Taxing Tuesday: Look Back to Olden Times and What Awaits Us in 2021

by meep

For the first Taxing Tuesday post of 2021, I’m mopping up old stories and looking forward to what may come this year.

One thing to note: with the Dems having (bare) majorities in the Senate and House, and with Biden as President, I am assuming some form of the Money-Palooza Monstrosity to return (I’m trying to determine if it should be named Money-Palooza Monstrosity 2: Electric Bugaloo or Money-Palooza Monstrosity 2: The Wrath of Pelosi. I guess I should wait for whatever Congress gets around to after their current circus before naming it.) With or without increased taxes of various sorts.

Let’s take a look at what we’ve got.

Death to the SALT Cap! Or… Long Live the SALT Cap?

The results are in from the 2017 TCJA, in which the dreaded SALT cap was imposed. That SALT Cap hit people like me, who live in very high tax locales. Of course, as I noted in 2019, my federal income taxes went down between 2017 and 2018. Part of that was due to less income (I dropped a side job due to Stu’s cancer), but most of it was due to the lower tax rates of the TCJA.

Well, unsurprisingly, it turns out that the TCJA really stuck it to the high-income folks living in places like mine.

The Center Square: Analysis: Federal tax overhaul increased taxes on wealthy in many blue states

The 2017 Tax Cuts and Jobs Act, harpooned by progressive Democrats as a handout to wealthy corporations, turned out to be more progressive in practice, new data from the federal government revealed.

The federal tax reform measure supported by President Donald Trump increased taxes on some wealthy property owners in high-tax jurisdictions such as Illinois and New Jersey and decreased tax burdens on the middle class.

Internal Revenue Service data released in December, analyzed by the National Taxpayers Union Foundation and Wirepoints, show the federal tax overhaul that took effect in 2018 didn’t necessarily become the tax break for the wealthy as it was criticized as.

The top 1% of earners, those with income over $540,009, paid 40% of all income taxes, according to the data. That’s despite the tax reductions they’d received under the new tax code change.

Okay, we all know how that math works — everybody could be paying lower tax rates and the burden primarily fall on the top income earners. From the Tax Foundation, in 2017 (before the TCJA), the top 1% paid 38.5% of federal individual income taxes. By the way, this is out of proportion with their share of income: 21%.

(To give you an idea where I fall: I’m in the top 10%, but not top 5%. Yet!)

Wirepoints: 2017 Federal Tax Cut Turned Out To Be Progressive. A Few Lessons For Illinois And Beyond – Wirepoints

For the first time, we have the actual results instead of estimates and assertions. In 2018, the first year for which we have hard numbers on TCJA’s effect, the wealthiest Americans paid a greater portion of the burden than they did before.

There’s more. TCJA, according to separate research, lopped a full trillion dollars off the value of high-end homes, not middle-class homes, which was part of a trade-off that accrued to the benefit of the country as a whole.

Here are the details:

The IRS publishes data on which income groups paid how much about two years after each year’s filing deadline. Those numbers for 2018 recently came out and were analyzed by the NTPU, the National Taxpayers Union Foundation. Their conclusions:

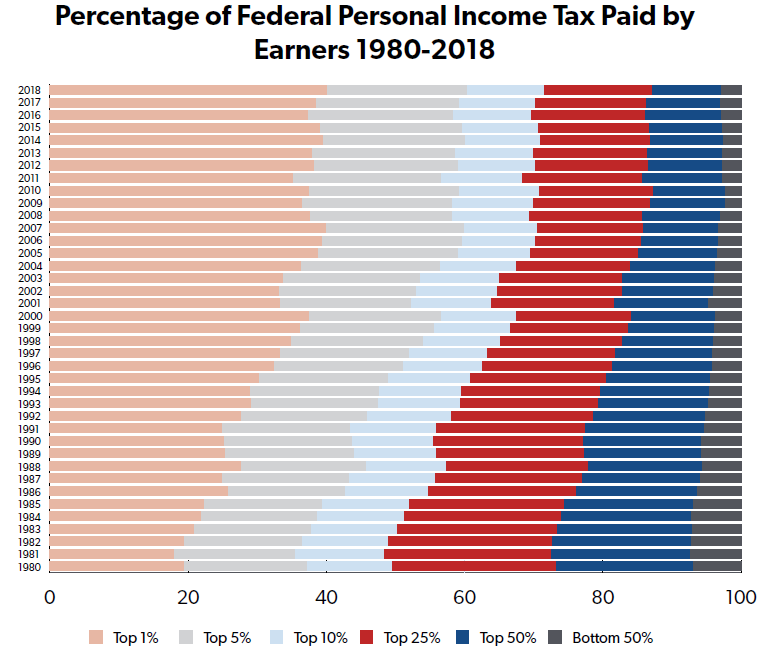

As a result of the TCJA, the share of federal income taxes paid increased for the top 1 percent from 38.5 percent in 2017 to 40.1 percent in 2018…. On top of this, the share of income taxes paid by the top 5 percent, top 10 percent, top 25 percent, and top 50 percent all increased. The bottom 50 percent of taxpayers saw their share of federal individual income taxes drop from 3.1 percent to 2.9 percent.

