Actuaries on Social Security: Bruce Schobel on Reforms, Robert Myers on History, and Richard Foster on Medicare/ACA

by meep

As per my setting up the issues post on Social Security, I don’t really expect Social Security reform to be on the political agenda this year. But that doesn’t mean we shouldn’t talk about it.

BRUCE SCHOBEL TALKS SOCIAL SECURITY

An Interview with Social Security Expert and Former President of the Society of Actuaries Bruce Schobel

(Interviewer: Jon Evans)

Bruce D. Schobel, FSA, MAAA, may be the most knowledgeable actuary on Social Security in America. Bruce is a former President of the Society of Actuaries, 2007-08. He worked under the legendary Social Security Chief Actuary and Deputy Social Security Commissioner Robert Myers during 1979-88. Bruce was a key player in developing the reforms that saved the Social Security system from bankruptcy in 1983. He reviewed parts of Ronald Reagan’s speeches and once even briefed President Reagan one-on-one before a speech.

Q: The classic question: Is Social Security going to be there when I retire in (10, 20, 30, 40,…) years?

A: Of course the program will “be there”! Nobody could possibly turn off the lights and lock the door. The real question is what will the program look like in (10, 20, 30, 40,…) years? Certainly not exactly like it does today, because under present law, the current program becomes unsustainable in the 2030s.

…..

Q: What was the solvency crisis facing Social Security under Reagan?A: In a nutshell, the financing provided by the sweeping 1977 Social Security Amendments proved to be inadequate to withstand the very high inflation and slow economic growth that began during the second oil crisis of 1979. Social Security was allowed by special legislation to borrow funds from the (at the time) much healthier Medicare program, but even that borrowing could not carry the program beyond June 1983. The July benefit checks could not have gone out on time without corrective legislation. The 1983 Social Security Amendments were signed by President Reagan on April 20, with just 70 days to spare!

…..

How much things change!

Q: What changes might be implemented now or in the near future to extend the solvency of the system?

A: Some of the changes that worked in 1983 can’t be repeated. The program now covers virtually everyone who works, with the exception of 5-6 million state and local government employees, for whom mandatory coverage raises constitutional issues. Taxation of benefits phases in to 85 percent, so that can hardly be increased. The normal retirement age could be raised beyond 67, but people start getting squeamish around 70, and increases in life expectancy haven’t been shared very well across economic strata, so it’s a problematic idea. Certainly the payroll-tax rate and the maximum taxable amount (the “wage base”) could be raised. Many observers note that this Congress would never pass tax increases like that, but we’re concerned about what Congress might do in the 2030s. We haven’t met most of them yet!!!

Q: Which of these changes do you think are most likely to be implemented and when will they most likely occur?

A: I believe that some roughly equal mix of tax increases and FUTURE benefit reductions is inevitable, in order to get the political support necessary for passage. Everybody has to suffer a little. On the tax side, raising both the rate and the base seems quite plausible and realistic. On the benefits side, COLA reductions, similar to what Congress did to Federal employees (including Congress itself) in 1986 appear likely to me, along with probably some further increase in the retirement age. There may be some less transparent changes to the benefit formula. I do not expect to see means testing, simply because it can’t save very much money without digging pretty deep into the upper middle class. Taking away Warren Buffett’s benefits won’t accomplish much!

I know both Bruce Schobel and Jon Evans from various actuarial activities, and it’s worth going to the link to read the whole thing. Bruce comments on what it was like to talk with Reagan, and has some comments on defined benefit pensions and how Social Security compares with other countries’ plans.

Just in case that one doesn’t work, here’s the thread at the Actuarial Outpost, which has a PDF version available.

THE FOUNDING ACTUARY ON SOCIAL SECURITY

Robert J. Myers, who died in 2010, was the Chief Actuary of the Social Security Administration from 1947 – 1970 (now that’s tenure!) and was there at the beginning of the program, part of the group working out the original details. His Wiki article is sadly bare, and if I didn’t make a vow of never editing Wikipedia again, I’d fix that.

