Chicago Doings: The Storm Before the Storm

by meep

Let’s check in with the Chicago Way, shall we?

CONVENIENT RETIREMENTS

Via The Daily Beast, retiring before getting charged with anything is a popular move:

Chicago Cops Retire to Avoid Discipline

Three officers who were recommended for discipline over a case that allowed ex-Mayor Richard M. Daley’s nephew to escape criminal charges have retired, which means they’re no longer subject to punishment, The Chicago Sun-Times reported. City Hall Inspector General Joseph Ferguson urged discipline for six cops involved in the investigation in the 2004 death of David Koschman, who suffered a fatal brain injury after a drunken confrontation. Daley’s nephew Richard J. “R.J.” Vanecko pleaded guilty to involuntary manslaughter in 2014 after a judge appointed former U.S. Attorney Dan K. Webb as special prosecutor to reinvestigate the death. According to the Sun-Times, former Chief of Detectives Constantine G. “Dean” Andrews, 51, and former Cmdr. Joseph P. Salemme, 56, retired in early December, evading any disciplinary action. Andrews and Salemme are reportedly getting pensions that top $100,000 a year. Detective James G. Gilger, 58, also has decided to retire. Three other officers remain on the city payroll.

I mentioned the Vanecko case before:

Mind you, this issue with Chicago cops and covering up misbehavior is not new with Rahm. The Vanecko case involved city cops covering for a Daley nephew, and the infamous Burge case.

The Daleys were better able to weather this stuff because they still had plenty of money to play with.

Rahm doesn’t have that luxury.

This “I’ll retire before you can fire me/punish me” is not unique to Chicago, of course. Ask Lois Lerner about that.

Of course, other than professional discipline, there can be criminal charges, but what are the chances of charging cops with crimes?

Anyway, what about that money situation?

PULLING BONDS….LACK OF SUCKERS?

Chicago Public Schools was going to issue some bonds. But then it hit pause:

Chicago Public Schools, or CPS, needs to issue $875 million in long-term bonds to help the district avoid bankruptcy – but on Jan. 27, the school district backed out of the planned sale. The district announced that it has postponed the bond sale and will assess the situation on a day-to-day basis.

The failure to issue the bonds means the district has to postpone the refinancing of several debts. According to CPS, $340 million of the total borrowings will be dedicated to refinancing old debt, and nearly $90 million will go toward paying off other short-term loans. The district plans to use nearly $400 million to pay for capital projects.

So think about this: of $875 million planned issuance, about $430 million – ALMOST HALF – was going to be used for refinancing purposes.

Note – the $90 million for changing short-term loans into long-term debt got my attention.

That’s not a good sign.

But why did they pull the bond sale if they really really really need the money?

CPS’ new bonds were expected to pay approximately 7.75 percent, an interest rate 5 percentage points higher than the rate at which AAA-rated government entities borrow. Despite that massive premium, investors failed to bite.

Oh wait, they need to find somebody to actually give them the money. They thought they could find some people willing to take a chance that they’d actually get paid.

They got no takers at 7.75%, which is a really nice yield for munis.

Well, munis that aren’t junk.

So…. Now what?

MR. RAHM GOES TO NEW YORK CITY

New York City?! Good luck with that.

Chicago Mayor Rahm Emanuel is in New York City this week for a series of meetings with financial institutions about Chicago’s “strengthening” financial condition according to a statement from the Mayor’s office.

The meetings come on the heels of the Chicago Sun Times reporting that Emanuel has been calling New York bond investors to rescue the Chicago Public Schools’ (CPS) delayed bond deal.

…..

The CEO of CPS, Forrest Claypool, told the Chicago Tribune last week, one day after delaying the bond deal, that he was confident that a deal would be done by early this week.Earlier this month, Illinois Governor Bruce Rauner pushed for a state takeover of the windy city’s education system, while saying that Emanuel had “failed” to correct the dire situation.

In August 2015, Standard & Poor’s downgraded CPS debt to junk status from BB to BBB signaling the potential of a higher rate of default.

I’m not sure where the “strengthening finances” idea comes from.

So yippee, you’ve got a little more tax.

More:

The planned debt sale came after Illinois Governor Bruce Rauner, a Republican, called for the state to take over the district and potentially authorize bankruptcy, which currently isn’t allowed. That idea was immediately rejected by Democrats in control of the legislature and Emanuel, who have unsuccessfully pushed for an influx of state aid.

