Public Finances: Governments Desperate for Cold Hard Cash

by meep

So the story of people being hounded by Social Security for debts as old as me is going around, and while one could dig into the rights and wrongs of the situation, the big question is: Why now?

It could be the case that they just got around to upgrading their systems enough they could do a little data mining.

I don’t think that that’s what this is about.

Here’s something you haven’t heard much about recently: Social Security is already cash negative, and has been since 2010.

The Wikipedia article has a deceptive graph:

The notation on the graph gives it away: the projection is from 2007.

You know, from before the big crash?

So no, Social Security didn’t go negative in 2017. It went negative in 2010.

And don’t get me started on Medicare.

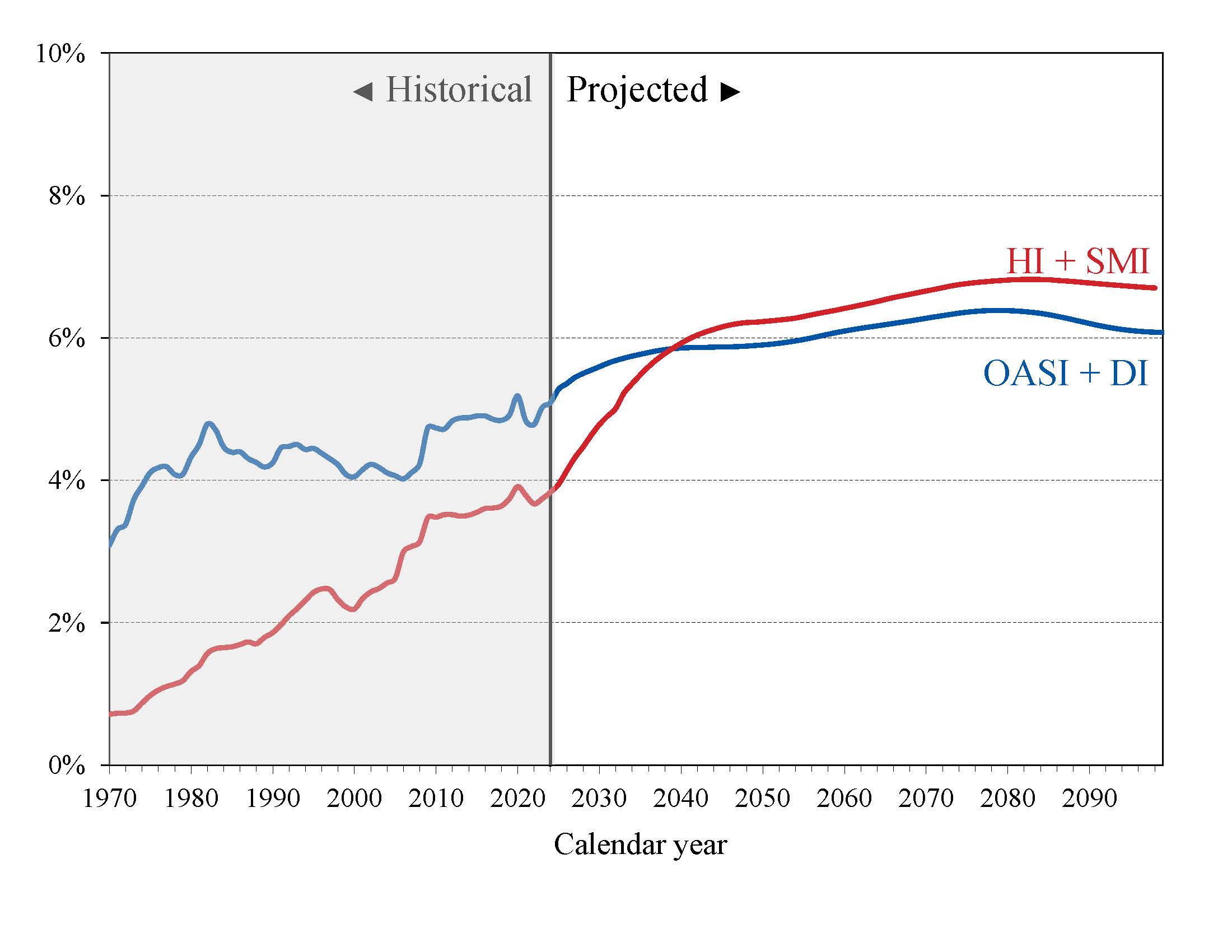

Here is the official image from the 2013 Social Security Trustees Report:

Yes I know it’s huge — but I want you to see the detail: look at where the red lines go above the blue lines. And stay above the blue lines. Think on that.

