Kentucky Meltdown: Teachers in Revolt, Bill in the Sewers, and Nothing Actually Solved

by meep

Where to begin?

How about we start with this:

What stinks most is the way pension bill was passed

To say that the Kentucky General Assembly’s passage of Senate Bill 151 late Thursday night was offensive to Kentuckians is an understatement.

The bill will erode our ability to recruit dedicated teachers to our state. The bill saves taxpayers a bit of money, but it’s less than one percent of the unfunded liability of the state’s pension system.

It likely violates state law, but as we have seen repeatedly in recent sessions, constitutionality doesn’t really matter to our state senators and representatives.

But of all the outrageous actions taken by our representatives in Frankfort, perhaps the most atrocious is the process by which, or more accurately, the lack of process, it followed to pass the pension overhaul bill.

First, Republican legislators were unable to pass the bill during regular session due to its unpopularity among teachers, public employees and the public. These folks used their voices to protest, as we encourage in a democracy, and legislators paid attention, as they should.

But instead of acknowledging the will of the people against this bill, House Majority Floor Leader Jonathan Shell, Rep. Bam Carney and their cronies in the House decided that they knew better than the people of Kentucky and replaced a wastewater sewage bill in the State Government Committee with a revised pension plan.

Ah, procedural trickery. What a firm foundation for pension reform.

Your legislators passed this bill despite the fact that it violates state law requiring any change in pension statutes to have an actuarial analysis. This means we have no idea the impact this bill will have on taxpayers.

For all the Republicans who profess fiscal responsibility, how was voting for a 291-page bill, which they hadn’t even had time to read or had no idea what it would actually cost, be fiscally responsible to their constituents?

What about all the taxpayer money that will be used to challenge these actions in court? The hypocrisy is rampant within the General Assembly.

There is nothing fiscally responsible about passing a bill before anyone has had a chance to read it. The fact that it’s likely illegal is just a bothersome little requirement to be overcome at a later date because what was important to these guys was to pass some sort of pension reform, even if that reform doesn’t save a lot of money. They checked a box.

I wholly agree.

Part of the reason I hadn’t been covering the back-and-forth over the Kentucky pension “reform” legislation struggle that frequently is these items:

- there has been extremely little public analysis of the impacts of proposals (actuarial or otherwise)

- many of the proposals out there either: don’t affect the unfunded liability situation much or do affect it greatly… in an unconstitutional way

- I didn’t see anything really getting passed

Now, I was wrong about the last one (the first two hold). Let’s check out what we can about the bill that got passed.

STUCK IN THE SEWERS: THE PENSION BILL

These are the supposed changes.

Pension benefits for future Kentucky teachers set for big changes under bill passed Thursday

Here’s a look at how SB 151, if signed into law, will impact public-sector employees in Kentucky:

Hybrid cash balance plans and optional 401(a) accounts

This will be the largest shift for Kentucky educators hired after Jan. 1, 2019, and is similar to pensions offered to many state and local government workers.

While state and local government workers covered by the hybrid plan originally received guaranteed 4 percent returns for their accounts, that’s no longer the case under the bill. Still, investments in the hybrid plan won’t lose money under SB 151.

Teachers and other government workers can also opt for 401(a) defined-contribution accounts instead of the hybrid plan.

Teachers will need to contribute 9 percent of their salaries toward the hybrid plan, with an additional 6 percent of payroll coming from the state and 2 percent from local school districts.

Retirement eligibility

The accounts can be annuitized once teachers hired into the plans are eligible for retirement after they reach age 65 or have at least 30 years of service by age 57.

That’s a change from the current 27 years of service before retirement eligibility.

Sick days

Teachers and other government workers won’t be able to accumulate sick leave after Dec. 31 and apply that total toward their retirement eligibility after July 1, 2023.

Still, those who have built up unused sick leave will be able to count that time toward their pension calculations.

Inviolable contract

New teachers hired into KTRS after Jan. 1, 2019, won’t have inviolable contract rights, meaning legislators will be able to amend their benefits anytime in the future.

Lawmakers inserted a similar provision in a 2013 pension reform bill that placed state workers in hybrid cash balance plans.

Legislative reciprocity

Legislators also addressed the practice of reciprocity, although the legislation only applies to future benefits.

SB 151 says any salaries earned by lawmakers in other public-sector jobs after Jan. 1, 2019, won’t count toward their pension benefit calculations.

Double-dipping

SB 151 also ends the practice of double-dipping, in which government workers collect both retirement checks and salaries if they retire and take another public-sector job.

