Choices Have Consequences: While Waiting for the Greeks to Decide...

by meep

…on whatever it is they voted on today, let me go through some other people’s commentary.

THE GREEK MATH

Kevin Williamson at NRO has a piece titled “The Greeks Invented Mathematics, and Now It’s Bankrupting Them”.

Except I do not agree.

If it were the case that what they really needed to have someone construct a circle having an area equal to a specified square, using nothing but a straightedge and a compass, then yes. The mathematics the Greeks created would have bankrupted them. (Aside, here have some old math videos. I need to get back to doing those.)

“That’s not mathematics, that’s arithmetic.” – Truman Capote about the Greeks. (maybe I took some liberties)

The real problem is having an appetite well beyond their means, and even the means of their future. Much of the math being the supposed cause of the ruin of the Greeks is not causing ruin for others (yet).

But let us see what Williamson has to write:

In the run-up to the 2008 financial crisis, Greek leaders lied to bond investors and the bosses at the European Union, claiming that they were complying with EU restrictions on the size of government deficits and national debt. In reality, the Greeks had been scheming with their bankers — notably Goldman Sachs — to keep excess debt off the books. Financial crisis or not, that book-cooking was always going to be revealed: Greece maintained an excessively liberal pension system (Greeks could retire after 35 years of work at 80 percent of their working income; for Germans, it’s 45 years and 46 percent); it is publicly and privately corrupt, with jobs in its bloated public sector being handed out as political patronage and tax evasion running rampant; workforce participation is low, and private-sector workforce participation — i.e., engaging in genuine economic production — is very low.

Seriously?

Okay, I don’t actually know the details of these deals, but I’m skeptical about this neat little story about the eeeeevil Goldman Sachs and the Greek politicians snowing the bond market.

It reminds me of the various stories of the eeeeevil Bernie Madoff and the eeeeevil CDOs, etc.

Yes, obviously Madoff was a criminal fraud, but a lot of the people/institutions were deliberately “blind” to the shenanigans. I think Markopolos’s book on this is excellent, and if nothing else, read the appendix for Markopolos’s red flags to the SEC (that was ignored).

One thing I noted was not only did lots of professionals realized Madoff had to be doing something illegal (though they thought it was front-running), some of them who did realize it still did business with him (while others realized it would be bad news, and stayed far away.)

People were desperate for returns and did not want to look too closely at where they were coming from.

Something similar is going on in pension funds, btw, but that’s for later posts. And yes, Markopolos is involved.

FAIR AND UNFAIR COMPARISONS

The Vox-splaining on the Greek situation has some decent stuff in there, but it’s by MattY, so you know there’s going to be some innumerate shit in there.

And this part stood out to me:

8) The problem with Germany constantly demanding reforms in Greece

The other thing you hear a lot about with regard to Greece is “structural reform,” which Greece’s creditors want the country to undertake.

It’s easy to see from the broad economic aggregates that Greece really would benefit from some kind of reform. Even at its pre-crisis peak, Greek GDP per capita was much lower than the GDP per capita in Germany or the Netherlands. And Greek labor productivity per hour worked was dismal by European standards.

Let’s check out the graph they link to, via Google’s public data visualizer

Yeah, Greece does suck… when you compare it to Finland and Germany.

What odd choices. There’s more to the EU and the eurozone than those two countries. Let’s throw in some more! Let’s put in a bunch of other european countries… and the US.

Hmmmm.

Poland and Hungary are in the EU, but not the eurozone. Turkey has talked about trying to join the EU in the past, but that seems unlikely. Greece doesn’t look too bad when compared to those three, now does it?

Let’s check out another one where Greece looks awesome:

I also made a graph where Greece really sucks, but I don’t want to fly off on that tangent too much… (OOH REAL MATH)

Okay, let’s do a fair comparison. I took all the Eurozone countries, i.e. all the ones that use the euro as a currency, and got this graph:

I changed the dates to start with the establishment of the eurozone in 1999.

Greece isn’t even at the bottom. We don’t hear about those other countries having issues… probably because they have appetites more in line with their means.

GRAPHMANIA!

I have heard multiple reasons for the Greek disaster.

The GDP graph doesn’t show us the source of the Greek disaster, because the countries lower on the GDP totem pole are not running into the same problems. Perhaps if we look at more graphs, we can get an idea of where the problems are coming from. To be even more fair, I’m going to stick the U.S. and the UK in there.

