State Bankruptcy and Bailout Reactions: No Pension Bailout, No State Bankruptcy Contingent

by meep

I meant to post this some days ago, but things happen. Also, turns out the appropriators, the House of Representatives, won’t be back next week. As I said to somebody on the phone, the name “Senate” literally means “a bunch of old guys”, so maybe the Senate should rethink being near each other. Then again, it may free up some seats that have been occupied by the same people for a very long time. So I figure I’ll get at least a few weeks’ worth of posts out of the next state/local government funding bill.

To remind you of the situation: Illinois asked for money from the feds, and specifically, some to pay for their pensions. McConnell replied no pension bailouts for you, but hey, what about state bankruptcy?

There have been reactions. I’m in the group I’m covering today.

Here is my stance: no COVID-19 relief funds are for paying for pensions, specifically, the unfunded liabilities built up over decades. [For most of the U.S. public pensions, they built it up over the past 20 years, as most were fully-funded in 2000. For the worst-funded pensions, it reaches before 2000, and sometimes to before I was born in the 1970s.]

In addition, no, Congress shouldn’t try passing some sort of legislation allowing for a bankruptcy process for states.

I decided to start with this grouping because there aren’t a lot of variants here. There are only so many ways to say “No, states aren’t allowed to use federal courts to shield themselves from creditors” and “No money for old pensions”.

The ones wanting bailouts, and the ones willing to use a carrot-and-stick approach to state finances, have lots of variations they can play, from the amounts they think are “fair” to dole out to profligate states to the various strings-attached-conditions that could get through Congress.

Then there are the people who are totally delusional one way or other in terms of practical politics. No, Illinois pensions are not going to get bailed out. No, there is no way you are going to get your requires-30-years-to-enforce plan through Congress and make it stick.

I will not be completely exhaustive [after all, many people are commenting on this], but I do hope to be comprehensive in covering the various points of view.

Let me address the concept of state bankruptcies first. You can skip this next section if you understand what municipal bankruptcy means. [Also, I am not a lawyer, so I will likely get some of the details wrong… I’m trying to hit material points. Feel free to correct me, though: marypat.campbell@gmail.com]

Understanding Municipal Bankruptcy (Chapter 9)

First, you need to understand what bankruptcy is. It’s a legal process, which has different “chapters”, where it depends on the kind of entity you are [corporation, individual, municipality], and you have to qualify to be able to file.

Even for municipal bankruptcy, the debtor can’t simply decide “I want to dump all my debt, let me file for bankruptcy”. Even though bankruptcy is overseen by federal courts, the requirements for municipal bankruptcy can differ state by state.

Indeed, Prichard, Alabama attempted Chapter 9 bankruptcy with respect to its pension obligations, and had that cause denied at least once. I’ve been trying to dig up the final disposition of the case in federal court, but all I know is that ultimately Prichard and its pensioners came to some sort of private agreement after the money completely ran out of the pension fund. The Prichard example is important to remember, because many municipalities have only their pension debt as an ongoing obligation.

Back to states: most states have outstanding bonds, and may even have unpaid vendor bills (like Illinois) they’d love to discharge.

But here’s the point: federal judges oversee the process, can say an agreement is not acceptable, etc.

This is not a problem for regular municipal bankruptcy. Most Chapter 9 bankruptcies are not even for what we’d consider regular government entities. Of 311 Chapter 9 bankruptcies from 1980-2018, 181 were of municipal utilities or special districts [like a special water district]. 54 were of city, county, or village bankruptcies — what most of us would consider governmental entities. In almost all of these cases, it was just bonds being renegotiated: not pension benefits, and certainly not benefits already accrued.

The first municipal bankruptcy that really had a pension benefit cut was Detroit’s in 2013. Prichard’s, as I said, I couldn’t find out how that resolved. [again, I am not a lawyer]

With Detroit, the benefit of the bankruptcy process was to have a definitive legal settlement with all creditors, with oversight to make sure the settlement was actually supportable by Detroit. I am skeptical that the pension cuts were enough, especially as Detroit Schools weren’t part of the workout, but that remains to be seen.