But back to Mr. Myers, and his oral history of Social Security, taken from 1996:

Q: At one point you were called in to work on providing some actuarial estimates that would account for a retirement test. Can you just describe what that was about?

Myers: Yes. This was with Murray Latimer when the Senate was going to put an actual retirement test in because I was told the House didn’t know exactly how to write it so they just said: “Well, we’ll leave that up to the Senate.” But then there was to be the general principle that the plan was to be self-supporting, up through 1980, and the retirement test was in there, and what I did was to work backwards as to what assumption of the average retirement age would make the plan self-supporting. And so I made the estimate on that basis, the plan is going to be self-supporting, and then worked back to see what that assumption would involve as the average retirement age, which turned out to be 67, which I didn’t think was unreasonable. If it had taken something like age 70 I would have said, “I can’t stand in back of this estimate.” But at that time—with no experience except what you knew about how long people worked and so forth, and the benefits weren’t that big, that people were going to rush forth to retire just to get the benefits — the resulting figure of 67 seemed to me to be a reasonable assumption.

Q: If there had been no retirement test in the law, then it would have been more difficult for the program to be self-supporting, for it to be in actuarial balance.

Myers: Yes, because what you’re saying in essence is that benefits are paid automatically at age 65 regardless of cessation of employment and obviously more benefits would be paid than if you assume that people retired (at 67), and the system would not have been self-supporting with the tax schedule that was in the proposal.

Q: I’m very interested in this issue of the retirement test because there’s a very common, what I consider to be a myth, about the retirement test and I want to check if I’m right. It’s now said by some people that the retirement test was put in the law in order to discourage older workers, to get them out of the labor force so that younger workers could take their place, and that was the intent of the retirement test. And then these people would argue we no longer need that sort of effect and, therefore, we don’t need a retirement test any more. Is that an accurate description of what happened and how the retirement test came to be in the law or is that a myth that’s evolved?

Myers: That’s a myth that I’ve frequently pointed out. That was a by-product, perhaps, that people would retire, but my demonstration of why it’s a myth is that the average benefit was going to be maybe $15 a month and the average wage was around $100 a month, so people weren’t going to rush out, leave $100 jobs to get $15 benefits. And that wasn’t going to remove very many people from the labor market.

…..

Now one thing though, this 17 percent reduction had to produce some sort of reasonable result. If it required an average retirement age of 75 that would have been obviously wrong. Now as I calculated, the 82 percent factor is equivalent to an average retirement age of 67, which I didn’t think was unreasonable. As it turned out, in actual experience, people are retiring earlier and of course, 65 is the earliest you can retire with full benefits, so 67 is on the high side and probably something like 66 or 66 might have been better. At any rate this was to express the general principle of self support.

Thing is, when Social Security came in normalizing 65 as a retirement age, the actual retirement age did come down. But that may be confusing cause and effect.

From the NYT obituary on Myers:

Congress and the Roosevelt administration wanted the Social Security program to be self-supporting — financed solely through payroll taxes and investment earnings, not general government revenues. Mr. Myers was asked to figure out the age at which people should stop working and start drawing benefits, to make the system pay for itself.

His initial calculations showed that the right age was 67. By the time the Social Security Act was signed into law in 1935, however, the age had been lowered to 65.

“Why is it 65? Why not?” Mr. Myers wrote in a 1992 memoir, “Within the System, My Half Century in Social Security.” “That age has been credited to — or blamed on — German Chancellor Otto von Bismarck. In truth, he didn’t do it.”

Bismarck in fact selected 70 as the minimum qualifying age when he established the world’s first social security system in 1889.

“Age 65 was picked because 60 was too young and 70 was too old,” Mr. Myers wrote. “So we split the difference.”

Hey, blame the actuaries. We’re used to it.

DID SOCIAL SECURITY ACCELERATE EARLIER RETIREMENT?

