Starting the Year Off Right: Lawsuits Over Kentucky Pensions

by meep

There are two sets of lawsuits here – one set originating from a single person who has been pursuing this for years, and one lawsuit newly filed (December 27, 2017).

SUING OVER ASSET MANAGEMENT AND GOVERNANCE

There are multiple news stories on this, so I will quote a few.

Bloomberg: KKR, Blackstone Sued by Lerach Group Over Hedge Fund Returns

Kentucky suit cites poor results, excessive hedge fund fees

Disbarred class-action veteran Lerach is advising plaintiffsKKR & Co., Blackstone Group LP and their founders are accused of failing to deliver hedge-fund returns as advertised, in a Kentucky lawsuit that could preview new legal challenges for managers of alternative investments.

The lawsuit was filed on behalf of state taxpayers and the Kentucky Retirement Systems’ pension plans by a group whose lawyers are advised by William Lerach, a now-disgraced, former class-action lawyer who once sent shivers through corporate boardrooms for his brass-knuckled negotiating tactics.

The plaintiffs, including a retired state trooper and a firefighter, allege that the big asset managers misrepresented expensive and risky “black-box” bundles of hedge funds as safe ways to generate high returns. Instead, those investments contributed to the pension system’s virtual insolvency, the plaintiffs said, while the managers pocketed excessive fees.

Okay, there’s a particular slant here. Let’s check out why William Lerach was disbarred:

Before leaving his law practice in August 2007, Lerach was a partner in the San Diego-based firm Lerach Coughlin Stoia Geller Rudman & Robbins, now known as Robbins Geller Rudman & Dowd. He had founded the firm in 2004 as a spinoff from Milberg Weiss Bershad Hynes & Lerach; the latter firm was subsequently indicted in 2006 for paying kickbacks to clients in its class action securities lawsuits,151617 a scheme in which Lerach would later be alleged to have taken part.

…..

Lerach pleaded guilty to one felony count of conspiracy to commit obstruction of justice and making false declarations under oath related to his involvement in the Milberg Weiss kickback scheme.25 On February 11, 2008, he was sentenced to two years in federal prison, two years’ probation, fined $250,000, and ordered to complete 1,000 hours of community service.26 He was imprisoned at the Federal Correctional Facility, Safford, Arizona. The final two-and-a-half months were spent in home confinement following stints in the Arizona federal prison and a halfway house in San Diego.27 His license to practice law was suspended in December 200828 and on March 12, 2009, he was disbarred by the California State Bar.29 He was officially released from custody on March 8, 2010.30 Lerach’s former Milberg Weiss partner, Melvyn Weiss, was similarly sentenced in early June 2008.31In an interview following his release, Lerach offered his thoughts and opinions that possible political motivation and the timing of his indictment could have been likely factors in his prosecution. He also stated that his firm’s modus operandi was generally accepted legal practice regarding lead plaintiffs in class action lawsuits.3233

Hmm. But let’s find a different source, that may not focus quite so much on the Lerach angle.

Insider Louisville: KRS pensioners sue hedge fund giants, financial advisers and former leadership for crippling Kentucky’s pension system

A major lawsuit was filed Wednesday against several private equity companies and the current and former advisers, trustees and officers of the Kentucky Retirement Systems, alleging that the pension plans’ assets were heavily depleted through a civil conspiracy of disastrous investments in risky “black box” hedge funds and breaches of fiduciary duties.

The 146-page complaint was filed in Franklin Circuit Court by eight current and retired government workers covered by a pension plan within KRS, on behalf of the taxpayers of Kentucky and derivatively on behalf of KRS. The plaintiffs would not be directly paid damages in the lawsuit, but they are seeking billions of dollars in damages that would be deposited back into KRS, along with a court-appointed special fiduciary who would supervise such funds to make sure they are not misused again.

….

The complaint filed Wednesday largely focuses on the controversial $1.2 billion investment by KRS on a single day in August of 2011, when three international hedge fund sellers sold three different “black box” hedge fund vehicles — in which the investor knows little if anything about its content. The complaint states that these “risky, toxic” investments had poor returns that depleted the system’s assets, alleging how the private equity firm behind the worst performing hedge fund vehicle — the “Daniel Boone Fund” — used its influence to convince KRS to invest $300 million more into it in 2016.The giant hedge fund sellers listed as defendants in the complaint are KKR & Co., Prisma Capital Partners, Blackstone and Pacific Alternative Asset Management Company (PAAMCO), in addition to six top executives at these firms. The complaint accuses the companies of targeting the underfunded KRS with risky hedge fund vehicles while charging massive fees, which eventually reaped poor returns that hastened the collapse of KRS assets.

