Taxing Tuesday: Bernie Tax!

by meep

Thanks to one of my friends, I have gotten to see the glory that is Bernie Tax!

There are two parts to this tax (and I find this misleading, but I’ll get to that in a bit).

First, more tax brackets at the upper end! [I’m using income of $100K, single filer, just for simplicity]

From the website:

My own graphing of marginal tax rate by income just so you can see:

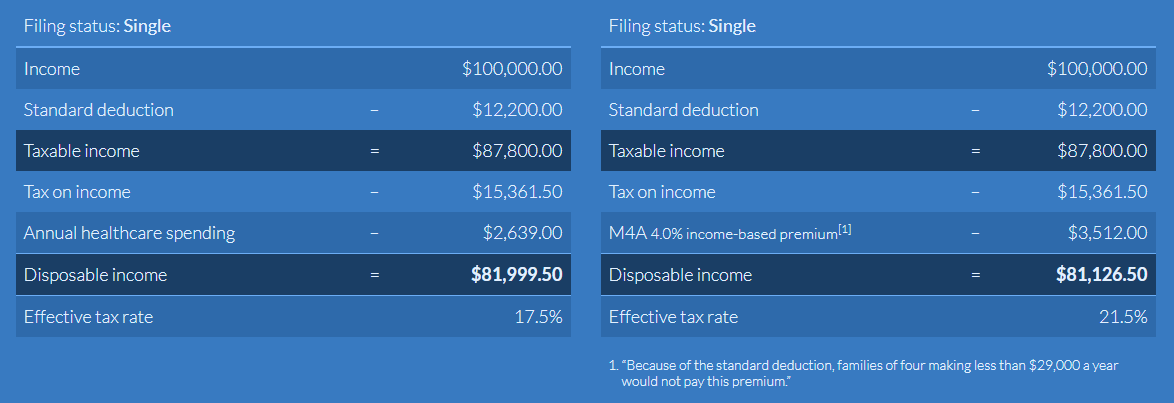

Now, the part I considered misleading: breaking out 4% additional tax at this step of the calculation:

The concept is that you would compare the 4% tax against what you paid in healthcare. As opposed to adding that 4% to all the taxes above, as all the taxes are fungible.

Then there’s the question of what that 4% would get you in either case.

MEEP TAX UPDATE

Second place goes to the IRS!

— Mary Pat Campbell (@meepbobeep) February 20, 2020

That one is my smallest refund. I do feel pretty proud coming within 30 bps of my taxes on federal. I've pretty much given up on state, and will get my 200 bps or whatever back each year

I am still waiting on New York.

I don’t like that it’s taking NY so long. I wonder….

TAX STORIES

- Pa. property tax: Essential to schools, tough on seniors

- 15 Legal Secrets to Reducing Your Taxes

- The Netflix and Spotify tax: States are making streaming services more expensive

- TurboTax maker is spending $7.1 billion to buy Credit Karma, a free tax service competitor

- Ending the credit union tax exemption hurts everyone

- High-tax state exodus drives boom in ‘secondary’ luxury housing markets

- Scammers Are Sending Fake Tax Forms To Taxpayers Via Email

- West Virginia Republicans Move Forward on Tax Overhaul

- Buttigieg, husband Chasten saved thousands under Republican tax cuts, review of 2018 return shows – not surprising at all. Most people got a tax cut.

- Did the Trump Tax Cuts Help Amy Klobuchar? – interesting that they took the standard deduction, after havnig $47K in deductions before. I go over the SALT cap by more than 150%, and still… itemized deductions are better for me than the standard deduction. Some of us have charitable contributions.