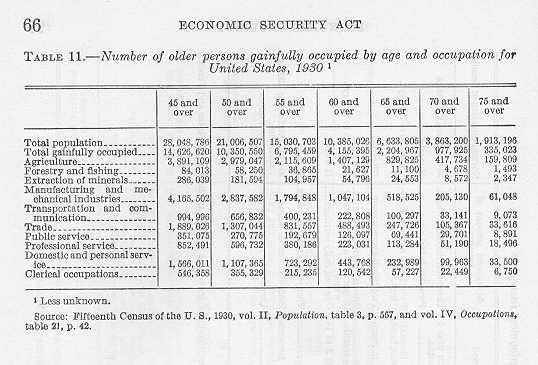

I’ve been trying to find good stats on labor force participation rates (for men) over age 65, but this is the best I’ve been able to find so far in terms of going back a long way:

That’s from The Evolution of Retirement: An American Economic History,

1880-1990, Chapter 2, The Evolution of Retirement.

Now, we may try to be fair and say that one of the issues with the older years is that male life expectancy past age 65 wasn’t that high — most of the men would be dying a few years after age 65 anyway. So of course the labor force participation rate would be higher in ye olden days… because those over age 65 were probably still under age 70, and in later decades, men would be living to much older ages (though not able to work.)

So here’s a different graph from the same source:

So if we define “average retirement age” as when the male labor force participation rate was at 50% (it will just have to do), then we can see it dropped from about 84 in 1880 (yes, most men would die before that age) to about 78 in 1900, and then there are a bunch of lines I can’t tell apart… it looks like around the Depression and WWII there was some up/down on retirement ages. But clearly, past 1950, the retirement ages were steadily going down til 1990, at which point the retirement age hits 65.

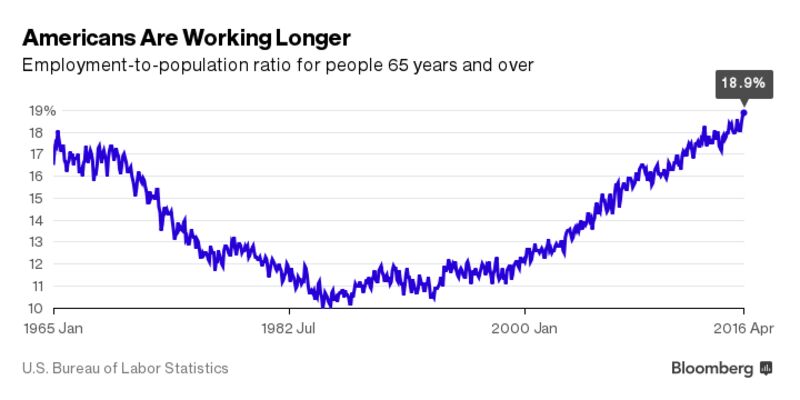

FWIW, in recent years, older age participation has been increasing:

The Bloomberg article says the following:

Almost 20 percent of Americans 65 and older are now working, according to the latest data from the U.S. Bureau of Labor Statistics. That’s the most older people with a job since the early 1960s, before the U.S. enacted Medicare.

Now that’s both sexes, and I concentrated on men only for historical because the labor force participation rate for women used to be highest at the youngest ages — before women got married and had children. (There’s still a child-bearing effect, but I’ll leave that for another time.)

By the way, if you made it to age 65 as a man, your additional life expectancy was about 11.5 years in 1900. Yes, it’s over 16 years now, but no, people weren’t just dropping dead at age 65.

In any case, it looks like the earlier retirement trend preceded Social Security. As Myers said, many people make much more money by continuing to work than by retiring.

(Unless you’re in some special employment categories…)

ROBERT MYERS ON ACTUARIES IN GOVERNMENT

Here’s a bit of interesting perspective on actuarial ethics and professionalism:

Q: Now, there’s always been this kind of tradition of the actuaries being very objective and apart from policy and politics, can you talk a little bit about that tradition?

Myers: I feel very strongly about that. The Actuary, regardless of what he or she thinks of various proposals that are put forth, should make the best possible estimate for them. It may not be right, but it should be the best that you can make, regardless of whether it’s a good proposal or a bad proposal. And the policy makers shouldn’t influence you and say “we don’t like this—put a high cost on it,” or “this is our proposal, let’s say it doesn’t cost so much.” And to the best of my knowledge, very rarely has anyone ever tried to breach that principle.

