Connecticut Pension Plans: Funding the Unfunded... or Not

by meep

So in the time it took Stu to get STUMP back up, a lot of the bad pension ideas kept rolling along.

First, it’s always nice to be quoted by others.

The plan has received unenthusiastic reviews. The state’s treasurer has questioned the legality of the split. Pension blogger Mary Pat Campbell pointed out splitting the plan into one part that is funded and one part that isn’t (as opposed to having one big underfunded pool) won’t to make the pensions more secure. “I love these plans where the already accrued pension promises aren’t affordable right now will somehow magically become affordable in the future,” she wrote.

The post being linked is this one on splitting the CT pension.

REFERRER BREAK

I found out that I was quoted because Stu checked the referrers for me, and said there was this new site that popped up. Thanks for the quote, Liz!

Here are my other referrers for the past couple weeks:

Somebody’s linking from facebook (it’s not me!), and I’m not quite sure who. So howdy, person-linking-me-from-facebook!

Thanks to all the referrers!

CONNECTICUT: IT’S DEMOCRATS ALL THE WAY DOWN

Okay, that title is not quite right, but the repeated mention of Democrats in the next article just came across as funny to me.

But the situation is not funny at all. The idea to split the CT state pensions into a funded and unfunded part, the idea that broke my brain, is coming from Governor Dannel Malloy (Democrat).

A different idea is coming from the state comptroller (also Democrat):

HARTFORD — Agreeing that Connecticut is facing a pension funding crisis, the state comptroller offered an alternative Tuesday to the governor’s plan of splitting the pension system into two parts.

Comptroller Kevin Lembo, a Democrat, said that Gov. Dannel P. Malloy’s recent proposal has helped bring a public focus to the state’s underfunded pension plan. But Lembo said his plan would not split the system into two parts according to when employees were hired, as Malloy has proposed.

“More traditional adjustments to our pension funding system have the potential to achieve the same goals as your recent proposal without creating the uncertainty inherent in the unorthodox approach of moving a portion of retirees to a pay-as-you-go plan or moving to an open amortization schedule,’‘ Lembo wrote to Malloy, also a Democrat.

…..

Lembo is calling for extending the current payment schedule beyond the current 40-year period and lowering the assumptions on investment returns. He also wants to change financial calculations to smooth out long-term fluctuations in the stock market.

“We should also consider regular independent comprehensive audits of the plans’ actuarial valuations to determine the reasonableness of the actuarial methods and assumptions being used,’‘ Lembo wrote to Malloy. “Such regular audits will help right the ship should the state veer off course again.”

I don’t know if it’s that the assumption sets were way off that caused the following:

But notice they started out very unfunded at a time when most public pension plans were very well-funded (the very end of the dot-com boom).

And it only got worse.

The recent history was not so bad in terms of contributions, but the issue is the contribution rates continue to climb while the funded ratios continue to drop:

That’s tough to keep up with.

QUIT PRETENDING A PRIOR DEAL IS REAL

But back to the article:

Officials said that Malloy’s plan would give the state more time to make payments, comparing it to switching from a 15-year mortgage to a 30-year mortgage.

Through the years, governors and the legislature have failed to make the proper payments that would have fully funded the state’s pension plan. In those years, the legislature helped close budget deficits by using some of the money that officials say should have been poured into the pension system.

Lembo noted that Malloy has made the required contributions since 2012.

In his letter to Malloy, Lembo wrote that “historic underfunding, questionable actuarial assumptions and a substandard funding methodology continue to plague the system.

“The increasing costs are placing a significant burden on the state budget. Pension costs are rising faster than state revenues, requiring cuts to other important services and tax increases to make the necessary payments.’‘

Like Malloy, Lembo sees that that state faces a major balloon payment in 2032 if no changes are made. A 40-year plan was adopted under Gov. Lowell P. Weicker in 1992, and it would expire in 2032. That plan was altered in 1997 to a 35-year plan, but the balloon payment is still due in 2032.

Stick a pin in that one — we’ll be back.

Two Boston College researchers crafted a 67-page study of the state’s pension system that the Malloy administration used to help craft its proposal.

Alicia Munnell, a professor and the director of the school’s Center for Retirement Research, said there should be no concerns that Connecticut would be the first to try such a split.

“I think this is the sensible thing to do,”’ Munnell said.

…..ok, I’ve dealt with the press before. I have a feeling there is some elision going on.

