Taxing Tuesday: Last One of the Year!

by meep

Well, taxes will go ever on, but there are plenty of pieces on new taxes for the new year.

ILLINOIS: CAR TAXES

Illinois Policy Institute: SUBURBAN FAMILIES COULD PAY $1,700 MORE IN VEHICLE-RELATED TAXES STARTING JAN. 1

The gas pump is just one place Illinois drivers will feel pain in 2020, when the remaining transportation tax and fee increases Gov. J.B. Pritzker approved in 2019 take effect.

On Jan. 1, Illinoisans will awake to a new year and new taxes, with those imposed on driving and transportation potentially taking the biggest chunk out of the family budget.

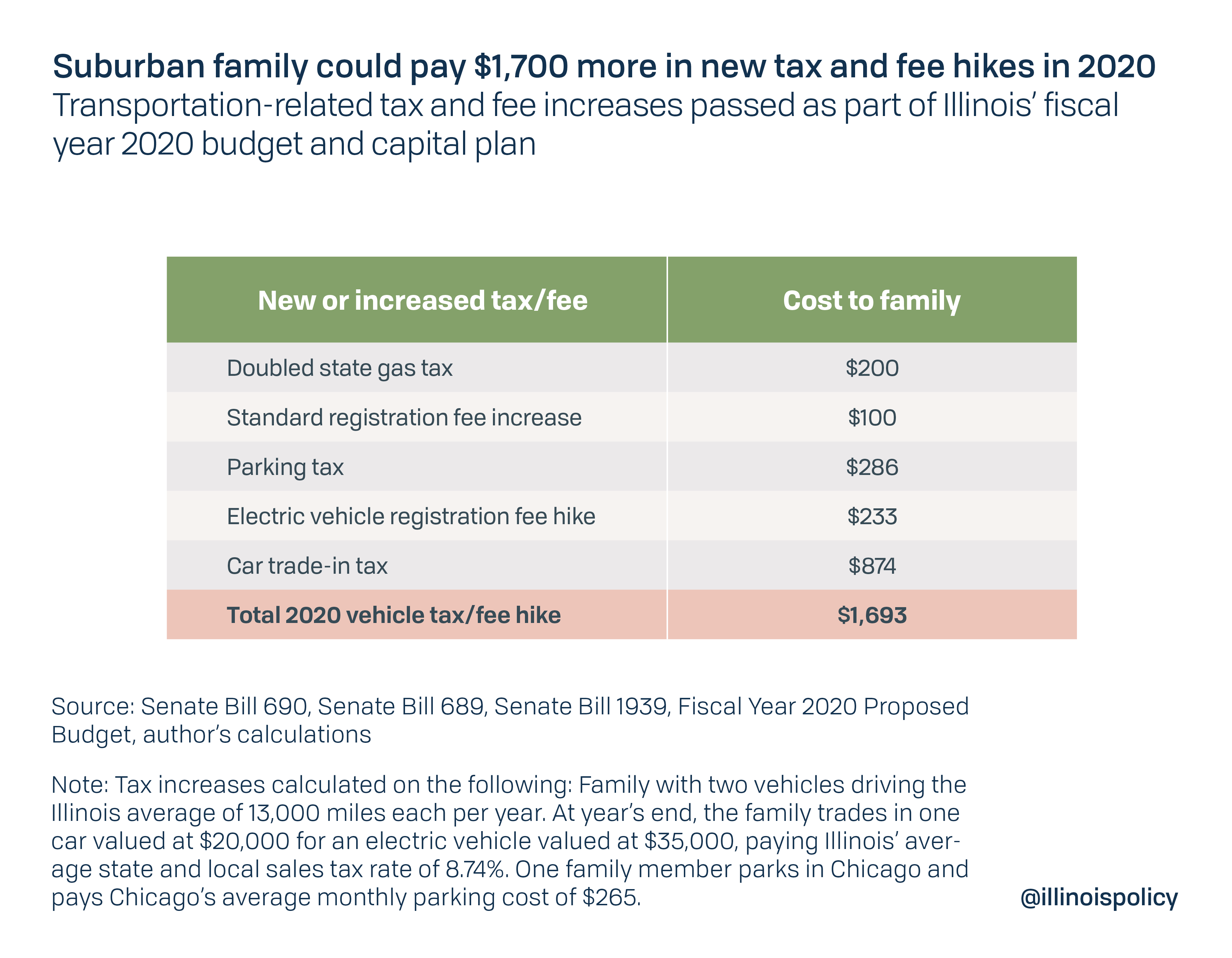

Five new or increased taxes and fees will be placed on driving, parking, registering and selling cars to finance Gov. J.B. Pritzker’s record $40 billion budget and $45 billion capital plan. That means a family in the Chicago suburbs with two cars in 2020 could pay up to $1,700 more in taxes than they paid in 2019.

