On the Illinois Bailout Idea and Other Shenanigans

by meep

No, not the idea for Illinois to bail out Chicago.

The idea for somebody else to bail out Illinois:

Just as the Federal Reserve Bank extended loans and other assistance to banks and financial institutions during the fiscal crisis, the central bank could lend money at low interest rates to states and municipalities, contends Saqib Bhatti, a Chicago-based fellow at the Roosevelt Institute and director of the ReFund America Project, which seeks ways to improve the financial health of U.S. cities that suffered during the 2008 recession.

During that financial crisis, the Fed extended a variety of credit programs, including short-term deposits, bridge loans, and other lending facilities to financial institutions. This is in addition to the Treasury Department Troubled Asset Relief Program (TARP) which spent about $475 billion to stabilize banks and automakers. (Congress initially authorized $700 billion but that amount was reduced.)

This type of lending would enable cities and states to avoid high fees from Wall Street money managers and free up funds for services, Bhatti argues.

The Fed has the power to lend to cities and states for up to six months, but Congress would have to authorize the central bank to make direct long-term loans.

Another option is for Illinois to establish a state-chartered bank that could accept loans from the Fed, Bhatti said. North Dakota is the only state with such a bank. Established in 1919, the Bank of North Dakota issues loans to farms, business owners, students, and home buyers. It can borrow at the Federal Reserve’s discount window and lend directly to local governments at rates lower than those available in the municipal bond market.

“Financial institutions can go to the discount window but states cannot,” Bhatti said. “The cheapest money is not available to taxpayers.”

The Federal Reserve isn’t the only route to low-interest loans. Experts have floated other methods.

For example, professors Joshua Rauh of Stanford University and Robert Novy-Marx of the University of Rochester proposed that a state be allowed to issue tax-subsidized pension security bonds for the purpose of pension funding.

(and yes, I noticed the dread 80% made an appearance in the piece. I’ve added it to the list.)

NO NO NO NO NO NO NO

No.

No.

No.

YOU DON’T GIVE MORE MONEY TO PROFLIGATES

The depth of Illinois’s problems came from fiscal irresponsibility far more than outside circumstances beyond their control.

Heck, even the shortfall due to investment losses are a great deal their own fault: if they had used a much lower valuation rate, they would not have missed their target over the long period of history.

But for the meaning of fault in public pensions another time.

Illinois should not be given the ability to borrow at a cost so much lower than the risk inherent in their fiscal situation. Being able to borrow to “fill” their pension pit is partly what got them into trouble to begin with.

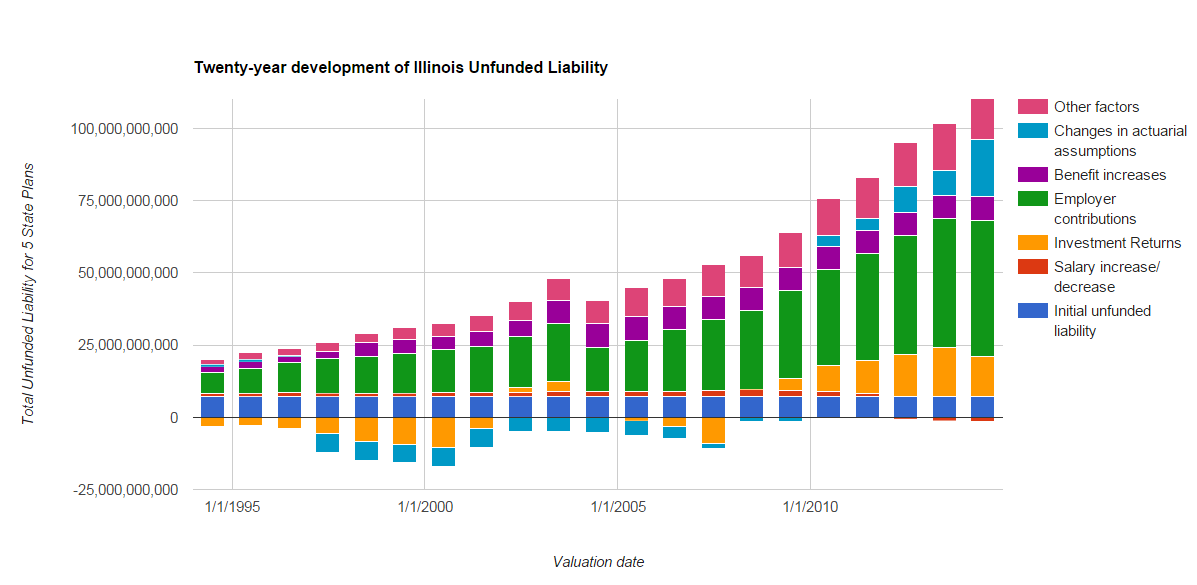

And the graphs I show above are just for the statewide pensions, not for Chicago, which only adds on to the pain.

