Taxing Tuesday: Income Tax for Chicago?

by meep

ABC7 Chicago: How a Chicago income tax could solve the city’s revenue problem, without touching property taxes

During his campaign, Mayor Brandon Johnson promised to raise $800 million in new revenue for Chicago, without touching property taxes, which are usually how cities come up with the money they need in a pinch.

But with ideas like a financial transactions tax and a business head tax already hitting roadblocks in Springfield and the City Council, some supporters say an income tax on high earners may be one of the mayor’s only remaining options for raising significant revenues.

Another thought would be to cut spending, but that’s obviously not on the table.

Johnson has not endorsed a city income tax. But a plan backed by many of his allies and supporters would levy a 3.5% tax on all household income above $100,000. Supporters say it could generate more than $2 billion in new revenue for Chicago, all without hitting its poorest residents or touching property taxes.

Poll:

https://twitter.com/CPD1617Scanner/status/1682866323922247680

Do you support a city income tax?

— 16th & 17th District Chicago Police Scanner (@CPD1617Scanner) July 22, 2023

Do you support a city income tax?

— 16th & 17th District Chicago Police Scanner (@CPD1617Scanner) July 22, 2023Population Trajectories

https://twitter.com/meepbobeep/status/1682875555857719296Good point — Detroit started its city income tax in 1962https://t.co/ETvDY2XuE4