In municipal bankruptcy, it’s not that there is no money for operations after it is all worked out. Indeed, the whole point of discharging the old debt [and perhaps replacing it with new, smaller amounts], is so that the functions of government can continue. There are likely cuts — employee contracts changed, headcount reduced — but most of that stuff can be done before bankruptcy, and often is. It takes the bankruptcy process to legally settle all the debt [not cash flow] issues.

Ultimately, here is the point: municipalities have limited sovereignty themselves; indeed, many municipalities don’t even have the power to file for Chapter 9 bankruptcy without legislative approval in their state. Municipalities in California can file if they meet certain financial conditions. Municipalities in Illinois cannot without explicit permission from the Illinois government.

States have sovereignty — and municipalities don’t.

It is not of a concern that a governmental entity with very limited powers has a federal court overseeing some of its financial decision-making.

It is of concern if the federal court is overseeing the political and financial decisions of a sovereign state.

No to State Bankruptcy: States are Sovereigns and Can Default

If financial obligations states have accrued are too much for them to ever pay, then they can gird their loins and tell their various creditors to come to the table. If they can’t pay the pensions AND the bonds AND not drive all the taxpayers away, there are all sorts of things they can do.

It’s not all or nothing. And yes, it’s a political negotiation process.

Yes, there are consequences to any of the actions they take, including partially defaulting on promises already made. If they default on bonds [again, could just be a “haircut” – doesn’t need to be a complete default], they will likely not be able to issue any bonds for a long time. If they do like Rhode Island, and cut parts of pension benefits, you can have bad blood with public employee unions. In many cases, state governments first try to increase taxes, and thus can get bad blood with taxpayers [or lose taxpayers as they leave the states].

The most likely result is that all three groups get hit once the money runs thin. And lots of people get angry.

But you know, there are also consequences to making promises you cannot fulfill. And no, the federal government is not going to step in for that. And no, they’re not going to give you third-party cover to have a federal judge oversee the process.

A sovereign state deciding to default on their bonds and pension promises is a political decision. But then, municipal bankruptcy in Chapter 9 is also a political decision. The political entity actually has a lot of power, even in Chapter 9, to shape the direction of the bankruptcy work-out. I am not a lawyer, and have looked at this only from the outside. But it is true that the process does give a veneer of “the judge made us do this” as opposed to “We have decided to make a haircut on the bonds, and pension benefits, and hike taxes and yes, current politicians decided this.”

Sovereigns have to take responsibility for their actions, and cannot hand off that responsibility to a different government.

Kevin Williamson on State Bankruptcy

I think Kevin Williamson wrote about this best: States Should Not Receive Bankruptcy Protection

In the United States, we have a bankruptcy law for individuals, another one for businesses, and yet another one for municipalities and their subordinate agencies. We do not have a bankruptcy law for the states or for the federal government, for the same reason: They are sovereigns.

…..

Because bankruptcy law is federal law, putting states into bankruptcy reorganization would upend our basic constitutional arrangement, making state governments answerable to federal bankruptcy judges and, behind them, to Congress. The people in Illinois are, for their sins, represented by the elected officials of Illinois in matters pertaining to Illinois.

….

Sovereigns don’t go bankrupt. Sovereigns default.And that is what is likely to happen with the pension crisis, at least as far as states’ creditors are concerned. It is what should happen. It will be unpopular: Unlike many other financial instruments, municipal bonds are held mostly by households, not by financial institutions.

Um, not exactly true. But the financial institutions that hold municipal bonds are supposed to be sophisticated investors [also, not necessarily true].

That said, the muni bonds with the worst credit ratings do tend to be held by individuals, and often individuals who are looking for high yield for their retirement income [and a tax-free instrument, too.] There are vulture hedge funds that specialize in these distressed munis, who have legal teams to look out for their interests. You may have heard of such in the Puerto Rico pseudo-bailout.

In any case: buyer beware.

Back to Williamson:

If we want debt markets to work, then investors have to pay the price for bad investments. (Lending money to an organization run by Bill de Blasio is a bad decision.) Making creditors take a painful haircut creates incentives to discourage such willy-nilly lending and profligate spending in the future. The more it hurts, the better. It is going to hurt a lot and already is hurting some, which is why investors have been running away from municipal debt.

Government debt should in this respect be treated like any other debt — and we should change the law to strip municipal bonds of their tax-free status, which creates a subsidy for debt.