Same for the various police & fire pensions that are causing so much financial pain for Illinois. That I will need to dig up another time, but I’ve been seeing more and more local budgets getting busted by that problem.

They cannot afford the promises that were made. The answer is not to have the rest of the country pay for it.

Don’t tell me “but they’re only borrowing at below-market interest rates” in these plans. They can’t even afford that. That means at some point they’d end up defaulting on whatever federally-guaranteed anything.

Same for whatever fancy idea of pension obligation bonds. Ugh.

THEY CAN’T PAY THEIR NORMAL OPERATING COSTS

Yes, pension contributions are normal operating costs, though that’s hard for people to recognize.

But people have absolutely no trouble recognizing that vendor payments for services rendered in the past year are definitely operating costs.

Vendors flood Illinois Capitol with disconnect warnings, pleas for payment

…..

Billions of dollars continue to be spent on services ordered by federal court orders or limited legislative action, but the lack of spending authority means bureaucrats are spending more time dealing with angry vendors. Consider:n The storeroom staffer’s failed shopping trip led a supervisor to compile a list of Springfield businesses that had cut off the state. It included a janitorial supply shop, hardware stores, a carpet store, an electrical supplier and a general construction firm.

…..

n A New Jersey landlord threatened to evict Illinois Revenue Department tax auditors from their rented home in that state unless he received five months’ rent totaling $37,936.20. It was paid.John Ulzheimer, an Atlanta-based consumer-credit expert, said credit risk is judged the same way for a government with a $35 billion budget as it is for an individual: If you don’t pay, you get cut off.

“People are going to start avoiding doing business with you or setting terms that are punitive because you’re risky to do business with,” Ulzheimer said.

This is not just an issue with them not passing a budget. This has been a problem for years. At prior blogs in 2013: No, Really, Illinois Vendors: Require Cash and Illinois Vendors and other operating expenses to go on the credit card. Just a couple of many times that regular operating costs were not being paid, and then folded into long-term borrowing.

Shifting large portions of your current operational expenses into long-term debt is a bad thing.

CHECKING OUT THE DEBT

Nick Binotti has a piece on the CPS and debt situation:

ILLINOIS POLITICIANS PUT OUR CHILDREN IN PERPETUAL “HUNGER GAMES”

A state income tax hike is inevitable.

There, I said it. Regardless of the outcome on the budget impasse, there is no getting around it. The state’s gun barrel is pointed squarely at the wallet in your left hip pocket, the state’s sadistic version of a million-dollar wound where they keep the money but we get the bowl of ice cream. I’d be pleasantly surprised if we got out of this at 4.5 percent. The only question now is if it will be retro-active to Jan. 1. The state has plans for that extra money

and it probably doesn’t involve you. Or your children. And speaking of the children… …..

So I thought I’d revisit that same exercise based on the today’s tax rate of 3.75 percent and a predicted 4.75 percent for the (near) future. And while the amount of money lost does decrease slightly, the total amount of foregone savings still remains a substantial sum of money that will impact numerous decisions over the course of your child’s lifetime. And that no one really cares.……

The state universities certainly don’t care about your children’s finances. Take a look at University of Illinois Champaign-Urbana’s enrollment figures. Back in 1985, only 15 percent of UIUC’s student population came from out-of-state. In 2015, non-resident enrollment is up to 38 percent! Over that 30 year time frame, Illinois gained 1.2 million residents and overall enrollment at UIUC increased 25 percent. Yet UIUC enrolls 3,000 less Illinois residents today than in 1985.

…..

The Cook County Pension Fund: $6.5 billion underwater, or a mere 5 record-setting Powerball jackpots away from solvency. Tucked away on page 22 is a Projected Member Count chart that shows, by the year 2025, there will be 2 inactive members (retirees) for every 1 active member (current employee). Surely, a severely under-funded pension system that is extremely reliant on incoming contributions will be fine when the number of retirees withdrawing funds is DOUBLE the amount of employees contributing, right?! Et tu, Toni?