There was a very good write-up about the work of the Office of the Actuary over the years in the conference report on the Independent Agency bill, and I would refer you to that. I use that quite a bit because they talk in there about why they did not put in the bill that there should be a legislated position of Chief Actuary (although later this was done).

But nonetheless, the tradition of the past has been thus, and I would say, unfortunately, at the moment, it’s being breached some.

That interview was in 1996 (and there’s a lot more there, check it out). What he is referring to actually came to a head with Medicare’s Chief Actuary (now retired), Richard Foster.

RICHARD FOSTER: TICKING OFF REPUBLICANS AND DEMOCRATS

If there’s one thing actuaries are really good at, it’s being annoying.

Richard Foster, former chief actuary of Medicare, managed to annoy both the Republicans and Democrats in exposing costs they didn’t want exposed. What I linked above has to do with Foster’s remarks on the Affordable Care Act and the claims being made about effects on Medicare and Medicaid.

Bur Foster first came into the limelight in 2003, when GWB and company were putting together the Medicare drug benefit, Foster made some very unwelcome cost estimates and Congress was not informed until fairly late in the game:

IT WAS FRONT-PAGE NEWS LAST SPRING: The estimated cost of the newly enacted Medicare prescription drug benefit was now substantially greater than the $400 billion limit set by the congressional appropriations committees. Many articles claimed that the Bush administration’s own cost estimates had been purposely withheld from Congress. And, without exception, all of these stories mentioned me [Richard Foster] (sometimes favorably, sometimes not).

This article summarizes what happened in 2003 when Congress requested actuarial assistance from the Centers for Medicare and Medicaid Services (CMS) during development of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. It describes the dilemma I faced and how I responded. Here I will also try to place this sequence of events in the context of a broader and fundamentally more important issue.

Actuarial Assistance to Congress

From the very beginning of Medicare, the Office of the Actuary at CMS has provided technical assistance to Congress. This assistance has always been independent and nonpartisan, not favoring one policy or party over another. I’ve been proud to be part of this tradition throughout my 31-year career at CMS and the Social Security Administration (SSA).

……

What Went Wrong in 2003?Congressional activity on the legislation that became the Medicare modernization act got underway in May of 2003. In June, the then-administrator of CMS ordered me to cease responding directly to congressional requests for actuarial assistance. Instead, I was directed to provide the responses to him for his review, approval, and ultimate disposition. Following several vigorous discussions, the administrator made it clear that this was a direct order and that if I failed to follow it, “the consequences of insubordination are extremely severe.” I understood this statement to mean that I would be fired if I provided the requested information to Congress.

Consultation with a CMS attorney convinced me that the administrator had the legal right to direct our activities in this way, despite the decades-long precedent of our responding directly to congressional requests. Her reasoning was that, since I was a member of the executive branch of government, members of Congress had no legal basis to direct me to provide technical assistance to them, under the separation of powers provisions of the United States Constitution.

…..

Some years earlier, in anticipation of the possibility that an administration might want to restrict our assistance to Congress, I had sought guidance from the Actuarial Board for Counseling and Discipline (ABCD), an organization established by the American Academy of Actuaries to facilitate compliance with the Academy’s Code of Professional Conduct. After careful consideration, the ABCD issued a formal opinion that our duty to the public is just as important as duty to either the administration or the Congress. The board concluded that:“The Chief Actuary must be free to provide information that, in his or her professional judgment, responds to a request clearly and completely.”

As a result, I was caught between two opposing forces. The law, as I understood it, gave the administrator the legal right to restrict the release of our estimates to Congress. But from a professional, actuarial standpoint, Congress should have access to the information it needed to modify the Medicare program. Between “what’s right” and “what’s legal,” what should one do?

……

It doesn’t have to be this way. Our political leaders can, and often have, worked far more cooperatively and harmoniously to tackle critical challenges facing the United States. Through 1982, for example, the National Commission on Social Security Reform was stalemated over how to address the imminent depletion of the Old-Age and Survivors Insurance trust fund.After months of analysis, proposals, and debate, and despite the best efforts of its executive director, Robert Myers, the commission’s deadline was fast approaching and it was unable to reach consensus on recommendations. When its last scheduled meeting ended, still without any resolution, the late Democratic Sen. Daniel Patrick Moynihan and Republican Sen. Bob Dole met privately, each having concluded that the Social Security issue was too important to let the commission’s efforts fail.