The legislation requires that anyone who retires from government work and takes another public-sector job within three months, they will void their retirement and pay back any benefits earned.

So, most of these changes apply only to new hires.

New hires aren’t really the problem. The unfunded liability for the pensions are for people who have already been working, may for years….and in some cases, already retired.

THE OTHER PENSION BILL: SURE, YOU CAN UNDERFUND FOR SOME MORE YEARS

Look what slipped in during the rest of the brou-ha-ha.

Stuck in this piece: While all eyes were on budget and taxes, what else did lawmakers approve?

The legislature on Monday revised House Bill 362, a measure dealing with high school students pursuing military careers, to provide the pension relief.

Senate Bill 66 initially was the vehicle to cap annual increases in pension contributions for local governments, school districts and regional universities, among others.

Without SB66, local governments faced huge increases — some as high as 70 percent — in how much they must pay for their employees’ pensions.

Gov. Matt Bevin said last week that he would never sign SB 66 into law, saying it is “nothing but a kick down the road” in Kentucky’s struggle to deal with its financially-troubled pension systems.

With the legislature backing a revision of SB 66 in HB 362, the governor can veto it, or let it become law without his signature. If he vetoes it, lawmakers have the opportunity to override his veto.

The initial bill would limit annual pension contribution increases for cities, counties, school districts and others in the County Employees Retirement System to 12 percent a year for 10 years, beginning July 1. The revised bill changes the date to Jan. 1 of next year.

Now why would the expected increases be so high?

The contribution increases are driven primarily by revised financial assumptions that the Kentucky Retirement Systems Board of Trustees adopted last year at the urging of several Bevin appointees.

The board previously assumed a 7.5 percent rate of return on investments for CERS, but that was lowered to 6.25 percent based on what CERS actually was earning in recent years. The board also assumed a payroll growth rate of 4 percent, but it cut that to 2 percent to reflect stagnant government salaries and declining numbers of public workers.

Oh right, that. Flashback: Kentucky County Pensions: 60 Percent Fundedness and Decreasing is Awful

Nutshell version:

- Kentucky CERS is similar to Calpers and Illinois Municipal Retirement Fund – run by a state-level organization, it dictates to local governments how much they have to contribute to the pension fund to cover their employees/retirees

- Kentucky CERS is similar to Calpers in that its too-sunny valuation assumptions meant that 100% contributions (as they dictated) led to lower and lower funded ratios

- Kentucky CERS is unlike Calpers in that its valuation assumptions were even “sunnier” and thus they eroded faster

So, finally, CERS was recognizing what it should have recognized long ago:

- No, investments weren’t going to fill up the hole

- No, there will not be bigger and bigger contributions later

- So more contributions need to be put in NOW

Would have been great if that had been recognized 15-ish years ago.

I agree that the localities would have been extremely hard-pressed to increase their contributions by 50% – 70%:

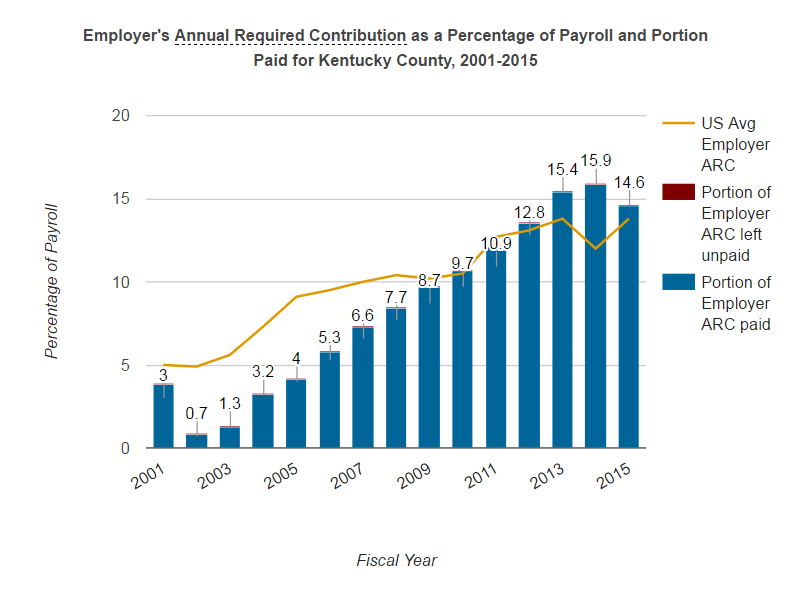

So they had been paying about 15% of payroll (by the way, that ramp pattern is a bad sign — always an indication they think they can pay more later… well, later is now.) from FY 2013 – FY 2015.

