March of the Deadbeats: Illinois, New Jersey, Kentucky, Puerto Rico and Central States

by meep

You know, I do leave some threads hanging. To be sure, most of these are ongoing stories, but I’m not a daily reporter.

First, let me thank my referrers:

- Wirepoints – check out Mark Glennon’s post on amending the Illinois constitution

- Pension Tsunami

- The Other McCain – check out wombat-socho’s post From Balticon to the EDC (if you’re into that sort of thing… not exactly a lot of public pension overlap)

And my mysterious facebook linker, you know who you are. Because I don’t.

RAPIDSHOT UPDATES

I’m in Denver for actuarial stuff right now, and gotta check out of the hotel in an hour or so.

So let’s crank this out, one by one!

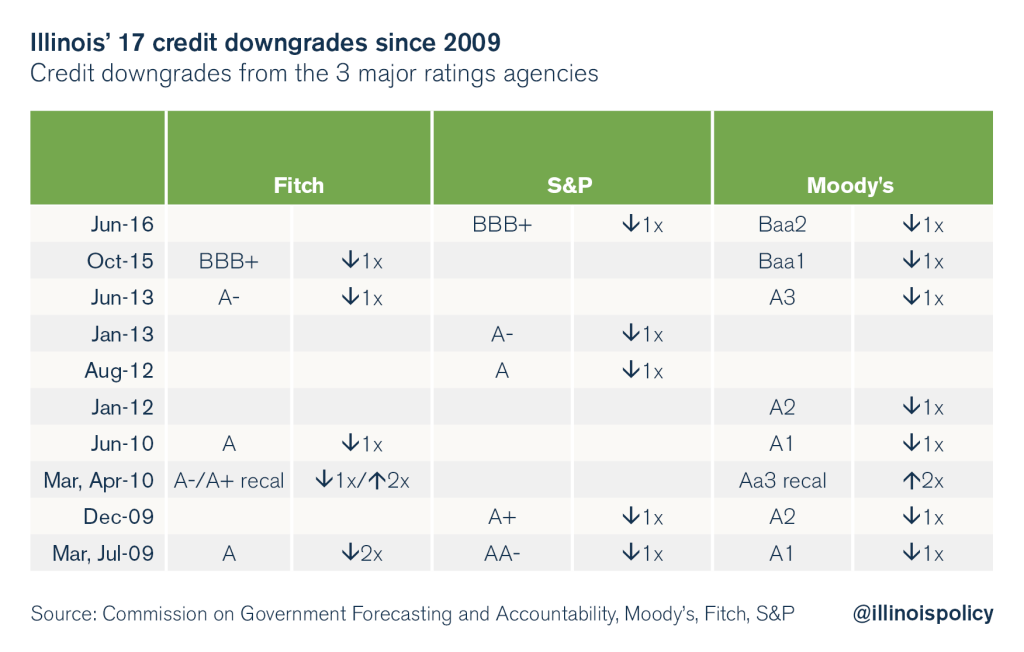

ILLINOIS: MORE DOWNGRADES

Most recently on STUMP we saw Illinois and Chicago casting around for more revenue. They’ve got some huge holes to plug, because the Illinois Supreme Court told Chicago they weren’t going to have any more luck in reducing pensions than Illinois did.

So what now?

More downgrades.

Just from this past week:

Bond Buyer: Illinois Ratings Punished for Impasse

Barrons: Illinois Credit Rating Gets Even Lower

A useful table from the last one:

Unsurprisingly, we hear stuff like this: BlackRock Calls For a Muni Market Strike in Budgetless Illinois

“We as municipal market participants should really be penalizing in some way, by almost not giving them any access to the market,” Peter Hayes, who oversees $119 billion as head of munis at BlackRock, said in New York on Wednesday. “Think about it — they’re a state without a budget, they refuse to pass a budget, they have the lowest funded ratio on their pension of any state, and yet they’re going to come to market and borrow money.”

So what does Illinois do?

That’s right.

Issue more bonds:

UPDATE 1-Illinois sets $550 mln bond sale for June 16 amid budget impasse.

Of course.

NEW JERSEY: NO COLAS FOR YOU!

The last time I talked about New Jersey, it was in a post about Puerto Rico. And on the day we were waiting for a Supreme Court decision relating to PR debt, there was a decision handed down in New Jersey.

A few of the stories:

- New Jersey top court sides with state in high-stakes pension case

- New Jersey’s Suspension of Cost-of-Living Pension Boosts Is Upheld

- N.J. Supreme Court hands Christie big win on pensions

- New Jersey retirees won’t get pension increases

- What Christie, N.J. unions are saying about big pension court ruling

From that last one:

Eddie Donnelly, president of the the New Jersey Firefighters’ Mutual Benevolent Association

“Today’s decision by the New Jersey Supreme Court is appalling, however, at a time when first responders are among a class of workers that are under attack, it is not a surprise. It hits our most vulnerable members especially hard, and it gives younger firefighters/EMTs and dispatchers pause, questioning whether or not risking their health and safety for their entire career will leave them subject to a post-work life of financial insecurity.”

