Public Pension Watch: The Fragility of "Can't Fail" Thinking

by meep

Calpers, the large California public pension plan, has filed an amicus brief in the case of Detroit’s bankruptcy.

Calpers does not like the Detroit pension plans being treated like unsecured creditors in a bankruptcy proceeding, and cites the constitutional (state constitutional, that is) protections for pensions. Thing is, there’s law, and there’s reality.

But let’s see what Calpers had to say on this matter:

U.S. Bankruptcy Judge Steven Rhodes ruled last year that Detroit was entitled to creditor protection under Chapter 9 of the U.S. Bankruptcy Code and could try to alter the terms of workers’ pensions. The decision, which would let a bankrupt municipality fail to meet its pension obligations in spite of state prohibitions, was “wrong on several levels,” Calpers said.

“Congress did not envision that Chapter 9 would become a haven for municipalities that seek to ignore and break state laws and constitutional provisions in order to adjust their debts,” the pension fund said.

Calpers, which has been involved in disputes with the bankrupt city of San Bernardino, California, said the judge’s decision raises issues of critical importance to its 1.7 million members. If a municipality in bankruptcy is allowed to break state laws and ignore its obligations to the pension system, it “may threaten the actuarial soundness of the system as a whole,” Calpers said.

I do not agree.

What actually threatens the actuarial soundness of public pension plans is behavior like the following:

- Not making full contributions.

- Investing in insane assets so that you can try to reach target yield. Or even sane assets that have high volatility to try to get high return, forgetting that there are some low volatility liabilities that need to be met.

- Boosting benefits when the fund is flush, and always ratcheting benefits upward.

Calpers should be extremely familiar with that sort of behavior.

Here is the problem: all sorts of entities directly involved in public pensions have thought that the pensions can’t fail. Because of stuff like: constitutional protections of benefits (so paying pensions would take precedent over other spending needs, like paying for current services), “government doesn’t go out of business”, the supposedly infinite taxation power of the government, and so forth.

Because they thought that pensions could not fail in reality, that gave them incentives to do all sorts of things that actually made the pensions more likely to fail. Because, after all, the taxpayer could always be soaked to make up any losses from insane behavior.

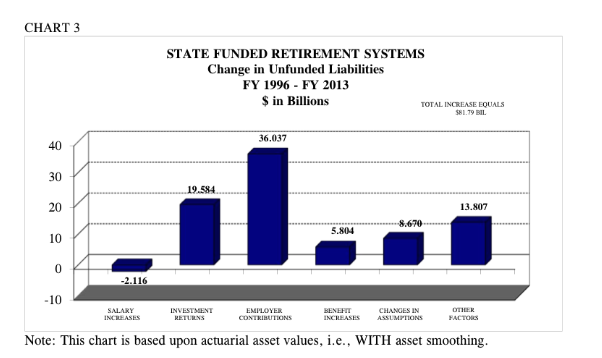

Public employee unions have been pretty quiet over the years as states and municipalities have undercontributed to pensions. Take a look at this graph:

That’s the components of the changes to unfunded pension liability for Illinois from 1996 to 2013. Far and away, the biggest reason for the extremely low funded ratio in Illinois is that Illinois made far less than the full contributions needed to keep the plan at full funding. Note that the second highest component comes from not meeting investment targets (8% return for that period, iirc).

If the employee unions in Illinois knew that it was possible that they might actually only get 40% of what was promised, they might not have been so blasé about the undercontributions. They might have asked for more realistic investment targets.

The explicit ability to renege on pensions (known by all parties) would make them less likely to fail, because employee unions would then have some incentive to make sure pension contributions are made, and they would be less likely to ask for benefits that may make their pension plan insolvent. If they knew that no, the taxpayer wouldn’t be there to bail them out of stupid investment decisions, they might not be so happy with all the opaque investments.

Detroit’s bankruptcy is making it clear that pensions are not safe, and that they can go down with the ship. They really aren’t much different than any other creditor. It may not be fair that they get whacked, but then, it’s not the bondholder’s fault either (though, really, bondholders are more faultless than those directly involved in boosting pay and benefits…and bondholders always knew they could be defaulted on.)

Calpers does not like this veil being lifted.

It was one thing when it was a puny place like Prichard, Alabama, where the pensions actually failed (and the bankruptcy itself was ultimately rejected, but the pension was gone anyway. Reality always trumps law.) Central Falls, RI, was also troubling but similarly puny. In both these cases, the pension plans were in horrid shape, and the direct cause of bankruptcies.

Detroit is much larger, and the pension plans supposedly were in good funded status. Calpers is in a similar position. And Detroit is very big. Calpers is even bigger.

Calpers may very well win the legal argument. In the short-run.

But they’re not going to win the argument with reality. It always wins.

If they only knew that ahead of time.

Related Posts

The Kentucky Pension Mess: Ain't Getting Cleaned Up Now

The Moral Case for Pension Reform

Kentucky Meltdown: Teachers in Revolt, Bill in the Sewers, and Nothing Actually Solved