Public Finance: Raining on Chicago's Parade

by meep

So… I hear from Chicago….

I SAID I HEARD FROM CHICAGO THAT THEY’RE HAVING A BIG PARADE TODAY.

I come here to bury Chicago, not to join in the party.

(Ain’t that just like a New Yorker)

If you don’t want to read a bummer for Chicago, go to this post on various Chicagoan celebrations. That will make you feel better.

HOW MUCH DOES THE TEACHER DEAL COST?

The last time I covered Chicago, I called into question whether Chicago could afford the new teacher deal.

The question remains if Chicago can really pay for it. Maybe they can get away with one year’s worth of accounting tricks.

But blaming Rauner for Chicago’s profligacy is not going to make money appear magically.

After that first giddiness of the CTU strike being averted and once they get over the Cubs hangover, a lot more Chicagoans will be asking the same thing:

CPS, Teacher Contract to Cost District More Than $9.4 Billion

Chicago Public Schools’ newly ratified labor contract with the Chicago Teachers Union is expected to cost the district more than $9.4 billion over the life of the four-year deal.

The district released the first look at the agreement’s financial layout Wednesday morning, hours after more than 70 percent of CTU members voted in favor of the contract.

….

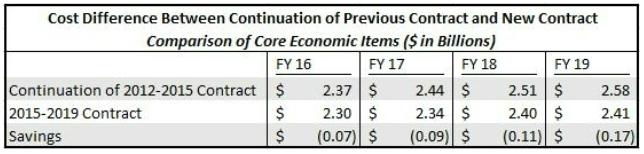

Though he was light on specifics, Claypool repeatedly called the deal the “most cost-effective contract in the history of mayoral control” and said it will save the district more than $400 million over the previous deal. Those savings come from deducting the cost of the new contract from the cost of the previous deal if it were hypothetically extended until 2019.But that extension was never a realistic option, as CPS actually refused to prolong the previous deal by one additional year back in 2015.

Reminds me of the “savings” that Richard Carstone of Bleak House keeps referencing when he spends less money than he originally planned on spending… though in both cases, he couldn’t afford the expense at all.

DICKENSIAN INTERLUDE

Here we have Richard explaining how much he had saved:

The number of little acts of thoughtless expenditure which Richard justified by the recovery of his ten pounds, and the number of times he talked to me as if he had saved or realized that amount, would form a sum in simple addition.

“My prudent Mother Hubbard, why not?” he said to me when he wanted, without the least consideration, to bestow five pounds on the brickmaker. “I made ten pounds, clear, out of Coavinses’ business.”

“How was that?” said I.

“Why, I got rid of ten pounds which I was quite content to get rid of and never expected to see any more. You don’t deny that?”

“No,” said I.

“Very well! Then I came into possession of ten pounds—”

“The same ten pounds,” I hinted.

“That has nothing to do with it!” returned Richard. “I have got ten pounds more than I expected to have, and consequently I can afford to spend it without being particular.”

In exactly the same way, when he was persuaded out of the sacrifice of these five pounds by being convinced that it would do no good, he carried that sum to his credit and drew upon it.

“Let me see!” he would say. “I saved five pounds out of the brickmaker’s affair, so if I have a good rattle to London and back in a post-chaise and put that down at four pounds, I shall have saved one. And it’s a very good thing to save one, let me tell you: a penny saved is a penny got!”

So Claypool is comparing a budget he was never going to be paying to begin with with one that he did agree on paying. Savings!

I will use the numbers given in the table to make a little graph:

Look at all those savings!

But let’s note that we don’t see the FY 2015 to compare against. From the article I linked:

On its face, the new contract will boost district spending by $55 million in the coming year. That amount is comprised largely of step-and-lane pay increases for teachers, but will be offset by additional Tax Incremental Financing (TIF) dollars allocated from the city.

So, assuming that FY 2015 is $55 million lower than the new contract level for FY 2016:

Oooh, those savings aren’t looking all that fabulous now.

That said, the vertical scale is really distorting things, so let’s start that scale at zero, and turn everything into the actual dollars so we can see just how many zeroes are involved:

That doesn’t really look like much of a win at all. Chicago really needs to pare down its budget, not have it grow. There are fewer children in the system, Chicago can barely deal with its debt as it is… a growing budget shouldn’t be the baseline.