Gov. Chris Christie

“Under today’s Supreme Court decision state taxpayers have won another huge victory, one that spares them from the burden of unaffordable benefit increases for public employee unions. … It also affirms my administration’s position that our Constitution and public pension system must work for all New Jerseyans, not just the special class of public union employees who represent just 8.9% of New Jersey’s population.”

Wendell Steinhauer, president of the New Jersey Education Association

“I am outraged that the Court has condoned the actions of Gov. Christie and the New Jersey Legislature in taking away the COLAs that our members have earned over the course of their careers. This is theft, plain and simple.”

Charles Ouslander, retired prosecutor and plaintiff

“Based on this decision, all public employees should be gravely concerned that their remaining pension benefits have any legal protections left. In addition, given the court’s past decision … that upheld underfunding of the pension system, despite another contractual obligation, pensioners are now only left with the obligation to pay increased contributions with nothing in return.”

John Bury has something similar to say.

I will post about this later. For now, I will simply point out that the Illinois Supreme Court cut down such COLA cuts for Illinois state pensions and Chicago pensions.

KENTUCKY: THE AMATEUR GOES AWAY, HEY WHAT ABOUT HEDGE FUNDS

My last main Kentucky post was from mid-May, and involved the fired chair of the board of trustees of Kentucky pensions.

The proposed replacement removed himself from consideration:

Bevin’s initial choice to succeed Elliott, Dr. William F. Smith of Madisonville, spared the governor more embarrassment by declining the appointment. Smith lacked the 10 years of experience in the finance sector that’s statutorily required for that board seat, as the AG also advised.

I wrote about Bill Smith before. He was an ill-considered appointee.

They got a little Financial Times coverage recently:

Kentucky, home to the worst-funded pension plan in the US

…..

Kentucky, famous for its horseracing derby and its fried chicken, has one of the largest pension funding holes in the US: a deficit of $36bn in 2015. That is more than three and a half times the tax revenue collected by the state in 2015, according to a report by Kentucky Chamber, an organisation that promotes local business interests.

Kentucky’s experience underlines the huge impact pension deficits have, not just on public workers, retirees and budgets, but also on taxpayers and economic growth.

With the state’s pension hole ballooning, bond rating agencies have lowered Kentucky’s credit rating. It has the third-lowest rating of all US states, just behind Illinois and New Jersey, both of which are also struggling with large pension problems, according to Standard & Poor’s, the rating agency.

……

One of the plans it runs, the KERS non-hazardous pension fund, has just 17.7 per cent of the assets it needs to pay 120,000 current and future retirees. This makes it the worst-funded public pension plan in the US.

…..

However, Mr Thielen says cash is what the pension fund needs. “[The pension deficit] can only be fixed by the infusion of money. Our politicians and a lot of people outside the system don’t seem to understand that.”Earlier this year, Kentucky’s general assembly, its legislative branch of government, passed a budget that allocates $1.2bn to the state’s ailing pension system. The move was backed by both Republicans and Democrats.

But John Sugden, a senior director at S&P, says that while this is a “positive step”, it is not enough. “There will continue to be pressure unless there is a concerted effort to increase funding or reform the benefits or both,” he adds.

Oh, and while they did put a nice cash infusion, look where some of it is going:

Kentucky Pension Recommits to Hedge Funds Amid Governance Turmoil

Following a string of high-profile hedge fund exits, the Kentucky Retirement Systems (KRS) investment committee recommended $300 million in allocations to its board of trustees Thursday.

……

As of March 2016, the $15 billion pension and insurance fund had $1.6 billion in “absolute return” strategies. The new investments will not affect KRS’s target hedge fund allocation of 10%, said CIO David Peden, but will replace investments in Pacific Alternative Asset Management Company and Blackstone Alternative Asset Management.This recommitment to hedge funds comes weeks after the $55 billion New York City Employees’ Retirement Systems voted to do away with hedge funds altogether. The California Public Employees’ Retirement System famously made a similar move in 2014.

Insurance giants AIG and MetLife also recently announced decisions to slash their hedge fund portfolios.

However, research by data firm Preqin shows that public pension funds on average are increasing their allocations to hedge funds, growing their investments from 7.2% of their total portfolios in 2010 to 9.2% in 2016. KRS comes in slightly above average, with an allocation of 10.6% in March.

Anyway, good luck with that, Kentucky. Not sure who is in charge of the pension board.