Good luck with getting the government to say “Oh, yes, the bonds we issue should totally be taxed… so that we have to pay after-tax interest rates on the bonds.”

It doesn’t matter if I agree that’s what should happen. It’s not going to happen right now.

The most likely way forward — the only plausible way forward short of gutting the Constitution — is for states to engage in a long, painful, disruptive negotiation with their creditors, their pensioners, and other interested parties. There will be endless lawsuits, unpopular budget cuts, unpopular tax hikes, and much else that is designed to make no one happy except for the lawyers. (The lawyers always get paid.) But these are the decisions the democratically elected representatives of the people of the several states have made, and they will have to live with them.

Yep, and they shouldn’t have the cover of federal courts.

But here’s the great thing, politicians — many of y’all won’t be the people who have been in office for decades creating the problem. You can point at Evil Dead Politician and say: “Hey! That’s the guy you should be angry at!”

Unless you’re in Illinois and many other states, where many of the guys who did make those decisions to overpromise and underpay are still in office. Ask Mike Madigan, in office since before I was born, how he feels explaining that he’s responsible for why he has to make hard choices now.

So you can see why some may be looking at the bankruptcy option as a bad, but not as bad as not getting a bailout nor bankruptcy and having to make these really ugly political choices.

Reminder: Most Public Pensions are Limping Along, Not in Dire Straits

Only a few states are really in the bucket of never being able to pay for what they’ve already promised. The obvious ones: Illinois, New Jersey, and Kentucky. Their funding ratios were abysmal before the coronavirus crisis, and they are obviously worse now.

Here is a map from the Tax Foundation, as of end of fiscal year 2017. I could get some FY2018 or FY2019 stats, but those funded ratios move by only a little year-to-year, partly due to smoothing but also due to a relatively benign market environment up til this year.

The next states: Connecticut, Colorado, and Rhode Island. Rhode Island might consider this route; they have already adjusted state pensions by freezing COLAs, but they may need to cut further. Connecticut… woowhee. Look at what happened when Hartford floated the idea of municipal bankruptcy.

But my point is that only a few states are really in the position that they need their already accrued pension obligations bailed out immediately. Others can limp along for a very long time, even with the market hit they’re taking this year.

There will be a handful of sizable pension funds that are going to be extremely stressed this year. I will cover that another time.

But as I noted in my lookback at the 2011 floating of “state bankruptcy” idea, there are years if not decades left to run even on many of these pensions.

When we’re talking pension bailouts, we’re talking only a very limited bunch who would really need it, while it would be “nice to have” for many more.

Argument for No Pension Bailout for Illinois, New Jersey, and Kentucky

Why should the rest of the country pay for Illinois’s, Kentucky’s, or New Jersey’s pensions? This has nothing to do with coronavirus.

There is no accident that these three states have pensions in dire straits right now.

All three chose to grossly underfund their pensions over decades.

Illinois: from 2017, Geeking Out (and Illinois Pensions): Fixing a Graph and Assigning Blame for Underfundedness

The largest single component driving the unfunded liability for these is that the state chose to underfund these pensions. Out of $126 billion in unfunded pension liabilities in fiscal year 2016, $52 billion is due to decades of deliberate underfunding.

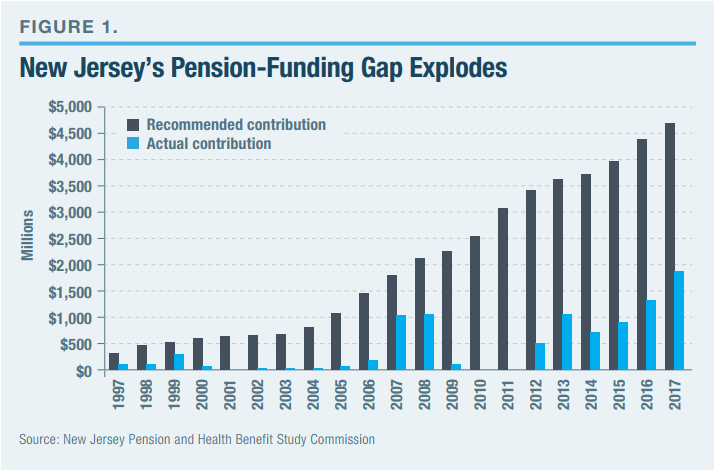

New Jersey: From January 2018, New Jersey: Running Out of Money and Options

So, they’ve never made full payments in over 20 years. Just eyeballing, the highest percentage of a payment they made was, at best, 60% of the “required” amount.

