Taxing Tuesday: Happy New Tax Year!

by meep

I’m half-assing it today, but that’s okay. My whole ass is huge.

MORE COMPLEX IS NOT REFORM

In Utah: TAX REFORM PACKAGE INCLUDES A $160 MILLION TAX CUT AND A $70 MILLION ONE-TIME TAX CUT

Good news for Utah taxpayers: the tax reform package that passed on Dec. 12 during a special session includes a $160 million ongoing tax cut plus an estimated $70 million one-time tax cut. The enacted legislation ensures Utah’s economy stays competitive while also alleviating some of the tax burden placed on Utah families. The state is able to provide a tax cut thanks to the Herbert administration’s focus on shrinking the size of government while continuing to provide quality services. In FY 2019 there were fewer state full-time equivalent employees (20,700) than in FY 2002 (20,850), despite considerable growth in Utah’s population.

In addition to the tax cut, some of the significant strides taken during the special session to rebalance the state’s tax code include broadening the sales tax base to include some services and gasoline, putting the sales tax back on unprepared food, increasing the car rental tax from 2.5% to 4% and creating a new diesel excise tax.

The Legislature should be commended for passing this tax reform package. While more work remains to be done, including taxing a wider array of services, the enacted changes will shore up the general fund enough to allow government to meet the service and infrastructure demands of a growing population for the near future.

Yeah, that’s the fluff bit.

Not everybody agrees with this bright and sunny picture.

There’s a group that wants to referendum veto the bill:

Backers of a citizen referendum to force a public vote on the legislature’s tax overhaul bill have increased the signature count.

The Lt. Governor’s Office reported Monday that 1,647 signatures had been verified by county clerks. Organizers of the referendum said in a statement Monday they had collected 6,486 so far with more still being turned in.

Referendum supporters must collect just under 116,000 by January 21 to qualify for the November ballot.

The signatures are collected by volunteers fanning out across the state. They are then turned into Utah’s 29 county clerks who must validate them. Those verified numbers are then reported to the Lt. Governor’s Office.

The Utah State Legislature passed a bill that overhauled the tax code by cutting the income tax (which pays for education) but also hiked the sales tax on food, gasoline and imposed new taxes on some services. The move sparked a lot of pushback and spawned two referendum efforts. One that was rejected by the state is currently being fought over in federal court.

So there’s that.

Then this: Dan McClellan: Utah suffers from taxation without representation:

In his 1776 “Thoughts on Government,” John Adams wrote regarding the soon-to-be-constituted legislature that,

“It should be in miniature, an exact portrait of the people at large. It should think, feel, reason, and act like them. That it may be the interest of this Assembly to do strict justice at all times, it should be an equal representation, or in other words equal interest among the people should have equal interest in it.”

This reasoning is the beating heart of the American experiment, but Utah’s Legislature doesn’t seem to have gotten the message. Our Legislature’s demographics are wildly out of sync with the state’s. Men represent 50% of the population, but make up 77% of the Legislature. Latter-day Saints constitute 62% of the population, but 88% of the Legislature. Hispanics and Latinos constitute 13% of the population, but only 4% of the legislature.

There are some things I could point out here, but I will forebear. I will simply say that the specific demographic details (sex and/or gender, religion, ethnicity, etc.) don’t necessarily mean much about how people will vote.

On top of that, with last year’s manipulations of propositions 2 and 3, and last month’s regressive tax restructuring revisions, the Legislature has repeatedly sent the message that they feel they serve at their own pleasure, and not ours.

Our leadership has suggested we’re not well-enough informed to make decisions about things as complex as health care and taxes. They’ve snapped that we cannot “overrule the laws of mathematics.” They’ve argued that we don’t understand our own interests. They’ve prioritized the interests of their legislative leaders and the large industries and corporations that fill their campaign coffers.

You can read the whole thing.

I decided to look at where Utah’s sales and income taxes stood with respect to other states before this bill.

This map, though it says 2020, seems to be before the bill was passed.

Being #22 is not that great, and with a sales tax increase, it obviously will move in ranking (unless everybody else also increased their sales taxes), falling down the list (#1 is lowest sales tax – New Hampshire, #50, the worst, is Alabama. Hmm.)

