tested the ability to cut retiree health benefits (and some have). Illinois is not allowed to cut a damn thing, so they should have been reporting this liability every year since the dumbass court decision that Illinois is not even allowed to bump up co-pays on retiree healthcare.

I remember various pension actuaries telling me that OPEBs (that’s other-than-pension employee retirement benefits) are easily cut, unlike pension promises. Well, that’s not been true for Illinois for five years. From accounting principles alone, they should have been booking this liability since fiscal year 2014.

But, of course, many states have not recorded the value of OPEBs until this year (fiscal year 2018 reporting), once they’re being forced to.

These liabilities have been sitting there the entire time. It’s not a real “loss” because the liability has just been recognized. But it does look ugly on the paper, doesn’t it?

CHICAGO PUBLIC PENSIONS

2019 public pensions watch thread at the Actuarial Outpost. I’ve been making these threads since 2009, and I have to create a new one each year. Originally, I was going to have it be one big thread… until somebody complained about it going over 1000 posts.

As I type this, the 2019 Public Pensions thread is over 1600 posts. Yes, most are by me, and most are just links & copy/paste of pieces. If you ever just want to read stories, go there. I hoover up a bunch of stuff I never blog about.

- Affordable homes to be built on site tied to Daley’s pension boondoggle

- Chicago loses first round in pension fund intercept litigation

- Ignoring the elephant in the room: Sun-Times advice to Chicago Mayor Lightfoot skips pension reform – Wirepoints Original

- Lightfoot vows to tackle pension crisis once and for all, even if means risking her political future

- Chicago Mayor Lori Lightfoot proposes pension handoff to state

- ‘Now is the time’ to deal with pension debt, Lightfoot declares

- CTA Veteran Says He Was Forced To Retire After Blowing The Whistle On Pension Spiking; ‘I Feared Further Retaliation’

- Pritzker, Lightfoot silent on whether city’s pension fund discussed at ‘productive’ meeting

- Pritzker, Lightfoot to meet over mayor’s pension-shift plan

- Mayor Lightfoot’s pension handoff proposal

- Stanford report, Wirepoints president single out Chicago’s pension crisis as a worst-case scenario

- What Pritzker and Lightfoot did and didn’t say about a possible pension deal

- Gov. J.B. Pritzker says Illinois can’t take on Chicago’s public pension liabilities without trashing state credit rating

- Op-Ed: Chicago pension bailout isn’t the solution, reform is

- Chicago’s pension debt overshadows improvements

- Chicago Boosts Pension Payments, Only to See Debt Keep Growing

- Why Chicago’s Lightfoot should push for a pension amendment, not tax hikes – Wirepoints Special Report

- Lightfoot urges pension changes, calls 3 percent COLA ‘unsustainable’

- Chicago kept saying it would pay for pensions later. Well, it’s later.

- Lightfoot: “Pensions are absolutely a promise” but “structural changes” need to be made

- Wirepoints’ Dabrowski: Pension reforms only way out from under Chicago’s mountain of debt

- Ald. O’Shea introduces pension funding ordinances

- Latest Chicago pension fund reports lay out frail conditions

- Pritzker Throws Cold Water On State Takeover Of Local Pension Debt

- City Analysis: Pension Debt Grew Last Year

- Police Pensioners Told To Come Back To Work Or Lose Their Benefits Say They Aren’t Willing Or Able

- Chicago Pensions Are No Longer 27% Funded (It’s Now 23%)

- Lightfoot’s pension pitch hits wall in Springfield

- Court decision nears on Chicago pension funding tax dispute

- Chicago/Illinois Pensions: What Does It Take To Get To Reform? Insolvencies, Subsidies, Rating Agencies

- Editorial: This crisis alarms Lori Lightfoot. Does it alarm J.B. Pritzker, Michael Madigan and John Cullerton?

- The mayor says out loud what many of us are thinking — “We’re screwed”. Ok, I may be inaccurate here.

- Are Contribution Underpayments Really The Cause Of Chicago’s Pension Woes?

- Editorial: Lightfoot wants to poke the pension monster. How about it, Springfield?

- Chicago Fire, Chicago Police, Chicago Pensions: Why A COLA Change Isn’t A Cure-All

- Lowering Chicago’s pension contributions would be seen ‘negatively’: S&P

- S&P leans on Lightfoot to find pension fix

- A Tale of Two Chicagos

- It’s The Insolvency, Stupid -Why Pensions Really Are An Urgent Issue For Chicago

Re: the concept of a state bailout of Chicago (and downstate pensions…)

Really?

Is the bigger bankrupt supposed to bail out the smaller bankrupt?

How is that supposed to work?

ILLINOIS PUBLIC PENSIONS

2019 public pensions watch thread at the Actuarial Outpost. Yup, same thread, but I’ll try not to repeat the stories from above.

- Moody’s new report shows Illinois is nation’s extreme outlier when it comes to pension debts

- $250,000,000,000 and counting – of course, if you don’t actually pay those promises, they’re worth quite a bit less!

