Remember my Obamacare Prediction? I Didn't Predict Hard Enough

by meep

Back at the beginning of the year, I made the following prediction:

Obamacare: In February, you will start to see a lot of angry posts and pieces from people who are getting hit with Obamacare penalties/taxes. And not only on conservative sites.

…..

I will monitor this using a google news alerts on “obamacare tax” and “individual responsibility payment” [the government-ese for this penalty/tax] to follow how many search results I get over time. I will be looking specifically for stories in mainstream (i.e. liberal) media.I will check back monthly on the site to see how my prediction is doing.

I don’t go for hard predictions. I prefer to be correct rather than extreme.

In my second post on the prediction, I set out a few of the things to watch out for, and I noted that not only might there be a tax penalty for not having coverage, but there may be a clawback of subsidies.

But wait! There’s more!

To keep your subsidies, you have to file a tax return, including a specific form that a lot of people found onerous. I noted after tax day that many people may file for the automatic extension – til Oct 15 – to try to get it fixed.

Oct 15 has come and gone.

THOSE WHO NEVER FILE FEDERAL TAX RETURNS

Here’s the stuff I forgot to predict: not just some lying about coverage to avoid the tax (it was just a checkbox. Why not?) Not just some people having penalties and paying/not paying for it.

But the loads of people who didn’t file tax returns.

Maybe people who have never filed.

Mind you, they may not be breaking the law. You do have to meet a certain income threshold to be required to file federal tax returns.

This decade-old article posited about 15 million non-tax-filers. This piece from Slate in 2009 indicates the upshot of not filing a return when you’re supposed to:On April 15, millions of Americans will stand in long lines at the post office to file their tax returns. Although usually a law-abiding citizen, the Explainer can’t help but wonder: What happens if you get tired of waiting and decide not to file your taxes at all?

….

Probably nothing. If you’re self-employed without any major assets or loans, the odds of getting busted are extremely low. In fact, an estimated 7 million Americans fail to file their taxes every year, and in 2008 the IRS examined only 158,000 such cases. That comes out to a roughly 2 percent chance of getting caught. Even if the IRS does audit you, the agency probably won’t press charges. Instead, they’ll just file a tax return for you and charge you a fee for the trouble.

Okay, whether it’s 15 million or 7 million or something like that, there are millions of people who don’t file.

So it’s no surprise that a significant number of those receiving insurance subsidies are non-filers.

YOUR FREE MONEY GOES POOF WITHOUT PAPERWORK

It was tough enough trying to get through the damn exchanges to get coverage. You wouldn’t have bought if you didn’t have the subsidies. You have never filed your taxes before, or have only ever filed 1040EZ.

Whaddya mean my subsidies are going away next year?

Tens of thousands of people with modest incomes are at risk of losing health insurance subsidies in January because they did not file income tax returns, federal officials and consumer advocates say.

Under federal rules, anyone who receives an insurance subsidy must file a tax return to verify that the person was eligible and received the proper amount of financial assistance based on household income.

When the federal insurance marketplace opens for the third enrollment season next Sunday, users will see a new question: “Did your household file a 2014 tax return and reconcile any premium tax credit you used?”

If the answer to that question is no, consumers risk losing the subsidies they receive to help pay premiums. Without such assistance, many would find insurance unaffordable.

Many of the people potentially affected have incomes so low that they would not otherwise have to file tax returns. But if they received insurance subsidies in 2014, they were required to file this year.

In July, the Internal Revenue Service said 710,000 people who had received subsidies under the Affordable Care Act had not filed tax returns and had not requested more time to do so.

If those people do not return to the marketplace this fall, they may be automatically re-enrolled in the same or similar health plans at full price. And when they receive an invoice from the insurance company next year, they may be shocked to see that their subsidies have been cut to zero.

By the way, over 80 percent of those buying through the exchanges get subsidies.

Now, those are the ones who don’t file at all.

How about the ones who didn’t do all the paperwork?

The I.R.S. also said 760,000 taxpayers had received subsidies and filed returns but had not attached the required form comparing the subsidies paid with the amount they were entitled to receive. Taxpayers describe that document, I.R.S. Form 8962, as daunting.

Well, that’s only about 1.5 million people together. How significant could that be?

