Kentucky Pensions Even Closer to the Brink: New Assumptions, New Report

by meep

In yesterday’s post, I ran one of Kentucky’s large pensions through the ringer. The info I had was Kentucky’s pension plan being at 22% funded.

But that was using fiscal year 2015 numbers.

There are new numbers, and it’s so much worse.

REPORT: WHY KENTUCKY PENSION SOLVENCY SUCKS

A few weeks ago, a presentation was given to the Public Pension Oversight Board of Kentucky.

State-commissioned report reveals how Kentucky pension systems became worst-funded in the nation

The PFM Group presented an alarming report to the Public Pension Oversight Board detailing the factors that made Kentucky’s pension systems the worst funded systems in the United States. The report revealed that the systems have had a combined $6.9 billion negative cash flow since 2005 as benefits paid to retirees plus program expenses greatly exceeded appropriated funding. According to the report, if this negative cash flow is not corrected, the ability to make payments to current and future retirees is at risk.

…..

The PFM report revealed the factors over the past decade that led to the cumulative combined growth in the state’s unfunded pension liabilities:• *The largest contributing cause was “negative amortization” caused by using a “level

percentage of payroll” funding method and inaccurate assumptions about payroll growth.*

This “actuarial back-loading” accounted for 25 percent of the growth in the retirement

systems’ unfunded liabilities.• Underperforming investments relative to assumed rates-of-return and market benchmarks were responsible for 23 percent of the growth in unfunded liabilities.

• Changes to actuarial assumptions intended to align with revised expectations contributed to 22 percent of the current recognized unfunded liabilities.

• Failing to fund the ARC caused 15 percent of the growth in unfunded liabilities.

• Nine percent of the growth is attributable to granting, but not paying for, retiree cost

of living adjustments (“COLAS”).

I have described these problems before.

WHERE IS THE REAL PROBLEM?

The assets didn’t really underperform — if you compare them to other public pension funds. They basically undershot the target return used in valuation — this used to be 8.25%, but in recent years it was dropped to 7.5%. I will get to current valuation assumptions in a moment.

There are some issues with the pension fund governance, but they don’t seem to be performing worse in returns compared to other, better-run pension funds.

The liability part is a real bear: not only was the discount rate too high (but that’s not unusual), they used some very iffy assumptions.

From my digging into the liability trends:

If the payroll doesn’t grow as fast as the assumed growth rate, you end up with actuarial losses. The Public Plan Database gave me the payroll growth assumption for only a few years: 4.5% in 2013, and 4% in 2014/2015.

Let’s see what the historical payroll growth rate has been: 2.7% from 2001 to 2015.

….

Checking the 2015 CAFR, I see that they changed the mortality assumption to something fairly standard — RP-2000 brought forward using scale BB (though it looks like they’re using only some improvement; that said, they said they were using an experience study).So I looked at the 2014 CAFR to see what the mortality assumption had been before.

“The rates of mortality for the period after service retirement are according to the 1983 Group Annuity Mortality Table for all retired members and beneficiaries as of June 30, 2006 and the 1994 Group Annuity Mortality Table for all other members. The Group Annuity Mortality Table set forward 5 years is used for the period after disability retirement.”

Yeah, that’s a problem.

Basically, every assumption that could be jiggered with to make the liability look smaller, or to make for smaller required payments was pushed in that direction.

It also didn’t help while this mathematical jiggery-pokery was going on, Kentucky ERS wasn’t even getting full contributions.

PROJECTIONS AND RECOMMENDATIONS

The report further revealed:

• Absent reforms and fully funding the ARC going forward, negative cash flows at KERS-NH

and TRS are projected to continue unabated for the next 10 years.• Moving from a “level percent of payroll” to a “level dollar” amortization methodology

would add hundreds of millions of dollars to the system’s required annual contribution in

the near-term, but decrease the system’s unfunded liabilities more rapidly.• $2.9 billion of TRS’s growth in unfunded liability was a result of underperforming

investments, equal to 29 percent of the growth in that system’s unfunded liabilities.• In addition to its pension liabilities, Kentucky has nearly $6 billion of unfunded OPEB

(“other post-employment benefits”) obligations, primarily associated with retiree health

care.

Notice I pretty much never touch the OPEBs… because those are even messier in trying to get at valuations.

The assumption has been those are “easily” cut, compared to the defined benefit pension amounts. That may not be true.