……

Recently, the Teachers Retirement System spun an incredibly naive yarn on the utopian society created by their teacher pension dollars and the resulting economic “stimulus” it adds to the state. For the moment, put aside the inconvenient fact that this report completely ignores the opportunity cost or economic impact of spending the money allocated to pensions on…oh, I don’t know…ANYTHING ELSE. Can’t we apply the same logic to our children’s retirement funds? Wouldn’t their 401(k)’s stimulate the economy in the same way? But if tax hikes are pilfering the early sources of that retirement fund (remember my example above), how do we expect our kids’ retirements, or lack thereof, to have the same economical impact? And if the answer is to make cuts in our family budget elsewhere, doesn’t that undermine their argument as to how consumer dollars stimulate the economy to begin with?So our kids battle it out in a veritable financial “Hunger Games” as the politicos pick the haves, the have-nots, and the not-really-haves-but-you-are-now-because-we-ran-out-of-haves, ensuring all children emerge from the bloodbath traumatized in some fashion. And years down the road, as the Game’s survivors creep towards old age, a new batch of ignorant politicos will undoubtedly ask them, “Why didn’t you save enough for retirement?!”

There’s a lot of meat in the piece, so go check it out.

WE WOULD PREFER NOT TO

So while all this crapstorm continues, it looks like the Illinois politicians really would rather not to deal with the problem. Republican Gov. Bruce Rauner wants lawmakers to address Illinois’ worst-in-the-nation pension crisis ‘right away’; Democratic leaders say that might be difficult in an election year:

CHICAGO — Democrats are unlikely to address Illinois’ worst-in-the-nation pension crisis until the state has a budget, despite a rare agreement between Republican Gov. Bruce Rauner and Senate President John Cullerton and calls from the governor to send him a bill “right away.”

Rauner announced last month that he’s backing a Cullerton plan to give workers a choice in retirement benefits as a way to chip away at Illinois’ $111 billion unfunded pension liability. He struck an optimistic tone in last week’s State of the State speech, calling it one of the most critical steps lawmakers can take to save taxpayers money.

But Cullerton, a Chicago Democrat, says it will be even tougher than usual to pass pension legislation this year because of upcoming elections, opposition from labor unions, an Illinois Supreme Court ruling that declared a previous law unconstitutional and the ongoing state budget saga. A pension bill could be part of a broader deal between Rauner and majority Democrats on a budget and other issues, he said — a process that’s likely to take several months, if not longer.

“With the union opposition and without 100 percent of Republicans on board, it’s going to be difficult,” Cullerton said. “Just like everything else this year, people want to know what the big picture is.”

…..

Cullerton said he’s hopeful a budget deal could be reached by May, adding he doesn’t think the stalemate will last through the November elections.

I’m making no prediction on this.

IT’s NOT JUST ILLINOIS

These long-term structural debt problems are not only a problem of Illinois (and one of the reasons a bailout won’t happen). Time to Restructure:

Puerto Rico is bankrupt. But, so is Illinois. So is Chicago. So is just about every city, town and county in Illinois. So is NY. So is NJ. So is Kentucky. So is California. If governments across the nation did an honest actuarial accounting of their liabilities, along with their ability to pay them, a majority of them would be bankrupt.

Pundit Glenn Beck has been scaring his listeners with the thought of “Great Depression times 100”. In San Francisco and New York, they are going to allow public urination. Is it any wonder people like Socialist Barry Sanders and businessman Donald Trump are doing well with pollsters?

One of the things that should make people very optimistic about the future is the technological innovation that we are starting to see daily. The way we live life will be changed dramatically in the next twenty years. It will be easier. But, instead of being optimistic people are fearful of innovation.

……

The big government way to solve problems is come up with a policy, and then pay for it with fees or taxes. Solving problems with entrepreneurial innovation is met with penalties. In Chicago we have a cloud tax. First in the nation. We have a technology tax in our cabs, .50 cents per ride. We have an AirBnb tax. We already have the nation’s highest sales tax and some of the highest property taxes in the nation. Chicago still runs ever increasing deficits.

…….

Big Government sees people as liabilities to be managed. Hence the policies put forward by big government politicians are always dead ends. Homeless problem? Let’s give them better grocery carts to get over curbs and maybe more comfortable chairs for them while they are sitting on the street. While were at it, let’s let them urinate in a public park. Nothing big government puts in place actually solves the core problem.Instead, we ought to view people as raw assets that can improved, polished and set free. The way to solve it is through policies that encourage private economic growth. Any dollar spent by the government comes from taxpayers. That means taxpayers have one less dollar to invest. Getting rid of Big Government needs to be priority number #1 because Big Givernment’s attitude isn’t going to change.

