Sweet Pensions Alabama

by meep

Yeah, couldn’t help myself.

Recently, I read a piece saying worry not, all is well with Alabamian pensions:

The myth about the pension crisis in Alabama

By David Bronner, chief executive officer, Retirement Systems of Alabama

Much ado has been made recently about a public pension crisis in Alabama and the need for reform. The groups and legislators who are clamoring for reform always neglect to mention two critically important facts: the Legislature has already reformed Alabama’s public pensions and there is no pension crisis in Alabama.

First, major pension reforms have already been enacted. In 2011 and 2012, the Alabama Legislature passed pension reform legislation designed to address the very issues that are now being touted as causing a crisis. These reforms were comprehensive and impacted current members (repeal of DROP and increasing employee contributions) and new members (increasing the retirement age and decreasing the benefits). These pension reforms tied with Pennsylvania’s as the most extensive in the nation and significantly reduced the state’s cost of benefits for Alabama’s education and public employees. The RSA is not protecting the status quo by objecting to another major overhaul of the system, but is instead trying to allow the reforms that were so recently enacted to continue to work.

Second, manufacturers of the pension crisis emphasize a large unfunded liability ($15 billion) and increasing employer contributions as evidence of the crisis. Yes, $15 billion is a large number, but it represents pension benefit obligations to be paid in the future over a long period of time, much like a mortgage. The money received from the state and RSA’s investment income is used to make the “mortgage payment” on this obligation and the unfunded liability is being systematically paid off.

The RSA has some other big numbers that can put the unfunded liability into context: $15 billion is the amount of only five years of benefit payments made to RSA members; the RSA paid out roughly $3.1 billion in benefits in fiscal year 2015. The RSA has generated $15.3 billion in investment returns since 2010 and as of September 30, 2015, had approximately $32 billion in assets, an increase of 28% since 2010. What other state entity generates that much income? Or holds that much in assets? Or pays as much into the Alabama economy?

Lots of numbers there being thrown around.

I get a whiff of special pleading in there, so let’s check out how things are in Alabama.

GOING TO THE NUMBERS

Here’s Alabama’s page in the Public Plans Database, so let me pull out what I see for funded ratios:

Alabama ERS 66.9%

Alabama Teachers 67.5%

Hmmm, seems to me that it doesn’t really make the plan look good if 5 years’ worth of pension payments is one third of the pension liability. It makes me a bit suspicious, even.

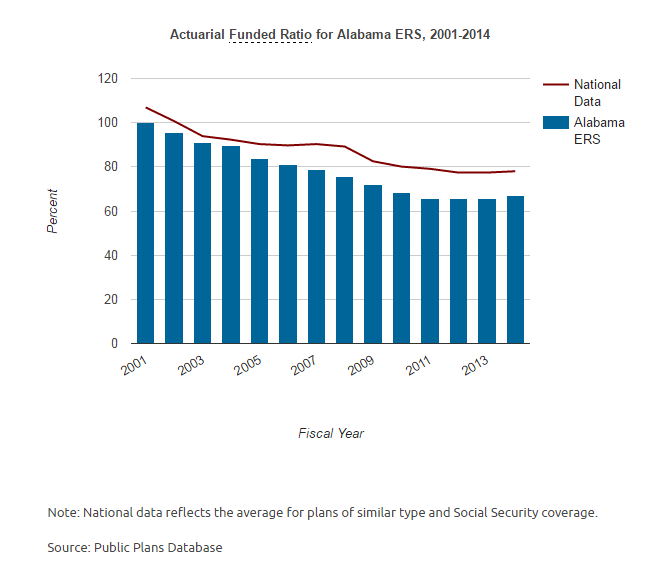

When I dug into the two plans separately, I see that the graphs say they’re making 100% required contributions (though the pattern is odd)…. but that the funded ratios have been sliding down even so.

How can that be?

Yes, I see that these track closely with nationally similar plans, but doesn’t this make one a bit suspicious? Even after years of a bull market, the funded ratio doesn’t appreciably improve.

FULLY-FUNDING DOESN’T LEAD TO FULLY-FUNDED?