Their full report is here.

Here is the National Taxpayers Union Foundation report.

A graph from the report:

That’s percentages. I would like to see the absolute amount, with a comparison between 2017 and 2018.

Here are how the percentages have changed over time:

Look, I know everybody is about sticking it to the 1%, but this is not a great tax structure. If you think political donations move politics, you’d better believe being more and more dependent on a very small group of people for funding all activities (not just getting re-elected) will distort things even worse.

Ask California about that.

Back to the Wirepoints story:

But there’s clearly another reason why higher earners didn’t get a windfall, one that became immediately obvious to anybody paying high property taxes in states like Illinois. For high earners, TCJA slashed the SALT deduction – deductions for state and local income tax, sales tax, and property taxes, essentially capping them at $10,000. With a higher standard deduction protecting low and moderate incomes, that cap only hit big earners.

Both state income taxes (from CT and NY) and property taxes (from Westchester County, NY) are individually over the SALT cap for me. I did end up with a tax cut, nevertheless, due to the lower marginal rates.

It just was a puny tax cut compared to my relatives down in the Carolinas.

As Mark Glennon and John Klingner at Wirepoints point out, that Pelosi (in high-tax San Francisco, filled with high-income techbros) and Schumer (in high-tax New York) want to remove the SALT cap benefits only people like me: high income, expensive real estate, and very likely not hurting much from pandemic lockdowns. That’s not very friendly to those needing economic help. Don’t you guys want to tax people like me?

My preference is to set the SALT cap at 0, frankly, but that is a harder political move because people don’t understand that their total tax burden can go down if that occurs.

My expectation is that they will get the SALT cap removed and bump up marginal rates so that I’ll be back to paying higher taxes.

Illinois tax content during their lame duck session

I like to warn people about Illinois content.

4 Jan 2021: Tax hike in Illinois? Lawmakers to meet Friday as state faces $4 billion deficit

In a surprise move last week, Illinois House Speaker Mike Madigan announced the House will reconvene Friday for the first time since May.

Madigan’s future and the state’s desperate financial situation hang over the proceedings. Then on Monday, Republican lawmakers issued an urgent warning.

“It’s often been said that no Illinoisans life, liberty or property is safe when the legislature is in session,” House Republican Leader Jim Durkin said. “That has never been more true today and the week ahead.”

Madigan, who is still hunting for votes to keep his leadership post, has called a special session in Springfield set to kick off on Friday. Madigan has told lawmakers he’s prepared to vote to increase the state’s income tax rate.

Republicans said they believe the legislation is about to be introduced.

“Madigan and his cohorts will be trying to sneak a tax increase, yes, sneak a tax increase into the lame duck session,” Durkin said.

Well, most of the news has been about Mike Madigan’s difficulties in getting voted to continue as Illinois House Speaker.

I will illustrate with an Eric Allie cartoon.

(If you are confused: this refers to the movie A Christmas Story. Also, that Madigan has been House Speaker 35 years and was the longest-serving state speaker of the House in the country — in the position for all but two years since 1983, when he was first voted to the position.)

The fight for higher taxes is a little rocky: Opposition to income tax hike in Illinois mounts

With Illinois facing a nearly $4 billion dollar budget shortfall this year, some are fearful of a possible state income tax increase in the near future, possibly while lawmakers conduct business in Springfield this week.

…..

The last tax hike was just over 3 years ago. On July 6, 2017, the Illinois General Assembly voted to override then-Gov. Bruce Rauner’s veto of a record-setting income tax hike. Personal income tax rates rose 32% to 4.95%, while corporate income taxes rose 33% to 7%.Democratic Represent Lashawn Ford would support an income tax hike only if Republicans were on board.

“It has to be bipartisan because we have to make sure that we are fair about the taxes and have input from Republicans as well as Democrats as it relates to spending of the revenue,” Ford said.

Pritzker’s office has asked state agencies to prepare for the possibility of budget cuts reaching up to 10 percent by fiscal year 2022. He has already announced over $711 million in cuts for this fiscal year, but details remain unclear.

Yes, I understand wanting to spread the blame around. $711 million in cuts is not too shabby, but a $4 billion deficit is quite a bit bigger than that.

More Illinois tax stories:- https://www.wcia.com/news/local-news/illinois-to-withhold-federal-tax-breaks/ – well, that’s one way to do a sub rosa federal bailout

- Illinois Policy Institute: PRITZKER WANTS $500M TAX HIKE ON ILLINOIS SMALL BUSINESSES – that’s the same story as above

- US News and World Report: Pritzker Proposes Federal Tax Decoupling to Save $200M – the math in the headline doesn’t match the story (which also has hinky math) – it’s the same story as the previous two

- Rich Miller, December 23: Too late for a tax increase now

- City Bureau: Map: How All of Illinois Voted on a Graduated Income Tax

- Illinois Policy Institute: PROPERTY TAXES CONTINUE TO ROB OWNERS OF ‘HOME ALONE’ HOUSE

Legalizing Sin and Then Taxing It

Ho hum, New York increasing taxes.

