Taxing Tuesday Special: State of the Cities from Truth in Accounting

by meep

In lieu of my normal post for Taxing Tuesday (back next week), I am covering the release of Truth in Accounting’s 4th annual State of the Cities.

Here is what they have to say in their press release:

CHICAGO — The 2020 Financial State of the Cities (FSOC) surveys the fiscal health of the 75 largest municipalities in the United States. This data is released today by Truth in Accounting (TIA), a think tank that analyzes government financial reporting. TIA analysts draw their data from the fiscal year 2018 audited Comprehensive Annual Financial Reports on file in city halls across the country, which are not analyzed on this scale by any other organization.

The 2020 FSOC report found that 12 of the largest cities have more assets than obligations, a key indicator of long-term financial health. The remaining 63 cities carried varying levels of debt, many of them in the billions of dollars range.

Irvine, California has the best city finances in the U.S. with a $380.4 million surplus. If you were hypothetically to divide that figure by the number of Irvine taxpayers, each Irvine taxpayer’s share is $4,100.

Not every city in the U.S. is so lucky. Many larger and older cities owe billions of dollars to unfunded retirement plans for public sector employees. New York City claimed the prize for worst municipal finances in the U.S. for the third year in a row. Every taxpayer in the Big Apple would have to pay $63,100 in order for the city to pay off all its bills. Chicago (second-worst in the nation) would need each taxpayer to pay $37,100. The average taxpayer burden across all 75 cities in the report works out to $7,040.

These new findings are notable for several reasons. For example, Truth in Accounting’s rigorous methodology cuts through common bookkeeping gimmicks to present data free of political distortions. Fiscal year 2018 was the first year city governments reported all retirement liabilities, but Truth in Accounting has been including this information in their analysis for the last several years. This study uncovers exactly how much debt will fall into future taxpayers’ laps.

“We have good news this year. The cities are finally reporting all of their liabilities on their balance sheets, including those related to retiree health care benefits,” said TIA founder and CEO Sheila Weinberg. “The bad news is for every $1 of promised retiree health care benefits, the 75 cities have only set aside 13 cents to fund these promises. ”

I said that for this year I was going to lay off Illinois and Chicago a bit (after all, plenty of people around to do that) and concentrate more on New York and Connecticut.

Well, there’s only one city in New York in the top 75 largest U.S. cities, and it’s New York City. So let’s look at the damage.

IT’S UP TO YOU, NEW YORK, NEW YORK

Let’s look at the bottomline results — the surplus or deficit per taxpayer. Some actually had a surplus.

First — the two scales are different (which is obvious, given the $4K per taxpayer surplus for Irvine extends beyond the $18K deficit for New Orleans. Let me redo that graph:

So you see that on a per taxpayer basis, the sinkhole cities are far worse than the sunshine cities.

You need to remember that New York City is the A-number one, top of the heap – that is, it has the largest population within the city itself. While other metropolitan areas may have larger populations (I guess it depends on how you define it), NYC is up there.

So if it’s the worst on a per taxpayer basis (and it is), it is HORRIBLE with respect to absolute amount of the hole.

From the report itself:

(75) NEW YORK CITY remains in

last place because it needs more than

$186 billion to pay its bills. The city’s

finances continue to deteriorate as the

amount of unfunded retiree health care

promises balloons to more than *twice

the amount of unfunded pensions*.

The city’s pension plans are 76 percent

funded, but the city has only funded

four percent of the $106 billion in

other post-employment benefits that

employees have earned and have been

promised.

I’m going to take the data TIA has provided on NYC, and do a really simple illustration of the problem.

So, to make this fair, I am removing all capital assets & debt from the illustration.

NEW YORK CITY IS IN A DEEP, DEEP HOLE

We are looking solely at assets available for current expenses and accrual of past non-capital expenses (you may know this better as pensions and other post-employment benefits (OPEBs, aka retiree healthcare)).

I want you to look at that. The total assets available are just about 60% of the retiree healthcare liability.

And no, this is not one of those “if everybody retired tomorrow”. This is the present value of retiree healthcare promised to current retirees, and for future retirees assuming their retirement at normal patterns in the future, with healthcare cost trends what you would expect in the future.

But hey, I split out the components. Let me stack these next to each other. This should be fun.