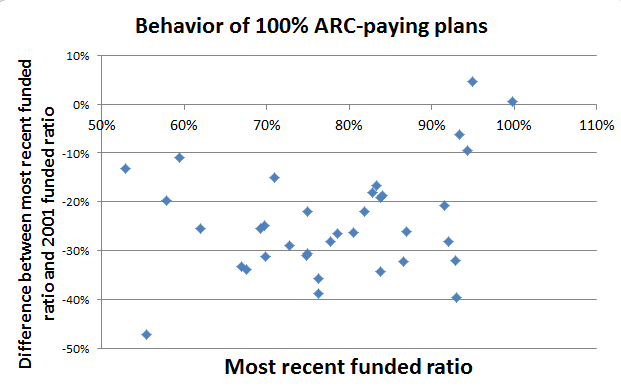

I posted these graphs recently, so let me trot this out again:

That’s a graph of the change in funded ratio (in percentage points) between 2001 and the most recent funded ratio, where the plans supposedly contributed 100% ARC each year.

This is plotted against the most recent funded ratio.

Of those plans, only one was near 100%. Another had an increase in funded ratio since 2001, and was north of 95%, so that is pretty good.

But the others?

Something odd is going on, and I’m thinking of investigating the distinctions of those plans making 100% contributions and having decreasing funded ratios. I have an inkling re: two possible sources of this decline — assumptions (discount rate, particularly); method (such as Eantry Age Normal, etc.)

Now, having chatted with some people, there may not be enough differences between the 100%-funding-but-not-100%-funded plans to tease out what’s driving this, but I should look.

ON GOOD GOVERNANCE

But there’s another aspect that I wouldn’t have looked at too closely unless Mr. Bronner, the CEO of the Alabama Retirement Systems, had written that piece.

How an Alabama state employee built a billionaire’s lifestyle in a taxpayer-funded job (opinion)

:

According to Forbes Magazine, Alabama is currently home to exactly zero billionaires. But if you spent a day with the state’s highest paid government employee, you might assume Forbes must have overlooked something.

Dr. David Bronner has been Chief Executive Officer of the Retirement Systems of Alabama (RSA) for over *40 years. From a palatial office overseeing downtown Montgomery, Bronner manages the pension fund for employees of the state of Alabama, including teachers. Through some early successes and some crafty propaganda — much of it published in the RSA’s own newsletter — Dr. Bronner’s reputation as an investment wizard has endured, even as his pension fund has deteriorated to the point that Alabama taxpayers are compelled to contribute roughly $1 billion per year to prop it up.

A research paper published by the Alabama Policy Institute last year estimates that the collective Retirement Systems of Alabama (RSA)—the Teachers Retirement System (TRS), Employees Retirement System (ERS), and Judicial Retirement Fund (JRF)—have $29.4 billion in assets, and $44.6 billion in liabilities.

In other words, the RSA is short for current and future retirees by $15.2 billion.

According to the paper, between 2003 and 2013 the unfunded liability for the RSA grew from a manageable $2.1 billion to the $15.2 billion it is today—putting each of Alabama’s 4.8 million residents on the hook for $3,166, or $8,724 per household.

…..

In the midst of it all, Dr. Bronner has built for himself a lavish lifestyle that far exceeds his roughly $600,000 taxpayer-funded salary.An avid golfer, he has used RSA funds to build golf resorts around the state, which lose roughly $20 million per year. Resort employees told Yellowhammer on condition of anonymity that Dr. Bronner is a frequent and demanding guest in the hotels’ priciest suites.

Dr. Bronner has dismissed the financial losses by saying the golf courses and resort hotels attract tourism dollars to the state that are not directly reflected in their bottom line. Critics have responded by saying that even if that is true, it is his job to get the largest return possible for state employees, not to use their pension fund as an economic development loss leader.

That sounds pretty sweet, eh?

CEO for forty years, though? That sounds insane to me. How the hell did he get such a perch, from which he hasn’t been dislodged?

Let’s check out his wiki entry:

After teaching in various graduate schools of Education and Business, he was appointed as assistant dean of the Law School at the University of Alabama. Shortly thereafter, Bronner took his present job with RSA in 1973. At that time RSA had approximately $500 million of funds and was owed $1.5 billion by the state. By the end of 2014, RSA had amassed over $34 billion in investments making RSA the 115th largest public pension fund in the world.2

He was born in 1945, so in 1973 he would’ve been 28 years old.

WHAT?

Does nobody find that a little odd?