Don’t give me crap about the “Trust Fund”. That is an accounting fiction, and the very fact that they have to print the supposed “special issue” bonds on paper and stick them in filing cabinets somewhere should tell you that they’re fake. (yes [reference needed], but I can’t find it right now. I will tell you they’re not treated like real bonds, which can be traded in the market)

Now, to be sure, the few thousands of $$ Social Security is trying to claw back from now-middle-aged (and older) people for decades-old supposed overpayments are not going to do much for the cashflow negatives, but it’s becoming clear that all sorts of governmental bodies have been given marching orders: Revenues By Any Means Necessary…and when necessary, to raise taxes explicitly (as opposed to these sub rosa attempts).

I think that’s partly what’s behind the harassment of Cliven Bundy — some talk about environmentalists run wild, cronies wanting the land, BLM getting too big for its britches…. but I saw the bit about wanting to sell the cattle they rounded up and that a lot of the dispute is over money they want out of Bundy…. yeah, I’m going with the money explanation.

And, of course, there’s a pensions connection here.

The Chicago deals that Rahm has been trying to push are still in process, but there is plenty of commentary by those watching on. Somebody noticed about the desperation to raise taxes without getting much outcry

Illinois is overpromised, overspent, overborrowed. Present trajectories point to doom. So the race for luscious new revenue is quickening.

The road to perdition

Four weeks before announcing to his fellow legislators that something had to give, Madigan, along with Senate President John Cullerton, had authorized the House and Senate votes of 1/11/11. They and their fellow Democrats raised the individual income tax rate by 67 percent: They would extract more billions from the Illinois economy and hand the money to a state government that, despite that windfall, still qualifies as insolvent — unable to pay its bills as they come due.

For many years Illinois politicians pandered to voters by expanding those programs and services. They sweetened their employees’ retirements, which earned them union loyalty on Election Day. They cheated (and continue to cheat) by using lax “Illinois math,” rather than the rigorous actuarial math they should have used, to calculate the honest cost of their giveaways.

Snapshot from a disaster: A 1991 Tribune editorial explained how former Gov. James Thompson and legislators had settled on a new formula to end erosion of retirement funds. Then they ignored the plan, didn’t appropriate enough to meet their obligations, and raised benefits for state retirees: “Thompson, meanwhile, got a deal that doubled his own pension.”

……

Thus the ruling Democrats are competing to see who can impose tax increases before voters catch on to their macro-gambit:Gov. Pat Quinn wants to perpetuate the income tax bonanza for Springfield that, in 2011, he and other of his party’s lawmakers said would be temporary. Toni Preckwinkle, president of the Cook County Board, is mulling higher taxation to help reduce her government’s pension burden. Emanuel inherited such lethal finance crises from his predecessor that Chicagoans can only ask how many tax hikes he may have to negotiate with city unions. And Madigan? He tried but, uncharacteristically, failed to corral enough votes to advance a constitutional amendment for a surtax on personal income above $1 million.

Wondering who’ll come after you next?

Wondering what promises to believe?

Emanuel’s budget chief, Alexandra Holt, says City Hall won’t ask Springfield to further postpone an increase of $1 billion in annual Chicago pension costs: “This problem needs to be fixed,” she tells us. “We cannot pretend this problem is going away. Because it’s not.”

Holt is correct. Pretending that this problem of runaway overhead costs would go away is precisely how Illinois and Chicago sank to where they are today.

And these costs are coming due right now.

