Divestment and Activist Investing Follies: Shooting Yourself in the Foot?

by meep

As I’ve remarked on many times before, there’s a divestment theme for public pensions in recent years.

The latest fad that popped up again is against guns. So, let’s check out this handy-dandy study of which states are most dependent on firearms manufacturers/retailers:

Idaho is the state that’s most dependent on the gun industry, according to a new report. The economies of four other Western states — Montana, Alaska, South Dakota and Wyoming — are also more dependent on guns than other places.

The report, released last week from the personal finance website WalletHub, measured the economic impact of the gun industry on each of the 50 states. Each state was assessed in terms of firearm industry jobs and wages; “gun prevalence,” including gun ownership rates and sales; and “gun politics,” including political contributions to members of Congress and other factors.

So I took a quick look at the original study, and this is stupid. It’s all based on rank-ordering, and I bet there are some heavy clusters that would indicate some states are really little different from each other.

I’m going to go waaaaaay out on a limb re: Idaho, Montana, Alaska, South Dakota, and Wyoming. The reason they’re so high on the list?

There’s not many people in any of those states. Most to the point, they probably have lowest population density in the country, excepting possibly North Dakota. I’m writing this before I look it up, so let’s check the facts.

List of U.S. states and territories by population density

I’ll exclude the territories.

Least densely populated states, as of 2015:

1. Alaska 2. Wyoming 3. Montana 4. North Dakota 5. South Dakota 6. New Mexico 7. Idaho

Okay, ya got me — I forgot about New Mexico.

Anyway, there may be a wee bit of a link between needing to shoot a bear and being very very pro-gun. Dear Lord, what idiots. Show me your underlying stats… I wanna do a statistical analysis. This is a garbage study.

That said, I believe in one of their lists — gun prevalence. So let’s check gun prevalence against the states which are looking to divest their pensions of gun-related assets.

(Grabbing their image)

I’m happy to see that the best state, Alaska, has 12x the gun ownership of the worst state, Delaware.

Oh, that’s not what you meant by best & worst? Perhaps you should have been a bit more precise, eh?

Fine, let’s check Alaska’s gun murder rate against Delaware’s.

Alaska: 5.3 per 100,000

Delaware: 5.5 per 100,000

=squint=

Not sure if I really see a meaningful difference there.

[W.r.t. gun murder rates, just looking at states, Lousiana is the highest at 18.0 and Hawaii is the lowest at 0.3.]

Anyway, it seems to me that the ones looking at gun-related divestment are the ones who can showboat their commitment to purity.

OH WAIT, WHO’S PURE?

It annoys me to no end that there is a bunch of this divestment crap coming from the New York pension funds.

But hey, let’s check this bit about:

New York’s pension funds still invest in guns, tobacco and oil

Divesting from controversial companies or industries is not so simple.

In January 2013, just weeks after the shooting at Sandy Hook Elementary School in Newtown, Connecticut, state Comptroller Thomas DiNapoli announced that he would freeze the state pension fund’s investments in gun manufacturers.

“The New York State Common Retirement Fund will not buy stock in companies whose primary business is manufacturing firearms for commercial sale,” DiNapoli said at the time. “After the terrible events in Newtown, it is clear that the national movement toward greater regulation of firearms manufacturers will impose significant reputational, regulatory and statutory hurdles that may affect shareholder value.”

By 2014, the fund had sold off its shares of Smith & Wesson Holding Corp., the country’s largest producer of pistols, and Sturm, Ruger & Co. Inc., America’s largest overall firearm maker.

…..

But as a practical matter, divesting from controversial companies or industries is not so simple – even after high-profile incidents, such as the Florida school shooting in February that left 17 dead, increase the political pressure to do so.Since the Sandy Hook shooting in 2012, the state’s massive retirement fund actually increased its investment in at least one gun manufacturer. Between 2016 and 2017, the fund doubled its shares of Olin Corp., a Missouri-based company that owns the Winchester brand of rifles and ammunition.

Unlike Ruger and Smith & Wesson, firearm sales make up only part of Olin’s business, and because of this, Olin is not on the state pension fund’s restricted list. While Winchester accounted for just 13 percent of Olin’s 2016 revenue, the brand is a major producer of small caliber ammunition, holding several contracts with the military, the U.S. Department of Homeland Security and numerous other law enforcement agencies.

