Taxing Tuesday: New York is Still Number One! Also: MORE TAXES FOR EVERYBODY!

by meep

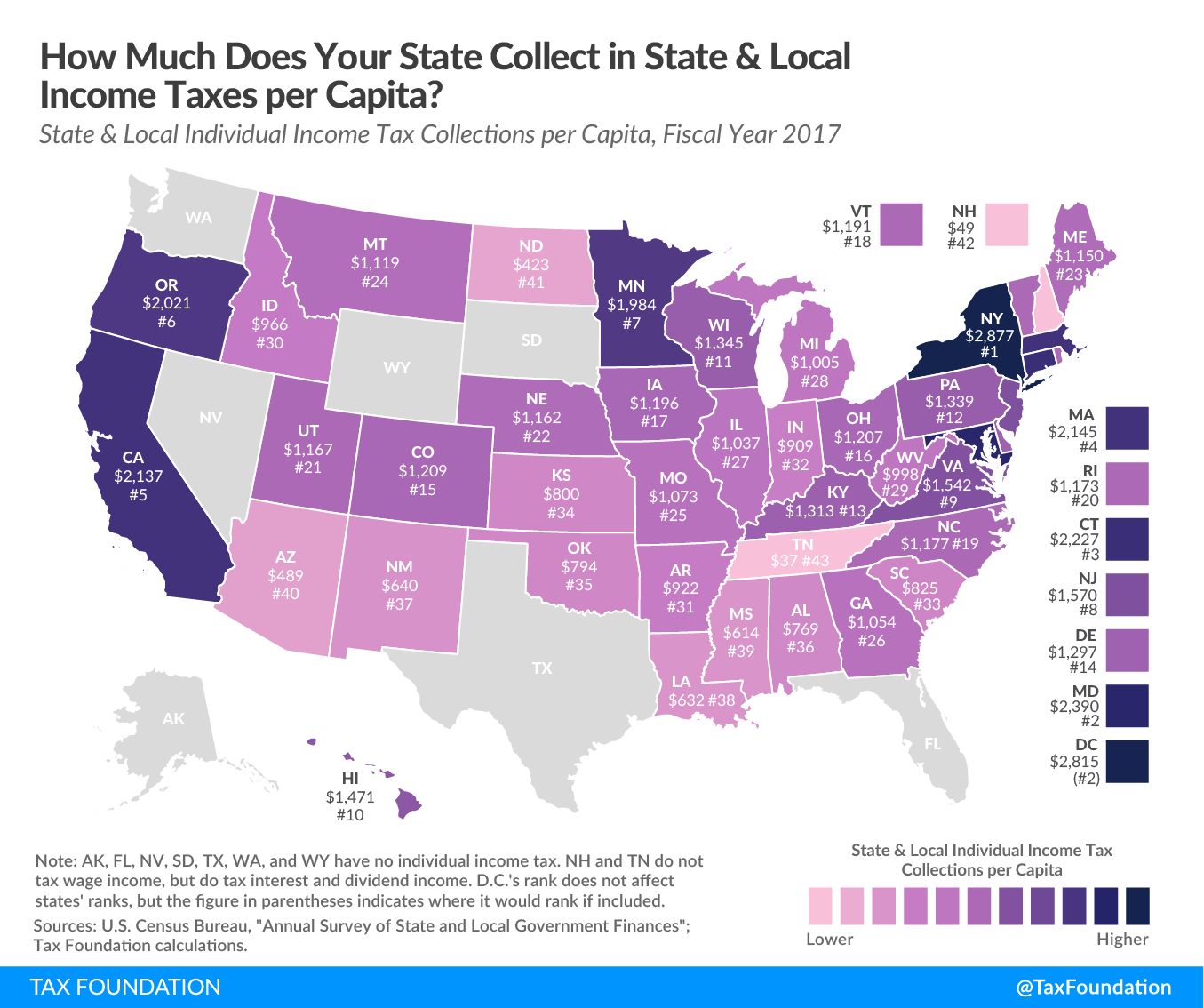

The individual income tax is one of the most significant sources of revenue for state and local governments. In fiscal year 2017, the most recent year for which data are available, individual income taxes generated 23.3 percent of state and local tax collections, right behind general sales taxes (23.6 percent).

The map below shows combined state and local individual income tax collections per capita for each state in fiscal year 2017. Forty-one states and the District of Columbia levy broad-based taxes on wage income and investment income, while two states—New Hampshire and Tennessee—tax investment income but not wage income. Tennessee’s tax on investment income—known as the “Hall tax”—is being phased out and will be fully repealed by tax year 2021. Seven states do not levy an individual income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

…..