The assets available cover only 25% of the total liabilities. And given current fiscal leadership in New York state and in the city, I don’t see this getting much better.

So here’s the scary bit of the story.

If you subtract the assets off from the liabilities, you have a hole of $186.7 billion for NYC by itself.

The whole TIA State of the Cities measures a hole of $323.2 billion.

New York City, by itself, is 58% of the top cities’ hole. That gives you an idea of the problem.

Here’s another way to look at it:

THE MISSING JERSEY CITIES

By the way, Newark and Jersey City aren’t in this report… let me quote why:

Unfortunately, TIA was unable to

include two of the most populous

cities—Newark and Jersey City in

New Jersey—because they do not

issue annual financial reports that

follow generally accepted accounting

principles (GAAP). As a result,

we included the next two largest

municipalities based on the U.S.

Census Bureau’s 2017 population

estimates.

Given how New Jersey overall is doing… how do you think they would likely have stacked up?

BALANCE SHEET BLUES

The problem I have (and many of my public finance peers) is we talk balance sheet, which is so abstract to many people.

I’m not going to do the usual trick and knock 0s off the end of the numbers above. Even then, many people would have trouble with thinking about these numbers in any realistic way. They think — “Oh, like my mortgage!”, which just throws people off. Because no, it’s like your credit card balances. And saving for your own retirement. And so many other things most people don’t have a good way of thinking about because they don’t understand the long-term nature of finance.

Many people who do understand finance would dismiss TIA’s numbers because “These aren’t all due at once!” This is a minimizing statement that’s being used more and more to hide the fact that these are current operating expenses that are accruing every year as debt, like living way too high for your income and putting it on a credit card.

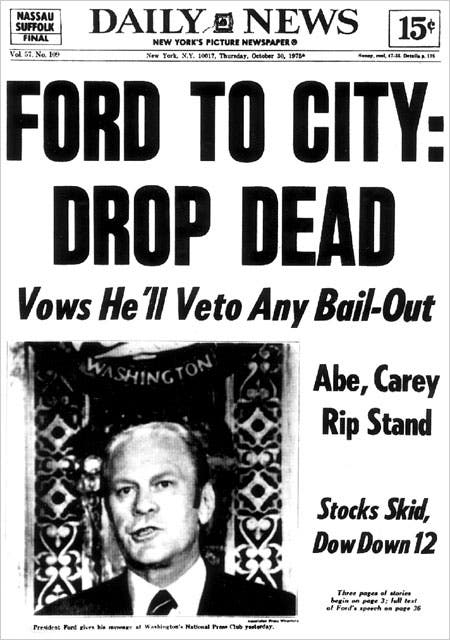

But here’s a point I want to emphasize: the reason I’m highlighting New York City and the absolute amount of its hole, is because the various cities and states will be going to the federal government with hat in hand, trying to minimize the enormity of their debt.

Putting up a per taxpayer debt amount for that city works if and only if you’re expecting that tax base alone to deal with that debt. I can see attempts to nationalize this debt, and let’s head that off at the pass.

This is not some accident, some bad luck on the part of New York City. They have made some very large promises to its current and future retirees, and the rest of us did not make those promises.

WHICH STATES ARE WORSE OFF THAN NEW YORK CITY?

I went to Data-Z, Truth in Accounting’s data project. I decided to check to see which states had worse deficits than New York City.

Unsurprisingly, Illinois is in that camp. For the September 2019 release, Illinois was $224 billion in the hole, against New York City’s $187 billion.

New Jersey is $209 billion in the hole.

Connecticut is at $68 billion in the hole.

California is not in the bottom five, as the ranking is based on a per taxpayer basis. And California, still, has a lot of taxpayers. Cali is $275 billion in the hole.

If the feds bail out New York City… why not these states? Don’t look at the per taxpayer shortfall, look at the total amount — because that’s what’s going to come cap in hand for a bailout.

And the U.S. cannot afford to bail out every profligate city or state.

The PDF of the full State of the Cities report is here, from Truth in Accounting.

Related Posts

Taxing Tuesday: Income Tax for Chicago?

Taxing Tuesday: Lazy Days of Summer

Taxing Tuesday: A Retrospective of Stupid Tax Policy - Soda taxes, Amazon tax, SALT cap