I can think of all sorts of nasty jokes my dad used to tell me, like the one about the big vat of ice cream with a teeny tiny mouse dropping in it.

But in lieu of my childhood indulgence, have a graph:

This was something that happened with the California funds, too, after they were given a mandate to divest of gun-related stuff after the Sandy Hook mass shooting. The California funds ran into walls, because a lot of their gun-related stuff was in hedge funds/private equity funds, the whole point of which is to make a commitment for a relatively long amount of time and lock in your investment.

Maybe… just maybe… public pensions shouldn’t be getting into such locked-in arrangements to begin with. But then there’s their biggest lock-in of all: the pension promises they are trying to back.

I can see how that’s tough.

LETTING OTHERS MAKE THEIR CASE

Now, the above is about guns, primarily, but the longer-running divestment theme is re: fossil fuels.

So, I’m going to let someone make the case to divest.

Want a richer pension? Divest of fossil fuels

After several years without an increase in greenhouse gas emissions, the world experienced a spike in 2017 even though many governments had promised to cut their emissions.

Some NGOs, including 350.org and DivestInvest, promote divestment from the fossil fuel sector as a way to reduce carbon emissions. Furthermore, some investors like Quebec’s Caisse Depot and The New York City Pension Funds have announced that they plan to reduce their fossil fuel investments or divest totally from the sector.

This movement is also part of private and governmental efforts to connect the financial sector with climate finance by both divesting from fossil fuels and reinvesting in a low-carbon economy.

Though the divestment movement’s outreach goes beyond direct financial impacts, questions remain about the financial and carbon-related consequences of divestment.

Pensions in danger?

Without knowing the answers to these questions, institutional investors, such as pension funds, are at risk with regard to fiduciary duty. Some beneficiaries will rightfully ask whether they’ll lose parts of their pension if their pension fund divests from fossil fuels.What’s more, it’s still unclear what types of investment strategies are able to significantly reduce the carbon footprint of financial portfolios.

Finally, it’s important to understand the consequences of divestment in a fossil fuel-heavy market like Canada. Many argue that divestment in a small and concentrated market increases financial risks.

In a recent study at the University of Waterloo, we analyzed what happens if different divestment strategies are applied to the Canadian stock index TSX 260.

Okay, so.

TSX 260, as far as I can see from the web page, has only 250 individual stocks on it. On the first page of 5 pages of stocks, I see the following:

Advantage Oil & Gas Ltd. AAV

Algonquin Power & Utilities Corp. AQN

AltaGas Ltd. ALA

Baytex Energy Corp. BTE

Birchcliff Energy Ltd. BIR

I’m just going by company names, not trying to vet what they’re actually up to. I was looking for stuff that could be fossil-fuel related (I excluded the intriguingly named Aurora Cannabis Inc. ACB).

So out of the first 25 listed, I see 5 energy-related stocks. Hmm.

Back to the piece:

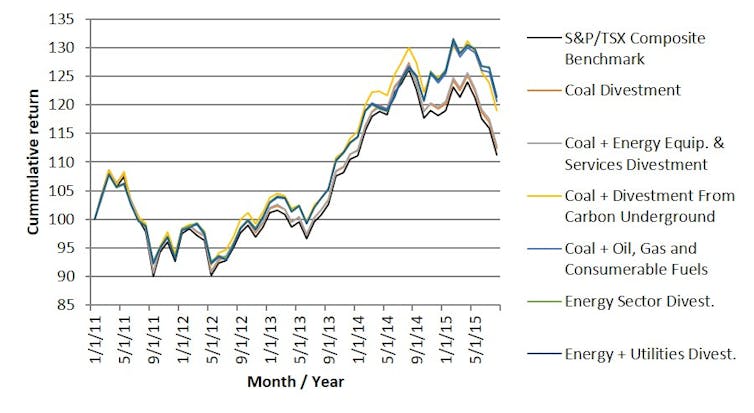

The following graph compares the financial returns of the different divestment strategies and the original benchmark TSX 260. The black line represents the TSX 260. The other lines show the financial performance of the different investment strategies. The divestment portfolios out-perform the Canadian benchmark with regard to risk-adjusted financial returns.