(in addition: is Munnell also a Democrat? Not that it really matters, but it seems the theme of the article. Democrats with very different ideas.)

But back to this balloon payment agreement: this thing is even more idiotic than the Edgar ramp.

The Edgar Ramp had at least some minimal plausibility… the contribution would grow… sometime… in the future. But any individual annual growth wasn’t too far outside the realm of some possibility.

Not so the Connecticut agreement.

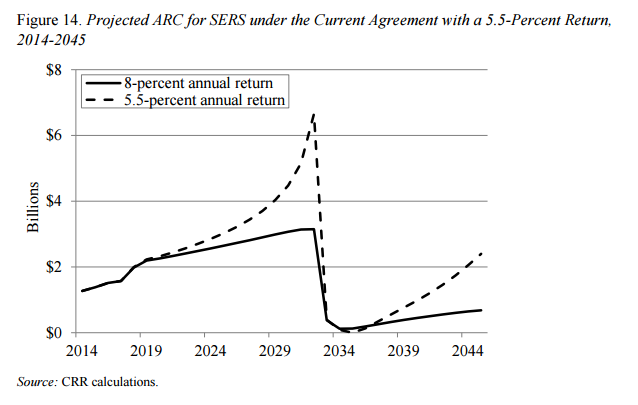

Here’s a graph:

CENTER FOR RETIREMENT RESEARCH STUDY

The Center for Retirement Research recently published a study on the CT situation..

The report’s key findings are:

- Connecticut’s pension systems for state employees and teachers face large unfunded liabilities, despite recent efforts by the State to fund.

- A significant source of the problem is the “legacy debt” built up before the State began pre-funding its pensions in the 1970s.

- Since pre-funding began, inadequate contributions from the State and low investment returns have added to the problem.

*One way to address the problem is through a two-step approach:

- separately finance the legacy debt over multiple generations; and

- fund ongoing benefits using a level-dollar amortization method over a reasonable rolling period; and reduce the long-term assumed return.

The graph I’m showing above is the projected “actuarially required contribution” for CT SERS under two different situations: the fund achieving the assumed 8% return on plan assets and the fund achieving a 5.5% return.

Eyeballing it, I see a step up in contributions for both… to over $2 billion in the near future.

How does that compare to state revenues?

So CT took in revenue of about $16 billion for FY 2013-2014, and comparing $2 billion against that… that’s pretty substantial.

Oh, but wait. That was just for SERS. I’m not including the Teachers plan.

Yeah…. $3 billion. And climbing.

Here’s the deal: they were never going to make the balloon payment. And on top of that, there’s an outstanding pension obligation bond for the Teachers plan.

I’m tired of the pretending that sure, we can’t pay for this stuff ahead of time, but by the time the pension payments are made to retirees, the money, for sure, will be there.

If the state cannot afford to pre-fund the pensions assuming that they actually get 8% per year, they are not going to be able to magically afford the pension payments on a pay-as-you-go basis.

That said, I can see the point of splitting out the accounting between the not-pre-funded era and the pre-funded era.

JOHN BURY’S REACTION

John Bury wrote 4 blog posts on the CRR study.

CRR outlines one of the the problems with the Connecticut plans…and proposes to:

“separately finance – over a long time horizon – the liabilities associated with members hired prior to the pre-funding.” using this silly rationalization:

……

As if it would be fairer to have taxpayers in 2050 (or 2525) pay for promised benefits that were not funded by what would then be several generations.

Fair has nothing to do with anything with respect to these proposals. I wish everybody involved would just drop that pose.

What was “fair” was that the taxpayers who received the services paid for the pensionable service at the time it was given.

That didn’t happen. That didn’t happen for decades.

The proposal to push out the funding of the unfunded portion has nothing to do with fairness, and has everything to do with what can actually be paid, when.

The three other Bury posts on the CT situation:

In the last two posts, Bury actually points to the cash outflows for benefits. That’s what is really needed to be known, especially if the state is seriously thinking of doing pay-as-you-go on some pension benefits. How much will it be? When will those people start dying off?

Bury posts these as pictures, so I’m going to go back later and see if I can put these in spreadsheets for graphing purposes.

But even before the graph, this is what is to be noted, as per Bury:

Back in 2000 the SERS reported having $8 billion in assets and there has always been a substantial net outflow (averaging about $300 million) annually. You would expect assets to be close to depletion by now but as of 6/30/14 the SERS claims to have over $10.5 billion in assets due to exceptional investment earnings.

