Chicago and Cook County Update: Tax Bills are Coming

by meep

Before I get into this particular unpleasantness, there’s loads of unpleasantness in the news lately, no?

Let’s talk about some happy stuff first.

Here’s last week’s good news:

- Absolute poverty and childhood mortality are waaaaay down in the past 200 years, and continues to improve at amazing rates, worldwide.

- Lots of cool tech helping people live better lives (and just live)

- Hair braiders in Kentucky are free to ply their trade, and one of the best political pics of the year

- The story of how Bobby Bonilla has an 8% annuity

- Some people can buy wine in a grocery store (but not me, living in Yankeeland)

I will see if I can find more happy news for future posts, but in the meantime, here’s some otters:

Here’s the nice people who have been linking me lately:

- The Other McCain

- Pension Tsunami

- This link to me from November in Governing, which I didn’t catch earlier

And my mystery facebook linker.

And great news, the Vladimir Bukovsky fundraiser got linked by Instapundit!

BOB ZUBRIN AND CLAIRE BERLINSKI BOTH SAY THIS IS LEGIT: Vladimir Bukovsky: Brave Freedom Fighter Needs Your Help Now. He’s a Putin critic facing the usual difficulties. More background here.

This was my own posting on the matter.

PROPERTY TAX BILLS SENT OUT

COOK COUNTY PROPERTY TAX BILLS CAUSE OUTRAGE:

Cook County taxpayers are outraged after property tax bills showed up in the mail. The bills are skyrocketing this year.

The city of Chicago and its public school district’s fiscal problems literally hit home over the weekend, when property owners saw their second installment tax bills.

Outside the assessor’s office, city homeowners told one property tax horror story after another.

“Our taxes increased fivefold,” said William Phillips of Rogers Park. “I was expecting it to go up maybe twice as much but not four to five times as much.”

Yowza.

Well, let’s see what people were told in June:

The average homeowner in north and northwest suburban Cook County will see property taxes increase by $110 in the coming year, according to data released by Cook County Clerk David Orr’s office Monday.

Well, that could be a fivefold increase… if your original taxes were only $30. These stories don’t really mesh.

Let’s go back to that other story:

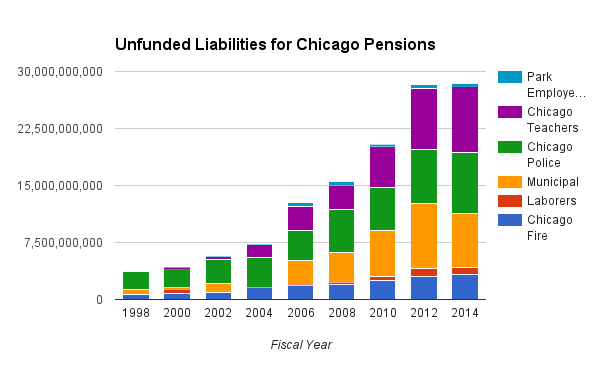

The bills that arrived over the weekend reflect rising Cook County real estate values and, in Chicago, the city’s $588 million levy increase. Most of it is to restore police and firefighter pensions that Mayor Rahm Emanuel says his predecessors underfunded.

“A number of people across the spectrum, politically, denied, deferred and delayed the day of judgement,” said Mayor Emanuel.

“I don’t think that I’m getting the services for what I’m paying for,” said King.

Sensing taxpayer unrest, Cook County Board President Toni Preckwinkle promised not to consider a property tax increase to resolve her government’s deficit.

And the older story:

The average tax bill for those suburban homeowners comes in at $6,685, up from $6,575 last year, according to Orr’s figures. That’s despite the taxable value of homes in the county’s north and northwest suburban suburbs dropping on average 2.3 percent this year thanks to the way the Illinois Department of Revenue calculates property tax rates in Cook County. The homes’ average taxable value went from $71,267 last year to $69,781 this year, but most tax rates rose along with the amount of tax revenue being sought, which drives up property taxes for most residents.

…..

Homeowners in Wheeling can expect the largest bump with property taxes paid to the village rising 11.3 percent from last year.

……

Cook County residents in Elgin can also expect an average increase of 11 percent that city officials said was due to wage increases, debt payments and mandated pension obligations. The average Elgin homeowner paid $1,559 last year to the city alone and is on the hook for a $1,731 tab this year, according to Orr’s office.