Despite their different political philosophies, they met regularly to determine possible solutions and persuaded other key commission members to join in this effort. Before long, the group had reached consensus on a package of legislative reforms and subsequently persuaded the remaining members of the commission to buy in to this compromise.

This example of leadership by Sens. Moynihan and Dole resulted in a powerful commission report and led directly to the Social Security Amendments of 1983, which have helped successfully guide the OASDI program for more than 20 years.

It can’t continue to be this way. Despite the Social Security Commission’s efforts, of course, the long-range financial problems facing Medicare and Social Security have not gone away. Our society continues to face very critical challenges as the post-World War II “baby boom” generation reaches retirement and continues to age thereafter. A. Haeworth Robertson has forcefully warned of these concerns for 30 years; Bob Myers, Dwight K. Bartlett, and many other actuaries have joined in this message.

Only recently, however, has the severity of this situation been widely acknowledged among policy-makers. (Robertson, Myers, and Bartlett are all former chief actuaries for Medicare and Social Security.) To address these concerns in the time remaining, the nation needs the sort of wisdom, determination, and leadership shown by Sens. Moynihan and Dole in 1982. We simply cannot afford to have further divisiveness and extreme partisanship at this critical time.

I don’t really see that happening this year.

But it’s a nice dream, isn’t it?

MEEP NERDING OUT

For my later delectation, the studies done at the inception of the Social Security program for old age pensions, all the unpublished volumes and reports, and the other records.

Oooh, this is neat:

Materials for the public to promote Social Security.

Uhhhh…. I wonder whose Social Security number this is….

And this:

After my dad died, my ma just said “forget it” when she saw what a pain it was to change everything. That’s why I didn’t change my name when I got married. I didn’t have to do a damn thing! Yay! Avoid bureaucracy! Keep your name!

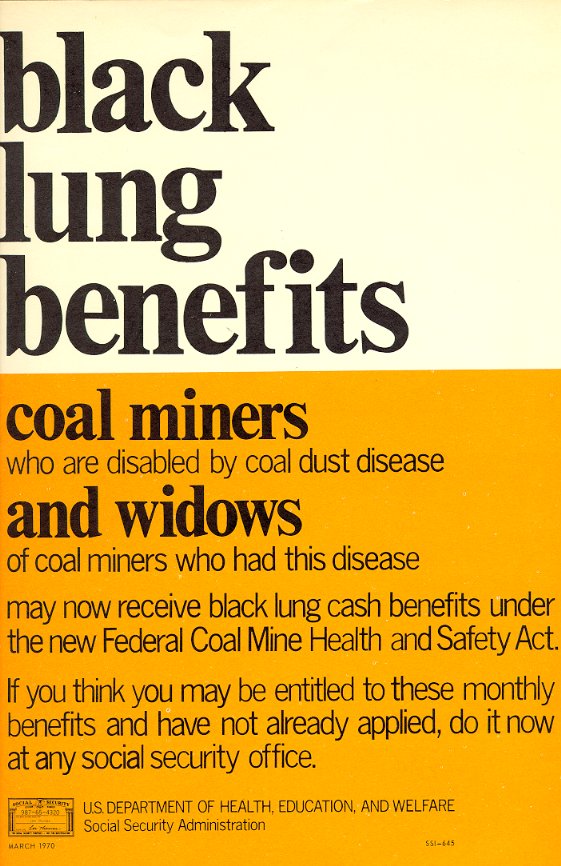

Finally….

We may be coming back to that with the mineworkers pension plan failing…

Related Posts

COVID Data Follies: Vaccination Rates, Relative Risk, and Simpson's Paradox

Public Pensions, ESG, DeSantis, and The Catholic Church

COVID round-up: Reduced deadliness, length of immunity, second (and third) waves, and more