It's Happening: First Union Voted to Reduce Retiree Benefits

by meep

And I mean reducing benefits retirees are getting right now.

It also reduces future benefits for others, but cutting the benefits of those already retired is always a bigger deal.

THE NEWS

Washington Post — In unprecedented move, pension plan cuts benefits promised to retirees:

A pension fund in Cleveland became the first plan to approve benefit cuts for current retirees — even though it is still years away from running out of cash. The move, some critics say, could open the door for other troubled pension plans to follow suit.

The financially-strapped Iron Workers Local 17 Pension fund proposed a plan for extending its lifespan by reducing benefits for workers and retirees. Now that the plan has received final approval, roughly half of the 2,000 participants will see their pension benefits shrink on Feb. 1. Benefits will be cut by 20 percent on average, but some retirees are expecting their monthly payments to be slashed by as much as 60 percent.

The unprecedented move comes after a 2014 law made it possible for troubled pension plans to reduce benefits to retirees if it would improve the financial health of the fund. The legislation dealt a major blow to federal protections that for nearly 40 years guarded the financial promises made to retirees.

…..

The impact will vary based on the individual’s work status and age. About half of the participants are not going to see any cuts at all because of their age or a disability. Others will see minor reductions. But more than 300 participants will see their checks cut by between 30 and 60 percent. Some people who took advantage of an early retirement option are among those facing the steepest cuts.Some critics say the divide in outcomes may have ultimately pinned workers, who could have felt they were choosing between a smaller pension and no pension at all, against retirees who feel they have few options for making up the lost pay.

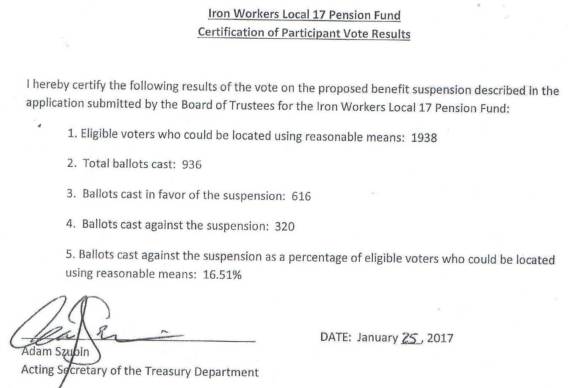

More than half of the 1,938 people eligible to vote did not cast a vote. About 16 percent, or 300, voted against the cuts. Another 600 members voted in favor of the changes.

John Bury has the voting detail:

On December 16, 2016 the Ironworkers Local 17 Pension Fund became the first (and only) multemployer (union) plan allowed to reduce benefits under MPRA by, in this case:

when all Participants are considered, the average monthly benefits will be reduced under the Suspension Plan by 20%, from $1,401 to $1,120.

However, for those benefit cuts to go into effect as of February 1, 2017, a majority of 1,938 eligible plan participants and beneficiaries had to vote for it. Yesterday the results of that vote were released:

So a plan that may have about $75 million in assets remaining with $13 million coming in annually will now be paying out $16 million instead of $20 million per year to start that is supposed to forestall bankruptcy.

Pertinent data from latest 5500 filing:

Plan Name: Ironworkers Local 17 Pension Fund

EIN/PN: 51-0161467/001

Total participants @ 4/30/15: 2,042 including:

Retirees: 1,108

Separated but entitled to benefits: 302

Still working: 632Asset Value (Market)

5/1/14: 86,864,772 Value of liabilities using RPA rate (3.61%)5/1/14: $363,251,849 including:

Retirees: $228,859,286

Separated but entitled to benefits: $37,935,839

Still working: $96,456,724Funded ratio: 23.91%

Unfunded Liabilities as of 5/1/14: $276,387,077Asset Value (Market) as of 4/30/15: $85,756,315

Contributions: $12,851,327

Payouts: $19,353,116

Expenses: $843,039

Not even half of the eligible voters voted.

Even when it’s their own money on the line.

With 616 out of 1938 eligible voters approving the cuts, that’s about 32% of the members approving the cuts.

THE HISTORY

Just to get you up to speed: in December 2014, Congress passed the Kline-Miller Multiemployer Pension Reform Act of 2014. It was a last-minute thing that surprised a lot of interested parties (most notably, the unions who have these MEPs.)