You can see the full presentation here — it’s fairly comprehensive.

Oh, and I never did give the punchline — remember how I said Kentucky ERS was 22% funded? Well, the FY 2016 number is 16% funded.

MORE NEWS ITEMS

It’s been a while since I last looked in on Kentucky, so I’m dropping a lot of pieces here right now:

Kentucky Pensions Could Face Insolvency in Five Years:

Kentucky’s retirement system faces a funding shortfall across its pension systems of $33 billion, and could face insolvency in just five years, according to an audit report from the PFM Group.

“If the commonwealth reverts to the pattern of underfunding the system that it followed from fiscal year 2004 to fiscal year 2014,” said the report, “we project that the [Kentucky Employees Retirement System] fund will be depleted by fiscal year 2022.”

The report said that, based on alternate return assumptions for a 10-year investment horizon and increased liquidity requirements consistent with an updated KRS policy, the unfunded liability would rise to $42 billion. The audit also cited the state’s last-place ranking by Standard & Poor’s with just 37.4% of total current obligations now funded, compared to a national median of 74.6% as of fiscal year 2015, the most recent period reported by S&P.

…..

The system lowered its investment rate of assumption to 5.25% from 6.75%, its inflation assumption to 2.3% from 3.25%, and its payroll growth assumption to zero from 4%.The change in assumption rates means Kentucky is currently $13 billion underfunded for what it is expected to pay retirees over the next 30 years. State agencies will have to contribute nearly 78% of each employee’s salary to the pension fund, up from 50%. That means for every state worker earning $50,000 a year, taxpayers will owe the pension fund $39,000.

Changing the assumptions and making decisions based off the more realistic figures will mean a much bigger actuarially required contribution (ARC) payment will be needed from the General Assembly to shore up the system, according to the Kentucky Chamber of Commerce.

Those are fairly drastic assumption changes, if you couldn’t tell.

Will there be a great pension freeze?

…. When independent consultants recently released a second report on the audit of Kentucky’s pension plans, they claimed an additional $700 million annually — on top of the $2 billion being spent on the retirement systems this year — is needed to keep them from going belly-up.

Will such additional gobs of spending spun as a one-time infusion to help keep the retirement systems stable follow the frequent pattern of taxing, spending and pension-benefit increases which never come to pass but always come to stay?

A defined benefit pension system like Kentucky’s must maintain the relationship between available funding and benefits granted or it will implode.

For too long, Kentucky’s beneficiaries have been led to believe a higher benefit for any year of service must be applied to every year of service.

However, a defined benefit system — as Kentucky has and its government workers and retirees fight to keep — only works when there’s a direct relationship between benefits, funding and investment returns.

…..

The fact is, if Kentucky had abided by the rules of a defined benefit system by funding pensions based on normal payroll costs and conservative investment assumptions, the resulting greater-than-assumed rates of return on investment funds during those fat years would have created surpluses for use in the lean ones.The only way Kentucky will survive this fiscal storm is by freezing benefit-accrual rates for all members of every system, and resetting the pension plans so that beginning January 1, benefits are awarded based on their relationship with investment returns and payroll contributions rather than the warm, but deceptive, weather of political palatability.

Jim Waters is president and CEO of the Bluegrass Institute for Public Policy Solutions, Kentucky’s free-market think tank. He can be reached at jwaters@freedomkentucky.com and @bipps on Twitter.

More from the Bluegrass Institute for Public Policy Solutions here. They have their own Powerpoint presentation with recommendations.

Here are a few more news items in response to the report from PFM:

Kentucky Needs $700 Million More Per Year for Pension Debt

REPORT REVEALS HOW KY PENSION SYSTEMS BECAME THE WORST FUNDED IN THE NATION

From back in February, the plans had gotten a warning: Pension System’s Woes Could Be Worse Than Previously Thought — pretty much everything in that article ended up in the PFM report

MORE POLITICKING

It was mentioned above, but here is some more on the valuation assumptions getting changed this year.

Back in February, Governor Bevin mentioned a tax increase for pensions:

Gov. Matt Bevin used his second State of the Commonwealth address Wednesday to warn lawmakers he’ll be asking them later this year for a painful vote for a tax reform plan that will address the state’s crisis in funding public pensions.