New York ($2,877), the District of Columbia ($2,815), Maryland ($2,390), Connecticut ($2,227), Massachusetts ($2,145), and California ($2,137) came in with the top five collections per capita.

Here, have a map:

Now, I noted New York was number one last year. Though that one was for all state and local taxes, and this one is just individual income taxes.

MEEP TAX UPDATE

Coming up last, a week after the IRS, is New York State!

— Mary Pat Campbell (@meepbobeep) February 28, 2020

[deposit was February 27]

Which had to essentially give me all my money back. Because I already paid it all to CT.

Now I have to look at filing taxes for the Soviet Memory Project, Inc., a nonprofit I’m involved with. I expect the taxes for us to be minimal.

BERNIN FOR TAXES!

Bernie Sanders reveals ‘major plans’ to be funded by new taxes, massive lawsuits, military cuts

Bernie Sanders unexpectedly released a fact-sheet Monday night explaining that he’d pay for his sweeping new government programs through new taxes and massive lawsuits against the fossil fuel industry, as well as by slashing spending on the military, among other methods.

Needless to say, the piece tears apart all the taxation ideas (and that the lawsuit concept may not be workable).

This is what’s on Bernie’s website:

College for All and Cancel Student Debt

It will cost $2.2 trillion to make public colleges, universities and trade schools tuition-free and to cancel all student debt over the next decade. It is fully paid for by a modest tax on Wall Street speculation that will raise an estimated $2.4 trillion over ten years. Click here to read the plan.

That is a transaction tax. You know, any time you rebalance your retirement savings. You’re paying for somebody else’s college.

Expanding Social Security

Bernie’s bill to expand Social Security will increase benefits for low-income senior citizens and people with disabilities by more than $1,300 a year. It is fully paid for by making the wealthiest 1.8 percent of Americans – those with incomes over $250,000 a year – pay the same rate into Social Security as working families.

The current Social Security cap is $137,700. I’ve been going over the cap (not necessarily that cap) for almost a decade now.

But note that there’s a big hole from the current cap to $250K. Mmmhmmm.

Housing for All

Bernie’s proposal to guarantee housing as a human right and to eliminate homelessness will cost $2.5 trillion over the next decade. It is fully paid for by a wealth tax on the top one-tenth of one percent – those who have a net worth of at least $32 million. (Bernie’s wealth tax will raise a total of $4.35 trillion.)

Ugh. Wealth taxes are so idiotic, even France dropped it.

Universal Childcare/Pre-K

Bernie’s proposal to guarantee universal childcare and pre-school to every family in America who needs it will cost $1.5 trillion. It is fully paid for by a wealth tax on the top 0.1 percent – those who have a net worth of at least $32 million. (Bernie’s wealth tax will raise a total of $4.35 trillion.)

Dude, you keep hitting up the same people to fund all this stuff.

Eliminating Medical Debt

Bernie has introduced a proposal to eliminate all of the $81 billion in past due medical debt held by 79 million Americans. It is fully paid for by establishing an income inequality tax on large corporations that pay CEOs at least 50 times more than average workers. .

Oh you idiot. CEO pay got distorted because of crap like this.

Yeah, I’m not doing the rest, as we saw the Bernie Tax last week. That’s enough for me for right now.

MORE TAXES FOR NEW JERSEY!