Indeed, the wiki article reads like a fluff piece. Let’s check who edited it. This anonymous editor seems to be from Alabama.

MORE QUESTIONS ABOUT BRONNER

The legislative scrutiny began in earnest in 2011, when Republicans took control of the Alabama Legislature for the first time in 134 years. The new GOP majority confronted a state budget still devastated by the Great Recession, and like their counterparts in most states, Alabama legislators took steps to reduce overall pension costs. One way they did this was to create a new, less generous tier of benefits for new employees. Legislators also hiked the contribution rates imposed on current employees from 5 to 7.5 percent. The raft of changes reduced RSA’s total liability by $2 billion. That meant that the state — and thus its taxpayers — would save $5 billion over the next 30 years in pension costs. As a result of the changes, the funded ratio of the pension plans has remained about the same for the past several years, after a long period of decline.

……

One way RSA tries to improve its bottom line is by spending less than most pension systems on outside investment firms. The fees these firms charge can have a significant impact, reducing the rate of return for typical pension funds by as much as 0.5 percent, according to RSA. But most of Alabama’s investments are managed by RSA’s staff, so it pays extremely low fees by comparison. Bronner’s staff says RSA’s 10-year returns would look better if other plans’ higher fee expenses were taken into account.

…..

But Orr set off alarm bells when he decided to seek outside advice. The Republican senator enlisted the help of The Pew Charitable Trusts, which partnered with the fiscally conservative Arnold Foundation. The Arnold Foundation is named for its founder, former Enron energy trader and billionaire John Arnold, who is probably the most active critic of public pension systems in the country.Pew and Arnold had previously played a prominent role in Kentucky’s decision to create so-called hybrid or cash balance pension plans. Under those plans, participants are guaranteed a lower rate of return than in a traditional plan and share any excess investment returns with the state. Public workers are likely to get less money when they retire, but their employers save more money. When Pew got to Alabama, some of the work it did for the committee was to outline how Alabama too could put a cash balance plan in place.

Bronner, who regularly runs anti-Arnold ads in his newsletter to RSA members, is incredulous about what he sees as outside interference. “Let’s not put Pew in the category of good guys. That’s ridiculous,” he says. “It is an organized attack on public pension funds by the super rich.” It’s not only Arnold or Pew, either, he says. It’s the oil-billionaire Koch brothers and their network paying for reports by think tanks and universities that undermine public pensions.

And you’re not suspicious at all, non-medical Dr. Bronner.

As a practical matter, Bronner’s job is safe for the foreseeable future. He reports to the control boards of the two major pension systems, and he has always been able to count on their support. The teachers’ system is twice as big as its counterpart for state and municipal workers, and 80 percent of the board members for the teachers’ fund are elected by participants in the system. So as long as Bronner keeps retirees and current workers happy, elected officials have limited options for telling him what to do. When asked why he’s never been fired with so many people after him, Bronner is frank: “Because,” he says, “I’d snuggle up to the teacher board. [Otherwise,] the politicians would have nailed me decades ago.”

Uh, yeah. I imagine having run the fund for longer than I’ve been alive, I’m sure he has plenty of connections (and dirt to be disclosed if someone crosses him)…I still wonder how he got that position when he was 28 for crying out loud.

Anyway, this is one of those “probably should be audited well before it fails” pensions.

So many public plans with sketchy governance, so little time….

DIGGING UP THE PAST

I decided to dig through my public pensions threads (goes back to September 2008…what timing) and find every post on Bronner:

- March 2010: Alabama golf courses save pension fund

If you don’t like the way things are, then change them. That’s what one Alabama state worker did about 20 years ago. And it’s paid off big!

Back in the late 80’s when the pension fund for Alabama’s state employees was small and struggling, the head of the retirement systems teed up an idea about golf. He works today in one of the most stunning state office buildings you’ll ever see. Where Dr. David Bronner sits, is an empire of pension money.

….

Before the golf trail, annual tourism was under $2 billion. Now, it is pushing $10 billion, and Bronner has remade Montgomery’s skyline. That new construction and all those buildings with green tops? All built with retirement systems cash.He has invested Alabama’s retirement funds in world class hotels, spas, media — even a landmark office building in New York City.

Uh, New York City?

December 2014: Finance director suggests pension oversight committee:

MONTGOMERY, Ala. (AP) – The state finance director on Wednesday urged the teachers’ pension system to consider creating a new oversight committee, noting that one key measure of pension plan health has fallen for 13 years in a row.