Yesterday, Illinois’s secretary of education, who was appointed by Rauner in March, asked the state board of education to gather CPS’s financial data and identity potential candidates to oversee the district if the legislation is passed, according to a memo provided by a person close to the administration who asked not to be identified.

The school system’s $6 billion of outstanding debt has been lowered deeper into junk by three major credit companies in the last three weeks. The district has to put money into a fund to cover its debt payments on Feb. 15, and it planned to use some proceeds from the delayed deal to “support near-term debt service,” Moody’s said.

How does that help with this:

TEACHERS WANT MORE TAXES

Teachers are not happy with the proposal in front of them:

Teachers union rejects CPS contract offer

The Chicago Teachers Union — citing a lack of trust and concerns about long-term school funding — unanimously voted Monday to reject a four-year contract offer.

In the days ahead of the vote, the teachers union had called the Chicago Public Schools proposal a “serious” one, leading some to believe a tentative agreement was likely.

“I know people were expecting something completely different, but that’s not how we work at the Chicago Teachers Union,” CTU President Karen Lewis told reporters after the vote Monday.

Wait a sec — unanimously?! The whole union?

If you read on later, it sounded more like the team of 40 people involved in the contract talks unanimously agreed, which is not so far-fetched, especially given this info:

Though “a lot of things were great” in the contract offer, Lewis said, the union’s Big Bargaining Team was concerned that CPS hasn’t come up with a way to provide long-term financial stability for the cash-strapped district.

“The cuts that they are asking for will not solve the problems,” Lewis said. “So what we are looking for is sustainable funding, which means serious revenue. That is not in this contract. There is no guarantee that the promises that are made are promises that can be kept.”

This is somewhat reasonable, actually. If they will be scrabbling for money in a year or two’s time, this isn’t much of a deal.

Thing is, what they’re really asking for are substantial tax hikes to get funnelled into the Chicago public schools. That’s the only thing “serious revenue” can mean… because it’s not like there’s a state slush fund that is just waiting to be siphoned off for Chicago.

Here was what was put in front of the negotiators:

In the rejected offer, teachers would have received raises of 2.75 percent next school year and then 3 percent for each of the next two years, the Sun-Times learned. Teachers would continue to receive “step and lane” raises for experience and added education through June 2019.

But CPS wanted teachers to pay their entire 9 percent pension contribution, including the 7 percent the district agreed decades ago to fund. So veteran teachers would start paying 3.5 percent more toward their pension starting in July and then the whole 7 percent as of July 2017.

Lewis said CTU members were concerned about the pension pickup in particular.

“This came out of our pockets as opposed to a steady stream of revenue,” Lewis said.

Again, this translates into taxes.

The teachers union really, really need to thinks what leverage they have.

Because there is not going to be much sympathy from those who are expected to bail them out of the entire hole of the pension pit that they have to pay the contributions they were supposed to be paying this entire time.

Truth in Accounting has a page on Chicago’s financial status… and that’s using stale data (there’s always a lag as we wait for newer info to come out.)

That’s just one part of a two-pager from Truth in Accounting.

And don’t go looking to the state for a bailout, Chicago. Here is an infographic from Reboot Illinois on the state’s fiscal state. Spoiler alert: it’s not good.

I’ll just post part of their graphic:

CREDIT: Reboot Illinois

Go to their post for the full infographic.

(And yes, I noticed the 80% myth popping up, which I’ve smacked Reboot Illinois over before).The state is not in a position to bail you out, Chicago. It needs its own bailout (more on which in a later post). This is what is on offer from the state, Chicago teachers:

GOVERNOR PROPOSES THE ABILITY TO GO BANKRUPT

Actually, it wasn’t only the governor:

But win or lose, this aggressive takeover effort will again force state lawmakers to confront a nagging legislative question: Should Illinois allow municipalities, and their related agencies, to declare bankruptcy?

Right now, they can’t. But declaring bankruptcy is at the crux of the Republican plan to overhaul the Chicago Public Schools in one fell swoop. Without that federal court-sanctioned authority, it’s unlikely their ambitious agenda to dismantle and rebuild CPS’ governance, union contracts, debt load and managerial structure goes anywhere.

While announcing the Rauner-backed plan last week, Senate Minority Leader Christine Radogno and House Minority Leader Jim Durkin spoke of the General Assembly giving Chicago and CPS the option of filing for Chapter 9 municipal bankruptcy in federal court.

Mayor Emanuel, CPS chief Forrest Claypool, public union leadership, many influential state Democrats, including House Speaker Michael Madigan and Senate President John Cullerton, say they abhor the idea of sanctioning municipal bankruptcy, especially for CPS.