“We’ve got to do these together – pension and tax reform. They’ve got to be done together because if they’re not done together this state is going to become financially insolvent,” Bevin said. “It will not be easy, frankly. It will not make you popular with everybody.”

Bevin said a realistic estimate would put the combined obligations of Kentucky’s public pension systems at more than $80 billion dollars – a problem that can’t be solved by “a tax neutral tax plan. It’s not. We can’t afford for it to be. That’s a straight up fact.”

….

But the tax and pension reform bills will wait for a special legislative session later this year – and that’s when Bevin said lawmakers will have to take a stand on the most difficult public policy questions.

We’ll see if that happens.

From March: Kentucky Governor Intent On Addressing Public Pension Woes – that’s by Bob Williams, President of State Budget Solutions.

Also from March: Kentucky’s new leadership tries to pull it back from the pension cliff — this “new leadership” is the Republican-controlled legislature. As noted, KY was the last southern state to get a Republican-controlled legislature. We’ll see if it’s as feckless as the federal Congress.

Here’s a group getting ready — Nonprofit formed to ‘educate the public’ on state pension crisis:

FRANKFORT, Ky. — A new nonprofit group formed by three Republicans may soon be buying radio and television ads to bring attention to Kentucky’s public pension crisis.

The group is called Save Our Pensions Inc. and Kentucky Secretary of State records show that it was formed on May 4 under section 501©(4) of the Internal Revenue Code.

“Save Our Pensions was formed to educate the public about problems and solutions relating to Kentucky’s pension systems,” one of its directors, Louisville attorney Bridget Bush, said in an email.

…..

The formation of Save Our Pensions comes as several leaders of the legislature’s Republican majorities have said only Bevin, as the governor, can launch the type of statewide information campaign needed to build public support needed to win passage of any tax reform plan.As to whether Save Our Pensions would also deal with educating the public on tax reform as part of the pension crisis solution, Sellers said in her email reply that the group “as formed to educate the public about problems and solutions relating to Kentucky’s pension system.”

Bevin has not said when the special session will begin later this year, nor has he released his specific tax reform plan.

Tres Watson, spokesman for the Republican Party of Kentucky, said he was not familiar with Save Our Pensions but that the party favors any efforts that will help draw attention to the need to address Kentucky’s pension problem.

As far as I can tell, Gov. Bevin hasn’t called the required special session yet to deal with the pension issues. Should be interesting to see what happens there.

SPLIT OFF THE COUNTY PLANS?

Also back in February, a bill to consider splitting the county plan from the state plan was put to the Senate:

The Kentucky Senate is getting a bill that would split the Kentucky Retirement Systems in two, spinning off the better-funded local government pension funds while letting the struggling state pension funds face an uncertain future alone.

With no debate, the Senate State and Local Government Committee voted unanimously Thursday to approve Senate Bill 226 and advance it to the Senate floor.

The bill, sponsored by committee chairman Joe Bowen, R-Owensboro, would allow the County Employees Retirement System, which covers about 230,000 local government workers and retirees, to depart KRS. This new pension agency would be run by a nine-member board, with three members elected by workers and retirees, and six chosen by the Kentucky League of Cities, the Kentucky Association of Counties and the Kentucky School Boards Association.

Bowen compared linking local and state government pensions to tying the future of Toyota to the coal industry.

There are a variety of reasons of considering splitting the two, and I pointed out that even splitting from the state plan, the county plan is in an awful position.