I’m sure it was longer than 20 years, but 20 years is all I have from the graph.

Kentucky: from 2017, Kentucky Pension Blues: Let’s Get This Fire Started

KENTUCKY PENSIONS IN A NUTSHELL

I’ve covered the awful condition of Kentucky pensions before, but here’s the very short version:

1. The main state pension is in an awful funded position, at 19% funded. Don’t take my word for it.

2. A few things fed into this awful funded position, but the main one is they never paid full contributions — much less than full contributions.

3. That said, the county pension plan that the state runs, and requires 100% contributions into, isn’t doing much better. Some tout their near-60% funded ratio as being something good… but it SUCKS if you’ve always made 100% contributions.

4. What’s up with that? Some bad valuation assumptions meaning those “full contributions” happen to be less than they should be, too.

In general, most public pensions in the U.S. take an approach that encourages too much risk-taking on the asset side, and too little contributions being made even if they didn’t take such volatile asset-side risks.

What About the Cities?

So above I mentioned the states needing a pension bailout [and they’re not going to get it]. What about cities in that state?

Luckily for them, they do have access to Chapter 9 bankruptcy processes.

While New York State’s pension funds are topped-up, the city funds are almost as bad as Illinois’s. And let’s not talk about Chicago.

The thing is, of course, that many of these cities are not allowed to declare bankruptcy without approval of their state legislatures, as mentioned above. Chicago and New York City are in such a position. Cities in places such as California can decide to do it on their own.

Of course, there are consequences to declaring bankruptcy, but there are also consequences of running out of pension money and not being able to pay your bonds.

Back in January, I looked at Truth in Accounting’s State of the Cities. Here we go:

Unsurprisingly, both New York City and Chicago are at the bottom of that list.

You can see most of the NYC debt is related to retiree benefits, whether pensions or healthcare.

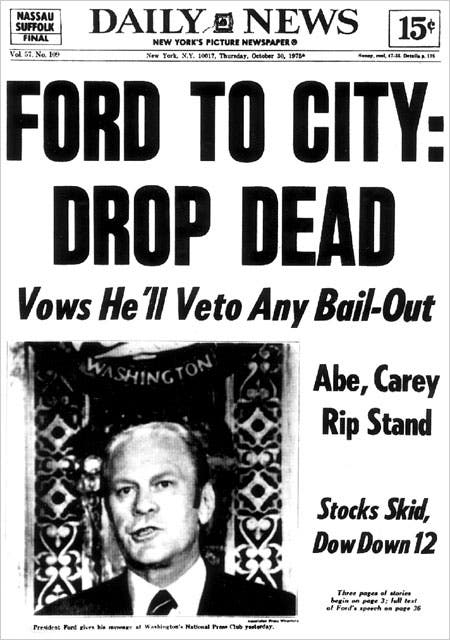

I do hope that NYC gets a partial bailout of its increased costs [and reduced revenue] due to coronavirus impacts. It has been hardest hit in the country, and whether local leadership was involved in making it worse, I am trying to be somewhat charitable [with regards to motives and decision-making ability]. Crisis management is extremely difficult, and Mayor de Blasio could barely deal with regular NYC operations [that’s as charitable as I can get.]

So yes, I am fine with a partial federal bailout of cities and states, directly tied to coronavirus impacts. That’s it.

Pensions shouldn’t come into it at all, nor retiree healthcare benefits.

How Can the Feds Help With Underfunded Public Retiree Benefits?

As I said on twitter:

The feds can help to the extent that they can provide a path to get all public employees in Social Security [so we don't have to hear about how they don't have SocSec when the pensions run out of assets.]

— Mary Pat Campbell (@meepbobeep) April 25, 2020

But this is not the time to be discussing that, specifically.

Let’s get them all on Social Security and Medicare, like everybody else. Some public employees are already covered by Social Security:

Note that Illinois has one of the lowest percentages. [Don’t ask me about Nevada].

