80 Percent Funding Myth September/October Roundup

by meep

I let it go for two months this past time, but Mark Glennon pointed out my first three-peater a couple days ago, so I should do a roundup.

TWO HEROES!

I count Mark Glennon in my heroes list, because why not?

Mark explains why this particular battle is worth fighting:

No, 80% is not considered healthy. That’s an often-repeated myth propagated by politicians who want to cover up the mess they made and sloppy, uncritical reporters.

The American Academy of Actuaries says just that — the 80% funding standard is a “myth.” It’s not complicated. You don’t need to be an actuary to understand this. Pensions either have what they need or they don’t. That’s why 100% funding is the measurement for a healthy pension, the Academy says (though actuaries and accountants in practice don’t follow that).

Ninety percent isn’t enough, either. You either have enough gas to make it home or you don’t. And that’s where actuaries and accountants, in practice, play tricks, among other places. Virtually all calculations of the “ARC” target only a 90% funding level. It’s now common to compare what a government is paying into its pensions to the ARC — the Actuarially Required Contribution. For example, you now sometimes see it reported that Chicago has been funding only about 1/4 of the required ARC. But that, too, actually understates the shortfall because even paying 100% of the ARC wouldn’t clean up the problem.

Politicians and actuaries are simply defining away part of the problem to hide its severity.

But Mark’s not the only hero for this time period.

Step up John Hanna of the AP to break down this myth:

The 80 percent benchmark has been cited in federal reports, but it’s hard to pin down its origin, and its value is questioned by a national financial rating agency and a group for state pension system administrators. The American Academy of Actuaries, representing people who assess financial risk for a living, even called it a “myth” in the headline of a 2012 report.

Such experts say a pension system’s financial footing depends on multiple factors. The actuaries’ academy said in its 2012 report that a pension plan’s health should not be reduced to a single benchmark. There are also concerns such a marker encourages public officials to slack off on pensions funding once it’s reached.

Bill Hallmark, a Portland, Oregon actuary and chairman of the academy’s subcommittee on public pension plans, said one danger is that by targeting 80 percent funding, state and local governments will lose sight of the more laudable goal of full funding of pensions.

I like that “laudable” goal: that they will actually have enough to pay the pensions.

That’s not laudable, that should be standard. That should be expected.

It’s like saying it’s a laudable goal that none of your politicians be corrupt, but eh… whatcha gonna do?

ASIDE ON NUMBERS BEING COMPARED

I have gotten criticism from some that my graphs, figures, etc. have been based on the official numbers, as opposed to using other discount rates, mortality rates, etc.

While I do agree with these people that I think the official numbers undervalue the pension promises, after doing much digging I’ve found that things are horrible even using the official numbers.

Also, it’s less work for me if I’m not always adjusting the numbers… and people can go check for themselves that the numbers I’m using are in the public reports I base my graphs on.