Let me grab more recent contribution rates – split out by hazardous & non-hazardous.

Here are the official 2017-2018 numbers:

And here are the 2018-2019 numbers:

I will do the math for you — don’t look at percentage point change, because that’s not going to give you the 50-70% change.

CERS non-hazardous: 28.05/19.18 – 1 = 46% increase — there’s the almost 50%

CERS hazardous: 47.86/31.55 – 1 = 52% increase

I’m not sure where the 70% increase is coming from, other than possibly they’re including their payroll increasing at the same time. For a 70% increase in total, when you’ve got a 50% increase in the rate being paid, that means the payroll needs to have gone up by 13% itself (approximately). I can see how that would happen.

So now, they want to cap the increase to 12% (per year) — let’s see how that works, just looking at CERS non-hazardous. I’m assuming that the payroll stays level and looking at percent of payroll being contributed.

FY 2018: 19.18%

FY 2019: 21.48%

FY 2020: 24.06%

FY 2021: 26.95%

FY 2022: 30.18%

FY 2023: 33.80%

FY 2024: 37.86%

FY 2025: 42.40%

FY 2026: 47.49%

FY 2027: 53.19%

FY 2028: 59.57%

So, that does ramp up gradually – but keeping in mind that years 2019-2022 are probably under 100% ARC. And the later years may be as well — it can be that the contributions would eventually stabilize, and you won’t have the 12% ramp-up… but the way things are going, I wouldn’t bet that way.

So this particular cap isn’t necessarily destructive… but it depends. This is not what all the brou-ha-ha is about anyway.

TEACHERS MARCH

I have got a lot of stories on the teachers in various localities protesting, marching, etc.

Let me excerpt one:

Thousands of Kentucky teachers fill Capitol to protest education, pension cuts

FRANKFORT – Thousands of Kentucky teachers stormed the state capital Monday, blasting lawmakers for passing an unpopular pension reform and demanding a reprieve from expected cuts to the state education budget.

“I wouldn’t feel very good about myself as a teacher if I wasn’t here,” said Andy Price, who teaches special education at Holmes Middle School in Covington.

If the budget goes through as proposed, said Price, a 15-year teaching veteran, it will be devastating to public schools and their students. With the pension changes alone, he said, it’s going to be ever more difficult to attract the next generation of teachers.

“It would be sad to see our state legislators do what they want to do,” Price said. “They’re making it so much harder for people to want to go into education.”

A Courier Journal analysis shows all 120 Kentucky public school districts are closed, 21 because of the rally, and the others because of spring break. Northern Kentucky districts that called off included Boone County, Kenton County and Covington schools.

This piece has a map of the counties where schools are closed

The purple counties are where schools are closed because of teacher protests. The grey ones are where the schools are on spring break.

And here are a lot more stories on the teacher protests:

- Irate Teachers Skip Class Across Kentucky To Protest Surprise Pension Overhaul : The Two-Way : NPR

- Frankfort fallout: Pension bill stirs reaction from educators; AG plans legal challenge | News | glasgowdailytimes.com

- Kentucky districts forced to cancel school after teachers stay home following pension vote | Lexington Herald Leader

- Kentucky pension bill: Campbell, Dayton, Gallatin, Carroll schools closed due to teacher absences

- Kentucky pension uproar grabs national spotlight amid larger debate on teacher benefits | Education Dive

- Kentucky teachers: Thousands protest education, pension cuts at Capitol

- Multiple Northern Kentucky schools closed Monday over pension bill and proposed budget cuts

- NKY schools close Monday to allow teachers, public to protest

- Schools closed as Kentucky teachers protest to defend their pensions

- Teachers feel betrayed by pension vote | News | richmondregister.com

- West Ky Teachers Rally Against Pension Reform Bill In Frankfort | WKMS

There are more than that, but I believe that’s enough.

Should be interesting to see how long it goes on.

HERE COMES THE LAWSUIT

What’s stupid is that this bill may get knocked out entirely in court.

AG Beshear says he will sue over pension bill | The State Journal

Kentucky Attorney General Andy Beshear on Friday announced he would sue over the state’s hastily passed pension bill if Gov. Matt Bevin adds his signature.

Beshear made the announcement in a video posted to social media, saying the contents of the GOP’s pension proposal would break the “inviolable contract,” which ensures state employees receive benefits they were promised when hired.

