Geeking Out: Testing Kentucky ERS to Death

by meep

I’ve been playing around with my Public Pension Cash Flow Projection tool, and I want to work through my list of vulnerable public pensions.

The list, where all cash flows are held constant going forward (the year is when the assets run out)

1. Chicago Municipal Employees, 2024

2. Kentucky ERS, 2024

3. Milwaukee City ERS, 2024

4. New Jersey Teachers, 2024

5. Cincinnati Employees Retirement System, 2028

6. St. Louis School Employees, 2028

7. Detroit Police and Fire Retirement System, 2029

8. Denver Schools, 2030

9. Minneapolis ERF, 2030

I already ran through the Chicago Municipal plan in two separate posts.

Let’s do the same to Kentucky ERS!

KENTUCKY ERS: AWFUL CONDITION

As noted in the prior post, Kentucky ERS looks awful even in the baseline:

Kentucky ERS didn’t show up in my list of my “endangered pensions” when I matched recent trends… because they’ve really been ramping up the contributions.

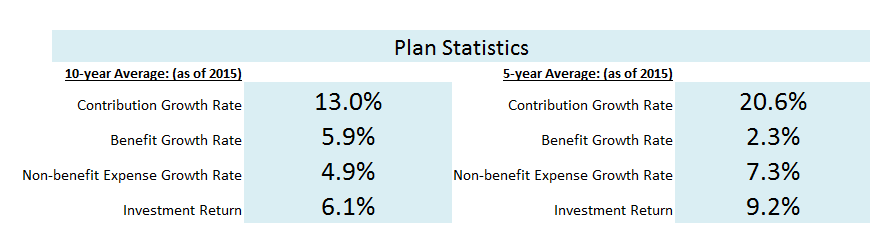

Here are what recent stats for Kentucky ERS look like:

Yes, the recent benefit cash flows have slowed in growth rates. But the contribution growth rates…. those look unsustainable.

But keep in mind, up until recently, Kentucky ERS hasn’t been making full contributions:

So perhaps that big step up in contributions will have slowed.

I will be posting about more recent info from the Kentucky pension systems, but at this point, I’m going to stick with the info that goes up to FY 2015.

FWIW, the funded ratio was 22% at the end of FY 2015.

Chicago Municipal Employees was at 33% fundedness at that time. And yet they came in as failing first. Just something to think about when you consider fundedness ratios.

VARYING ASSET RETURN

As a quick reminder, I have 4 different cash flows: investment income, contributions, benefits, and non-benefit expenses. To do my simulations, I hold the expense level constant and then vary the growth of the others (assuming them at constant percentage rates).

Then I see what year the pension fund runs out of money.

So here are some results.

VARYING INVESTMENT RETURNS

As with Chicago MEABF, I will look at failure years with three different investment returns: 10% per year, 7%, and 0%:

10%:

7%:

0%:

So this past week, I read Kentucky ERS faces insolvency within 5 years:

Kentucky’s retirement system faces a funding shortfall across its pension systems of $33 billion, and could face insolvency in just five years, according to an audit report from the PFM Group.

“If the commonwealth reverts to the pattern of underfunding the system that it followed from fiscal year 2004 to fiscal year 2014,” said the report, “we project that the [Kentucky Employees Retirement System] fund will be depleted by fiscal year 2022.”

The report said that, based on alternate return assumptions for a 10-year investment horizon and increased liquidity requirements consistent with an updated KRS policy, the unfunded liability would rise to $42 billion. The audit also cited the state’s last-place ranking by Standard & Poor’s with just 37.4% of total current obligations now funded, compared to a national median of 74.6% as of fiscal year 2015, the most recent period reported by S&P.

Looking at my own projections, failure by 2022, or 2023 (or even earlier) is definitely within the cards.

Looking at the stats, benefit cash flow growth has been at about 2% per year for the past 5 years. Even at that level, I have return and contribution growth scenarios where that occurs.

SURVIVAL CONTRIBUTION GROWTH RATES

As with MEABF, I’m going to look at the contribution growth rate needed to make the pension fund to survive past 2040.

Given the history of benefit cash flows, I’m going to test at two benefit growth rates: 2% per year and 4% per year growth rates. I will assume 0% expense growth rate and try different investment returns from 0% to 10%.

This is the result:

Not too bad, in terms of contribution increases. Definitely not as bad as what Chicago MEABF requires to survive, but I think part of this is the ramp up in increased contributions for Kentucky ERS has already occurred…and it’s barely getting there in Chicago.

But these are very simplified assumptions, with constant growth rates in everything.

If the benefit cash flows grow faster (they could), the investment get negative returns (they have in the past), and contribution increases falter — yes, Kentucky ERS could be out of assets within 5 years.

You can check out the spreadsheet yourself in which I did these calculations, and play around with these simplified assumptions yourself.

Related Posts

Kentucky Update: Republicans Take Legislature, Pensions Still Suck, Hedge Funds to Exit

Public Pensions Watch: Choices Have Consequences

Did New Chicago Mayor Brandon Johnson Inherit The Worst City Pensions in the Country?