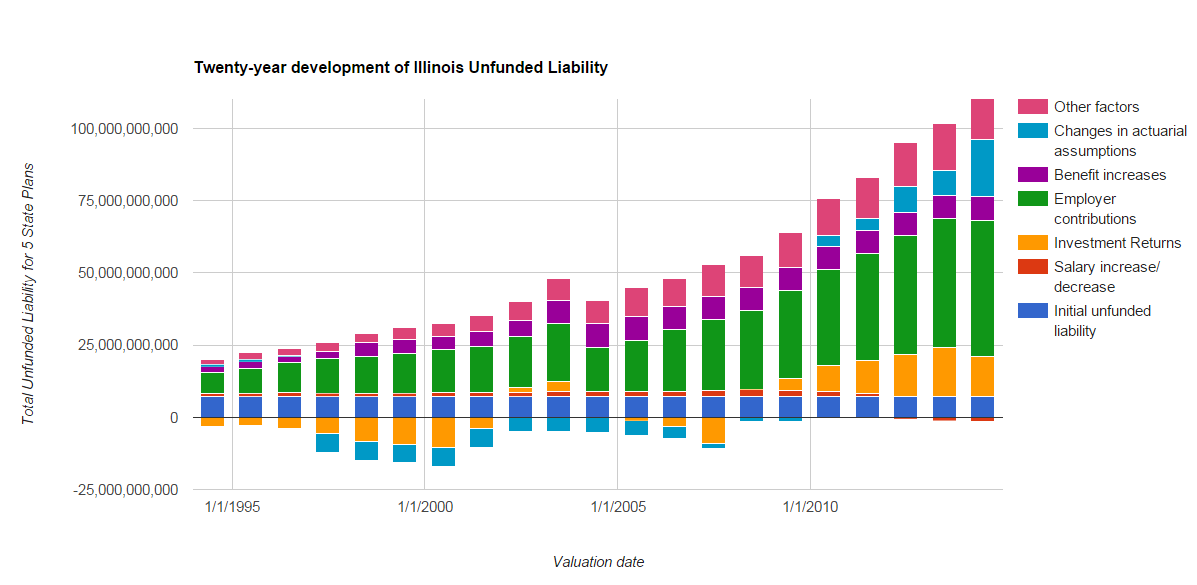

And certain analyses, such as depicting the cause of the growth of the unfunded liability, you see that underfunding often swamps bad assumption sets with respect to cause of liability growth:

At least with respect to the worst plans.

Yes, using really old mortality assumptions and 8% discount rates reduces the size of the liability. But the unfunded liabilities even with these cushy assumptions are huge.

So don’t try to cut it down by 20% to say 80% is good enough. It most definitely is not good enough.

“But we can really only target 80%!”

Which means you weren’t planning on paying the whole 100% pensions. Did you tell the retirees that? Or did you just assume you’d be dead and gone before it would be a “real” problem?

HALL OF SHAME NEW ENTRANTS

…and a not so new one.

Let us give the newbies some time first.

Sen Arthur Orr, Alabama state senator:

“With a couple good years with RSA, with the five-year smoothing, my expectation will be we’ll be over 70 percent funded,” he said. Orr said “optimally,” he would like to see the funds at between 85 and 95 percent funding, but said “it’s always going to fluctuate.”

I’m sure he thinks full funding is a “laudable” but unrealistic goal.

Elizabeth Regan, CT News Junkie:

The most recent pension report showed that as of 2014, the State Employees’ Retirement System was funded at 41.5 percent. That means the State Employees’ Retirement System has about $10.5 billion worth of assets, which is enough to cover 41.5 percent of the $21 billion in liabilities. Experts say an 80 percent funding level is considered healthy.

Oh, those experts say the darnedest things.

John Krupa, IMRF Communications Manager:

2. IMRF’s funded status increased from 86.3 percent in 2010 to 93.1 percent in 2014. Experts consider a funded status above 80 percent to be healthy. Our goal remains to be 100 percent funded.

Thank goodness their goal is laudable.

But he really should know better about the 80% lie, being a public plan official.

Analysts typically cite a funded ratio of 80 percent as a mark of sound fiscal health.

Bleh. A week later Phaneuf changed it to the ungrammatical:

Fund actuaries typically site a funded ratio of 80 percent as a mark of strong fiscal health.

I really really hope the fund actuaries did not cite 80% fundedness as a marker of strong fiscal health, much less sited it. Nobody was named, so I’m guessing that no, fund actuaries did no such thing.

And our final one is no newbie — she first entered in April, came back in May, and here she is for the three-peat: Let’s hear it for Karen Peirog of Reuters!

The funded ratio rose to 42 percent from 40.6 percent at the end of fiscal 2014, still far below the 80 percent level considered healthy.

I tried emailing her this time. Here’s hoping she doesn’t come back for a fourth time.

ONE YEAR OF STATS

The Hall of Shame opened for business at the end of October 2014. How’s it gone since then?

- 7 heroes (YAY!)

- 67 entries in the hall of shame (BOO!)

- 15 blog posts

Doesn’t look like this feature is retiring any time soon.

Related Posts

Public Pensions, Leverage, and Private Equity: Calpers Goes Bold

Rhode Island Pensions: Liability Trends

Houston and Dallas Pension Bills Signed: Now What?