You want to talk about cash flow negative? Some of the Illinois pensions were going into an asset death spiral, and I noted that back in 2010.

Let me quote from myself 4 years ago:

People who say things like “The City of Chicago is too big to fail,”, no matter how smart they are elsewhere, are whistling past the graveyard. (To be fair, Prof. Rauh is well-versed on this subject and a Greece-like disaster is one of the possibilities he forsees – but he has a different political calculation than I do.)

No, Chicago can fail. There’s a reason Daley is jumping that ship, and it’s not because Chicago’s best bud trio Rahm, David, & Barack are in DC.

New York learned the hard way, 40 years ago. Some very special interests are going to find out “there ain’t no money of” as my youngest sister used to say.

If Chicago is like other places, some key groups of workers, and definitely the retirees, live someplace else. Their political pull, in terms of votes, is negligible.

Various groups might come together to try to solve the problem, but said problem was forged decades ago, and the bill is coming due now.

Cities will break contracts, and pensions will not be paid. The state can’t bail out Chicago, as Illinois is broke; and if the feds are going to bail them out, they’d better rush before November [in 2010].

Sure, it’s taken a few years until the desperation has really taken hold, but after all, most bankrupts can stave off the final reckoning for a little while if they can just meet interest payments….. until they find their debts finally coming due.

It’s difficult to raise taxes explicitly, though, as Rahm just ran into when trying to ran through a pension “reform” proposal….so state entities have been trying to get clever. Like going after people who have no recourse against them — like with the Social Security clawbacks, Cliven Bundy’s issues… and…. out-of-state entities

Revenue-hunting states have lately gone beyond raising their own taxes; now they’re trying to shake down firms and workers in other states. Stretching the limits of the U.S. Constitution’s Commerce Clause to the breaking point, local revenue agents have seized out-of-state trucks simply passing through their jurisdiction, refusing to release them until the firms that dispatched them fork over corporate income taxes. Finance departments have slapped out-of-state businesses with bills for thousands of dollars in corporate back taxes, based on little more than a single worker visiting the state sometime during the year. And tax agents have targeted employees who work remotely for in-state firms, claiming that they owe personal income taxes, even when they’ve never stepped foot in the taxing state.

…..

Along with the extraordinary administrative costs they impose, states that are brazenly expanding their tax nexus violate fundamental principles of taxation, argue critics. “Determination of jurisdiction to tax should be guided by one fundamental principle: a government has the right to impose burdens—economic and administrative—only on businesses that receive meaningful benefits or protections from that government,” maintained the Council on State Taxation, an industry group, in testimony before Congress. Taxed businesses in many of these cases, however, receive no such substantial benefits.In the same way, argues Zelinsky, when states overreach on taxing nonresidents, they undermine the federalist principles of the U.S. Constitution. “Central to the federalist enterprise is the ability of each state to tax and govern within its own borders. National legislation outlawing New York’s (and other states’) taxation of out-of-state telecommuters would enhance federalist values by protecting the states in which nonresident telecommuters live and work.”

But as Congress dithers, the problem is rapidly worsening. To preserve their right to tax out-of-state businesses, states are even withdrawing from a compact they formed in 1967, which determined tax nexus by assessing the amount of sales, property, and payroll that a firm had in a state. Firms with sales in a state but no property or employees were not subject to corporate taxes in the arrangement. As they have grasped for revenues, more than two-thirds of states have now abandoned the compact’s terms and enacted their own looser rules.

You will see that these are the kinds of tactics bankrupts play with before being forced to declare bankruptcy.

I know of a few other ploys in the insurance realm, but that’s my day job, so I don’t blog that here. ;)

Expect this sort of behavior to escalate until they are forced to deal realistically (somewhat like Detroit… but as long as it grasps to art it really can’t keep, I don’t think it’s dealing with reality yet.)

Related Posts

Priorities for Pension Funds: Climate Change or Solvency?

Around the Pension-o-Sphere: Actuaries Testifying, New Standards, Actuary Bloggers, Pew Report, and Connecticut

Kentucky County Pensions: 60 Percent Fundedness and Decreasing is Awful