Utah had been at #10 for individual income taxes, so that seems pretty friendly already.

Anyway, this looks like a “fun” story to follow in 2020. I can’t spend all my time looking at Pritzker’s progressive tax crusade.

A few more stories on the Utah situation:

- Deborah Gatrell: Voters can put the brakes on this regressive tax overhaul

- Poll: Majority of Utahns against tax reform

- From Dec 2020: What’s next for Utah’s tax reform bill and what does it mean for you?

Every state has a mix of revenue sources, and it seems to me that being too dependent on either sales taxes or income taxes or property taxes makes for shaky finances. Diversify revenue sources!

ALL YOUR MONEY BELONG TO THE GOVT

Christianity Today: The Hidden Cost of Tax Exemption

A short excerpt:

This feeling that churches don’t contribute to the common good is not uncommon in America. There are many municipalities that view churches as basically parasitical, receiving all the protection and benefits of local government without bearing their fair share of the financial burden. Cash-strapped towns have frequently tried to use zoning laws to block the development of new churches and are only stopped when the federal government enforces the religious land-use laws that Christian groups advocated for in 1993 and 2000.

These laws were framed as defenses of religious freedom, and there are indeed cases of hostile local governments wanting to limit religious expression because they find the preacher or theology of a church objectionable. But more often it is tax exemption itself that makes churches unwelcome neighbors. It is not the offense of the gospel that has made these churches toxic; it’s their tax-exempt status. Perhaps it is time to count the hidden costs of tax exemption.

I would argue the costs aren’t hidden at all. We tend not to have secret churches in the U.S.

And it’s a point that’s relevant in Hartford, where I work during the day. If you have too many properties exempted from property tax, as churches usually are, it cuts into revenue planning, yadda yadda. In Hartford, it’s not the number of churches, but the amount of state-owned property, that’s causing the trouble.

In Hartford, of course, the city can’t do a damn thing (directly) to stop the state government from buying/developing land. (They can threaten to file for bankruptcy, though.)

Thing is, it’s not only churches and government buildings that are an issue. Non-profit universities can be troublesome in this way as well. If I remember correctly, Providence, Rhode Island has threatened Brown University a few times re: taxes.

And then there’s farms…..

Okay, all sorts of lands and buildings get exempted from property tax, and it can be a problem. There are ways to approach this, and the entities that had been tax-free don’t have to remain so.

The article veers off course with respect to political activity in churches, which is not really the concern of municipalities (any more than a private university holds anti-Trump rallies, for instance.) I think the piece isn’t really about taxes, hmmmmm?

TAX STORIES

- 2020 Tax Refund Chart Can Help You Guess When You’ll Receive Your Money

- To replace gas taxes, Oregon and Utah ask EVs to pay for road use

- What to do about France’s digital services tax?

- US, France seek compromise to avoid digital tax on tech giants

- The Student Loan Forgiveness Tax Bomb – basically, any debt that’s forgiven is counted as income, and yes, you owe income tax on that.

- The rich get richer: Trump’s tax cuts have boosted Texas and its high earners

- WSJ: Economists Question the Benefits of Targeted Tax Breaks – I agree. I don’t like these “targeted” carve-outs.

- It’s Not Too Late to Reap This Valuable 2019 Tax Break (it’s maxing out your IRA)

- Beware tax scams in the new year | Scam of the Week – the scam is pretending to be a legit tax preparer, and grabbing your personal info. You can check if people are legit at this IRS page.

