The State of Chicago: Deep in the Suck

by meep

That’s the technical term, I believe.

Not all of the suckage relates to city finances, but it does form a huge part of the problem. Let’s start with that.

CHICAGO TAKING ON MORE DEBT

Oh yay. Just what Chicago needed. More debt to pay for other debt.

Junk-rated Chicago is returning to the municipal bond market to cover mounting pension obligations, even after a record property-tax increase.

The city is selling $500 million of general-obligation bonds to refinance existing securities and cover some debt-service bills, according to Bloomberg. The federally tax-exempt securities are being offered at a top yield of 4.93%, which is about 2.3 percentage points higher than benchmark debt.

According to Reuters, Chicago’s deal “refunded $280 million of bonds for a present value savings of $14 million and restructured $220 million of bonds to push out debt service payments to free up revenue for the city’s cash-strapped budget.”

A property tax increase helped shore up the city’s police and fire fighter pensions, but Chicago’s $20 billion pension shortfall across its four retirement funds remain a significant challenge. The city’s bonds traded more than 4 points above benchmark securities this month as Mayor Rahm Emanuel’s administration came under increased criticism for taking 13 months to release a video showing a police officer fatally shooting a black teenager 16 times.

“The fact that they’ve had those positive reforms has kept the door open in the market for them,” Merritt Research Services’ chief executive Richard Ciccarone told Bloomberg. “It’s given them the time to fight another day.”

4 percentage points is a huge spread in the bond market, by the way….depends on the benchmark, of course. If the benchmark was Treasuries, I can see why it was so large.

Now, refinancing debt is not necessarily a bad thing, and I don’t know if this move makes their situation worse. But it doesn’t really fix the underlying problem of large debt – it just fixes a short-term cash flow need.

To refer back to Gov. Rauner’s recent presser, Rauner pointed out the issue:

[Reporter 7] …what Mayor Emanuel, the way he’s run the public school system, and now the police department, what’s your assessment of how he’s doing and … [noise]

[RAUNER] Uh, oh boy. Let me say a couple things. He inherited a mess that was covered up significantly, and frankly, … some of what was going on even I didn’t know, and I been working trying to improve the schools, and the city for decades…

(10:12)

[RAUNER]…some of it I didn’t even know and I was, ya know, looking around, trying to look for trouble for a long time. He’s inherited trouble, but he hasn’t taken on a lot of structural changes, neither has President Preckwinkle.

No structural real improvements. They’re raising taxes, and not doing real structural change. And also, this … I don’t want to comment too much now, there’s a federal investigation going on about the handling of this police, community policing, and the videos.

And there hasn’t been much in the way of notable change. Some schools were closed, and there was some minor budget-cutting, it sounds like. But there is a large, ugly debt in pensions that is only getting bigger, and that hasn’t been addressed at all.

CHICAGO PUBLIC SCHOOLS IN CRAPPY POSITION

I have written about Chicago pensions multiple times, and it’s not just an issue of the teachers pensions. But there are some specific issues right now that focuses on the Chicago Public Schools in particular, and not just all Chicago pensions.

Mark Glennon pointed this out in December:

Some observations:

• The pension will continue to deteriorate even if CPS finds a way to balance its budget and make the pension contribution it plans. In other words, the can is being kicked.

…..

• The fund doesn’t even have enough to set aside to pay current retirees; nothing is there for active workers. The discounted obligation owed to pensioners already retired is $15 billion. (Roughly, that is. The actuaries didn’t bother to do their sub-totalling consistently on page 33.) Since the fund has only about $10 billion in assets, it doesn’t have nearly enough even for them. Active workers have nothing invested on their behalf.

And these are the conclusions with using the relatively sunny discount rate of 7.75% and whatever other assumption set it being used.

My own visualization of the Chicago Public Teachers pension unfunded liability:

Sorry, I don’t know what that large “other factors” means. But when you’ve got a $10 billion hole, does it really matter?

