Kentucky Pensions Update: Their Investment Returns Also Sucked

by meep

Kentucky’s ailing pension system lost money on its investments in FY 2016:

The $14.9 billion Kentucky Retirement Systems lost money on its pension investments during the fiscal year that ended June 30.

Preliminary statements show a negative 0.52 percent return on pension investments, trailing the industry benchmark return of a positive 0.21 percent, KRS said in a prepared statement.

KRS posted a five-year investment return of 5.38 percent and a 10-year return of 5.02 percent. Although that’s better, it falls short of the assumed rate of return of 6.75 percent that KRS counts on for its financial projections. The KRS board of trustees agreed to lower the rate of return to 6.75 percent from an even more ambitious 7.5 percent less than a year ago.

“Fiscal year 2016 has been a difficult year for all capital market participants. The year was marked by extreme capital market volatility,” KRS said.

The retirement systems did particularly poorly with equity investments from outside the United States and “absolute return” funds, which are funds that can employ risky strategies like those used by private hedge funds.

Not that this should be a surprise. Pretty much all July-to-July fiscal year funds are going to see, at best, “sideways” returns:

But the problem for Kentucky, of course, is that its pension funds are severely underfunded, and like many very underfunded plans, really can’t afford to underperform in the investments arena.

Underperformance was partly due to asset allocation, not just sideways markets:

As of June 30, the pension fund had an asset allocation of 26.1% U.S. equity, 25.1% international equity, 13.7% fixed income (split evenly between global fixed income and credit), 10.2% absolute return, 10.1% private equity, 8.4% real return, 4.7% real estate, and the remainder in cash and miscellaneous.

For the three, five and 10 years ended June 30, the $10.8 billion pension fund returned an annualized 5.45%, 5.38% and 5.02%, respectively, slightly below its benchmark returns of 5.9%, 5.91% and 5.49%.

Minimal exposure to CCC-rated corporate bonds, which had a “tremendous run” over the past few months, and active U.S. equity managers that underperformed as a whole hindered the pension fund relative to its benchmark, said David Peden, chief investment officer, in a telephone interview.

It’s so easy to look to the past and determine what the optimal portfolio would have been. But I’m pretty skeptical about ESP, so not sure it’s fair to fault the asset managers for having minimal exposure to the one asset class that did really really well. What if they had had non-minimal exposure, and the junk bonds had behaved like junk?

As an example, this article complains about Kentucky’s exposure to thermal coal. Mind you, much of the criticism there is not stemming from investment results but a very political divestment campaign.

BAD NEWS IS NO NEWS

The dismal news is nothing new for the Kentucky Retirement Systems.

A quick tour through this year’s Kentucky posts:

- The Woefully Underfunded Kentucky Retirement Systems

- March of the Deadbeats: Illinois, New Jersey, Kentucky, Puerto Rico and Central States

- Kentucky Update: A Crazy Day in Pension Governance

As for that last item, as far as I know, Kentucky’s pension governance issue is still ongoing. When it goes to lawsuit territory over who has control, that’s never a good sign.

HOW BAD IS IT?

Three recent studies named Kentucky one of the worst states for retirement based off amounts of cash states have on hand and their debt obligations, according to an article in Governing Magazine.

Kentucky, along with Connecticut, Illinois and New Jersey, are most likely to raise your taxes and cut government services due largely to unfunded liabilities for public-employee pensions.

In the first report, “The Arc and the Covenants,” J.P. Morgan calculated what each state “spends on bonds, pensions and obligations related to underfunded pensions and retiree health benefits, along with what they would be spending to cover those obligations over 30 years assuming a 6 percent rate of return on investments.”

The study found that Kentucky fares worse than Illinois and Connecticut: The state would have to raise taxes by 20 percent, cut spending by 13 percent or raise worker contributions by 435 percent in order to pay its retirement obligations.

That’s assuming it will pay its retirement obligations.

What does the funded ratio look like?

John Bury has made his own calculations, and though he finds Illinois is the worst (yeah, what a surprise), Kentucky is close behind at a funded ratio just scant of 50%.

The Kentucky funds, according to Bury’s calculations, have funded ratios ranging from 19% (KERS Non-Hazardous) up to 61% (KERS Hazardous).

