Illinois Pensions: Judges Retirement System (JRS) number-crunching

by meep

I’m building up to the grand finale, by clearing the smaller stuff away first.

So far:

- Development of the Illinois state pensions unfunded liability

- SERS number-crunching (State Employees Retirement System)

- GARS number-crunching (General Assembly Retirement System)

To go:

- Judges Retirement System

- State University Retirement System

- Teachers Retirement System

That last one is a doozy.

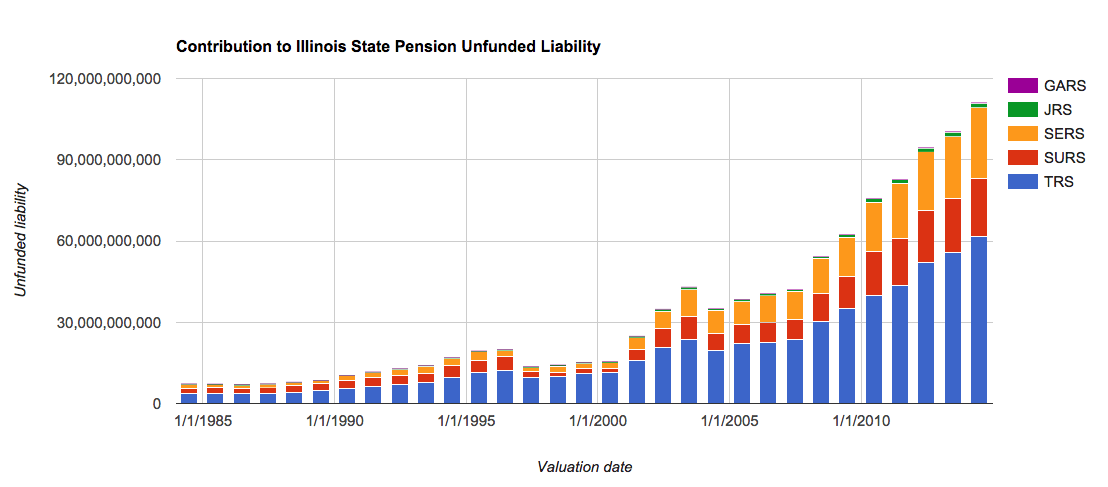

The JRS, like GARS, has a puny contribution to the overall unfunded pension liability for Illinois, for pretty much the same reason — there’s very few people in it.

Just using its most recent financial statements

Fiscal Year 2014 Highlights 970 Total Membership 951 Active Contributing Members

$776,013,028 Net Position–Restricted for Pensions, fair value

Contributions $15,918,732 Participants $126,815,881 Employer

$110,058,987 Net Investment Income 17.9% Investment Return

Benefit Recipients 767 Retirement Annuities 333 Survivors’ Annuities

$118,590,965 Benefits Paid

$2,231,263,870 Total Pension Liability $776,013,028 Fiduciary Net Position $1,455,250,842 Net Pension Liability

34.8% Funded Ratio

Yeah, that’s a crappy funded ratio. There are 1100 benefits being paid, compared to 951 actives. So it’s already retiree-heavy.

Let’s do our simple cashflow calculation:

Contribution = $142 million, which gives a nice $24 million cash cushion before even dipping into the net investment income. The investment income is throwing off some nice cash, but you’re not going to get a 18% return every year.

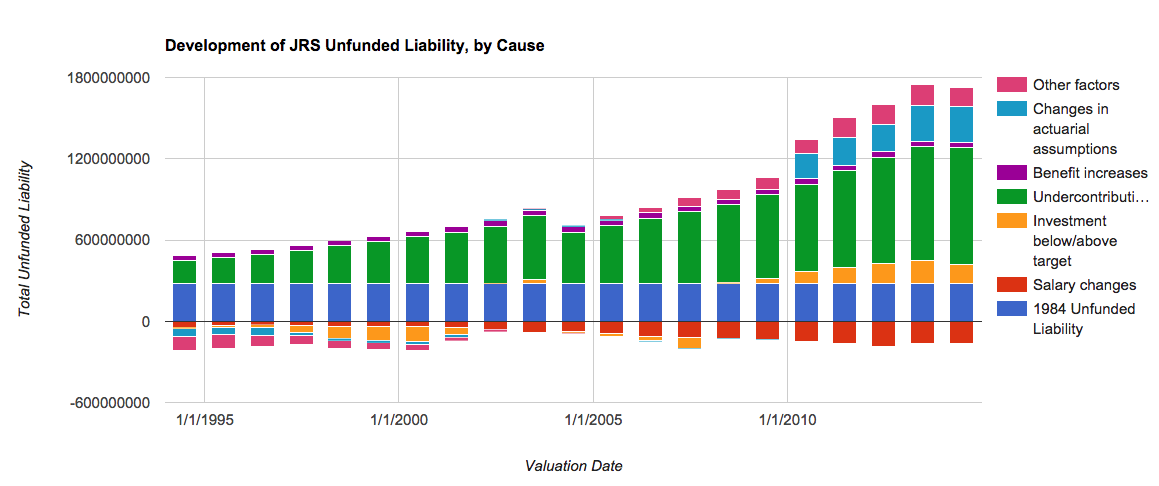

So let’s look at how the JRS unfunded liability has developed. Just like yesterday’s post, I’m going to start my graph a decade later than my data start, so it’s easy to read. After all, not much was going on in the 80s and early 90s compared to what happened when the market took off mid-90s.