Without changes to the nature of the plan you can expect benefit payouts and participant deposits to be steady over the years so, projecting forward, the TRS could still avoid bankruptcy assuming:

- continued miraculous investment growth, and

- Connecticut coming up with over 3.5 times more in deposits annually in 2027 than they are putting in now.

Neither appear likely.

Indeed.

DWINDLING TAX BASE?

So CT, you’d better keep an especially close eye on your top taxpayers, because it looks like some know where the moving vans are:

With the Litchfield Hills and Connecticut in our rear-view mirror as we move our 101-year-old manufacturing company to South Carolina, we are nostalgic, excited and disappointed. We love Torrington and Connecticut, but not all the things the legislature and Gov. Dannel P. Malloy have done to make us leave family and friends behind. After more than a century of manufacturing in Connecticut, we are not looking for handouts. We have paid our fair share, but enough is enough.

The combination of the high costs of doing business and the anti-employer attitude in Connecticut finally has driven us out. We are not moving for any government incentives. Consider these facts:

We sold our 50,000-square-foot building for enough money to buy a 100,000-square-foot building, and still had enough money left to pay for the transport of 100 trailer-loads of machinery and equipment to our new site.

The property taxes on our new 100,000-square-foot facility in South Carolina are considerably less than those on our 50,000-square-foot building in Connecticut.

Our utility costs in South Carolina, especially electricity, will be about a third of what we paid in Connecticut, and for more than double the space.

…..

And to make it worse, we had to speculate on how much more our taxes and costs would go up as Gov. Malloy and the legislature refused to pass a balanced budget. Under Gov. Malloy’s leadership, we have seen nearly $4 billion of tax increases. We are still running a deficit. We can’t afford to wait for Gov. Malloy and the legislature to admit they have a spending problem and finally address it. We can’t wait for the state to make any more “investments” with our money to grow the economy for a few favored companies.

Say howdy to all my SC relatives, Zordans.

And it’s not just manufacturing jobs leaving:

With huge losses in high-paying jobs at investment giants like UBS and Royal Bank of Scotland in Stamford, the state is facing blows in income-tax collections as high-end jobs have left the state.

Legislators discussed that issue Wednesday as two major financial committees joined together to analyze the state’s $254 million deficit in the current fiscal year and projections for even larger deficits in the next four years.

…..

Barnes, who previously worked in Stamford when Malloy was the mayor, said that UBS “doesn’t have nearly as many’‘ high-paid investment bankers as it did before the financial meltdown of late 2008 and early 2009 that led to a bottoming of the stock market in March 2009.“They’ve been replaced by much smaller, boutique firms,’‘ Barnes told legislators on the finance and appropriations committees at the Capitol complex. “Connecticut depended very heavily on them for high-wage jobs. We may not see those investment banker jobs come back for a long time.’‘

The state has been hit hard statewide by a reduction in the number of financial services jobs in a variety of firms, and the financial impact has been “disproportionately felt’‘ in Connecticut, Barnes said.

…..

When Boucher asked Barnes why Connecticut is not growing economically, Barnes responded, “It’s really the lack of oil reserves.’‘Nationally, Barnes said, the booming states have been places like Wyoming and Montana that have far more natural resources than Connecticut.

Yes, but you know who doesn’t have a lot of natural resources like that?

South Carolina.

It’s pretty much a swamp.

Other things are driving SC’s growth:

The manufacturing industry continues to be a major economic driver in South Carolina, though job creation is now shifting more toward the leisure and hospitality sector and the employment services sector, he says.

Not seeing too much about natural resources there.

By the way, other southeastern states have much higher growth rates (such as North Carolina). If you didn’t already know, it’s not fracking that is boosting NC, either.

CT could also do well with tourism, but it’s so damn expensive up here. You want to sail? Why not go down to the intercoastal waterway in SC? Lots cheaper to rent a house and a boat there than on the coast of CT. It’s accessible to the hoi polloi, can you imagine?!

Anyway, I’m sure there will be more discussion among Democrats in CT, because it seems they don’t understand why they’re doing so poorly while those Carolinian hicks are enjoying massive growth.

They will be so surprised when the money doesn’t appear magically, later, to cover their old pension promises.

Related Posts

Welcome to the Public Pension Watch: Hurray for New Jersey!

Governing Magazine: In Memoriam

Taxing Tuesday: A Campaign Video, Ready-Made, for Republicans, Illinois Tax Doom, and More