WSJ: New York Eyes Legalizing Sports Betting, Marijuana to Fill Budget Gaps

New York lawmakers kicked off their 2021 legislative session with calls to alleviate the fiscal pain caused by the coronavirus pandemic and plans to consider the legalization of marijuana and online sports betting.

Members of the state Senate and Assembly gaveled in at the Capitol on Wednesday, but many lawmakers attended virtually rather than visiting the chamber. Democrats have a two-thirds majority in both chambers, and adopted rules over GOP objections that will allow for remote voting and debate while a coronavirus state of emergency is in effect.

Senate Majority Leader Andrea Stewart-Cousins, a Democrat from Yonkers, said lawmakers would confront a projected budget deficit of more than $8.7 billion and planned to raise revenue by increasing taxes on the wealthy as well as legalizing marijuana and sports-betting.

“We need to get serious in making sure that everyone shares the burden. We need to make sure that more of the millionaires and billionaires who have gotten even richer step up during this pandemic,” she said.

Gov. Andrew Cuomo said he would begin outlining his formal agenda in a Monday presentation. On Wednesday, the Democratic governor reiterated his support for legalizing marijuana — as he did at the start of the past two years.

Mr. Cuomo also said he would support the legalization of mobile sports betting under a system similar to the existing state-run lottery. The New York State Constitution allows for sports betting at physical casinos, and Mr. Cuomo’s administration has previously said it was concerned about gambling companies’ proposals for online systems where bets are made at casinos through computers or mobile phones.

Well, it seems this is a very popular idea in our locality.

WSJ: Connecticut Governor Pitches Legalizing Marijuana and Sports Betting

Connecticut Gov. Ned Lamont outlined his legislative priorities for 2021 during a virtual State of the State address, striking a somber tone as he reflected on the state’s losses during the Covid-19 pandemic.

…..

The governor said he would give priority to legalizing recreational marijuana and legalizing sports betting and online gambling in 2021 to help boost the state’s coffers. Mr. Cuomo also said Wednesday he backs legalized sports betting and legalizing cannabis. New Jersey legalized marijuana in 2020 and began allowing sports betting in 2018.“Sports betting, internet gaming and legalized marijuana are happening all around us,” Mr. Lamont said. “Let’s not surrender these opportunities to out-of-state markets or even worse, underground markets.”

Give unto Caesar’s Palace what is Caesar’s.

While I do agree that these things should be legalized (and I don’t mind them being taxed like other goods and services), but I don’t think the state should encourage this behavior, which they’ll end up doing if they produce a large stream of tax revenue.

This is the problem with prominent sin taxes: yes, there are black market workarounds, but it’s more that the state encourages self-destructive behavior and gets substantial revenue from it.

I have seen this with cigarette taxes truly decreasing the use of cigarettes, and then people smoke less, so cigarette tax revenue goes down… revenue that usually gets earmarked for more than just smoking cessation programs. We’ve seen this with gas taxes – people have switched to hybrid vehicles or actually drive less, and then the states decide to hike up the gas taxes more, because they need more revenue.

The sickest trick states do is run lotteries, and then fund education and pensions with them.

Many have written about the education angle, but here’s something I wrote about funding pensions with lottery money: Stupid Pension Trick: Let’s Use Lottery Money! and STUMP Classics: How Reliable Are Lottery Revenues? .

Other tax-related stories

- City Journal: New York Doesn’t Need an “Amazon” Tax

- Burypensions: Biden on Taxes

- WSJ: New York State Lawmakers Weigh Tax Increase on Wealthy – bringing back millionaire’s tax

- Tax Foundation: Tracking Coronavirus Tax Developments

- Tax Foundation: The Drawbacks of State Taxes on Financial Transactions

- Tax Foundation: State Tax Changes Effective January 1, 2021

- CNN Business at MSN: Analysis: It’s easy for big business to dump the GOP now. Tax hikes will be the real test

- 12 tax deductions that have disappeared

- Procedural errors will delay pot tax – this is Grant County, Oregon, btw

- WSJ: Tax Season Is Coming, and It Could Be Messy

Oh dear God, tell me about it.

I got an email today from HR, because my company’s office is in CT, and I live in NY. I’m far from the only person in this situation — we’ve got employees in Massachusetts, too, who work out of the CT office. Well, I was reminded about this status and I really don’t want to think about how both CT and NY may hit me for 2020.

While working on wrapping up a Taxing Tuesday post, HR gave me a reminder that I live in a state different from the one the company has its office building (that I've been in only three times since March 2020)

— Mary Pat Campbell (@meepbobeep) January 12, 2021

ARGH I've been putting off thinking about state taxes, dammit

Hope your tax season is peaceful! Mine won’t be!

Related Posts

Weekend Videos: Is COVID Saving Lives, Pennsylvania Schools Employees, SALT Cap

Taxing Tuesday: THE RETURN!

Taxing Tuesday: California to Tax Texts?