This is using Kentucky’s own measurements of asset and liability values, of course.

Let’s see what others have to say about this state of affairs.

Three years after major reforms were made to the Kentucky Retirement System (KRS) for new hires in 2013, Pew Center on the States’ pension expert David Draine returned to Kentucky at the invitation of the Kentucky Chamber with an analysis of the progress report of the changes which he says are on track to save the state and provide more stability to the pension system and its recipients.

The most extensive suggestions of the 2013 task force were to fully fund the state’s required contribution to the system, to avoid adding costs to the systems through items like unfunded cost of living adjustments and to adopt a modified defined contribution plan for future state hires.

The suggestions resulted in the pension reform legislation of the 2013 session, Senate Bill 2, which included moving to a “hybrid” system in which the worker contributes 5 percent of his/her paycheck matched by the state and receives a guaranteed return on investment of 4 percent. The annual cost of living adjustment for retirees was also elimated.

Draine was quoted in 2013, saying the recommendations reached by the task force, which were strongly supported by the Kentucky Chamber, would be a “solid way forward” to solving the state’s pension crisis.

….

According to projections by KTRS’ actuaries Draine cited in the meeting Wednesday, if no actions are taken and no reforms are made, KTRS will run out of money by 2039.

Wait a second – running out of money within 25 years is being “on track”? I guess that’s more “on track” than what was going on before:

Wait a second — they’re not making the ARC. What the hell?

How is this on track:

Oh look. The funded ratio is going up. Barely.

60% AS FULLY-FUNDED

And there’s more. I mentioned above about the lawsuit over Kentucky pensions governance. As per prior posts, the governor of Kentucky fired the prior executive director of the funds, and the lawsuit is over whether the governor has this power.

I will not touch upon the legal aspect.

I will touch on something I see in an affadavit from that previous executive director, William Thielen.

You can see the full affadavit here.

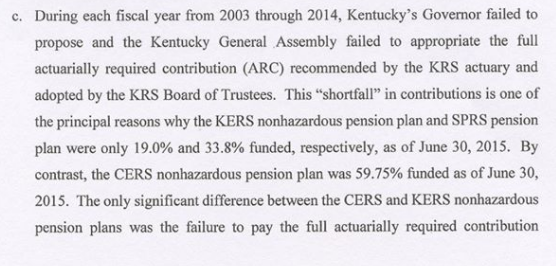

I want to point out paragraph 5c, which is on page 2 of the affadavit:

Let us understand this logic. The main difference between the execrably funded KERS Non-Hazardous and CERS, is that CERS receives its full contributions.

KERS Non-Hazardous is 19% funded.

CERS was 59.75% funded.

I will agree that the main reason for the fundedness difference of these two funds is the contribution pattern.

But the CERS plan, at 60% fundedness, is still in a horrible position. While these full contributions were being made, let’s look at what happened to the funded ratio of CERS using the Public Plans Database:

What the hell. It’s done nothing but go down.

Let’s look at the pattern of “full contributions”:

Look at that – a similar pattern as we’ve seen with New York pensions.

- supposedly, 100% contributions being made every year for at least a decade

- funding rates falling, falling, falling — worse than the NY pensions

- increasing percentages of payroll to meet full funding

- Ten-year return averages of 6%, and 5-year averages of about 9% — worse than the NY pensions

If the argument is that if only KERS Non-Hazardous had the same contribution requirements as CERS, the funds would be just fine, the actual history of CERS undermines that. Yes, it’s got a better funded ratio. No doubt. But CHICAGO has better funded ratios for its woefully underfunded plans.

This is not an argument that pension governance was just fine before Bevin, it’s just those darn contributions.

As mentioned earlier, I believe the court case is ongoing, and my guess is that the funded ratios of pensions will not matter one whit in whatever ruling. It’s going to be about the governor’s power, not actual results.

But dang, Kentucky is giving Illinois and New Jersey a run for their money for competition of the worst-funded pensions in the country (okay, according to Bury’s list, Connecticut and Pennsylvania are also in the running.)

Related Posts

Taxing Tuesday: Income Tax for Chicago?

Calpers Myths vs. Facts: Page is Gone But The Internet is Forever

Divestment and Activist Investing Follies: What's Next? My Lunch?