The feds can make sure everybody in the country is on Medicare and Social Security, and then we don’t have to hear the sob stories about those who don’t have any sort of retirement benefits once the state funds run out. Yes, there will be some issues in making this transition; after all, these folks weren’t paying the 12.4% total [on income up to a salary cap] for Social Security and 2.9% total for Medicare [no salary cap] for all those years. But as a bailout, it’s one I can get behind.

Yes, I know that what one gets from Social Security, especially if you have a decent salary, is a lot less than what you’d expect from 12.4% “deposits”, but welcome to the world most Americans have to deal with.

Deal with Public Pensions Later

For all that, this isn’t the time to make these changes. A lot of people are very stressed, and many can’t make good decisions in this situation. Also, these pension funds won’t be totally exhausted for at least a few years, even if they’re in asset death spirals right now.

[If you are unfamiliar with the term, an “asset death spiral” is when a pension fund has to sell off assets for cash to pay current benefits. This is not necessarily a bad thing for a closed plan in run-off. Most of the public plans, though, are not in run-off.]

So one goes back to first principles:

1. Pension abysmal underfunding has nothing to do with coronavirus, and everything to do with choices made over decades – choices to use high discount rates to value the pensions; and choices to underfund even with rosy assumptions

2. Choices have consequences.

3. We ain’t got the money of.

This leads to my conclusion:

There will be no public pension bailouts, no matter my preferences.

Those dealing with stressed public pensions right now will need to do the best they can, but they should assume no magic money tree will come to their rescue.

Others Who Agree With Me

Or, rather, I agree with them.

Before McConnell’s remarks, there was this from EJ McMahon: Washington has no need to fund New York’s wasteful ways

It’s reasonable to ask for federal help right now. But Congress shouldn’t feel compelled to subsidize what any state or local government “normally” does. New York’s budgetary “normal” would include funding $360 million a year in scheduled increases for unionized state-government employees, plus school aid to help underwrite more than $400 million in raises for teachers and other school-district employees outside the Big Apple.

Then there is Gotham, where Mayor Bill de Blasio is asking for his own federal bailout. His “normal” budget would include $1.5 billion in retroactive payments still owed to teachers and other city employees under Hizzoner’s backloaded first-term sweetheart deal with municipal unions.

….

And even before the pandemic hit, [Gov. Cuomo] had to close a $6 billion gap caused mainly by his failure to control Medicaid spending.No one ever said Cuomo lacked nerve — but for sheer chutzpah, he has been outdone by the Illinois state Senate leader, who has asked the feds for $41 billion, including $10 billion to replenish the nearly insolvent Illinois public-pension funds.

Okay, McMahon goes on to detail a strings-attached agenda. But again, things move rapidly, and he may have different things to write now.

Also from before McConnell’s remarks: States should say ‘no thanks’ to a federal bailout

History suggests that federal bailouts are not a “free lunch” for states. They decrease state sovereignty, incentivize future fiscal irresponsibility and create a moral hazard problem. Bailouts reward fiscally reckless states at the expense of fiscally responsible ones. Academic research from the Mercatus Center at George Mason University shows that federal bailouts could even lead to higher state level taxes. According to their research, every dollar of federal aid to states drives state taxes higher by 33 to 42 cents.

Now, from after McConnell’s remarks, here is something from Rick Scott, the ex-governor of Florida, and current Senator from Florida: Don’t Reward States’ Bad Decisions

When I became Florida’s governor in 2011, we had a huge budget shortfall and had lost 832,000 jobs in four years. I had to make tough choices. We cut taxes every year — more than $10 billion over my eight years in office — and saw revenues increase every year. The state went from losing hundreds of thousands of jobs over four years to adding almost 1.7 million in eight. We turned a $2.5 billion budget shortfall into a $4 billion surplus, with $3 billion a year in the rainy-day fund.

Florida’s pension system was funded at 83.9% when I left office, and for the first time in state history all three credit-rating agencies rated the state’s general-obligation bond at AAA. Compare that to states like Illinois, California and New Jersey, whose pension systems are funded at 38.4%, 68.9% and 35.8%, respectively, despite significantly higher taxes.

Florida is well-positioned to address the coming shortfall in revenue without a bailout. The state may need to make some choices, which is what grown-ups do in tough economic times. And if we need to borrow a small amount in the short term to get us through this economic crisis, that borrowing will be cheaper thanks to our AAA bond rating and the reduction in state debt.