“What that inviolable contract is was a promise made decades ago by the general assembly,” Beshear said. “They said that if you spend your life teaching our children, protecting our families as a police officer or firefighter, serving neglected children as a social worker that, while we wouldn’t pay nearly what you’re worth, we would guarantee you a solid retirement.”

In the video, he also criticized legislative leaders for altering a sewage bill to make way for pension reform.

“They did it through this amendment where they didn’t allow any public comment or testimony,” Beshear said. “They refused to hear from you. The plopped a 291-page bill in front of legislators and made them vote on it without reading it.”

Beshear also noted that legislators did not perform actuarial analysts on the newly introduced bill.

As pension reform bills have been introduced in the Kentucky legislature, Beshear has said the proposals would violate the inviolable contract, and he’s promised to sue if such a bill became law. He ended Friday’s video by promising that he would keep his word.

“So, I’m here today to reassure you that if and when the governor signs that bill into law, your attorney general’s office will file suit, seeking to overturn as much, if not all, of this terrible bill as we can,” he said.

Live by the procedural trick, die by the procedural nit-pickery.

And if it’s required to have an actuarial analysis… doing this shit ain’t gonna help (also: to the extent that it’s only for new entrants, the analysis would be that:

1. Nothing would happen to current unfunded liability except…

2. You would have to factor in that you’d have a shrinking payroll as the basis for the contributions, so if you’re using level % of payroll to amortize the unfunded liability…..

3. PAIN

I don’t know all the details, but it seems to me that much of the bill could be thrown out mainly because of the procedural crap. To be sure, this was attempted with Obamacare, too, and SCOTUS passed on some of it, and threw out other parts (not based on procedure.)

Anyway, Kentucky, get ready for state money to be spent on both suing over this law through the AG’s office, and defending it… hmmm, given the AG is suing, I guess there will need to be outside lawyers hired. They prefer their cash up front. Especially when you’ve got a state with financials looking like Kentucky’s.

WHAT’S THIS ABOUT HEDGE FUNDS?

That’s not the only lawsuit going on surrounding Kentucky pensions.

Kentucky pension crisis: KRS might join suit over hedge funds | Lexington Herald Leader

The Kentucky Retirement Systems Board of Trustees is debating whether to join a lawsuit that says the state’s pension agency was cheated on up to $1.5 billion in hedge fund investments by several wealthy corporations, with blame to be shared by some of its own current and former trustees and officials.

At stake is whether KRS can recover part of its estimated $27 billion pension shortfall from out-of-state billionaires rather than the state budget, which is being bled dry for pensions at the expense of schools, social services and other programs. KRS is responsible for providing pensions to about 365,000 past and present employees of state and local governments.

“There are only two known ways for KRS to avert the imminent collapse of its plans: a massive taxpayer bailout and/or the success of this lawsuit,” attorneys for plaintiffs in the case wrote in a court filing earlier this month.

A special subcommittee of the KRS board met in closed session Tuesday to discuss the suit.

“We have not yet made a decision,” said John Farris, KRS board chairman and president of Commonwealth Economics in Lexington.….

The suit was filed Dec. 27 in Franklin Circuit Court by eight public employees whose pensions are held by KRS, organized by Michelle Ciccarelli Lerach, an experienced financial class-action litigator in San Diego. The plaintiffs — including a circuit court judge in Clark and Madison counties, a former assistant Jefferson County attorney and a retired Kentucky State Police captain — say they seek damages on behalf of public employees and state taxpayers.The suit alleges that, starting in 2011, KKR & Co., Prisma Capital Partners, The Blackstone Group and Pacific Alternative Asset Management sold KRS hedge fund investments that were “extremely high-risk, secretive, opaque, high-fee and illiquid vehicles.” The hedge funds produced “excessive fees … poor returns and ultimately losses,” saddling Kentucky with a crippling debt that should be repaid by the hedge fund dealers and their owners, the suit alleges.

The “impenetrable spider web of fees” charged by the hedge fund dealers were impossible for any outsider to calculate, and deliberately so, the suit alleges. It cites a 2015 report from the nonprofit Roosevelt Institute in Hyde Park, N.Y., that found public pension systems pay an estimated 57 cents in fees to hedge fund managers for every dollar in net return.

And a report prepared for KRS by CEM Benchmarking found that its actual investment costs in 2014 were $126.6 million, or more than 100 percent higher than the $62.4 million it had publicly disclosed, the suit alleges. Most of this money was fees paid to investment managers.

Okay, let’s think this through.

There is a $27 billion hole they’re talking about. 7 years worth of investing.