By the way, some speculated that Rauner talking about Chapter 9 Bankruptcy possibilities was related to the Chicago bond yank:

Gov. Bruce Rauner “didn’t help” by floating a plan to take over the Chicago Public Schools and pave the way for CPS to declare bankruptcy, but that’s not the reason an $875 million borrowing was abruptly put off, a top mayoral aide said Thursday.

“It didn’t help. But it wasn’t the reason for the delay in the bonds,” CPS CEO Forrest Claypool said.

“It’s very common to test the market [then] delay. Investors come in, ask a lot of questions. They want [answers]. It’s a structured deal that has a lot of complexity. Some of our significant investors asked for a little bit more time to look at the documents. Fairly routine.”

Yeah, it’s fairly routine that a de facto insolvent city finds that prospective bondholders balk at lending out more money if they’re going to default almost right away.

Mark Glennon at Wirepoints comments:

The inevitable is here. The real importance of Governor Rauner’s proposal to authorize optional bankruptcy for Chicago Public Schools and the city is putting bankruptcy into the mainstream narrative. That’s good, and years overdue, but it also means we’ll be doubling down on the confusion, ignorance and political distortion that has plagued the debate about our fiscal crisis.

On this site we will focus hard on ensuring that all good articles about municipal bankruptcy for Illinois get posted, and we’ll try to cut through the fog. It’s not an easy topic, as I know from when I taught it to law students and from my first career as a lawyer, when I did lots of it in large, private sector insolvencies. Moreover, Chapter 9, which is for municipal bankruptcies, is vaguer, so many questions are open. Consequently, you will not find many reporters who understand it.

That problem will be made worse because objective experts will be hard to find. While there are some good, independent analysts in the municipal bond industry, that business is overwhelmingly just a big sales organization for a long-only market. Some of the comments I’ve seen out of the muni industry lately about the safety of certain bond issues in the face of bankruptcy risk have been stupefying. Practicing lawyers in the field likely either won’t talk much to reporters or, if they do, will be conflicted by the side their clients are on. Before them lies the biggest gravy train they will see in their careers. They have a pretty good idea about who they could represent as the wheels come off.

…..

That’s not an endorsement of bankruptcy for CPS or any other particular municipality. Each requires a detailed, individual review. CPS has not done that nor has any other Illinois municipality I know of. That’s financial nonsfeasance. Politicians in charge should recognize a duty to explore the option.Just remember the Cubs. They went bankrupt in 2010 but are now certain, as any fool can plainly see, to win the 2016 World Series.

Hmmmmmm.

Anyway, there are upsides and downsides to the bankruptcy process. It gives Chicago something of a chance to clean up their very messy balance sheets, and it teaches the bond market YET AGAIN that yes, you need to pay really close attention to the financials of those you’re lending money to.

Just like the banks needed to learn that about mortgages.

Related, an earlier post at Wirepoints: Who Is To Blame for the Status of the Chicago Teachers’ Pension Fund? – WP Guest

ROUGH STREETS

Back to a non-financial issue: the deadliness of Chicago’s streets.

There’s a couple different things here. The normal thing one thinks about when we think about deadliness: homicide rate.

2016 looks to be a record year, at least for January:

Chicago saw a dramatic spike in the number of homicides and shootings in January — the bloodiest start to a year in at least 16 years and a blow to a police force struggling to regain public trust following the release of a video of a white officer fatally shooting a black teen.

In a news release Monday, Chicago police reported 51 homicides were committed in the city last month, compared with 29 in January 2015. The number of shooting incidents more than doubled, from 119 last January to 242 this January. The number of shooting victims increased from 136 to 292.

“We can’t put our finger on” specific reasons for the increase, the city’s interim police superintendent, John Escalante, said. But he noted the increase coincides with an equally dramatic decrease in the number of street stops made in January.

He noted the decrease comes after a policy change that went into effect this year requiring officers to fill out lengthier forms after those stops than the brief “contact cards” they used through 2015. It could be that officers are taking more time to fill out the forms as they adjust to the change, preventing them from making more stops, he said. Officers are going through training now to help them deal with the new forms, he said.

…..

Chicago has become a national symbol of gun violence since at least 2012, when the number of homicides climbed past the 500 mark, far higher than any other U.S. city. With police initiating a number of crime-fighting measures and spending millions of dollars on overtime, the city saw the total fall closer to 400 in each of the next two years, and 2014 ended with the fewest homicides in decades. But last year the number of homicides and shooting incidents rose again.