- Florida pulls in billions amid high-tax state exodus

- WITH VOTERS SET TO DECIDE ON PROGRESSIVE INCOME TAX, ILLINOIS WEALTH FLIGHT AMONG WORST IN THE NATION

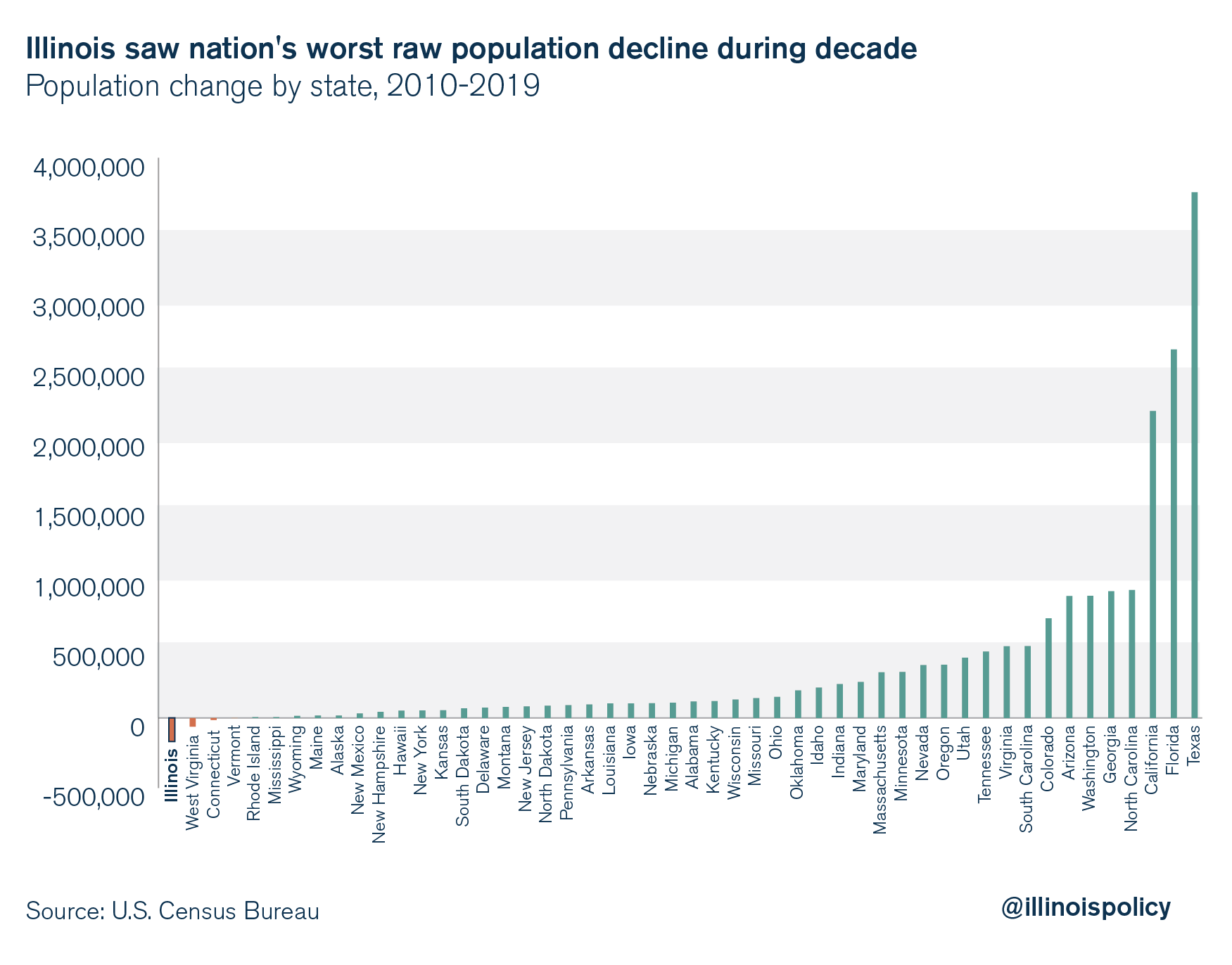

On that last one, you can see that Illinois is the worst in population drop over the decade in total:

From a percentage change standpoint, Illinois is second worst (West Virginia is the worst).