Murphy seeks over $1B in higher taxes, including for cigarettes

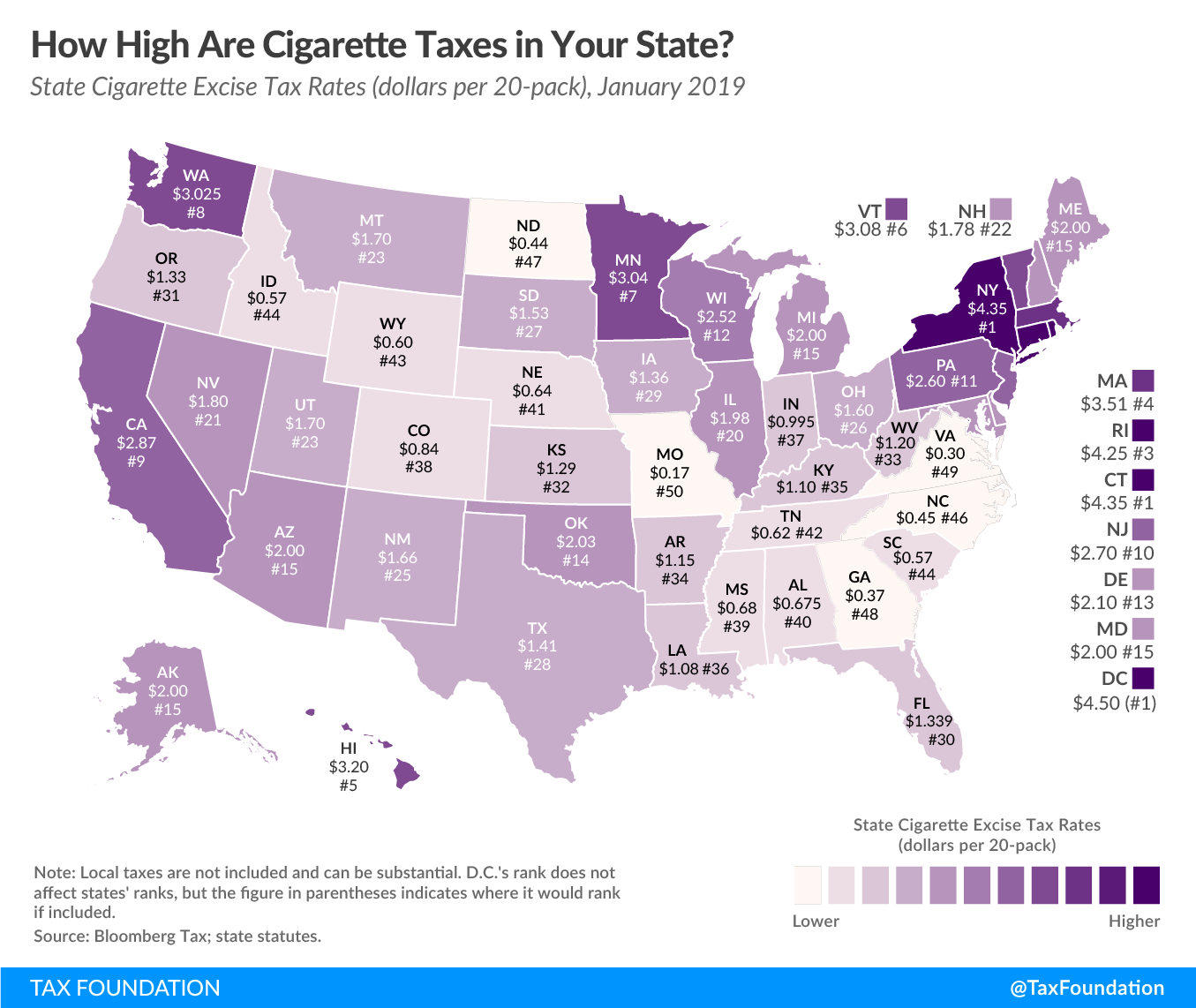

Gov. Phil Murphy is proposing a nearly $40.9 billion state spending plan for fiscal 2021, funded in part through more than $1 billion in tax and fee increases, including a $1.65 per pack hike on cigarettes.

Murphy proposes to boost income taxes by $494 million on people with over $1 million, projects the cigarette tax increase would cost smokers $216 million and wants to collect $180 million through a “corporate responsibility fee” on businesses whose workers use Medicaid for health coverage.

He is also proposing to create a state-level version of the health insurer assessment that was recently repealed by the federal government and provide at least $200 million from the revenue that results toward subsidies for New Jerseyans buying health insurance.

So let’s figure this out. I assume he’s proposing a balanced budget, so the $1 billion extra was on $39.9 billion before. That’s a 2.5% increase in taxes.

Still, I have a feeling the “targeted” taxes are not going to give him what he wants.

Looking at the 2019 cigarette tax rankings, New Jersey is sitting at $2.70 per pack tax…. and he wants to hike that up by $1.65? To $4.35?

I see the ploy – match New York’s #1 cigarette taxes in the nation.

New York has a cigarette smuggling problem due to its super-high cigarette taxes. It would be worse for New Jersey, because it’s not that large of a state. Delaware has a cigarette tax of $2.10… you really going to try to bust every vehicle coming from Delaware for cigarettes?

Supposedly, the extra billion is supposed to be for pensions. Yeah, we’ll see.

SODA TAX

Chicago’s Short-Lived ‘Soda Tax’ Cut Consumption, Boosted Health Care Funds

hicago’s brief and now-defunct soda tax did cut the consumption of sugar-sweetened drinks, a new study finds, along with raising funds for public health initiatives.

From August to November 2017, when the tax was in effect, the volume of soda sold in Cook County dropped 21% and the tax raised nearly $62 million, nearly $17 million of which went to a county health fund.

Yes, it dropped 21% because many people just went to the suburbs and bought their soda at grocery stores/Walmarts out there.

I forget how much the tax was projected to earn. Oh wait, I have my extensive soda tax series! Let’s go see.