Huh. That’s odd. Especially since Chicago is far from the largest U.S. city, and my understanding is that Chicago has some of the toughest gun control legislation out there.

But wait. There’s more.

Chicago has been shelling out loads of money to deal with police misconduct:

It’s well known that alleged misconduct by Chicago police costs city taxpayers dearly.

A new Better Government Association analysis shows just how dearly: $106 million in 2014 and 2015 alone, covering misconduct-related settlements, judgments, legal fees and other costs.

All told, Chicago’s municipal government – under Mayor Rahm Emanuel and his predecessor, former Mayor Richard M. Daley – spent nearly $642 million on alleged police misconduct over more than a decade, from 2004 through 2015, according to interviews and city records.

In 2015, nearly $41 million was spent, including roughly $28 million on damages, $10 million on outside legal expenses and $3 million on other costs, according to data obtained from city government’s Law Department.

Of course there’s a graph:

Now, as others in the article note, it may not necessarily be police misconduct, but that the city decides to settle instead of defending the cases. And in some of the cases, the city did go to court…and had jury judgments against the city.

BACK TO THE TEACHERS: YOU AIN’T GOT MUCH LEVERAGE

So in a financially-stressed city and state, they don’t have much going for them:

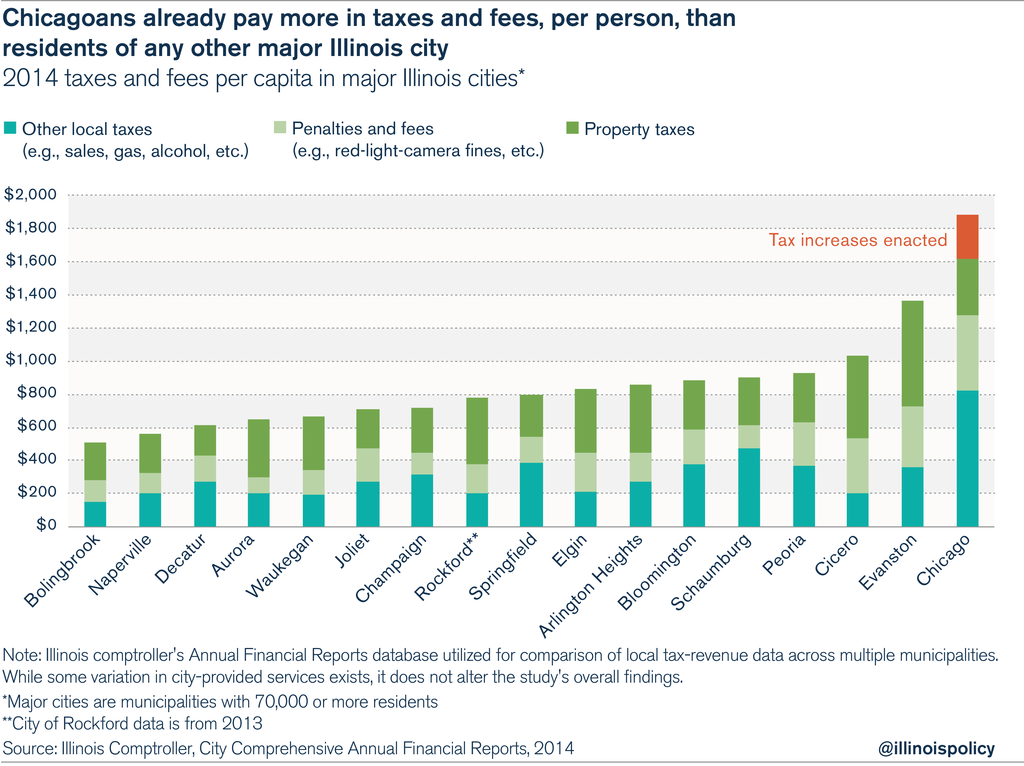

5. Chicagoans can’t bear more tax hikes

CPS shouldn’t expect additional tax revenue from Chicagoans anytime soon. Not only do Chicagoans already pay more in taxes and fees than residents in any other major Illinois city, they’ve just been hit with a record property-tax and fee increase of more than $700 million annually.

There are no mythical rich people and/or companies who will sit still to be taxed even more to have their money go into the giant pension pit.

They’re already having trouble getting value for money just being in Chicago as it is.

Related Posts

Friday Trumpery: DOL pick, take two

Divestment Dumbassery: Know What You're Protesting

ESG and ERISA -- Pity the Poor Tort Lawyers Their Lost Business as Biden Gives a Safe Harbor For Now