Much Ado About Discount Rates: Illinois and the Actuaries

by meep

Controversial pension paper will be published after all

A controversial research paper that is critical of the way pension plans estimate the future value of their assets will now be published, after the Society of Actuaries agreed to publish it as part of its Pension Forum series.

Pension plans currently set a level of expected long-term returns on investments and use that to help calculate how much needs to be contributed each year to meet future payments. The paper argues that is the wrong approach. Instead, liabilities should be discounted using default-free rates, such as those offered by Treasurys. The bottom line is that the unfunded liabilities of public pension plans are about $6 trillion, rather than $1.5 trillion, according to two of the paper’s authors.

The SOA and another professional group, the American Academy of Actuaries, earlier this month had said they wouldn’t publish the paper, which was being written by a joint task force. That decision, which also said the authors couldn’t publish it under their own names, had unleashed a storm of criticism.

There are two items there — the actuarial squabble which I detailed in a few posts:

- Public Pensions Actuarial Valuations: Point-Counterpoint-DENIED!

- Followup on Actuarial Squabble

- Rock Em Sock Em Actuaries: How Much are Public Pensions Worth?

This news out of the SOA is more-or-less the shoe drop I was expecting. But I will get back to that at the end.

What I want to talk about first is something at the very end of the Marketwatch piece:

The debate over how to value pension plans comes as investment returns have plunged. On Friday, the Illinois Teachers’ Retirement System cut its expected long-term rate of return to 7%, from 7.5% for the 2018 fiscal year that begins next July 1. Had that move been effective this year, it would have cost the state more than $400 million more in pension contributions. The move was opposed by the state’s governor.

Oh yes, I’ve been sitting on this over the weekend. It involves the worst-funded very large pension out there: the Illinois Teachers Retirement System.

WHIRLWIND TOUR THROUGH THE NUMBERS

Oh wait, I’ve already written about this plan. A lot.

Here is the most relevant post:

Illinois Pensions: Teachers Retirement System (TRS) number-crunching

A few items I want to highlight about this plan:

- TRS has never received a “full” contribution. I don’t count the issuing of Pension Obligation Bonds.

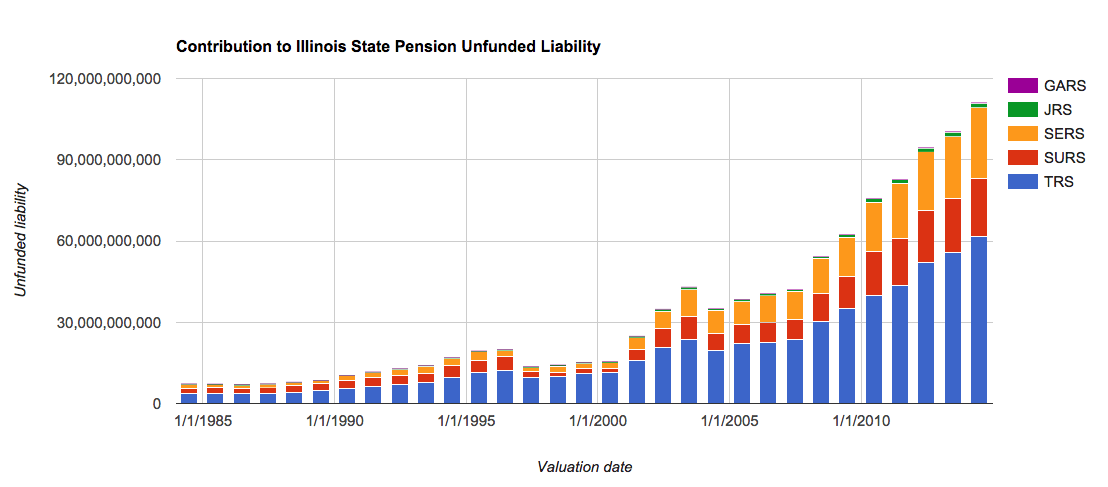

- This is the resulting graph of its unfunded liability, by cause:

Check out that huge green portion of the graph — you can see that most of the reason for the underfundedness is undercontributions.

- TRS is the single largest contributor to Illinois pension debt, of all the Illinois plans (the blue bar).

This is hardly surprising, given that teachers tend to be the largest number of government employees. Teachers pensions tend to be huge contributors to any state’s pension liability (fully-funded or no) as a result.

It also doesn’t help that most teachers are women, and women tend to live a few years longer than men.

The upshot: even before the discount rate change, this pension plan wasn’t doing well. Now it will look even worse.

ILLINOIS GOVERNANCE BROU-HA-HA

Last Friday, there was a meeting of the Board for the TRS. A bunch of kabuki occurred.

Before the meeting, Governor Rauner “warned” the Board that dropping the discount rate on the plan would be catastrophic:

Illinois governor’s office warns of crippling pension payment hike

…..