Hmmm, so that is up to $1,700 per year, not an average impact.

And given what it’s being imposed on:

So, people drive their cars longer (mine definitely are never about $20K in value when I trade in … I mean, who does that?) and will be even less likely to buy electric vehicles (fine by me — from a total energy cycle viewpoint, they’re more wasteful than conventional cars).

But the big upcoming tax story for Illinois in 2020 will be the ballot proposal for a graduated tax rate for income taxes. The groundwork has been laid in 2019 (including excuses of not opening the state constitution to amendment to get working on the state pension problem).

But the actual vote will take place in 2020. We’ll see more about that later next year.

BUT WAIT THERE’S MORE

REPORT: TAX RAIN, PLASTIC BOTTLES AND PLASTIC BAGS TO HIRE MORE STATE WORKERS

Before I quote this piece, is Illinois’s problem really that they have too few state employees? Just asking a basic question.

A new report from the University of Chicago recommends fees on the use of plastic shopping bags, plastic water bottles and storm water to fund more employees at the Illinois Environmental Protection Agency.

Hmmm, again… is this really a big problem for Illinois?

According to the researchers, the IEPA is overworked and understaffed, which makes them ineffective and poses a public health risk. The agency’s workforce fell 50% between 2003 and 2018 as federal funding fell and its regulatory responsibilities increased.

Maaaaaaybe this is something that can be dialed back?

I mean, I haven’t heard that Chicago and Illinois have the public environmental problems that, say, San Francisco has.

[a very unforgiving winter climate probably helps with that]

….and here’s the pension connection:

The IEPA is not the only state agency that has been cut as pension costs crowd out services taxpayers expect. The state this year will spend 25.5% of its revenue on pensions as part of a record $40 billion state budget. Pension spending increased by 501% since 2000 while services have been cut by about one-third.

Government spending reflects its true priorities, so until state lawmakers agree to amend the Illinois Constitution to protect earned pension benefits while allowing changes in future, unearned benefits, pensions will be the top priority. State police protection, child death investigations, grants for impoverished college students and help for the disabled have taken heavy cuts and will continue to take a lower priority, as will spending on environmental monitoring and regulation.

More revenue has failed to fix Illinois’ fiscal problems. Until spending is addressed, taxing the rain will become yet another failed strategy and another reason Illinois can’t attract or keep young families.

Yeah, I’m thinking that the biggest problem is an ever-increasing appetite of the pension funds… and that’s just to tread water in Illinois.

Expect more tax pain in 2020, Illinoisians.

MORE NEW TAXES…OTHER THAN ILLINOIS

Okay, enough beating up on Illinois (j/k — there will be more below).

Let’s check out new taxes elsewhere.

Sales tax expanded

The 6.35% sales tax will be expanded to new goods and services, including parking, dry cleaning and laundry, interior design and safety apparel. Included as part of the two-year budget adopted by Gov. Ned Lamont and lawmakers in June, the new taxes are estimated to bring in $25 million the first full year they are collected. Lamont had sought to expand the sales tax in a far broader fashion but was rebuffed by lawmakers.

Business entity tax eliminated

The $250 business entity tax, collected every two years from all companies that do business in Connecticut, will be eliminated. The measure was also included in the two-year budget. Getting rid of the tax will cost the state about $44 million in revenue in the upcoming fiscal year.

Oh jeez, sales tax on my parking. I hope that gets updated properly.

I am wondering about these numbers, for what it’s worth. The sales tax increase is not going to make up for the business entity tax repeal, for whatever reason they got rid of that.

A variety of taxes on electric/hybrid vehicles across the country to replace lost gas taxes:

The new year will bring new charges for some owners of electric vehicles, as an increasing number of states seek to plug in to fresh revenue sources to offset forgone gas taxes.

In Hawaii, the charge will be $50. In Kansas, $100. In Alabama and Ohio, $200.

New or higher registration fees go into effect Wednesday for electric vehicle owners in at least eight states. For the first time, a majority of U.S. states will impose special fees on gas-free cars, SUVs and trucks — a significant milestone as the trend toward green technology intersects with the mounting need to pay for upgrades and repairs to the nation’s infrastructure.

Though electric and plug-in hybrid vehicles comprised less than 2% of new vehicle sales in 2018, their market share is projected to rise substantially in the coming decade. State officials hope the new fees will make up for at least part of the lost gas tax revenue that is essential to their road and bridge programs.

They could do tolls, ya know.

Eighteen months after the Supreme Court gave states the green light to tax online transactions, small companies that sell things as diverse as recycled yarn and gold bullion are struggling to adjust.