In short, nobody is much interested in bailing out the high-promising, but low-saving, ways of Illinois, New Jersey, and Kentucky. It’s not merely a Democrat vs. Republican issue, though yes, the most well-known profligates are Democratic strongholds.

Elizabeth Bauer Also Agrees With Me

More to the point, I agree with her.

No, The Federal Government Should Not Force States Into Pension Reform Through Bailout Conditions

In the first place, with the exception of a few plans facing literal insolvency, pension funding is not an immediate crisis-driven need. Congress has a track record of writing pretty deficient legislation when it’s done in a crisis mode.

What’s more, the string-attaching is simply not going to work. The process required to get states such as Illinois into a firmer footing regarding their pensions is a very long-term one. A cash infusion would be a short-term action. How long afterwards would the federal government exert control over states in this manner? How well could it ensure that states are complying with funding requirements not merely in the short-term, with mandated contributions subsidized by the federal government, but going forward, even after those contributions end?

And the pension crisis has been the result of a long line of politicians refusing to take responsibility for pension funding. A set of mandates from the federal government will motivate Illinois politicians, to be sure — they will become all the more innovative at finding loopholes and seeking waivers, rather than taking responsibility. Giving them the means to blame Washington and cast their political opponents as the villain will not have the effect we want it to have. Only an honest reckoning by those politicians, and the unions who cling to generous pensions, will succeed.

I completely agree. Illinois politicians have to take responsibility for Illinois promises. If they can’t fulfill those promises, then no, the federal government is not going to cover for them.

Elizabeth reminded me a few days ago that the pension request from Illinois Democrats was for only one year’s worth of pension contributions to the state funds [and an indeterminate amount for local funds].

And we both agree that shouldn’t be part of any COVID-related bailout payment to the states.

She has had a followup post: Pension Bailout Or Bankruptcy? That’s Missing The Bigger Picture

There are huge disparities in how much of state budgets go towards basic day-to-day expenditures vs. the paying off of debts, such as, again, the 25% of funds that Illinois directs to pension debt. And there are proving to be equally significant differences in how states are responding to the pandemic; in some cases, trying to manage as prudently as possible; in others, spending aggressively with no seeming regard for where the money will come from. If the expected federal funds plug holes in budgets, whether due to loss of tax revenue or new spending, solely relative to the size of those holes, that will leave the more cautious states feeling punished for their caution and will encourage the others to boost their spending even further.

As Bauer mentions, some states have actually cut back on some of their spending during the crisis, while others have decided it’s the perfect time to go whole hog….. assuming that they will be able to foist the bill on the federal government later.

I came up with a solution to this problem.

Simple Bailout Formula

To be very simplistic, I said, let’s just go for a per capita amount. That’s fair.

Yes, New York City has been harder hit than anywhere else [so far], but everywhere is being hurt by economic effects of closing down, not just NYC. Also, earlier bailout bills were for direct COVID-19 costs, so this is about secondary effects. Per capita. Easy-peasey.

I've got a simple solution for state bailout $$.

— Mary Pat Campbell (@meepbobeep) April 28, 2020

Per capita.

Then it's not predicated on cuts/no cuts; high-tax/low-tax state.

There was already a bill re: direct COVID costs, so that helps the hardest-hit most already. This bailout is about 2ndary effects.

Congress figures out how much in total it wants to spend and then divides it up based on total population. Yes, include illegal immigrants. It makes up a little for the high tax places like New York, but not really. I’m sure Texas also has a lot of illegal aliens, for example.

Sometimes there are simple solutions.

In any case, long-term problems should not be attempted to be solved in the middle of a relatively short-term crisis.

Trying to rush people into a decision when there’s no reason to take a very short-term view is an old tactic, favored by sales people of all stripes. Fake urgency is annoying.

There is a real crisis right now, in the form of COVID-19. There is a slower-moving crisis with respect to public pensions, and it doesn’t require a rapid response.

Related Posts

Weekend Videos: Is COVID Saving Lives, Pennsylvania Schools Employees, SALT Cap

How About Turning Around Hartford?

When the Money Runs Out: Some Thoughts on Public Finance and Pensions