And that’s just the schools budget, which is carved out separately from the rest of the city’s budget.

OTHER COMMENTARY ON CHICAGO’S FINANCES

Let me give a little bit of positive light on Chicago’s finances: Praise for Chicago Budget, With Caveats:

Praise for Chicago Budget, With Caveats

CHICAGO – Chicago’s proposed $8.2 billion 2017 budget won the Civic Federation of Chicago’s endorsement in recognition of the city’s progress in tackling pension funding shortfalls and shedding poor financial practices.

But the civic research group’s support came with a list of concerns, and warnings that the city has yet to emerge from the fiscal weeds that dragged its ratings down as low as junk.

“This budget is relatively good news for the taxpayers of Chicago, because it continues the progress made by the mayor and his team in recent years, without any additional increases in general taxes,” federation president Laurence Msall said of Mayor Rahm Emanuel’s proposed budget, which the City Council will vote on later this month.

……

Financial TacticsThe federation praised the city’s plans to wean itself off scoop- and-toss debt restructuring by 2019 and to reduce the use of borrowing to cover judgments, settlement and equipment costs by devoting more funds for those expenses in the operating budget. But the federation suggested the city should make a more formal commitment.

Emanuel publicly announced the financial practice changes in the spring of 2015. Other pieces of the plan included converting the city’s general obligation floating-rate to fixed and terminating swaps to reduce bank risks. Those conversions and terminations – accomplished over the last year — became more urgent after rating downgrades triggered termination events on credit support and swaps.

The 2017 budget reduces by $63 million the $125 million of debt pushed off in 2016 and $225 million pushed off in 2015. Mayor Richard Daley’s administration began the practice a decade ago to keep debt service costs level and Emanuel continued the practice.

The city will incorporate all of the debt restructuring for budget relief planned through 2018 in an upcoming $1.3 billion general obligation sale.

“In order to ensure that the mayor’s proposal to end ‘scoop-and-toss’ comes to fruition and any deviation from the plan is given proper public vetting, the city council should consider codifying the mayor’s five-point plan to improve the city’s debt profile as part of an updated debt management policy,” the Civic Federation report says.

It doesn’t make me feel great that they’re using the TIF to try to cover the extra costs for one year of the school budget (which is not the budget being commented on by Msall).

And let’s get back to the school budget, with this commentary from Greg Hinz:

CPS brags, but new teachers’ deal still whacks taxpayers

Like Lucy telling Ricky that she’d saved him money by buying that new outfit—on sale—Mayor Rahm Emanuel’s school team today tried to tell Chicago taxpayers that they got a really good deal with the new contract with the Chicago Teachers Union.

To some extent, they did. The contract is not as rich as some of its predecessors. But neither is a Chicago Public Schools system that for all practical purposes is bankrupt, kept on its feet only by borrowing money at usurious rates.

The fact is that by 2019, CPS, by its own figures, will be spending another $110 million a year on teacher compensation and benefits. This in a system that can’t afford what it has now.

CPS’s sales job came in a briefing today during which it borrowed a page from Emanuel’s book of exaggeration and bragged that the new deal “will save CPS $400 million compared to the previous contract.”

In fact, said CEO Forrest Claypool, “Our agreement with the CTU is the most cost-effective contract in the history of CPS mayoral control.” Wow.

But here’s the truth.

Yes, the new contract, compared to the one entered into in 2012, is not as rich. There will be no cost-of-living pay hikes for two years (one of them already past), but they’ll get 2 percent in fiscal 2018 and 2.5 percent in fiscal 2019.

Beyond that, pay hikes for longevity and obtaining an advanced degree, known as a “step and lane” hike, will be reinstated immediately after a one-year hiatus.

CPS argues that’s better than the old contract. Had its terms merely been extended—including COLAs and step-and-lane hikes every year, CPS would be paying an additional $400 million more over four years.

Good grief! Who said that the old contract and its raises should just be rolled over at a time when the system is financially collapsing?