Finance Director Bill Newton asked the control board of the Teachers Retirement System to discuss creating the oversight committee similar to the one established by the board that governs the pension system for state employees. However, the idea prompted immediate pushback from David Bronner, chief executive of the Retirement Systems of Alabama, and board members who called it unnecessary micromanagement.

Newton said there’s been a consistent downward trend since 2000 in the pension plan’s ratio of assets to liabilities. Newton said the pension system had a funded ratio of over 100 percent in 2000 but that dropped to under 80 percent in 2007 and 65 percent in 2013.

“It’s not so much what the funded ratios are now, but it’s the trend,” Newton said. Newton said the board of the Employees Retirement System was concerned by those numbers and he believed members of the teachers’ pension board should be as well.

Newton said a recent analysis by State Street Investment Analytics also showed the teachers’ pension system had among the worst average returns among public pension systems over a 10-year period. Newton said the committee would have oversight over long-range investment policies, but would not be involved in daily decisions.

The board did not take a vote on the proposal, but some board members quickly joined Bronner in speaking out against the idea.

“I think the committee is a slap at me and a slap at the staff,” Bronner said during the meeting. He said all pension systems have gone through similar declines.

That kind of talk makes me suspicious.

December 31, 2015: Court blocks suit over state pension fund’s investments:

MONTGOMERY — The Alabama Supreme Court blocked a lawsuit Wednesday that challenged the state pension fund’s investment in hotels, golf courses and other properties in Alabama.

The court ruled 6-2 the suit filed by two public employees should be dismissed.

Public employees Tonya Denson and Venius Turner contended the Retirement Systems of Alabama had invested up to 15 percent of its assets in Alabama properties, including the Robert Trent Jones Golf Trail, convention hotels, office buildings, newspapers and TV stations, and they were yielding lower returns than other investments would have.

They wanted the courts to block future Alabama investments if they would yield lower returns than other investments would.

The Supreme Court said the state constitution gives the pension fund immunity from such suits.

The justices also said the Legislature had delegated investment decisions to two boards that oversee the Retirement Systems, and the separation of powers doctrines keeps the courts from overseeing the investment policies of another branch of government.

……

They filed the suit in 2011 when the Legislature required public employees to start paying more of their paychecks toward their pension benefits. The move came after several years of low returns during the recession.

Retirement Systems Chief Executive David Bronner said the suit was filed as “harassment” when returns were low. He said the returns have rebounded, averaging about 15 percent for the last three years and ranking in the top 13th percentile of public pension funds.

Chief Justice Roy Moore and Justice Greg Shaw dissented. They said the case should not be dismissed before a lower court considers all the issues in the suit.

The Retirement Systems appealed to the Supreme Court after Montgomery County Circuit Judge William Shashy denied a request by the pension fund to dismiss the suit shortly, after it was filed in 2011.

Over 4 years ago? Jeez.

September 2015: RSA under fire: Inside the latest battle over Alabama’s pension powerhouse:

Displayed on the walls outside David Bronner’s office in Montgomery are more than 100 framed political cartoons that span his career leading the Retirement Systems of Alabama.

A who’s who of Alabama politics, the framed illustrations depict Bronner scrapping with everyone from governors to judges over the billions of dollars in pension money.

“To get a political cartoon, you have to get your head kicked in on the front page, followed by getting your head kicked in on the editorial page,” said Bronner, 70. “That’s the third shot at you in the era of editorial newspapers.

“Each one represented a battle of trying to keep people from ripping off the system.”

If there’s any space left on those walls, Bronner might want to save it. That’s because the RSA CEO is once again fighting over the money he says belongs to the RSA’s 350,000 members.

Earlier this year, the State Legislature formed a subcommittee to consider pension efforts that have occurred in other states. Backed by well-organized political advocacy groups, some of these changes have eliminated guaranteed contributions to future employees while reducing other states’ pension obligations.

Last year, Alabama contributed more than three times the state’s General Fund shortfall – about $940 million – in support of the RSA. Lawmakers that are leading the subcommittee claim that Alabama’s pension system is a long-term liability in need of repair.

…..