1. What is the Kline-Miller Multiemployer Pension Reform Act of 2014?

The Kline-Miller Multiemployer Pension Reform Act of 2014 was enacted on December 16, 2014. In Kline-Miller, Congress established a new process for multiemployer pension plans to propose a temporary or permanent reduction of pension benefits if the plan is projected to run out of money.

In order for the reductions to take place, the plan trustees have to submit an application to the Treasury Department showing that proposed pension benefit reductions are necessary to keep the plan from running out of money. Participants and beneficiaries will be notified of any application to reduce benefits, will be provided with an estimate of the reduction in their own benefits and have the opportunity to comment on the application.

The new law requires that the application be reviewed by the Treasury Department, in consultation with the Pension Benefit Guaranty Corporation (PBGC) and the Department of Labor, to determine if it meets the requirements set by Congress. If the application is approved, plan participants and beneficiaries will then have the right to vote on the proposed benefit reductions before they can occur.

…..

4. What kinds of multiemployer plans will be affected by the new law?Under Kline-Miller, trustees of a multiemployer pension plan that is in “critical and declining status” – meaning it is projected to run out of money in less than 15 years (or 20 years in certain situations) – will have the option to seek a reduction of benefit payments under the plan, if certain requirements are met.

…..

6. How will plan participants be impacted?Plan participants in most multiemployer pension plans will not be impacted because their multiemployer pension plans have enough money to be sustainable over the long term. Plan participants should contact their pension plan to determine if Kline-Miller could impact them.

Multiemployer pension plans can only pursue benefit reductions if the plan is in “critical and declining status.” If a plan applies, plan participants and beneficiaries will be notified of proposed benefit reductions, including an estimate of their reduced benefits, and will have an opportunity to submit comments to the Treasury Department on the application. If that application is approved and other steps are taken (including a vote on the application by participants) then the pension plan trustees can amend the plan to reduce the benefits of workers and retirees in the plan.

It is critical – and the law requires – that the trustees of multiemployer pension plans take all reasonable measures to avoid insolvency before pursuing the benefit reductions that Congress authorized in Kline-Miller.

Breaking in: “impacted” is an awful word choice. “Affected” would have been better.

When people use “impacted” in this way, I think of molars or asteroid hits.

8. Is there a limit on how much an individual’s benefits can be reduced?

Yes. If you are in a plan where benefits could be reduced, Kline-Miller requires that your benefits cannot be reduced to less than 110 percent of the amount that PBGC guarantees. For example, if your plan currently provides a benefit of $1,500 a month, and if PBGC guarantees $1,000 a month, your plan could not reduce your benefit below $1,100, because that is 110 percent of the amount PBGC guarantees in this example. (The amount PBGC guarantees in a given case depends on various factors, including the rate at which your benefit is earned and your years of service under the plan.)

9. Are there certain plan participants who are impacted differently?

Yes. Kline-Miller imposes limitations on the reduction of benefits. In addition to the requirement that benefits cannot be reduced to less than 110 percent of the amount that PBGC guarantees, Kline-Miller specifies that no application may be approved unless it protects participants and beneficiaries in the following ways:

No benefit reductions for retirees age 80 and above (as of the effective date of the benefit reduction);

Lower benefit reductions for those aged 75-80; and

No reductions to benefits based on disability (as defined under the plan).Benefit reductions must also be distributed equitably over the participant and beneficiary population.

There’s more at the FAQ if you care to read.

Since the passage of the law, there have been 11 applications, though one of these was withdrawn.

The Ironworkers 17 cut plan was the first to be approved. Before that, four were denied. Obviously, that leaves four plans in review currently.

The denial of the four applications included complaints that: the assumptions used for projections were too optimistic (in returns, mortality, etc.); the cuts weren’t equitable; the cuts weren’t sufficient. Here is a post I did when Central States Teamsters plan was rejected by Treasury

There was no denial that these plans are in a bad place. Some of them will run out of money, and then be put on the PBGC, which has very low guarantees for MEPs.

THE COMMENTARY

A union in Ohio is actually cutting their pension benefits

This is the policy equivalent of seeing an actual unicorn. In Cleveland, the Iron Workers Local 17 union has approved cuts to their pension plan to avoid having it become insolvent. The cuts will affect different workers by varying amounts depending on their individual circumstances, but everyone will be feeling the pinch. (Washington Post)

….