……

While suburban homeowners saw modest property tax increases on average, Chicago property owners were tagged with an average 12.8 percent increase in property taxes due to a rate increase to help cover public pension costs.All told, data from Orr’s office showed property values increased 3.5 percent throughout the county and the county’s 1,400-plus taxing bodies are due more than $13 billion combined for the first time in history. Last year, the total tax bill for all agencies was a little more than $12.4 billion.

I don’t have the data, but I think what’s happening is that while there’s an 11 – 13% total increase in the tax bills, there are some large differences between properties.

THE PAIN IS DIFFERENTIAL

Here’s one piece that makes that claim:

(CBS) – Call it sticker shock. The average property tax bill in Chicago is up nearly 13 percent, or $400 over last year.

In some cases, the bills can be more than double. CBS 2’s Vince Gerasole has a look at how some homeowners are trying to fight that.

It came out of nowhere for Chad Lieberman.

“It went up so dramatically I was just so taken aback,” he says.

His upscale Logan Square condo looks out on the popular 606 Trail. That is coming at a price. His property taxes jumped from $3,100 dollars to more than $7,300.

Dayumn.

It is calculated on an assessed value that more than doubled, from $192,000 to nearly $430,000.

“I have had to make multiple phone calls to try and understand how assessment price is calculated,” the owner says.

To fund Chicago police and firefighter pensions, hefty tax rate increases were approved last year. But assessed values are also based on location, and living in trendy Logan Square is proving costly.

This is one of the many problems with property taxes. It turns out to be a real political problem in many places — obviously, some people bought properties well before they became pricey. Just because the current market price has jumped up a lot doesn’t mean a long-time property owner could buy at today’s prices. Should they have to move just because their property increased in value due to location? What about when the location has lost a lot of value? You’ll notice that tax offices generally don’t feel like dropping the taxes then.

This is something that’s happening in my own town. I happen to be one of the idiots who bought at the top of the market, so I may be paying a hell of a lot more in taxes than my neighbors who bought decades ago and have twice the size in property and building that we do. (a re-assessment is going on now, and there’s more to it than when we bought that’s an issue…. property taxes are fraught in local politics.)

Another piece on the differential impact:

Chicagoans are confronting their second-installment property tax bills. Prepare for sticker shock. Maybe each envelope should include a shot of bourbon.

The average homeowner’s property tax bill is jumping by roughly 13 percent, though there can be wide swings in either direction. A homeowner whose property has a market value of $225,000 will see his or her bill increase by more than $400. Ouch. In areas of the city where property values have climbed steeply — Gold Coast, South Loop, Streeterville — some property owners could get socked with an additional $5,000 in taxes. Ouch and ouch.

That is damn nasty.

I haven’t been in this situation yet, but I can definitely see the problem. Like these homeowners, when I get my property tax, I usually have one month to pay the bill. It’s thousands of dollars. I plan on having to pay the amount I did last year with margin for increases. But not the thousands it would take if my bill were to double.

They had to have known this would be a political issue.

POLITICAL OOPSIE

A claim that the Chicago alderman won’t take a political hit:

Chicago homeowners take bigger tax hit, but aldermen off the hook

Chicago property owners will take a far bigger hit for teacher pensions, but their aldermen will escape another difficult vote, thanks to the legislative compromise approved Thursday to ease the financial crisis at the Chicago Public Schools.

……

Now, beleaguered Chicago homeowners are facing a $250 million increase for teachers pensions. And that’s on top of the $588 million property tax increase approved by the City Council last fall for police and fire pensions and school construction.Still, a hoarse, exhausted, but relieved Emanuel said he was staying true to the “three-way handshake” to stabilize CPS finances that he outlined a year ago Friday.

…….

But how did an increase that started at $170 million get 47 percent higher?“It’s part of a compromise. It was also part of getting the state to be part of that solution. That’s what you do when you work through a series of issues that are important,” the mayor said after the vote.

A top mayoral aide, who asked to remain anonymous, added, “We had to raise the rate. We didn’t get quite as much as we wanted from Springfield. The state is stepping up. They wanted to see the city step up. Politically, there was a demand for equal parts. We were also working back from the number we needed to get to sustain CPS.”