— Mary Pat Campbell (@meepbobeep) July 22, 2023

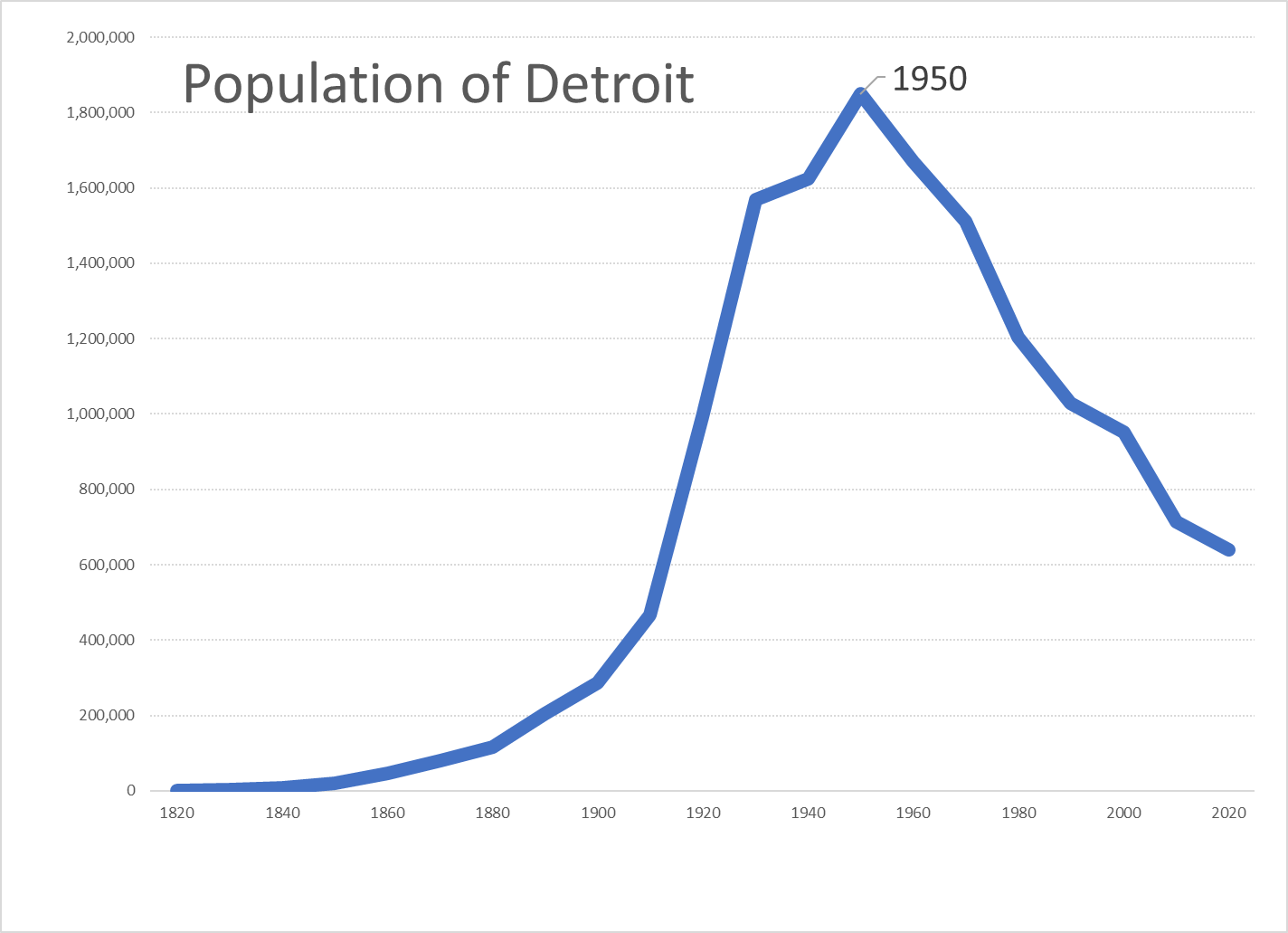

To be sure, it already had a population reduction from 1950 to 1960, but there's been a drop of 65% from the peak in 1950 to 2020 pic.twitter.com/dOiXckJkoF