PUERTO RICO: STILL WAITING

The House passed the bill, we’re waiting for the Senate to pass, and the Supreme Court has yet to release its ruling re restructuring debt.

The Supreme Court did take away Puerto Rican sovereignty in criminal cases. So that may be an indication.

That’s enough of that for now.

CENTRAL STATES: THE AXE STILL HANGS

My last Central States post was I guess the plan is to run out of money.

Some are trying for alternate plans:

The Left’s Not-So-Secret Agenda for Bailing Out Union Pensions:

The administration and congressional Democrats are teaming up to force a taxpayer bailout of private unions’ underfunded and over-promised pension benefits.

On May 6, the Treasury Department rejected a plan by the Central State Teamsters trucking union to reduce some of its pension benefits to prevent the plan from going belly up within a decade. And on May 25, Senate Democrats sent a letter to Senate Majority Leader Mitch McConnell calling for Congress to “protect” the United Mine Workers of America’s health and pension benefits by passing the Miners Protection Act (S.1714), and to “address” troubled union plans like Central State’s.

“Protect” and “address” are code for bailout.

These proposals would bail out select, and politically influential, private-sector union pension plans. Half a billion a year for the United Mine Workers of America or even a couple billion a year for Central State may not seem all that significant, but it would open the bailout floodgates to more than $600 billion in unfunded pension promises across private union plans. And although single employers have far less political clout than the unions, they hold another $800 billion in unfunded pension promises that could fall to taxpayers.

…..

Yet, the Miners Protection Act would give the Mine Workers of America—a select, coal miner’s union pension plan—direct access to nearly half a billion dollars per year in taxpayer funds.Lawmakers and taxpayers should not be fooled by the fact that those taxpayer dollars would first funnel through the abandoned mine land reclamation fund in hopes of erasing the appearance of a taxpayer bailout.

Despite the fact that the United Mine Workers of America contributes less than 10 percent of incoming revenues to the abandoned mine land fund, it would be given exclusive access to it to cover its unfunded retirees’ pension and health benefits while other coal mining companies would be left in the dark.

With even larger unfunded liabilities, the Central State Teamsters is the other pension plan in play for a taxpayer bailout. The Treasury rejected the plan’s application to reduce benefits so that it could prolong its solvency.

Plenty of Central States people realize that cuts can come more than one way:

A group of retired Teamsters demonstrated in front of the Leo W. O’Brien federal building in Albany Monday to protest pending threats to their pensions and to highlight the need for Congress to take action.

The march, largely by retired truck drivers, comes as dozens of union pensions nationwide are in danger of serious shortfalls or insolvency due to declining membership over time.And, retirees noted, it comes after Congress has, over the years, passed laws that have allowed further depletion of pension plan coffers.

Now, the looming shortfalls could force millions of retirees nationwide to swallow steep cuts to their pensions unless something is done.

…..

Teamsters and others, however, maintain there are other options, such as tapping some of the multi-billion settlements coming in from major investment banks resulting from misdeeds that helped foment the 2008 financial collapse.“The taxpayers bailed out Wall Street. Then those guys got millions of dollars of bonuses,” remarked Ted Oleski, president of the NYC Conference retirees group.

Tom Baum, the retirees’ representative for the NYS Conference, said he hopes that political pressure leads to action. “Obama doesn’t want this to happen on his watch,” he said.

Like many of Monday’s marchers, Baum is a retired UPS driver.

He realizes there are fewer union members than before. But he noted Congress since the 1980s, through a series of complex and obscure laws, has helped chip away at the health of private sector pensions (public sector pensions in New York and others states are constitutionally guaranteed, so if they run short of money, the government simply raises taxes or gets money through other savings to make up the shortfall).

Congress for example, greatly increased taxes on pension “overfunding.” That, however, meant there were far less reserves in many pension funds when the 2008 financial crash came along.

And they placed limits on the liability that employers have for pension agreements when a company is sold.

Pensions received by the retirees vary, depending on when they worked and for how long. At the top end, those who spent decades working at UPS, which offers top pay, can enjoy pensions of $60,000 or more.

But those who worked at smaller firms, or who retired decades ago when wages and benefits were far lower, get a fraction of that amount.Nationally, hundreds of thousands of retirees who are in multi-employer plans are in danger of seeing their pensions cut over the next couple of years, if some action isn’t taken, said Baum.

In upstate New York alone, there are 16,000 in the NYS Conference plan, including about 2,000 in the Capital Region.

I still think there will be no bailouts, but people may as well try. That’s about their only option.

And now it’s time for me to check out from my hotel.

Related Posts

Mornings with Meep: I'm Happy I Didn't Wait

South Carolina Pensions: Investment Returns Recalc

When Multiemployer Pensions Fail: Teamsters Local 707