……

Letting aldermen off the hook for the school property tax should make it easier for Emanuel to win City Council approval of the tax increases that will be needed to save the Municipal Employees Pension Fund. That’s almost certain to require $200 million in new revenue over five years.“That’s one less difficult vote. There’s one big thing left to go. There’s light at the end of the tunnel. We can finish the fiscal job. Politically, it gives us the ability to tackle the next challenge without worrying about the one that’s right in front of us” at CPS, the Emanuel aide said.

……

Possibilities include a “stormwater stress tax” on big-box stores and other business giants that put pressure on the sewer system; an increase in the utility tax on electricity, natural gas and telecommunications; a fee specifically for pensions that would be tacked on to water bills and yet another property tax increase.

……

Even without a third property tax hike, Chicago homeowners whose property taxes have been a relative bargain compared to surrounding suburbs will see the city’s portion of the tax that everybody loves to hate nearly double over the next few years. An $838 million increase. Talk about sticker shock.

I don’t know that the alderman are really off the hook.

But wait, let’s hear more directly from Rahm and not just unnamed flunkies:

Emanuel defends record property tax hike as bills hit mailboxes

Five days after agreeing to raise property taxes by another $250 million for teachers pensions, Mayor Rahm Emanuel on Tuesday defended the record increase for police and fire pensions and school construction reflected in property tax bills now landing like a thud in Chicago mailboxes.

The mayor was asked if he had “any words of consolation” for those taxpayers “stunned or even outraged” by their property tax bills, which reflect the $588 million property tax increase approved by the City Council last fall.

His response essentially was, “I told you so.”

“When I ran for office, one of the major issues was removing the doubt over our economic future [caused by] unfunded pensions. All four of ’em were unfunded. I was clear that the period of time in which we put our politics ahead of our responsibility had ended. That we were gonna do the tough things necessary to put our fiscal house in order,” Emanuel said.

“For too long, a number of elected leaders — not just political — a number of people across the spectrum politically, denied, deferred and delayed the day of judgment. . . . I understand it’s not popular. But I have to weigh the politically unpopular against the fiscal irresponsibility of leaving four pensions unfunded. And I was upfront to people. I told ’em in both elections: `We have to fix this and do it in a responsible way.’ ”

Well, I don’t really blame him.

He didn’t create this problem:

That said, don’t think people are going to suck up all this pain. You can keep saying “But we had to!”

That’s nice.

Many of these people are really squeezed already. They’re not happy with the Chicago crime situation.

They are being asked to pay thousands more to pay for service that was done decades ago. Many of these people weren’t around for the benefit of that long-ago service, and they are seeing current service declining.

Throwing up your hands, as a politician, and saying “It’s not my fault!” isn’t going to be all that effective.

Rahm knows that, which is why he’s trying a new gimmick:

So now the city is working on Plan B, a so-called rebate. Under four options being considered so far, low-income homeowners would qualify for one-time rebates averaging $100 to $254, according to an analysis from the mayor’s office.

That might sound like compassionate government, but it’s a ruse. The rebates would just take from one pocket to stuff a few dollars in the other. Under the various proposals, the rebates would total $10 million to $50 million, plus the cost of administering the program, which would likely be outsourced.

But the city can’t just reduce its contribution to the pensions and rebate that money. It would have to find the money elsewhere in the budget, either by cutting operating costs or levying a new tax or fee to make up those dollars. All that to shell out what amounts to a consolation prize: a rebate of a few bucks to ameliorate that whopping tax increase.

Tax rebates are gimmicky. Look, here’s some money back! A responsible government doesn’t collect taxes and then give back the change. And there isn’t any change, anyway.

We do that in New York, too. You bet I apply for the STAR property tax rebate. But it doesn’t really earn a lot of political points in NY now, because it’s just expected.

I don’t think a rebate of a couple hundred dollars is going to assuage the anger of enough property owners in Chicago or Cook County to make a political difference.

OTTER RELIEF

Okay, this is just depressing. Chicago is just going to go bankrupt eventually anyway. But there’s a lot of money to burn through before that’s realized, so here we are.

Here ya go, more otters for relief:

Related Posts

STUMP Podcast: Choices Have Consequences: Retirement Policy

Taxing Tuesday: SALT cap zero! Great new taste!

Taxing Tuesday: Taxes for Old, Taxes for New?