In This post, the county was suing a beverage industry group over the delay of the implementation of the soda tax by about a month. They asked for $17 million.

Hmmm, 4 months * $17 million = $68 million… hmmm, off by about 9%. That’s actually not too bad of an estimate.

Back to the article:

The researchers also found no significant increase in purchases of untaxed drinks.

…..

It is not the government’s business to determine what people drink, Powell said. “But governments do play a role in helping to correct what economists call ‘market failures’ that may lead consumers to over-consume certain products, such as sugary drinks or tobacco,” she noted.The goal of the tax is to help offset the negative health consequences that are associated with these drinks, which end up being paid for in part by other tax revenue, Powell said. “We have seen this same policy used as a means to help reduce smoking,” she added.

Yes, and the problem is they often used those taxes for other things, so as fewer and fewer people smoke, they end up having to increase the cigarette tax.

[looking above to New Jersey]

TAX STORIES

- It’s stupidly easy to get people to drink less soda – yes, it’s about the soda tax study

- HIGH ILLINOIS TAXES DRIVE OUT BUSINESS

- The Illinois exodus: A taxing problem

- WHY THE SODA TAX ‘WORKED’ AND THE PROGRESSIVE TAX WON’T

- Pritzker’s office pressures newspaper to unpublish news story on progressive tax

- However Bloomberg fares on Super Tuesday, Democrats should adopt his plan to tax the rich

- Upset you owe too much in taxes? Here’s how to fix that

- Americans continue to vote with their feet towards low-tax states

- What accountants want you to know ahead of Tax Day

- After one alarming tax fairness study, CT is wary of launching a second

- This is how much American workers saved during the first year after Trump tax overhaul

TAX TWEETS

We've got to make a progressive case that tax can pay for a civilised and decent society. pic.twitter.com/bZeqNMiF1Q

— Rebecca Long-Bailey (@RLong_Bailey) March 3, 2020

Bernie’s tax rate is 0.2% too high! pic.twitter.com/ESAqAYl9xB

— Elon Musk (@elonmusk) March 3, 2020

[note: the tax brackets these marginal rates apply to are not shown. There’s a reason for that.]

[also, I have no idea what the 0.2% relates to. I assume Musk is pointing out how high Bernie’s proposals are, and that other Dems are saying it’s only a little bit high… I don’t know.]

Hey

scottmorrisonmp</a> you keep saying you won't agree to a tax on people to reduce emissions.<br><br>You seem to forget that when the carbon tax was introduced the Gillard gov brought in SUBSTANTIAL COMPENSATION for us to mitigate the tax effect. <br><br>You are such a pathetic PM.<a href="https://twitter.com/hashtag/abc730?src=hash&ref_src=twsrc%5Etfw">#abc730</a> <a href="https://t.co/onQB9whGrI">pic.twitter.com/onQB9whGrI</a></p>— Father Ted (oldjoeschmo) March 3, 2020

`

#VoteForBernie because it is NOT radical to want your taxes to pay for healthcare fo all of us, not the chosen few. https://t.co/hWBQttaWlm

— Michelle H Burk Fight for it! (@MichelleH_Burk) March 3, 2020

You mean the people poor/disabled enough to be on Medicaid, or the people old enough to be on Medicare? Yeah, that’s the few.

Biden Makes Enthusiastic Promise To Raise Your Taxes. Don Jr. Chimes In. | The Daily Wire https://t.co/vRqlq01zUq

— Donald Trump Jr. (@DonaldJTrumpJr) March 3, 2020

Opponents of Bernie's wealth tax:

— Warren Gunnels (@GunnelsWarren) March 3, 2020

Steve "the foreclosure king" Mnuchin

Gregory "outsourcing is good" Mankiw

Larry "deregulating Wall Street is great" Summers

Jamie "a recession will be good for my bank" Dimon

= those who are funded by the establishment & the billionaire class https://t.co/064U9L7h78 pic.twitter.com/TjRGSzbTKH

And me. Who none of these people are paying. Harrumph.

“Free” health care sure is expensive…

— Heritage Foundation (@Heritage) March 3, 2020

Did you know Canadians pay up to 51% more in taxes, yet out-of-pocket health costs are close to Americans—even though Canada covers only marginally more than the U.S. https://t.co/lHvuVhOIma

Related Posts

Meep Quicktake: Congressional Bailout Bill Status and Positioning

Taxing Tuesday: Trying to Escape Property Taxes, Follow-the-Leader, More Married Couple TCJA Scenarios

Taxing Tuesday: Maneuvering to Benefit the Rich, Hope the Suckers Stop Looking, and More