Another big puff of smoke today came when CPS bragged that it is “eliminating” the 7 percent share of salary that employees are supposed to pay for their pensions, but CPS has been picking up in their stead.

Technically, the pick-up is gone for the newbies. But the same contract gives all newbies raises of 3.5 percent on Jan. 1, and another 3.5 percent on July. So, the net savings are zero. Nada. Zippo. But CPS keeps saying it scored a big win.

[squinting at my graphs]

Yeah, I’m not seeing any huge win, either.

The Cubs now, that was a huge win.

Bill Bergman at Truth in Accounting has his own take on the Chicago budget:

Today, I did something with costs and benefits. I sat through an entire Chicago City Council budget hearing.

The City Council meeting started at 10am, with the budget hearing the last item on the agenda. Following the parliamentary proceedings, the City Council invited the public to offer comments.

The first person invited to the microphone, “by tradition,” was Laurence Msall, President of the Civic Federation. Msall offered his organization’s analysis of the budget, with a bottom-line statement expressing support for the budget.[mentioned in clip above]

…..

After Msall’s presentation, about 20-30 people from a variety of walks of life had a chance to speak to the City Council. I was the last one invited to the microphone. I raised some questions relating to the claim of improvement, as well as the integrity of city financial management.Over the five years ended in fiscal 2014, the City of Chicago spent about a billion dollars a year more than it took in, through tax revenues, fees, and intergovernmental grants. The city’s interest expense has mushroomed since 2009, rising to over $850 million a year.

Yet the City of Chicago and its mayor lay claim to a “balanced budget” every year – and the city also says that state law requires the city to balance its budget.

Budgets are not results. Budgets are prospective planning documents. Results arrive, albeit imperfectly, in the audited annual financial statements. Looking at those statements, it is very difficult to conclude that Chicago is in better shape today than it was five years ago.

It sounds like he’ll be following up more on this later. I’m going to guess Bill is still celebrating.

MORE DEBT MORE DEBT MORE DEBT

By the way, The Chicago Board of Education has approved $1 billion in borrowing:

Chicago’s Board of Education unanimously authorized the sale of $1 billion in bonds Wednesday [October 26], with the bulk of the borrowing to pay for yet-to-be announced capital projects.

In addition to the $840 million for capital spending, Chicago Public Schools plans to borrow an additional $160 million to refinance debt taken on at interest rates as high as 9 percent, district officials said Wednesday. That’s on top of an anticipated $945 million in short-term credit needed to keep the district operating until property tax revenue rolls in next spring.

“These bonds are replacing high-interest variable bonds with lower interest fixed rate bonds. We anticipate savings this year,” finance chief Ron DeNard told the board, declining to quantify those savings.

Chicago Public Schools also still won’t say how much their deal with the Chicago Teachers Union will cost taxpayers, despite the fact that its higher costs will trigger a new round of yet-to-be-announced budget hearings and will go back before the school board.

“When we hold the Dec. 7 meeting we will approve the revised budget,” President Frank Clark said.

Speaking for the first time since the late-night deal was brokered, literally minutes before a midnight strike deadline, CEO Forrest Claypool said he’s hopeful that teachers will review the agreement and approve it when they vote on Monday and Tuesday.

Yes, this is separate from operational expenses (other than the refinancing, maybe). But.

All that debt is getting to be a bit expensive, eh?

But hey! Look! They’re dyeing the river blue for the Cubs celebration!

I don’t want to be a total party pooper, but who is paying for the Cubs celebration?

(Just kidding. I totally want to ruin the party. YOU GUYS NEED TO WATCH YOUR MONEY)

I googled a bit, and got this piece:

Everything you need to know about today’s Cubs parade and rally

And it tells me how to get there, where there’s parking restrictions, yadda yadda.

But not who’s paying for this.

Hmmm.

Oh, and to pile on: the mayor recently extended a 20-year digital billboard deal by an additional four years… a deal some say screws Chicago.

Anyway, enjoy the hangover, Chicago!

Related Posts

State Bankruptcy and Bailout Reactions: More Reactions

State Bankruptcy and Bailout Reactions: Chicago Pleads, Bailouts Rationalized, and Bailouts Rejected

Public Finance Roundup: What Happens When the Richest Move to Laputa?