Nicole Snow, chief executive of Darn Good Yarn Inc. in Clifton Park, N.Y., hired a part-time chief financial officer and purchased new sales-tax software in response to the court ruling. Darn Good Yarn plans to spend about $25,000 this year to collect and remit about $90,000 in taxes on $5.4 million in sales to buyers in 34 states.

Okay, this one is not totally new (I’m on Darn Good Yarn’s mailing list, so this caught my eye).

But yes, the complexity for compliance is a pain in the ass for online retailers.

Back to the piece:

Most states have tried to limit the impact on the smallest companies, with many following the lead of South Dakota, which exempted out-of-state sellers with $100,000 or less in sales or fewer than 200 transactions in the state a year. But limits vary, with a threshold of $500,000 in California and none in Kansas.

Huh. One situation where California is more sane than Kansas. I will clap for California, since they so rarely do well in comparison to other states, when it comes to businesses.

Gruber Industries Inc., a manufacturer of low-voltage cable products and a provider of power services, spent about a year figuring out its tax obligations and, in September, began moving to a new tax-calculation software. The Phoenix company now collects sales taxes in 36 states, up from 11 before the Wayfair ruling.

“We should be done by January 2020,” Gruber Chief Financial Officer Mark Schaeffner said. “The biggest surprise to us was the amount of complexity.”

It’s not surprising to me, but perhaps the states can take a little bit of experience from how they coordinate on insurance regulations, and think about how they may make compacts so that sales taxes can work more sanely for everybody (without having to get a federal VAT, which would annoy the hell out of me.)

FEDERAL TAX FORM CHANGES

Now, if you’re a senior – don’t freak out. The point of form 1040-SR is to make it simpler for retired seniors. Some notes:

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

It’s a two-pager, like 1040EZ, and has bigger fonts and designed to be easier to read in general. It has categories, such as pension income and Social Security income, that are common for those over age 65.

Unlike the old form 1040EZ, there are no income limits or restrictions on the kinds of income that can be reported on the form. And like the old form 1040EZ, taxpayers who file form 1040-SR must take the standard deduction. The standard deduction amounts for the 2019 tax year are $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly and surviving spouses. For 2019, the additional standard deduction amount for seniors or the blind is $1,300. The additional standard deduction amount increases to $1,650 for unmarried taxpayers. (You can find tax rates, standard deduction amounts and more for the 2019 tax year here.)

…..

So, will seniors rush right out to snatch up the new final versions of form 1040-SR in the spring? I doubt it.I have a lot of senior clients. And I’ve heard the complaints that the old forms were hard to read (let’s face it, even those of us under age 65 had problems reading the “postcard-sized” 2018 tax forms). But realistically, many seniors don’t file their tax returns by hand: even the most tech-averse use tax software or hire a tax professional; overall, nearly 90% of taxpayers are expected to use a tax preparer or file electronically.

And while I don’t have exact data on the numbers of seniors filing a return, you can do some extrapolation. In 2016, the last year for which complete data is available, the IRS processed just under 150 million individual tax returns (report downloads as a PDF here). Of those, around 15 million claimed the additional standard deduction, available only to seniors or the blind. That means that approximately 10% of taxpayers might qualify to file form 1040SR. In contrast, more than 25 million taxpayers filed the form 1040EZ before its recent elimination.

Oh, and that reminds me.

1040-EZ is gone. But that was something that happened in 2019, with the 2018 filing. The current 1040 is a two-pager, and fairly simple, too. I will revisit how many people took the standard deduction for 2018 & 2019 later in 2020, but with the TCJA, most people have simpler filings to do.

TAX STORIES

- Daily Caller: The IRS Placed Lien On Hunter Biden For About $113,000 In Unpaid Taxes From Year He Served On Burisma Board

- NYT: How Big Companies Won New Tax Breaks From the Trump Administration

- NPR: After 2 Years, Trump Tax Cuts Have Failed To Deliver On GOP’s Promises

- WSJ: ‘Aloha’ Increasingly Means Goodbye Thanks to High Taxes

- Chicago Sun-Times: New Chicago ride-hailing tax is a gut punch few saw coming

- Illinois Policy Institute: CHICAGO COMMUTER WILL SEE $286 PARKING TAX HIKE JAN. 1 UNDER PRITZKER PLAN

- Yahoo finance: Millions in Taxes From Legal Pot Won’t End Illinois’s Woes

- Interview: Tax Oddities of 2019

- Patrick Gleason: First Month Of 2020 May Bring Tax Relief In A State Whose Democratic Governor Opposes It, And Tax Hikes In A Republican-Dominated State

- Secure Act includes one critical tax change ‘that will send estate planners reeling’ (not reeling so much as having to change strategies)

- Michigan State Treasurer says taxpayers should prepare now to avoid tax refund delays

- Operation Education: How Indiana property tax caps will affect public school funding

- New Mexico lawmakers seek accountability on tax incentives

- Poll: Majority of Utahns against tax reform

- Tax hike, administrator leaving among top Washington County stories in 2019

- Report Says Trump Tax Cut Hurt NJ: Here’s How – new report? The hell? Do they know what year the TCJA was passed? (seems to me NJs high tax decision is what actually hurt them)

- Trump tax cuts are helping the middle class, do the math: Grover Norquist

- Will we ever see Trump’s tax records? Ask the Supreme Court.