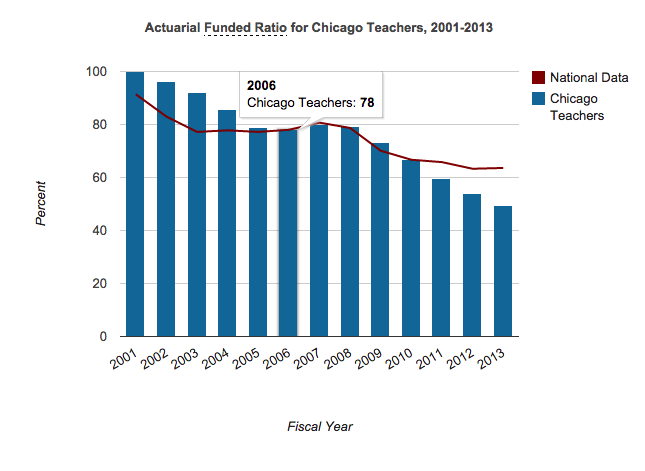

Here is the development of the funded ratio:

And here is how the contributions have gone:

Those last two graphs are from the Public Plans Database.

As Mark notes later, even wiping out this huge hole wouldn’t fix the CPS troubles:

Suppose bankruptcy for Chicago Public Schools could somehow entirely cancel all its unfunded pension liability, all its bonded debt, and let the school district switch over to a new retirement plan for future work funded at levels common in the private sector. Surely that would more than solve the district’s budget problems and free up plenty of cash for education, right? After all, its commonly reported that the only hole to be plugged in CPS’s new budget is $480 million, which CPS hopes to get to get from the state. Just the contribution to its defined benefit plan is $675 million this year, which smart readers probably know is many times what the private sector would pay. And erasing annual service on bonded debt would be huge, right?

Nope, even 100% haircuts on those obligations would barely balance the budget in a sustainable way. Here are the numbers:

First, the actual hole in CPS’s budget is $1.1 billion. That’s due to use of revenue in the budget from one-time sources and further “scoop and toss” borrowing, which is issuing new debt to pay off old debt, all according to a detailed analysis of the budget completed by the Civic Federation. None of that is sustainable, and it’s in addition to that $480 million CPS probably won’t get from the state.

…..

Writing a few hundred pages about what Chapter 9 might look like would be pretty easy for CPS, like most municipalities, but the bottom line would be that we don’t know. Municipal bankruptcy is fraught with unknowns, as experts constantly warn. The real issue is not whether bankruptcy is an attractive option, it’s whether it’s inevitable: If even total cancellation of pension and bond debt would barely balance its budget, how can it be balanced outside of bankruptcy?

So the new bond issue is just to buy a little time… but time to do what?

STATE BAILOUT?

Maybe the state will pony up!

Or….maybe not.

Gov. Rauner Says CPS Shouldn’t Expect Money From Springfield:

overnor Bruce Rauner says the state will not help out struggling Chicago schools as both the city and state deal with financial problems in the new year.

CBS 2’s Derrick Blakley spoke with the governor in Springfield Tuesday as Rauner starts his second year in office.

On frigid day in Springfield, Governor Rauner is turning up the heat on Democrats opposing him in a budget stalemate. He wants control over social service payments and is flatly telling Chicago schools, forget about additional money.

…..

The governor’s words leave CPS’s early February deadline for Springfield money or massive cuts, looming very large.“There’s kind of a crass, egotistical sort of mean quality to that,” said Chicago Teachers Union VP Jesse Sharkey. “It’s really a shame.”

Good luck with that, y’all. I doubt you’re going to be able to guilt trip Rauner into anything.

You need to think of your leverage. It worked on Rahm Emanuel, mayor of the city, in 2012 with the Chicago Teachers Strike then, but he didn’t have much money to play with. And Quinn was governor.

Rahm doesn’t have money to play with — he’s having to issue bonds to free up cash for operational expenses. The governor has said he’s not going to, and the recent presser was a reminder that it’s still difficult to get over a gubernatorial veto.

Think 2/3 of the legislature wants to cough up cash for Chicago?

Looks like it would require a party-line vote.….but that’s just the House. The Illinois state senate is not quite so lopsided in party representation.

More to the point, they can’t even get a budget passed for the state. They’re not going to give Chicago enough cash to “fix” anything.

RAHM ON THE ROPES?

Of course, Rahm Emanuel is not doing well right now. The ostensible reason is the Laquan McDonald case, which has all sorts of ugly dimensions to it. I’m going to assume a certain amount of familiarity with the news coverage.