- Tax refunds are going to be delayed for filers claiming these tax credits – mainly, the EITC

- 2020 Income Tax Refund Chart Shows Estimated Dates for Refunds

- Insights into the Tax Systems of Scandinavian Countries

- Maryland Lawmakers Consider Sales Tax Hike on Businesses

TAX TWEETS

As president, I will rebalance our economy so it works for all Americans, hold Wall Street and corporations accountable, and bring fairness to our tax system so we can lift millions out of poverty and into greater opportunity. https://t.co/uT86SGoaIV

— Pete Buttigieg (@PeteButtigieg) February 24, 2020

I agree; SALT cap zero!

History repeats itself as a sales tax hike pushes Japan toward recession https://t.co/wTOwtiLncG

— Bloomberg (@business) February 25, 2020

There just may be something else going on in the world right now, too, that could be affecting Japan.

Taxes. Lots of taxes. https://t.co/FjqAdUomCp

— Harry Khachatrian (@Harry1T6) February 25, 2020

More taxes. https://t.co/7SUZsOCgvF

— James Woods (@RealJamesWoods) February 24, 2020

And massive increases in your taxes. https://t.co/QDUBn5Nz6c

— The FOO (@PolitiBunny) February 25, 2020

Hmmm, I guess it was obvious.

The truth is all of you will get free healthcare from your taxes and hopefully you will take some free college to learn that you have been the oppressors this whole time. Just because they don’t put you in the gulag doesn’t mean you aren’t imprisoned by their systemic class war. https://t.co/RYvfmRMV6l

— Rep. Mike (@MaineSocialist) February 25, 2020

Get a load of this dumbass.

By the way, I looked at his profile. And saw it had a link supposedly to his website. This was the link. That’s right – he doesn’t have the domain. Or didn’t bother to link it up. My guess is he’s too cheap to pay for anything online.

Instead of free childcare, how about a prosperous economy and low taxes that require only one income so they can be raised by their loving mother instead of a heartless bureaucracy. https://t.co/7VgVWdJbDi

— ThirdMonkey (@ThirdMonkey97) February 25, 2020

Or, in my family’s case, raised by their loving father.

When you’re filing your taxes and the number starts going backwards instead of forward… pic.twitter.com/NMS5L9fcgg

— Kerry DeSean West (@ktweetedit) February 25, 2020

…. yeah

#BloombergIsAnOligarch and that's no lie. His only motivation is to not pay taxes that he can absolutely afford to pay. pic.twitter.com/QVcZhZBS6P

— Actual Identifiable Humanbeing who Supports Bernie (@melaniesdavis) February 25, 2020

Bloomberg did not run for president to save our democracy. He ran to maintain the status quo and avoid a wealth tax.

— Ryan Knight (@ProudResister) February 25, 2020

Dudes, I think his personal estate planning cost a lot less than $500 million.

Bloomberg has lots of options to avoid whatever dumbass wealth tax the various Dem Socialists cook up. That even the French dropped.

He didn’t get that rich by not knowing how to optimize his money.

wine + doing taxes wouldn't NORMALLY seem like a good idea but….. pic.twitter.com/Rgv5usX0ly

— Bon (@MadamoiselleBon) February 25, 2020

Personally, I go for bourbon.

I have paid my Income Tax in time. Have you paid yours? #incometax

— Dr. Sandeep Mittal, I.P.S., (@smittal_ips) February 25, 2020

Let us build the Nation together. pic.twitter.com/Ne5rriL5yJ

These “I paid my taxes!” certificates are cute. I don’t think we need them in the U.S., though. We have to file our returns to GET OUR MONEY BACK because we were forced to overpay in the prior year.

“You know bernie sanders will raise taxes right?”

— Kori in the House (@koricorry20) February 25, 2020

Me: voting for bernie sanders anyways pic.twitter.com/JSZoWeD7Yh

Okay, then. Why not just shovel more taxes at the government right now?

(SALT cap zero!)

Related Posts

Taxing Tuesday: The French People are Revolting (UPDATED)

Meep Quicktake: Congressional Bailout Bill Status and Positioning

Taxing Tuesday: Are People Moving Due to Taxes?