LET’S COMPARE NUMBERS

Charles Gaba does a little number-crunching to provide the context:

The wording of the article seems to be pretty clear that the two groups don’t overlap; that’s 710K who didn’t file at all, plus another 760K who filed but forgot the form. That’s up to 1.47 million people who a) were enrolled in ACA exchange policies as of last spring and b) were receiving tax credits. According to the CMS division, there were 8,656,210 people receiving APTC as of March 30th…so, assuming I’m reading this correctly, the IRS is saying that a whopping 17% of them are at risk of losing their subsidies if they try to renew their policies for 2016. OUCH.

17% is a lot. If you lost 17% of your sales, you’d be hurting.

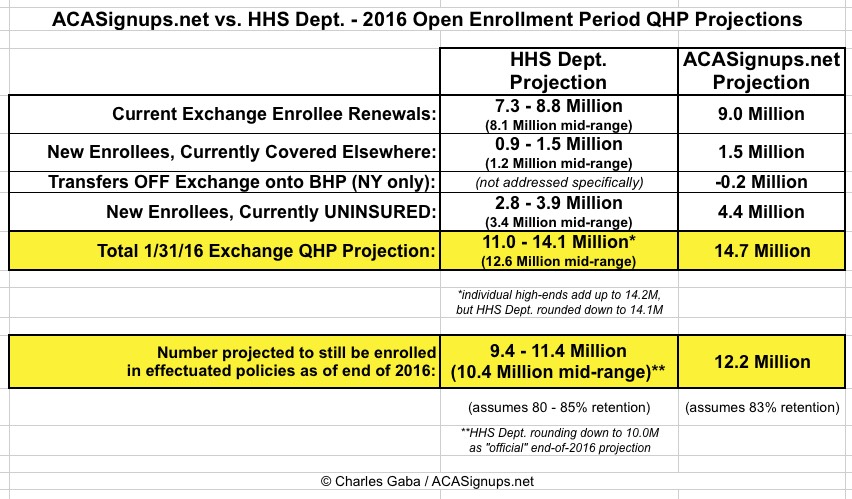

Gaba has made his own, independent Obamacare projections, and now he sees why the federal projects are more modest:

In other words, let’s assume that around 9.7 million people are still enrolled in time to renew their policies for 2016 in the first place. There’s a 2 million-person gap between that and the 11.7 million who selected QHPs last spring. What percentage of that 2 million gap consists of people who never filed their taxes (or forgot the required form)?

I have no idea, but I’m willing to bet that those who have never filed a federal tax return before are probably far more likely to also be among those who drop their coverage in the middle of the year for any number of other reasons. Perhaps that’s just snobbishness on my part; I don’t know.

In other words, it’s possible that a good chunk of those 1.47M have already dropped off the map, so to speak, and aren’t even part of the equation anymore…but whether this is 50K, 500K or a million of them, I haven’t a clue.

…..

Let’s assume that half of them have done so since this summer; that still leaves about 730,000 people who are likely to be hit with full-price premiums…and these are generally not people who can afford to pay full price.Whatever that number is, that’s probably a big part of the reason why the HHS Dept’s guidance for 2016 exchange enrollment is so much lower than mine. Take another look at the first line of the comparison table between HHS and myself:

And here’s his chart:

So while I thought this issue would bleed til October 15, and that it would pick up again next year in tax season… I forgot about the “subsidies go poof” pain.

It could be a one-time problem for people, just like dealing with the exchanges was a one-time problem.

But again: more angry taxpayers. And lots more incentives for tax fraud.

I’m just waiting to see what happens with the Cadillac tax.

A few prior Obamacare Tax Watch posts:

- Obamacare Tax Watch: What to Watch For

- H&R Block Notes Shoe Yet to Drop

- Obamacare Tax Pain Not Enough?

- You Gotta Wait for Your Wrong Tax Info From the Government

- Obamacare Tax Watch: Drop After Tax Day Move

- Obamacare Tax Watch Will be Playing Out Til October and Beyond

I’m not looking forward to this watch next year. The penalty is going to be even larger. And people will have dropped their coverage if they don’t have the subsidies.

Related Posts

Banning All Things Gun: It's a Poor Weapon That Points Only One Way

Kentucky: Flurry of Anti-Union Legislation as Republicans Take Control

Obamacare Watch: 31 Mar 2014 -- Answering Jonathan Bernstein