The first thing to remember is that we’re talking about a private sector labor union, not one for government workers. The effects on retirees are going to be serious to be sure, but what are the other options? The union made promises to the workers which it wasn’t able to keep. This is a system which is much like any sort of general entitlement program in that it always requires growth, or at least stability. You have to have more people paying into the system than drawing out of it and if the numbers contract, the math immediately ceases working. (It’s the old question of how many people can ride in the cart as opposed to the number who are pulling it.)I pointed out the private sector aspect of this because the premise of the government guaranteeing these pension funds was always dubious at best. How is it that the taxpayers are on the hook for these shortfalls when the system becomes insolvent? I realize that’s not a solution, but the problem wasn’t created by the government in the first place and the taxpayers had no seat at the table when the deals were originally negotiated. But that’s not stopping Ohio Senator Sherrod Brown, who is still pushing for a federal bailout of the plan.

The problem gets even more complex when we look at state pension plans which are hung around the necks of taxpayers. This report from Forbes last year spells out the doomsday scenario facing most of these funds.

So that’s just one piece of commentary so far, and I expect more to be coming out this week.

Let me set aside the issue of the PBGC’s own solvency. I don’t think the PBGC will get a bailout, but to bring things back for a bit, the guarantee for private pensions differs based on whether it’s a single-employer plan or an MEP.

The guarantee for MEPs is really low. I’ve pointed this out before:

From the NYT piece:

“When those funds run out of money to pay benefits, it will be up to the P.B.G.C. to step in. It now pays a maximum of $12,870 a year for workers who spent 30 years digging coal or driving trucks, even if the plan called for larger payouts. A worker with only 15 years of service gets half of that.”

That is specifically for MEPs. Not single employer plans.

That is incredibly low. It’s essentially about the amount many people get from Social Security. At least the MEP guys are covered by Social Security, too, but you’re not going to be happy if your pension is cut from ~ $40K/year down to $13K/year.

The Kline-Miller act requires the benefits to be at least 110% the guaranteed amount (otherwise, the plan may as well go onto the PBGC guarantees). But still — I am curious as to which members voted. The oldest ones would get no cuts at all. The newest retirees, and those yet-to-be retired, would see the heftiest cuts. But those younger guys may have just not voted, or were outnumbered by the older retirees. I don’t know. I’ll have to see if I can get some plan demographics later.

John Bury has been good at finding the worst-funded MEPs, and we’ll probably see some of these plans make their own applications. He flags 376 additional plans that may be under distress.We’ll see this calculus playing out again this year, I’m sure.

UPDATE: More commentary – A leak in the pension dam By Russ Vaughn

For decades, I’ve watched unions, both private-sector and public-service, collude with the Democratic Party to boost salaries, benefits, and pensions to levels unattainable to the average non-union American worker, all the time wondering, “How the hell are they ever going to keep that going?” For years, when we encountered one of those big, lumbering, quarter-million-dollar motor homes, my wife and I would joke, “There goes another retired lawyer or doctor.” These days, based on publicly available data, our speculation is that it’s likely a retired cop or fireman.

…..

And now comes what may be a small leak portending that pension dam disaster, which, when it breaks, is going to sweep away generations of American dreams in the fiscal waves and torrents of all that pent up political cronyism and greed. The Washington Post just reported that an ironworkers union in Ohio is doing the unthinkable: reducing benefits to its current pensioners, some by as much as 60%, to prevent the fund from sinking into insolvency as soon as 2024. According to the Post, these ironworkers make up only a tiny slice of the more than a million private-sector workers and retirees whose pension funds are predicted to be insolvent within twenty years. One of the largest, the Central States Pension Fund, which represents some 300,000 truckers, has already tried to reduce pensions but has been stymied in that effort by the federal government, which says the proposed cuts are insufficient to save the fund from insolvency.It’s a good bet that Chicago will be the first major Democrat stronghold to default on its public-service union retirement commitments, but it’s a sure bet that it is the entire State of California that is sitting on the nuclear incident of pension plan insolvencies, and when that Democrat unicorn reactor ultimately goes critical and melts down, as it most assuredly is going to do, it will shake this nation. We can hope it shakes some sense into Democrats and makes unions think twice about getting too greedy, but based on current attitudes, it’s not likely.

Well, we shall see. I still think Illinois gets hit first, in terms of state plans.

Related Posts

A New Plan to Deal with Multiemployer Pensions

Other Pension News: Low Interest Rates, MEP Cuts, and More

On the Bailouts That Didn't Happen, Part 1: Multiemployer Pensions