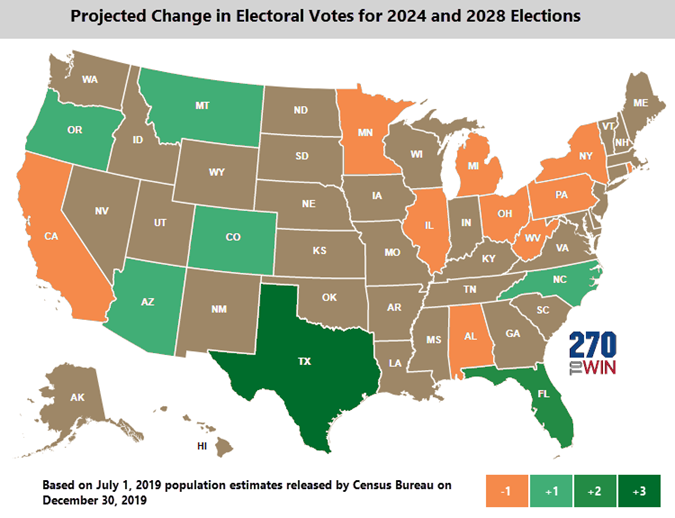

And one thing to remember in all of this: the 2020 Census is coming up (April 1!), which will determine Congressional apportionment. Also, it determines how many votes in the Electoral College each state gets. According to this, Illinois and New York are projected to lose seats/votes.

Texas is projected to gain 3 seats. Florida expected to increase by 2.

They also look at how the 2016 election would have gone with those electoral votes. Trump would have had 309 votes. He actually got 304.

Anyway, I’m looking forward to seeing whose seat will be disappeared in New York. MWA HA HA HA.

TAX TWEETS

Ultra-wealthy are free to pay as much federal taxes as they like. The few truly hi-net-worth people in the country could get together, vote on higher tax rate they would like to pay, publicize rate, &pay it, thereby bypassing dysfunctional Congress. https://t.co/FOoNrZVz55

— Nicole of Hell's Kitchen (@nicolegelinas) January 4, 2020

“Instead of a model that limits the ability of sovereign states to guard against the flight of capital and tax avoidance, governments can build a model of trade that supports tax justice.”https://t.co/4hZbjWWBaK

— Foreign Affairs (@ForeignAffairs) January 7, 2020

Wrong, he's increased our taxes and debt astronomically. https://t.co/WtJjB5rhsw

— Mr Stache (@MrStache9) January 7, 2020

In every country, conservatives love to complain about how legislative efforts to make a wealthy minority of residents pay slightly more tax is 'socialist'.

— Daniel Pitt (@DanDare42069) January 7, 2020

A well established Marxist group known as checks notes the IMF has just issued its official position on the matter. pic.twitter.com/wfJCwLgm7B

[This is not as strong an argument as they think]

We'll literally go to prison if we don't help the United States bomb poor people via federal income tax.

— FERRARI SHEPPARD (@stopbeingfamous) January 7, 2020

I have good news. Just be part of the 44% or so who don’t pay federal income tax. You just need your income to be low enough, and you’re (income) tax free!

Tough to capture in a single tweet: $8,500 avg tax on a $316,000 avg property value in 2018, but differs across municipalities.

— Tom Phillips (@TomPhillipsNJ7) January 7, 2020

Turns out, Americans actually do not want their tax dollars funneled into senseless, endless wars.

— Public Citizen (@Public_Citizen) January 7, 2020

Instead, they just want health care and meaningful jobs with fair pay.

It’s incredible that our politicians need polling to understand this. https://t.co/4nqsWvtPUE

A brilliant explanation of why we need a wealth tax in America on the top 1/10th of the top 1%.

— Qasim Rashid, Esq. (@QasimRashid) January 7, 2020

LOVE the point Sunny makes at the end

(And low key look at how Senator Warren ignores Meghan McCain’s attempts to rudely interrupt her.)

pic.twitter.com/5Z2HwZhzA5

It’s too bad that it’s so unworkable that even France gave up on a wealth tax.

States and cities handed out free cash to huge corporations but saw no new economic growth.

— Bernie Sanders (@SenSanders) January 7, 2020

Trickle-down economics was a success. Congratulations to the millionaires and billionaires who made out like bandits. You guys won.https://t.co/htjXeQbTcC

I do actually agree with Sanders on this. Stop doing this, cities!

See you tax people next week!

Related Posts

MoneyPalooza Monstrosity! The Positioning for Asking for State Government Bailouts

Taxing Tuesday: Let's Get Rid of Tax Withholding

Taxing Tuesday: Last One of the Year!