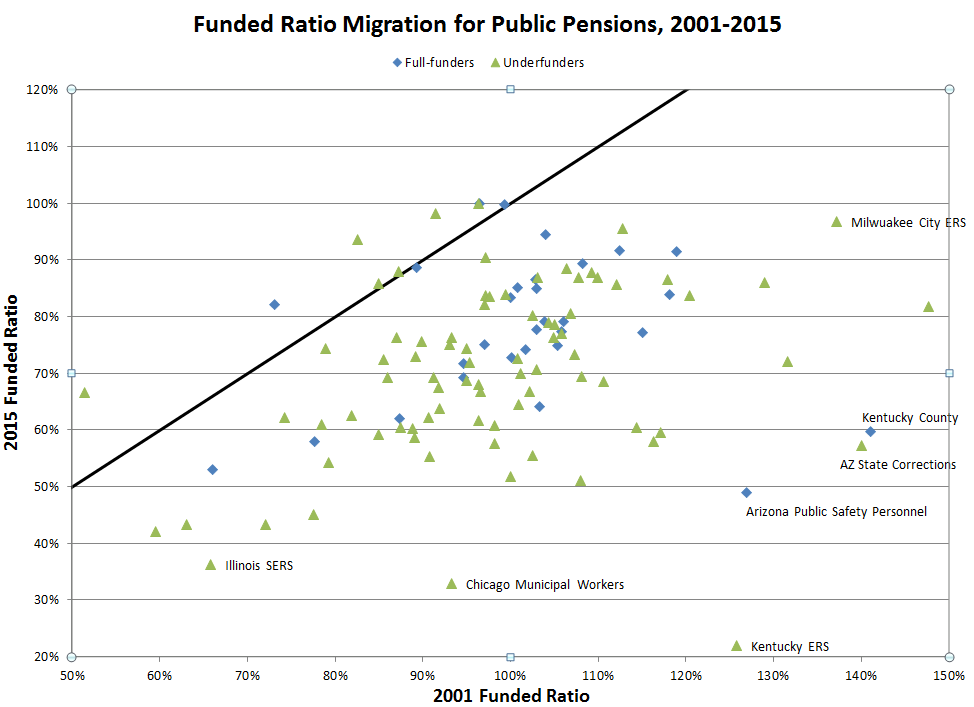

The same valuation problems plagued the County ERS — but because they paid 100% of the phoney-baloney “required payments” they were merely 60% funded in 2015, not 33% funded. But compared to other “100% ARCers”, they did extremely poorly:

See Kentucky County sitting all the way over to the right? It had been at 140% funded in 2001. And then down to 60% funded in 2015. That’s quite the impressive drop, considering they were supposedly “fully funding” all this time.

Pension system gets some good news:

….

David Eager, Interim Executive Director for KERS, told the board the system actually took in about $51 million more than it paid out last year — “but that’s nowhere close to what we need,” he added. KERS’ assets also grew over the last year — from $15.1 billion to $16.2 billion.According to legislative staff, all the pension systems enjoyed improved returns over the past nine months and are on track to meet their projected assumed returns for the year.

The improvement, however, isn’t enough to ensure financial stability, especially for the KERS plan.

That’s why CERS — which covers city and county employees, firefighters and classified (non-teaching certified) school employees — is asking to leave KERS.

Sen. Joe Bowen, R-Owensboro, sponsored legislation during this year’s General Assembly which would’ve permitted the split, but Bevin asked the bill be held pending an audit of the pension systems and Bowen agreed.

Bryanna Carroll of the Kentucky League of Cities told the board that local governments must by statute fund the entire actuarially required contribution to the system each year and it is 61.5 percent funded versus only 24 percent for KERS.

Local officials want to spin off CERS under a nine member board made up of appointees of member groups (cities, counties, school boards) and a financial expert and management expert.

Bowen said he supports spinning CERS off from KERS so lawmakers can focus on shoring up the KERS system “where the real problem is.”

He said he didn’t know if the governor — who alone can set the agenda for a special session — will include the question of CERS’ independence on the special session call — but Bowen would like it to be included.

Again, that 61.5% fundedness is nothing to crow about.

More comments:

Minutes from the April 24, 2017 meeting of the PUBLIC PENSION OVERSIGHT BOARD — has comments/discussion on CERS separation.

Pension funds improved, but more must be done

INVESTMENT TROUBLE?

Back in April: Kentucky’s pension deal offers lessons on risks, cost cuts

NEW YORK, April 28 (Reuters) – When Kentucky’s public pension put U.S. buyout firm KKR & Co LP in charge of its hedge fund investments in May 2015, its board expected the deal to save money and boost its returns.

For the Wall Street firm the deal paid off – over more than a year its unit, KKR Prisma, increased by nearly half the amount of money it managed on Kentucky´s behalf and its fee income rose by at least a quarter, according to KKR Prisma documents seen by Reuters.

Kentucky, so far, has come up short. While KKR promised to cut its fees and make one of its portfolio managers available to oversee investments at no cost, Kentucky’s hedge fund fee expenses rose at least 11 percent last year, according to estimates provided by the pension fund.KKR said the increase in Kentucky’s fee expenses was in part because the discount was only effective from August last year, more than a year after the partnership started. Kentucky declined to explain why the discount kicked in later.