The latest coverage looks worse and worse:

As the investigation and the recriminations over Chicago’s handling of the Laquan McDonald shooting continues to rile the Windy City, witnesses of the shooting are now coming forward to claim that the Chicago Police Department coerced them to change their stories to better conform to the statements of officers on the scene and even threatened those who refused to obey.

According to CNN, three witnesses have come forward to say that, in the hours after a Chicago police officer shot 17-year-old Laquan McDonald sixteen times in 2014, they were pressured to alter details of their story to conform to the accounts being given by the officers on the scene.

Further, recently released documents show that it wasn’t just the beat cops trying to wrangle accounts to fit their stories but their immediate commanders making the effort to justify the statements.

Attorney Jeffrey Neslund told CNN that more than just street cops were involved in the coercion. “It’s a lieutenant, a sergeant and detectives–and the lengths they went to justify what simply was not true.”

Yeah, I imagine the federal investigation may cough up some charges, even if Rahm and Company are supposedly buddy-buddy with Obama. It’s not clear to me that they’re aligned in interests.

Mind you, this issue with Chicago cops and covering up misbehavior is not new with Rahm. The Vanecko case involved city cops covering for a Daley nephew, and the infamous Burge case.

The Daleys were better able to weather this stuff because they still had plenty of money to play with.

Rahm doesn’t have that luxury.

Lots of people didn’t like Rahm before, and now they’re taking advantage of the situation to hit him and keep hitting him. Thing is, I think short of the threat of federal indictments, they’re not going to get Rahm out of there. They can keep pressuring him to resign… maybe he will, but that’s pretty much the only way to get him out.

OTHER ‘RANDOM’ CORRUPTION

I thought I’d throw in some lower-level chicanery. Toward the end of the Daley years, a lease deal was made on the city’s parking meters. Supposedly this was a win-win, but when the city had to pay when parking meter take was too low, just how “good” this deal was became known.

Rahm supposedly fixed the deal:

Throughout his reelection campaign Mayor Rahm Emanuel has boasted that he reworked the infamous parking meter deal and saved the city $1 billion.

Most recently, he’s turned the claim into an attack on Alderman Robert Fioretti, one of his challengers. Three times in the last two weeks Emanuel’s reelection campaign has sent out mailers blasting Fioretti for opposing the mayor’s “reform” of the meter agreement.

“If Fioretti had his way, the parking meter company would be keeping even more of our money,” the ads declare.

It’s an audacious statement, especially since Emanuel actually strengthened and expanded the meter deal. Records show that his 2013 “reform” gave the company control of additional parking spaces worth millions of dollars.

I assume he had to do that, because it’s not like he had lots of leverage.

Seven years after former Mayor Richard Daley pushed through his much-loathed $1.15 billion deal to lease the city’s parking meters, a former executive has been quietly charged with taking kickbacks to steer a multimillion-dollar contract to install the privately owned meters.

Philip “Felipe” Oropesa, 56, of Marietta, Ga., is due to be arraigned Jan. 22 after he was charged in U.S. District Court last month with one count of wire fraud, court records show.

The charges allege Oropesa, who was vice president of government relations for LAZ Parking, took about $90,000 in bribes in exchange for steering a $22 million contract to supply and install the parking meters to a company identified only as Company A.

I’m shocked that any Chicago deal has corrupt players in it.

RUNNING OUT OF OTHER PEOPLE’S MONEY

So we’re looking at an upcoming teachers strike as well as a continuation of Laquan McDonald-related protests as the weather gets warmer.

Even if Rahm is forced out… what are they going to do? Rauner didn’t say he’d give Chicago more money if Rahm was out. The bond market hit Chicago with 4.875% yields (yes, that’s high — 2.29 percentage points over other munis)….and they’re looking to issue billions more later this year.

You think the bond market will be happy with a Rahm replacement?

I don’t see Rahm leaving absent a perp walk. It could happen, but I think it unlikely.

So you’re stuck with him, Chicago. And he’s stuck with you.

And all y’all are stuck with a huge money hole.

What are you going to do?

Related Posts

Taxing Tuesday: Are People Moving Due to Taxes?

Public Finance Roundup: What Happens When the Richest Move to Laputa?

Puerto Rico Round-up: Trying to Determine How Bad It Is