Here’s the graph:

You can read the whole thing for yourself, but I will only point out that the Canadian stock market isn’t necessarily indicative of a much larger market, and more to the point, if you’re dealing with only 250 stocks and 20% of those are energy-related…. hmmm.

SATISFYING THE CUSTOMER

Recently, I ended up on this page. I was trying to get info for an asset allocation contest and I saw this:

I understand the need to respond like this — after all, they’ve got a lot of institutional investors, and deal with various 401(k)s and the like.

But seriously, this line:

95% of U.S. iShares ETFs do not hold shares of three American companies whose primary business is firearms manufacturing.

Hmmm. That spurs all sorts of questions.

How many publicly traded companies are in the world?

Balaji Viswanathan, finance geek, MBA, ran a fintech company.

Answered Sep 13, 2013There are over 100K publicly traded companies in the world. At one point, my tool used to track them all :).

The majority of them are thinly traded. In the US, less than 4000 companies are actively traded in NYSE or Nasdaq. There are another 15000 stocks that are traded over the counter (not in a major exchange) in the US.

So let’s see — three very specific companies are “excluded” from indices that may have up to 100K companies in them?

Even if we restrict to 4000 actively traded U.S. companies, that’s only 0.075% (in count… not market capitalization. But I’m not going to bother with market cap)

I’m going to be annoying and give you a little graph of what 0.075% looks like.

I think Excel’s line thickness on the area is making 0.075% look bigger than it actually is.

To give you an idea of 0.075% — that’s the mortality rate for an 18-year old male or a 32-year-old female, approximately. These are very low percentages.

That said, again, I have no problem with a service provider giving full information to customers. I just think that making a decision on asset allocation based on three companies is a bit iffy.

And I’ll note the two lists: U.S.-listed iShares ETFs with exposure to civilian firearm producers and U.S.-listed iShares ETFs without exposure to civilian firearm producers, the focus is on civilian firearms. What about the cops & military forces?! Why are they more pure?!

WHAT ARE THE RESULTS FOR THOSE PURSUING THEM?

Look, this is a tough biz.

In my own case, I’m not an asset manager. Heck, even for myself, I go for only broad index allocations.

While the Efficient Market Hypothesis says you can’t beat the market, I’m a bit agnostic on that score.

I hold to an extremely weak form of the Efficient Market Hypothesis: I, meep, cannot beat the market (at least, not by playing with securities). So I don’t try. But I also don’t cut out sectors because I’m not going to even try to determine which will underperform.

The one comparison we see above (the TSX 260 one) is a hypothetical.

What about a fund that actually followed this policy?

CalPERS’s Deep Dive into ESG Allocations Shows Mixed Results

While governance yields financial results, data still debated on sustainability and social investing.

One of the world’s leaders in activist investing is getting validation that it sees better investment returns from influencing companies to reform their governance structures, but it is less clear whether the California Public Employees’ Retirement System (CalPERS) gets rewarded monetarily when it comes to activism on corporation’s sustainability and social practices of its ESG investments.

You can go to the link itself to check that out, but I’ve always thought that the appropriate oversight in terms of appropriate corporate governance seems good. Make sure the agents aren’t making off with the principals’ money, as it were.

However, if your point is that you object to the whole business model and basis… perhaps you should have invested in something else in the first place?

ADDITIONAL STORIES

I don’t feel like commenting on the following:

- DiNapoli withdraws shareholder proposals at 3 energy companies

- NYC comptroller calls on Facebook to improve transparency, accountability

- CalSTRS takes a watch position on race, gender equity policy bill for alts managers

- NJ Pulls $1.9 Million from Semi-Automatic Gunmaker | Chief Investment Officer

- Pension Fund Leader Presses Exxon for More Climate Details

- Public pension fund wants changes to Facebook’s board

- BlackRock mustn’t mimic underperforming NYC pension funds

I have no advice for BlackRock. I understand they must fulfill the desires of clients, so I understand crafting funds to their constrictions….which has little to do with performance.

But one mustn’t underperform too much, or there may be deep deep pain.

Related Posts

STUMP Classics: The Fragility of Public Pensions Due To Can't-Fail Thinking

Public Pension Assets: Divestments for Everybody!

Kentucky Pension Liabilities: Trends in ERS, County, and Teachers Plans