At the same time, those hedge fund investments failed to beat its benchmark index last year for the first time in five years.

To be sure, neither the setbacks nor the promised benefits would have radically changed Kentucky’s dire condition as one of the nation’s most underfunded public pension funds, with just over $16 billion in assets and a $18 billion funding shortfall.

But the deal highlights the potential pitfalls cash-strapped public pension funds face as they scramble to shore up their finances by chasing discounts and riskier investments. Hedge funds promise higher returns, but are more complex and riskier than, say, government bonds.

…..

Rhodes-Kropf was the lead author of a Harvard Business School case study about a partnership between KKR and the Teacher Retirement System of Texas. KKR manages about $10 billion for the fund together with another buyout firm Apollo Global Management, LLC, according to the pension fund´s annual report.

Neither KKR, nor Apollo, nor the Texas pension fund, which manages $133 billion in total, would comment on their agreement or the fund’s performance.

The study showed that unlike Kentucky, Texas had several partnerships, including a $1 billion tie-up with the now-defunct Lehman Brothers.

The Texas fund also negotiated to pay less if some of the investments performed poorly.

“It´s really a question of: Do you have enough money to ask for a better deal? There´s no question there´s some risk to these partnerships,” Rhodes-Kropf said. “But if you get a big enough fee discount, then it may be worth the risk.”

The thing is, poorly-funded pensions like Kentucky’s are desperate and the hedge fund people know it. They would rather have some magic money machine to pump up fund values… and just going to the regularly publicly-traded market is unlikely to get you that.

ASSUMPTIONS AND MEASURING OBLIGATIONS

Back in April, the pensions chair wanted more conservative valuation assumptions.

FRANKFORT, Ky. – The newly elected chairman of the Kentucky Retirement Systems Board of Trustees says look for the board to make certain conservative assumptions next month that will paint an even grimmer – but realistic – outlook of the systems’ financial condition.

“What I think you’ll see is we’re going to be more conservative…” John Farris said in an interview after a KRS board meeting Thursday. “I’ve taken a deep dive into the numbers and I would say that I have to call into question the numbers that were approved in prior years.”

Farris questioned key assumptions used by the board in the past, such as that the government’s payroll would grow at a rate of about 4 percent – a key factor in projecting how much money the systems will get in the future from the contributions of employees. “But actually payroll growth has been flat or negative,” Farris said.

As noted, he got those assumptions changed.

Here is a common kind of reaction: Lowered Expectations Tack Billions Onto Kentucky Pension Debt:

The commonwealth’s already-limping pension system has slipped further into the red. Thursday, the Kentucky Retirement System’s official debt grew by several billion dollars.

The KRS board downgraded its assumptions about investment returns, state government payroll growth, and inflation going forward – bumping the estimated unfunded liability up by roughly $3 to 4 billion.

According to the Lexington Herald-Leader, that means the state’s largest pension fund now has just 13.8 percent of the money required to pay out benefits.

Governor Matt Bevin has been sounding the alarm on pensions since his campaign days. Last week, he warned Kentuckians that this is not a drill.

“Our pension systems are nearly out of money,” he told WUKY. “It’s important for people to understand. This isn’t just like a potential or it’s hypothetical. There literally will be no checks going to retirees in a very short number of years, within the lifetime of all those that are working now and many of those that have already retired.”

Actually, the lowered expectations did absolutely nothing with respect to the pension debt Kentucky has.

The pension promises are what they are. What they ultimately cost the state in money over time will become apparent as experience unfolds.

All that has changed is the estimation of what that ultimate cost will be.

(oops, sorry, I see the funded ratio here is 14%. Those numbers do move around.)

I expect this will get more heated as the special session comes into being. There will be those who will say these lowered valuation assumptions were exaggerated, to make it more politically palatable to cut benefits, raise taxes, and do other drastic moves.

There will be those who will say it’s the eeeeevil hedge funds at fault! Get them!

There will those who point to some iffy transactions between the Governor and a (now) pension board member.

I would definitely keep an eye out for more people trying to improve returns by boosting investment in alternative assets.

There are reasons to be suspicious of that, especially for public plans.

Related Posts

Calpers Myths vs. Facts: Page is Gone But The Internet is Forever

Happy Pension News: Wisconsin State Pensions...a Beginning

Connecticut Pensions: Pushing Off Payments Til Later Ain't Reform