“If the (TRS) board were to approve a lower assumed rate of return taxpayers will be automatically and immediately on the hook for potentially hundreds of millions of dollars in higher taxes or reduced services,” Michael Mahoney, Rauner’s senior advisor for revenue and pensions, wrote to the governor’s chief of staff, Richard Goldberg.When TRS lowered the investment return rate to 7.5 percent from 8 percent in 2014 the state’s pension payment increased by more than $200 million, according to the memo.

There was some kind of tussle over Open Meeting Act/Transparency rules and all that. It’s a bit of a bore, so I’ll pass over that. In addition, Rauner tried appointing some people to the Board, and screwed up residency disqualifications for one of them. Also boring.

But the discount rate drop wasn’t quite so boring.

Rather than do huge long excerpts, here’s a bunch of stories, and I’ll pull out a few major details:

- Illinois’s Biggest Pension Cuts Investment Return Rate to 7%

- Illinois’ pension payment expected to increase by $400M

- Illinois pension fund lowers investment rate, hikes state payment

- Pension Vote Will Cost State Hundreds Of Millions Of Dollars

- Illinois Governor Furious After Pension Fund Cuts Returns Forecast, Sticking Taxpayers With “Crippling” Tax Hike

- Rauner loses $400 million vote on teacher pension fund issue

- TRS Board Vote Comes As States Nationwide Face Lackluster Pension Investment Returns

Okay, that’s enough of the stories. Let’s pull out details.

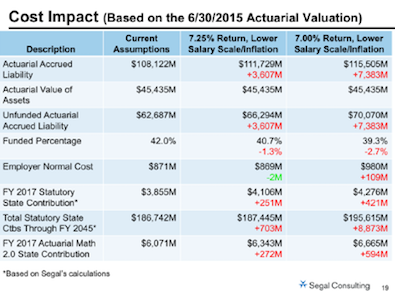

Detail one: estimated cost impact of the change:

Detail two: why would this result in a large increase in contributions?

The chronic under-funding of the pension system pre-dates Rauner. TRS was created in 1939, and in no year since then has the system received enough money from the state to keep it fully funded. A law that was passed in the 1990s ties the state’s contribution to a formula that is designed to get the system to a 90 percent funding level by 2045.

We will come back to detail two in a minute.

Detail three: Didn’t Rauner say they’ve got to stop putting off pension contributions?

Rauner learns a mean pension lesson

Live by the pension sword, die by the pension sword.

That’s the message from the action late last week by the state’s biggest pension fund to increase its annual demand on the state treasury by $400 million or so, an action that Gov. Bruce Rauner vigorously fought and which will make it more difficult to oppose a big tax hike in a few months.

Rauner likely was outfoxed in this inside fight by his old pal Mike Madigan, the speaker of the House. But he also set himself up to fail.

….

But Rauner stunned City Hall when he vetoed the measure, saying that delaying part of the hike now would just raise overall costs later. “This practice has to stop,” he wrote in a veto message. “If we continue, we’ve learned nothing from our past mistakes.”Emanuel asked for an override, and he got one, with numerous Republicans crossing the aisle.

Now, fast-forward to last week, when word leaked that the board of the Illinois Teachers Retirement System was preparing to lower its assumed rate of return on investment from 7.5 percent to 7 percent.

If return on investment goes down, you have to put more in. Especially in the case of TRS, which only has about 40 percent of the amount needed to pay promised pensions. In fiscal 2017 alone, the cost to taxpayers in the form of increased contributions would be $421 million.

I really don’t have a huge amount of sympathy for Rauner in this situation. He knew this going in.

HANDWRINGING OVER HAVING TO PAY THE PENSIONS

Let’s get down in practical politics.

The law that would automatically increase the contribution to TRS was passed 20ish years ago. Laws can be changed.

Heck, even when you write a law saying a certain amount of money has to be paid, and the money isn’t there, guess what happens?

Yes. It doesn’t get paid. That’s pretty simple.

Look at what happened with Chris Christie and NJ pensions. A law was passed in 2011… and he simply did not follow it. In June 2015, Christie won a lawsuit about not making the promised contributions.

So that’s where laws about “required contributions” get you. If they can’t force the state to pay when it’s New Jersey, they definitely can’t make it pay when it’s Illinois.

That said, if I were Madigan et. al. I’d be having fun pointing out that Rauner said pension contributions shouldn’t be put off.

Of course, Madigan et. al. also have dirty hands — they still passed a law to put off pension contributions for Chicago.

You better believe they’ll also do it for the state.

None of this has anything to do with the discount rate chosen.

HISTORY

This is what happened with Illinois TRS contributions:

Look at those red bits. That’s how much the contributions fell short. The “required” contributions bumped up for 2014 and 2015 due to the change in discount rate from 8% to 7.5%.

Note that the blue bar for those years about match the required level for the 8% discount rate.

So cry me a river. They will still underpay contributions, even if they let the impact of a decades-old law go through without adjustment.

BACK TO THE ACTUARIES

The actuarial story would be boring, if various parties hadn’t tried blocking authors putting out the paper they wrote under their own names. They would have done so outside the imprimatur of the Academy or SOA, and people could have gone back to ignoring the actuaries, like they always do.