Right now, the RSA could cover 66 percent of what it owes, below the national average of 72 percent, according to Pew.“That’s what we’re focusing on,” said Sen Arthur Orr, R-Decatur, co-chairman of the committee. “Not perceptions, not things that can’t be backed up by the raw data.”

Orr met the Pew officials for the first time last year at an Arizona conference after he gave a presentation about the changes the State Legislature made to the pension system in 2012.

Designed to save $5.05 billion over the next 31 years, the Alabama plan reduces pension benefits for teachers and other public employees hired since 2013.

…..

Two boards manage the RSA: the Employees Retirement System Board and the Teachers Retirement System Board.As of July 31, the ERS board oversaw $11 billion in assets and the RSA-friendly TRS board oversaw nearly $23 billion in assets.

The ERS board used to go through the motions when it met, according to some of its members.

…..

What recently caught Williams’ ire was the ERS decision in December 2014 to create four new committees to oversee the board’s operations.The committees are tasked with everything from audits to reviewing portfolio performance to “termination and long-term succession planning of key personnel.”

“Dr. Bronner may decide he’s going to retire next year,” said ERS board member David Bollie, speculating on the future of the RSA. “How are we going to have a smooth transition … if we don’t have some understanding of what’s going on? I hate to think we just pick someone new without having a good idea with what’s going on.”

But the committees rubbed Bronner the wrong way.

In the August edition of the Advisor, Bronner wrote about the “disturbing change in the way that certain members of the ERS Board approach their role.”

I’m sure it did disturb.

So the public plans that you run the investments for want to submit you to oversight? The answer should be “But of course!”

Anything else, and I would think something is up.

Final one – (til the ones above): October 2015: Concerns rise over possible state pension changes

:

A legislative committee will continue work Monday on a study of the state’s pension system that could potentially lead to changes to retirement benefits.

The Retirement Systems of Alabama’s CEO, meanwhile, has raised questions about the purpose of the committee and whether it is using research funded by a hedge fund investor.

For now, legislators are still learning about the issue, said Sen. Arthur Orr, R-Decatur, who is a member of the committee.

……

The unfunded liabilities in Alabama’s pension systems have grown in recent years, though the system overall remains healthier than in other states, such as Illinois and New Jersey.The RSA’s pension systems were fully funded during the boom stock years of the late 1990s, but have gradually slipped in recent years. As with other state benefit services, the loss of more than 5,500 state employee positions since 2010 have reduced total payments into the system. But David Bronner, the longtime head of the RSA said stock performance and benefit increases passed without additional funding were chiefly responsible.

“You got smeared on investments in 2008 and 2009,” he said. “But the big thing from year one going forward is the Legislature passing additional benefits and not paying for them over a 30-year period of time.”

According to the most recent audits, the Teachers’ Retirement Systems (TRS) was funded at about 66.2 percent at the end of 2013, with an unfunded liability of about $10 billion. The Employees Retirement System was funded at about 62.4 percent, with an unfunded liability of $2.5 billion. The Judicial Retirement System, smaller than the others, had a funding ratio of 58.7 percent, with an unfunded liability of $170.8 million.

Bronner said the liabilities would not be an issue so long as the state continued to make payments into it.

“It’s like a house mortgage,” he said. “So long as you’re making your payment, and the state has done a good job doing this, the state is going to be fine in the end. If you don’t make a payment in the end, the state is going to have a crisis.”

…..

“With a couple good years with RSA, with the five-year smoothing, my expectation will be we’ll be over 70 percent funded,” he said. Orr said “optimally,” he would like to see the funds at between 85 and 95 percent funding, but said “it’s always going to fluctuate.”

I think I put this in my 80% hall of shame… just give me a moment… Oh yes I did:

I’m sure he thinks full funding is a “laudable” but unrealistic goal.

It won’t be so cute when it’s your own pension on the line.

Anyway, Alabama has just got elevated in my radar (just as Kentucky and Connecticut had done), so I may be circling back with any new things I find.

It may be that it more impels me to check out the plans that supposedly are fully-funding, and yet have deteriorating financials, than focus on Bronner. But it depends on what happens with Bronner, doesn’t it?

Related Posts

Testing to Death: Which Public Pensions are Cash Flow Vulnerable?

Kentucky Update: Republicans Take Legislature, Pensions Still Suck, Hedge Funds to Exit

Meep's Data Visualization Evolution: Tile Grid Maps