Um, that’s quite a population drop

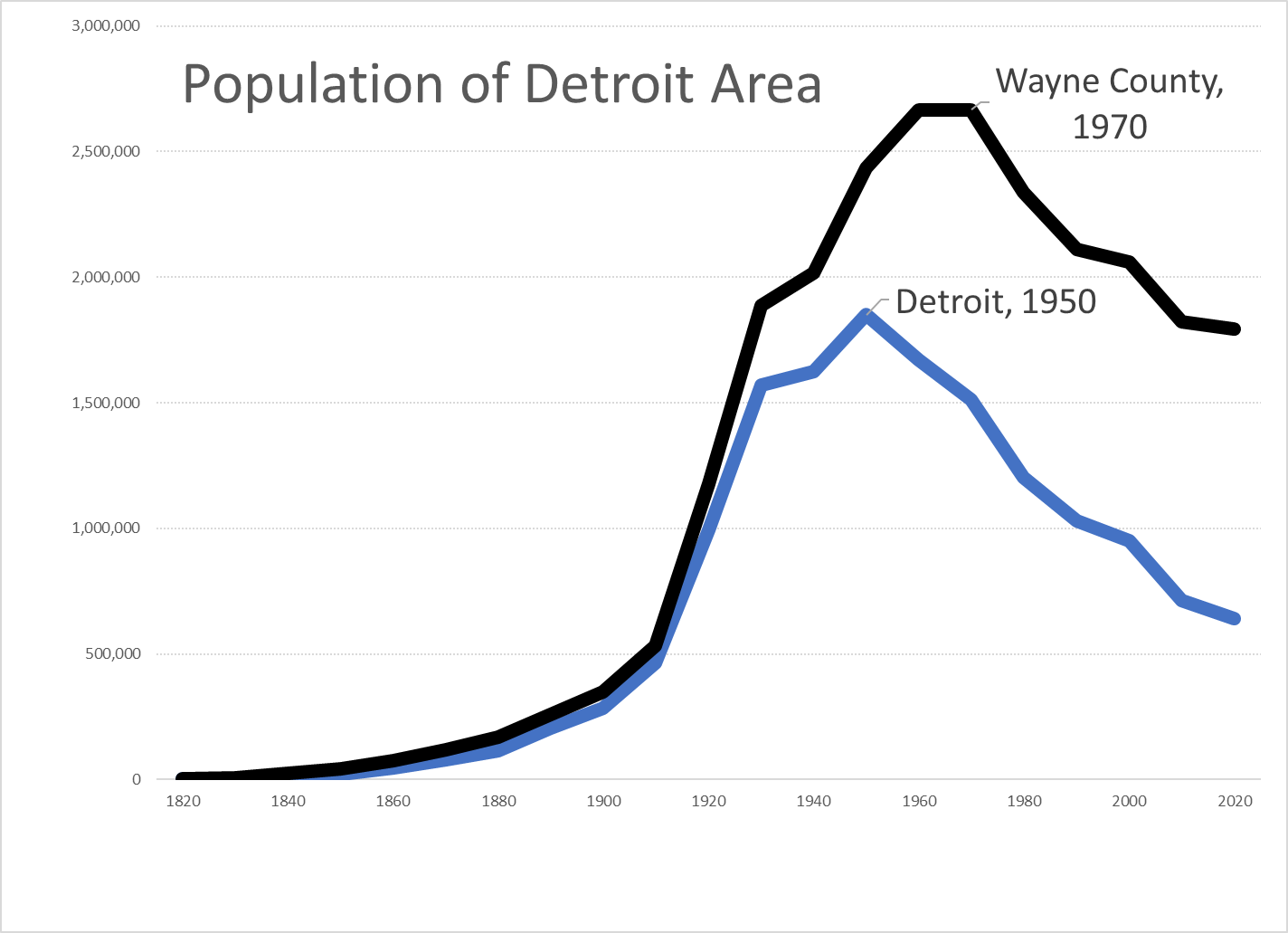

Detroit is within Wayne County, and you can see suburban growth to 1970

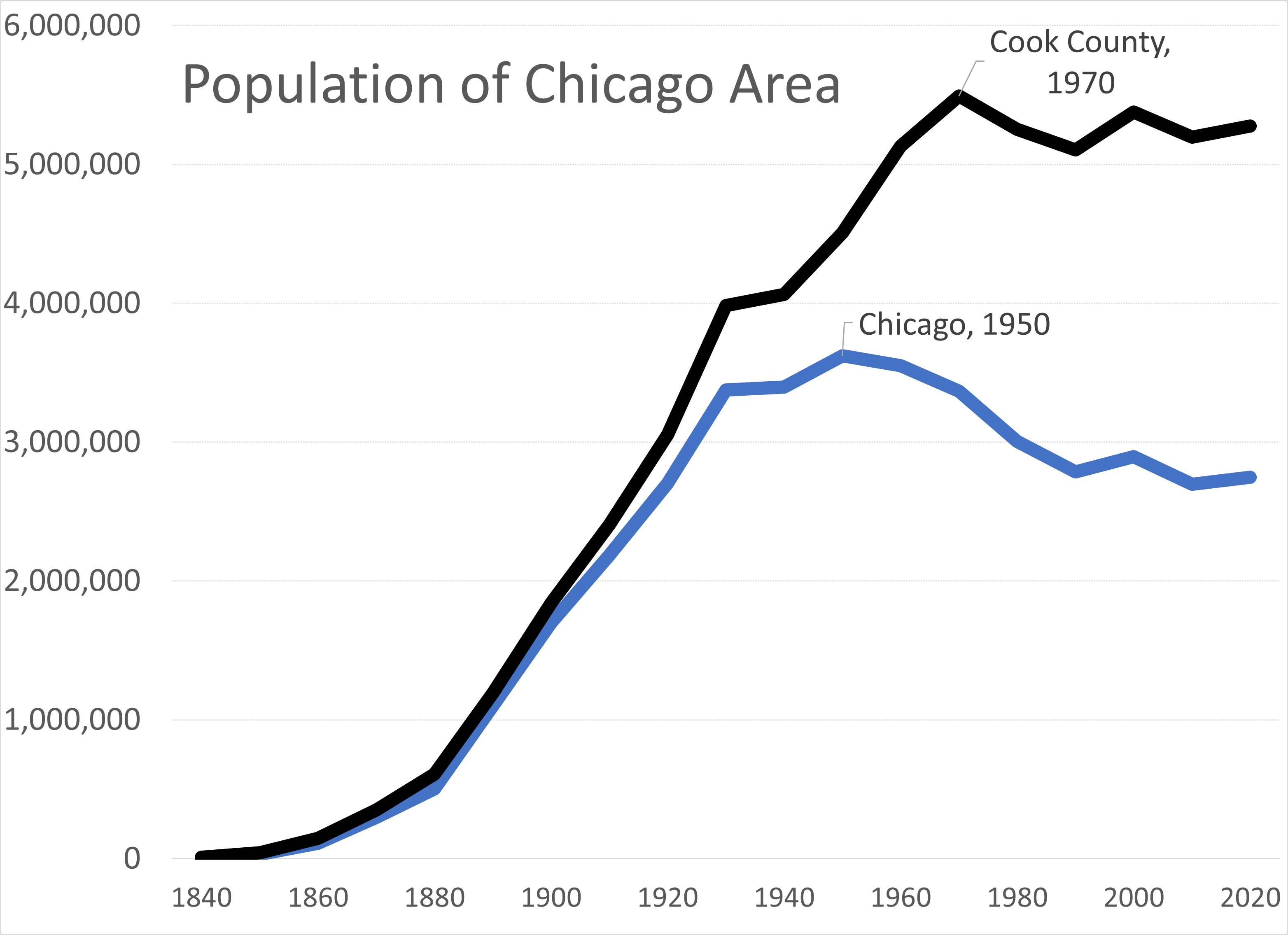

For what it’s worth, I just pulled the same numbers for Chicago and Cook County, which are doing better than Detroit:

However, we did see a similar trajectory: peaking in the city in 1950, and a shift to the suburbs, which peaked in 1970.

Podcast: State Revenues Today

State Revenues Today and Tomorrow, with Lucy Dadayan

We talk to state budgeting expert (and Public Money Pod fan!) Lucy Dadayan from the Urban-Brookings Tax Policy Center about all things state revenues. She explains the wide variation in revenue trends across sources and states; the many challenges of inflation; and her best predictions for FY24 and beyond, among many other topics. In the Ripped from the Headlines segment, we take a closer look at how states are managing their debt.

The main result: the fiscal year 2023 revenues (ending June 30, 2023) were down compared to FY 2022. This was hardly a surprise given the federal “stimulus” spigot was cut off.

Here is a good tweet from the guest reflecting what’s been going on:

https://twitter.com/lucydadayan/status/1677412631223648259

State tax revenues declined for the 6th consecutive month in nominal terms; 10th in real terms

— Lucy Dadayan (@lucydadayan) July 7, 2023

All major sources of state taxes showed Y-O-Y decline during July 2022-May 2023 period

- overall tax revenues⬇️5.3%

- personal income⬇️21.6%

- corporate income⬇️ 9.4%

- sales tax⬇️0.2% pic.twitter.com/xe5R5l3uUj

Lucy Dadayan did note that many states did have increased revenue in a nominal sense (that is, the actual dollar amount increased), but on an inflation-adjusted basis, it was a decrease.

Those who were more dependent on income taxes and capital gains taxes, specifically, were having a hard time. Income did not increase with inflation, and capital is not gaining.

Sales taxes, for obvious reasons, tends to increase in line with inflation… at least with staple goods.

Property taxes can be complex.

Related Posts

Taxing Tuesday: New Jersey Wants to Be Number One; More Federal Tax Comparisons

When the Money Runs Out: Some Thoughts on Public Finance and Pensions

Taxing Tuesday: Putting the Black in Black Friday