The least anticipated SCOTUS ruling ever.

Because even if they allowed Dems to scrape through the returns, the chances of them actually finding anything interesting is nil.

TAX TWEETS

Progressive candidates are called “unrealistic” for proposals that would actually improve conditions for average Americans and stimulate the economy— but it’s totally fine for conservatives to repeatedly give tax cuts to the rich that we can’t afford, that don’t help economy. K.

— Bree Newsome Bass (@BreeNewsome) December 30, 2019

[ok, gonna name drop — I used to babysit Bree when she was a toddler, along with her older sister, Gina.]

Property tax collections by local governments in Illinois increased nearly $1 billion between 2017 and 2018. Residents are FLEEING Illinois' high property taxes. We need to CUT taxes now! #twill pic.twitter.com/U4LYkKdTNO

— Rep. David McSweeney (@1980reagan) December 30, 2019

How about the ongoing crisis of hyper-taxation to give state employees pensions that are 8x to 18x more generous than private? —all so they’ll vote CT DEM. https://t.co/JcMDJtixOf

— CT Turnip (@ct_turnip) December 30, 2019

For years, Republicans, US Chamber of Commerce, and Federalist Society have pushed for stricter review of agency actions so they can scuttle environmental and consumer protections.

— Max Kennerly (@MaxKennerly) December 30, 2019

But when it comes to the Treasury Department rewriting the tax laws passed by Congress, crickets. https://t.co/bBX1tl56vY

All Americans should also know how much the tax cut helped Trump and his family. https://t.co/ic8eVJwWzz

— Orange Man (@orangemanlies) December 30, 2019

I can't stress this enough. The extraordinary new NYT report on how Trump's tax law has facilitated more corporate tax avoidance and elite gaming (link: https://t.co/9PaSYdB55q) goes directly to the core of one of Trump's greatest betrayals: https://t.co/K82yqBFrRT

— Greg Sargent (@ThePlumLineGS) December 30, 2019

Carbon tax plus HST equals 24% of my home heating cost for December.

— Brian Jutzi (@brianjutzi) December 30, 2019

24%.#carbontax pic.twitter.com/2v75ewBUlV

Have you heard even one Democrat attempt to defend the fact that 47% of Americans pay no federal income tax? Me neither!

— Janie Johnson (@jjauthor) December 30, 2019

They do pay payroll taxes, though (well, some of them do.)

#EmergingPakistan2020

— M Abrar (@M___Abrar) December 30, 2019

By closing tax loopholes and setting up a more targeted approach to widen the tax base, revenue collection improved by 2 ½ percent of GDP over the past three years.

Property taxes in Chicago to increase. Again.

— Beverly A. Pekala (@PekalaLaw) December 30, 2019

By $200Million.#NewYearsResolution #CallTheMovers #MondayMorning #Arizona #Nevada #Texas #Tennessee #Florida #Movers #Moving https://t.co/YUa3JIAMle

#PresidentSanders would be the spark that lit the boogaloo. Normal people will not accept a 500% tax increase, more endless wars, open borders, gun confiscations, etc.

— ArizonaPucker (@ArizonaPucker) December 30, 2019

Illegals and criminals in New York get:

— Andrew Pollack (@AndrewPollackFL) December 29, 2019

MetroCards & gift cards

Driver’s licenses

Free healthcare

College tuition aid

Law-abiding citizens in New York get:

Higher taxes

Higher taxes

Higher taxes

Higher taxes https://t.co/hpZKxGTE7o

You know there's a problem with our tax code when literal millionaires are begging to be taxed more. https://t.co/HSikcmEPEo

— Robert Reich (@RBReich) December 30, 2019

Congrats, Reich, you have earned the dumbest tax-related tweet of the year! [Nothing stopping ultra-millionaires from shoving more money at the government. Seriously, nothing. Write a big check. They won’t give the money back.]

[OOOOOH, you want those other ultramillionaires to also pay more, not just you. Uh huh. Just write the damn check.]

See you in the new tax year… next week!

Related Posts

Taxing Tuesday: Tax Season Begins and Taxpayers Keep Migrating

Taxing Tuesday: Poor Little Rich People and the SALT Cap

Taxing Tuesday: Not Too Many Interested in Iffy Way to Avoid SALT Cap