I wasn’t planning on making this “Illinois week” — I have posts on Puerto Rico and Connecticut in the hopper (I usually amass material/quotes and then pull the trigger later.) I hope to get to them.

But it’s almost like Trump and the media — they would have preferred to ignore him, but he keeps saying things that garner attention and they have to cover him.

Likewise, I’d prefer to ignore Illinois in order to get to other fiscal disasters, but the Illinois disaster keeps having people throw out idiotic comments.

WHAT IS THIS I CAN’T EVEN

How am I supposed to not blog stupid crap like this: Teachers union closes $725K account to protest bank:

A Chicago-based teachers union closed its $725,000 bank account Wednesday in protest against a bank it argues contributed to a citywide fiscal crisis.

The Chicago Teachers Union (CTU) argues Bank of America has been profiting at the expense of the city. The union and city have been in labor negotiations for a year, but financial issues have prevented a final contract. CTU Recording Secretary Michael Brunson was among a group of union officials who marched into the Chicago-area Bank of America to close the union account.

“We are demanding that Bank of America act as a good corporate citizen and deal fairly with our schools and city,” Brunson said outside the bank, according to the Chicago Sun-Times. “Most importantly, we encourage supporters of public education to take the same action at this bank and other banks profiting from the toxic interest rate swaps.”

I can’t even begin with this.

I dislike Bank of America as much as anybody else who has had a loan with them, but interest rate swaps, just because you’re out-of-the-money, doesn’t mean they’re inherently toxic. All sorts of financial institutions (like insurers) use them for risk management purposes.

That Chicago used them for speculation, as opposed to risk management, is not BoA’s fault.

Chicago is in a shitty financial position not because of interest rate swaps (though that obviously doesn’t help), nor the bad parking meter deal (though that didn’t help, either), but the underlying profligacy of spitting money everywhere, especially at the public unions.

The parking meter deal and the interest rate swaps deals were entered into to pay for that profligacy, the “root cause”, if you will.

You know, the problem you caused, dear teachers unions.

But sure, go ahead and rally again today.

SPEAKING OF UNIONS: DOES ILLINOIS REALLY LOVE THEM SO MUCH?

Daniel Biss thinks so.

Daniel Biss is a Democratic politician in Illinois who has made proposals re: Illinois pensions before. I mention one of the pension reform bills he co-sponsored last year.

Well, Biss is getting a bit huffy that Rauner is acting like he won an election or something. Yes, his margin was thin. But he did pretty well for being a Republican in Illinois. And it’s not like “I love them unions!” was a plank in his election bid.

Let’s see what Biss has to write:

But until Massachusetts made a surprise appearance in his State of the State address last week, Rauner’s efforts at reform have focused on emulating anti-union policies enacted in very conservative states like Texas, South Carolina and Mississippi—and, more recently, states like Wisconsin that have undergone dramatic political change.

The Illinois General Assembly has rejected many of Rauner’s ideas, but media coverage of the ensuing budget stalemate largely has focused on political and personality disputes.

What this coverage neglects is that the underlying dispute is about economic philosophy and values between a Republican governor and a Democratic-controlled Legislature. Rauner and his supporters believe in a theory of economic growth that focuses on competitiveness, which to them means decreasing costs for businesses and decreasing wages and benefits for workers. Democrats believe in a theory of economic growth that invests in people and infrastructure while relying on rising wages to build a thriving middle class that then drives further consumption and growth.

Rauner has been slow to figure out that this is a genuine disagreement. It’s not a consequence of politics or coalitions or alliances. It’s one of deep, long-held beliefs. If he wants to make progress on these issues, he’ll have to—slowly—convince lawmakers he’s right, not just rely on political pressure.

Oh, you cutie-pie. You think this is about principle? I don’t think Rauner is even hung up on principle.

If the principle is “opportunity for graft”, then sure. The public employee unions provide plenty of that. I noticed your code words of “invests in people” (i.e. shove money to the public teachers unions).

But the lovely thing is, if a certain Supreme Court case goes the way I wish it will (I am tired of paying “agency fees” to a union with whose interests I do not align at all, for my hobby job), Biss will find out just how much those Illinoisians love their unions.

Look at what’s happening in Wisconsin, Biss.

Notice that the union membership started falling before Gov. Walker’s 2011 anti-union legislation.

I will do a separate post on union membership later, because I just found a nice data set.

That’s another one of those “principle” states, where the principle used to be very pro-union. But that was a stance imposed on people, and now that they aren’t forced to be members, the membership has plummeted.

Related Posts

Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

Mornings with Meep: I'm Happy I Didn't Wait

Nevada Pensions: Asset Trends