If we look at our final valuation date, in 6/30/2014, we see that the bulk of the cause of the unfunded liability is undercontributions to the plan.

Note that the contribution of investments underperforming is fairly small… partly, this is because JRS has a lower expected return on assets than the other Illinois plans. Part of that is reflected in the light blue bar indicating the change in actuarial assumptions.

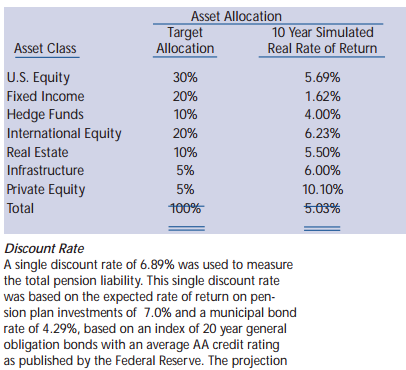

JRS currently uses an assumed return on assets of 7.0%. As with the other two plans we looked at, there was a modeling done of the portfolio, that projected something much lower than that:

Unsurprisingly, this 5.03% is the same as the other plans — I guess I like taking this screenshot over and over.

I find it interesting all these plans are using the same projected asset mix, and yet, they each have different assumed rates of return on their portion of the bucket of assets.

I wonder why that would be.

(No, I don’t.)

In any case, as with GARS, the JRS is a small portion of the unfunded liability for the whole system. Of course, there are some reasons the judges system may have concerns of affordability, but compared with the problem of having to pay the teachers pensions, supporting the judges is simple.

There is a reason that when pension reform comes around, one of the plans invariably skipped over (and this is not unique to Illinois) is those for judges:

- you’re trying to get the judges not to strike down the pension reform as unconstitutional, and

- the judges retirement plan is puny compared to the state budget and the pension problem overall

Of course, that first ploy didn’t work in Illinois.

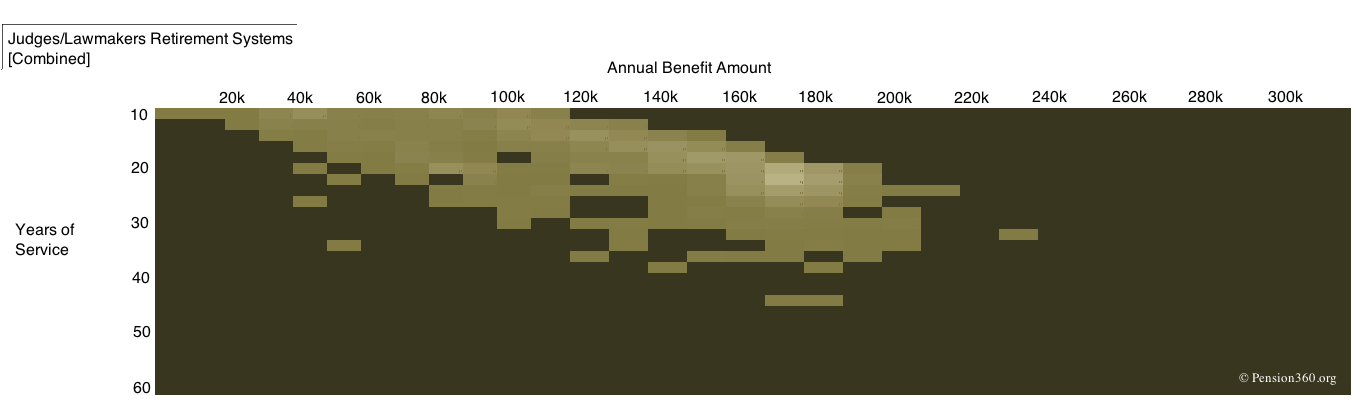

For a different visualization, from Pension 360:

This heat map, for GARS and JRS combined, shows the annual pension benefit currently being paid has a peak around $170K for about 20 years of service.

The amounts being paid (judges and legislators) are quite a bit higher than what you see for the teachers.

So yes, the GARS/JRS pensions are not so troublesome for Illinois, but if the teachers get whacked, you know they’ll want these highly-paid people who contributed to the problem to also get hit.

I am not a lawyer (much less an Illinois constitutional lawyer), but making a judgment that said the pensions basically can’t get altered, even for benefits on services not yet rendered, then they are not helping the situation. Yes, the 1970 constitution is not the fault of the judges, but given that they have an interesting interpretation that even health benefits can’t be altered for retirees (even though those costs have grown hugely), they’re definitely not helping anybody.

Related Posts

Cook County Soda Tax: Look Who's Come to Save the Day!

Sunday Sumo: Some Winning Moves on the Middle Day

Geeking Out: Florence Nightingale, Data Visualization Pioneer - and Redoing Her Famous Graph