If there had been no suppression, there wouldn’t have been an op-ed piece in the Wall Street Journal by Steve Malanga. Here is the version at the Manhattan Institute, so you don’t need a WSJ subscription.

The letter from SOA President Craig Reynolds refers to Malanga’s op-ed:

SOA President’s Letter on Public Pension Plan Financing

Message From Craig Reynolds

There have been a number of media articles and opinion pieces recently, including one that was published on Aug. 25 in the Wall Street Journal, concerning a paper on public pension plan financing that was a work-in-progress of a former joint task force of the SOA and the American Academy of Actuaries. Unfortunately, most of these pieces have misrepresented the viewpoints and activities of the SOA. The SOA has responded appropriately to this media attention, including a letter to the editor of the Wall Street Journal that I sent today.Working under the auspices of both our organization and the American Academy of Actuaries, we were unable to reach an agreement with the authors on a version acceptable to all parties through our standard editing process. Nevertheless, on Thursday, Aug. 25, before the publication of the Wall Street Journal opinion piece, we informed the authors of the paper of our plans to publish the paper representing their views in the SOA’s Pension Forum publication. The publication is anticipated by the end of October and will be accompanied by discussant debate from a range of perspectives. In the interim, the SOA has agreed to the authors’ request to allow them more time to edit the paper. We expect to post an updated draft on the SOA website the week of Sept. 5.

So that’s something to look forward to.

There was an update on August 22 from the Academy president:

Update (Aug. 22, 2016)

The Academy remains committed to publishing objective, unbiased public policy analyses on topics of public importance. This includes appropriately reflecting the potential contributions of financial economics to the design, management and financing of public pension plans. While certain members of the PFTF decided to reject the peer review input necessary to ensure balance and objectivity, we have continued our careful consideration of the concepts in the last draft of the PFTF’s paper. The PFTF draft could not meet the Academy’s publication standards. Nonetheless, we support a robust discussion of these concepts and ideas so that both actuaries and the public may have access to them. We will shortly be publishing a paper on public pension plans that will include concepts from financial economics.

I don’t mind a variety of ideas getting out there, and actually, these ideas aren’t really late for the vast majority of public pensions out there. Illinois has some of the worst-funded pensions out there, and really, the discount rate used is the smallest part of their problem.

BAD PENSIONS DIDN’T GET THAT WAY BY ACCIDENT OR FAILURE OF THEORY

I will look at better-behaved pensions later, but people do need to realize that the profligates: New Jersey, Rhode Island, Illinois, Puerto Rico — these are not representative public pensions.

The reason they get the headlines is obvious: they have been horribly managed, governed, maintained, what-have-you.

But ultimately, we need to think: it’s “fun” having these theoretical arguments, but the upshot has been that the political actors have been the ones setting the terms for valuing the pensions, and the political actors have been the key decision-makers in underfunding the pensions.

I will be looking later at pensions that are making required payments, and yet falling behind — that would definitely point out issues in current actuarial practice — but with regards to places like Chicago and Illinois, it’s not thoeretical disagreements driving the problem.

They were massively underfunding the pensions when they thought 8% was an appropriate discount rate.

They underfunded it at 7.5%. They’ll underfund it at 7%.

They’d underfund it at 4%, even. Or 10%.

Because that’s what the politicians have done. And in Illinois, it seems, they never have to take the blame. Not until they’re long gone, at any rate:

Editorial: How Illinois politicians consciously created these debt and pension crises

…..

Walstrum reports that while the typical U.S. state was spending an average of 5.7 percent more, year after year, than it had in revenue — a foolish habit, we think — Illinois governments together were spending 15.9 percent more than they had available. Imagine the compounded effect of overspending your income by 15.9 percent, year after year. Three-fourths of that overspending went to, yes, fat pension promises and other retirement costs. Another big expense: rising interest payments on all this rising debt.Walstrum doesn’t go here, but in countless cases that lavish spending, especially in sweetheart pension deals for public employees’ unions, bought incumbents the votes, campaign contributions and Election Day muscle that got them re-elected time and again. Not only did the public officials spend other people’s money, they spent money that didn’t exist. To cover their tracks, they borrowed vast sums and knowingly underfunded the very pensions they had sweetened.

…..

But the blame doesn’t belong with TRS. It belongs with every Illinois politician, House Speaker Michael Madigan and Senate President John Cullerton included, who for many years promised but then didn’t properly fund these pension plans — plans that would be affordable to taxpayers only when times were good.

But they weren’t affordable even then, were they?

They never targeted 100% funding. Even when times were good.

Illinois, Puerto Rico, Detroit, Rhode Island… they all spent more money than they had.

They thought they weren’t really spending money on pensions, because those benefits would be paid later… much later… and of course, the money would be there when the cash flow was needed.

That was the theory. Based on absolutely nothing.

None of these developments should surprise anybody.

Related Posts

Around the Pension Blogosphere

Public Pension Concept: Plan Long-Term for Long-Term Promises, and Don't Give Contribution Holidays

PSERS Update: What if it's just sloppy processes?