- Hidden In the Legislate-A-Thon, Illinois Restores Pension Spiking

- More Cautionary Tales From Illinois: Tier II Pensions (And Why Actuaries Matter)

- Our View: Reinstate cap on pension-boosting raises

- Editorial | Teachers spike pension ball

- Editorial: Pritzker, teacher’s pet, allows more pricey pension spiking

- EDITORIAL: Teacher pension ‘spiking’ is back — and we’ll all pay

- The best and worst examples of public pension oversight

- How many collecting Illinois pensions have moved to other states, and how much did they take with them?

- On pensions, a funding problem needs a funding solution

- Why did legislation make Illinois’ underfunded pensions worse?

- Unintended consequences

- Jim Dey | Pension promises pale in comparison to pension problems

- CRAIN’S PENSION FORUM: DEATH AND DOUBLE TALK.

- Pension Reform . . . For The Children’s Sake

- Miller: Pension issue not just in Chicago

- Illinois Is the Canary in the Pension Coal Mine, Says Adam Schuster

- Hundreds of small pension funds statewide face troubling debt. Is consolidation the way to go?

- Collapsing interest rates are devastating for Illinois’ troubled pensions

- Illinois Running Out of Pension Time?

- Police and fire unions must lead on pension reform

- Another major error in an op-ed on Illinois pensions – Quicktake

- A Modest Proposal To Solve Illinois’ Pension Woes

- Study: State law isn’t catching all municipal pension shorters

- Panel of experts discusses Illinois pension reform

- EAST ST. LOUIS FACES INTERCEPTION OF STATE FUNDS FOR $2.2M PENSION DEBT – this ain’t the first, and it sure won’t be the last.

- Third domino falls: Illinois Comptroller set to confiscate East St. Louis revenues to pay for city’s firefighter pensions

- Mayors on Lightfoot pension comment: ‘She’s right. They’re unsustainable.’

- Cash-strapped East St. Louis joins Illinois pension intercept list

- Illinois’ public pensions are 80.4 percent government funded, 7th highest in U.S.

- Moody’s new report shows Illinois is nation’s extreme outlier when it comes to pension debts

- Senator Heather Steans’ Empty Rhetoric Defines Springfield’s Failure on Illinois Pensions

- Op-Ed: Be wary of confident promises for painless pension reform

- Illinois Policy Institute: Bailout of local pension funds could boost state’s pension debt to $200 billion

- Constitution change is best hope for state’s ‘solvable’ pension crisis

- Illinois public services being cut to pay unsustainable pension cost

- Fact-Check: Lightfoot Stretches the Numbers on Downstate Public Safety Pension Funds

- Megan McArdle: Past pension promises always come due

- There’s no getting around it: We need a pension amendment

- Editorial: Pension reform: Local officials across Illinois, join Lori Lightfoot’s mission

And that’s all I wrote.

Okay, it’s not all. I omitted some of the posts, just due to repetition. I don’t need to share all the pieces on the teachers pension spiking bill.

This was idiotic.

Illinois teachers pension… is not well funded.

AN ANNOUNCEMENT: NEW PROJECTIONS

As mentioned earlier, I wanted to look back at what happened (or, rather, didn’t happen) this summer re: Chicago and Illinois, because some things are about to happen.

First, the aforementioned teachers strike. Chicago really can’t afford to give the CTU a damn thing – the Chicago Teachers pension gives you a good idea of the problem. Let’s ignore the funded ratio for now… this is the contribution pattern:

Do you think that Chicago can afford a pension plan where the cost is 40% of payroll?

Second, there have been reports coming out and I know one is coming out next week. I’ll want to use that.

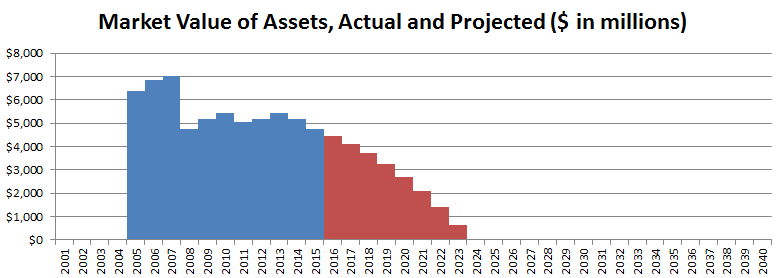

Third — remember my cash flow model? Back in April 2017, I debuted my model by testing Chicago’s MEABF — and matched another projection for when the money would run out:

I now have two more years’ worth of data. I’m going to run the Illinois and Chicago pension funds again.

Will anything have changed? We’ll find out….

I have to agree with

PeterTBurchard</a> on this -- it seems the "plan" is to let the money run out, and hope for a federal bailout that won't come. <br><br>Bankruptcy would give Chicago a better chance, so would state constitutional amendment to allow cutting COLAs. But it won't happen.</p>— Mary Pat Campbell (meepbobeep) September 16, 2019

Related Posts

Public Pension Roundup: Bailing out Pensions, The Return of Pension Envy, Kentucky Lawsuit, and more

Public Pension Concept: Plan Long-Term for Long-Term Promises, and Don't Give Contribution Holidays

Asset Grab Bag: Whistleblower Award for Blogger, Private Equity Fees and Returns, and more