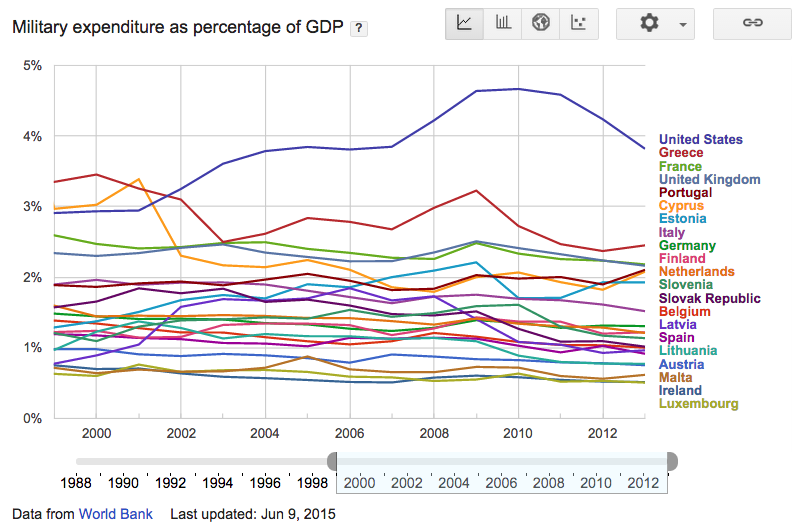

First, a too-large military:

Yeah, that’s an outlier.

Note that Cyprus is also pretty high. Both of these have had issues with Turkey, historically. Something to keep in mind.

However, the military expenditure doesn’t look too bad (compared to the United States, at least):

Debt compared to GDP – yeah, that looks bad:

Tax revenue as a % of GDP is very high:

But other countries, such as the UK, also have a relatively high percentage on that one. It’s interesting how low it is for the U.S., but then they don’t include Social Security payments, for instance, in that.

Self-employed workers is very high:

I have heard that being related to tax fraud. I note that the U.S. has the lowest percentage on this graph with respect to self-employed workers, which makes me very suspicious.

The percentage of the population over age 65 is also high:

Note that the percentage is even higher for Germany. Via the google data viewer, I can’t get at the info I really want: how much is being spent on pensions. Heck, I can’t get at the components of debt that I want to look at, either.

In any case, it’s pretty clear the problem is this: they spend way too much for the amount of money they actually bring in.

REALITY ALWAYS WINS

“Annual income twenty pounds, annual expenditure nineteen pounds nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds nought and six, result misery.”

-Mr. Micawber from David Copperfield.

If I wanted to have a Paris Hilton lifestyle, I need a Paris Hilton trust fund. It has nothing to do with what I or she deserves. It’s what we can maintain.

If I try to pursue that lifestyle, I will be ruined in multiple ways, but primarily the cash hit will be noticed first.

One “random” Greek comments on today’s vote:

“I fear the divisions being created in Greece right now and how people will react to all this,” he said. “We are in a no-win situation and we don’t know what to do.”

Sometimes there’s no getting out of the pain that one has accumulated, and that others enabled the bad behavior, allowing the borrowing and spending to continue, doesn’t really increase the sympathy.

I definitely have no sympathy for those who enabled the behavior for years.

It puts me in mind of indulgent parents who keep bailing out their kids, until those kids turn out to be adults, and then the parents’ resources (and patience) finally gives way.

If only the parents had said NO and let the kid take their lumps when the problems were relatively small.

It’s not really clear what happens if the “no” vote won… or, hell, even if the “yes” vote won.

Either way, there will be fiscal pain.

Because there really are no other choices.

BIRTH DEARTH

The EU as a whole really can’t afford to bail out the Greeks, because they all have a bunch of trouble — and some of those lower-income/GDP countries have not managed to accrue such disastrous debts (that I know of…. so far). Those age dependency ratios are coming for the Europeans, in a graph I hadn’t put up yet:

Note that Japan, having a notoriously low fertility rate, still manages to have a higher fertility rate than both Germany and Greece.

These are shrinking populations, in the long-run. Ireland and France have relatively high fertility rates, but they’re not going to be able to support the old folks in the rest of the EU.

Having an aging society does not necessarily mean it all falls apart. But it does mean that one expects the older folks to have to take care of themselves more, rather than hope for nonexistent younguns to do it via taxes.

Related Posts

Nevada Pensions: Liability Trends

Kentucky Pension Liabilities: Trends in ERS, County, and Teachers Plans

Divestment and Activist Investing Follies: What's Next? My Lunch?