A disparity of maybe $64 million in one year, but let’s assume that’s 7 years of extra fees.

So about $450 million.

It would be nice to get a $450 million hunk to the pension… but that’s less than 2% of the unfunded liability. And it may be iffy that they’re going to win their suit. We will see.

One other item on the lawsuit:

Kentucky pension crisis: Hedge funds want KRS suit sealed | Lexington Herald Leader

Several major investment firms that are being sued for allegedly cheating Kentucky Retirement Systems over $1.5 billion in controversial hedge funds want to take the lawsuit behind closed doors.

On Friday, after the Herald-Leader reported that the KRS Board of Trustees might join eight public employees who filed the suit Dec. 27, the firms asked Franklin Circuit Judge Phillip Shepherd for a protective order sealing documents and closing hearings in the case, to avoid “a public spectacle.”

In their motion to Shepherd, investment firms KKR & Co., Prisma Capital Partners, The Blackstone Group and Pacific Alternative Asset Management said they need confidentiality for any material produced in the case that might reveal financial, business or technical information about themselves or “trade secrets” that could give their competitors an advantage.

That’s the whole point of hedge funds, of course: secrecy.

It does not seem like public funds are appropriate investors in secret funds, for a variety of reasons.

The most obvious is potential corruption.

HELL TO PAY… FOR NOTHING

I guess the politicians in Frankfort voting for this are tired of having political careers.

Teachers are a huge voting bloc… and it doesn’t take a union for that to happen. The teachers and their families and many sympathetic onlookers are going to see this as political foolery. The politicians obviously didn’t have buy-in for what they managed to pass, if they had to do this crap. Bevin’s own proposal from last year was wholly unconstitutional and a non-starter.

They clearly weren’t willing to do their homework, actually build up support, and do this in manageable chunks. To actually attack the unfunded liability, they’re going to need to amend the state constitution. That takes much harder political work.

It looks like the other option, letting the money run out of the pension funds, is going to be the default.

Bevin doesn’t seem to care. If he cared, he’d have put more work into this. Politics isn’t his profession, so he can lose all the votes from here on out, and he can just bitch about politicians and whiny teachers and whatnot. Trying to cast himself as the white knight. Nobody else might believe it, but as long as he thinks he was a big man trying to valiantly battle a corrupt system… yeah, whatever. Bevin should be booted. He is a disgrace.

Of course, Conway wouldn’t have gotten anything done, either.

So let’s be clear: both your main options sucked in the last governor’s race, Kentuckians. In both cases, you’d be stuck with politicians who aren’t even trying to get things changed.

In the case of Kentucky, and other states, such as Illinois, it really will take a state constitutional amendment to fix your problems, if you want to do it properly.

When the money runs out, and you don’t have enough taxpayers to bleed, it will be too late for the pensioners. And you will have no constitutional means of cutting the pensions. But they will get cut, de facto, just because you won’t be able to pay them.

Don’t expect a federal fix, because Medicare and Social Security will be squeezed for the exact same reasons. And Medicare & Social Security tend not to be as cushy as state retirement promises. Also, not all states were equally as profligate — Wisconsin will be having no interest in trying to bail out Kentucky, much less Illinois, New Jersey, or California.

Other opinion pieces on this:

- SB 151: How our pension bill ended up in the sewers | Opinion | wkuherald.com

- Tom Eblen: Pension bill tactics show Kentucky’s GOP majority can’t be trusted | Columnists | host.madison.com

- Offering a teacher’s perspective | Columnists | thenewsenterprise.com

- Pension is more than a promise | Columnists | thenewsenterprise.com

- Pension reforms pass muster, Kentucky General Assembly | Bluegrass Institute | March 30, 2018

- No transparency on pension action | Editorials | thenewsenterprise.com

- Kentucky pension crisis: Republican tactics show they can’t be trusted | Lexington Herald Leader

This was not a serious attempt at fixing anything about Kentucky’s pensions.

I assume the legislature will not be doing anything substantive re: the pensions either this year, or next year, when there’s a governor’s race.

There is a Kentucky legislative race this year, and I assume the Democrats will retake the legislature just from this.

There’s still several months to go, so all sorts of wacky stuff can occur in the interim, but I’m not particularly sanguine about the various legislators’ chances.

But hey — I’m not their constituent.

Maybe they’ll get lucky.

Related Posts

Pension Assets: Investment Returns are in for FY 2017 and They're GREAT!

Kentucky Pension Liabilities: Trends in ERS, County, and Teachers Plans

Catch-Up Week: Dallas and Houston Pensions - Still A-Roar