Oh, I have a comment on that in a bit. Here is a deceptive graph of how money was lost:

(If you don’t understand the deception, I’ll make it easy: nothing indicates cash gained in the “good years”.)

But let’s find yet another source.

Huffington Post: Hedge Fund Bets Bilked Kentuckians Out Of Their Pensions, Lawsuit Says

Three hedge funds allegedly benefited from decisions that helped impoverish Kentucky’s state pension system.

Years of risky hedge fund investments helped plunge Kentucky’s public pension system billions of dollars into the red, making it one of the worst-funded state pension systems in the country.

Now, eight current and former state employees are suing a trio of hedge fund operators and current and former members of Kentucky’s pension board, alleging that they breached their financial duties to the state and its taxpayers by sinking millions of dollars into “exotic” hedge fund bets.

The lawsuit, filed in Kentucky circuit court on Wednesday, takes aim at three hedge fund firms ― KKR/Prisma, Blackstone and Pacific Alternative Asset Management Company ― and their executives, as well as seven current and former members of the Kentucky pension board, the pension system’s former chief investment officer, and a consulting firm that advised the board.

Together, the defendants “chose to cover up the true extent” of the pension plans’ financial shortfalls and to “take longshot imprudent risks” in an effort to make up for the funding problems, the suit contends.

“They misled, misrepresented and obfuscated the true state of affairs … from at least 2009 forward,” the suit alleges.

Kentucky’s pension plans, collectively known as Kentucky Retirement Systems, hold savings for more than 350,000 current and former state workers. At the turn of the 21st century, the suit states, the system held enough money to cover all its obligations with $2 billion in surplus.

But over the ensuing decade, it lost more than $6 billion in assets. Today, it holds enough cash to cover just 37 percent of its obligations. The largest of the state’s plans, the Kentucky Employee Retirement System, has enough in assets to pay only 17 percent of its future obligations. The system as a whole is facing a nearly $27 billion shortfall, according to official figures. The lawsuit estimates the actual funding gap could be as large as $50 billion.

So it “lost” $6 billion in assets. How much in benefits did it pay out in that time? How much in contributions were made?

Two more pieces:

AP: Kentucky workers suing hedge funds to recover pension losses

BenefitsPro: Workers sue investment firms over Kentucky pension shortfall

WHAT BROUGHT DOWN KENTUCKY PENSIONS?

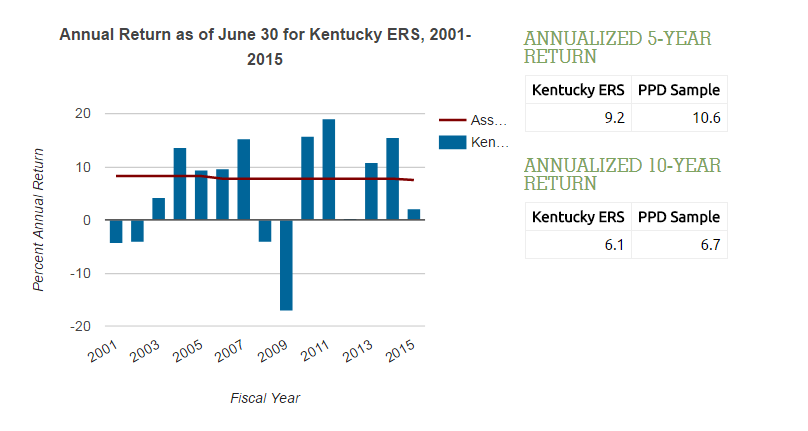

I will give it to the plaintiffs: Kentucky ERS funds have underperformed compared to peers.

I noticed this a year ago when I looked at Kentucky pension assets.

Now that was from a year ago, and the numbers through 2016 aren’t much better.

The 5-year average returns underperform by more than a full percentage point (that’s huge), and the 10-year average returns underperform by about 60-70 bps. But in 10 years, those differences can add up.

Using the 10-year average returns for 2016, Kentucky ERS got 5.0% over the period — so $1 billion would go to $1.63 billion at that rate.

But its peers got 5.7% per year — $1 billion goes to $1.74 billion.

Okay, that’s only a 7% difference in 10 years. That’s not why the funds are hurting so bad.

SIDELINE: BEWARE OF ALTERNATIVE ASSET CLASSES

It takes good governance and sound expertise to deal with alternative asset classes. Opacity does not inspire confidence.

As I pointed out in 2014, things can go south rapidly:

This isn’t something special about real estate, but the whole of real estate, hedge funds, private equity, and other alternative assets that public pensions pursue because they have a “plausible” case that these yield higher returns than publicly-traded stocks and bonds.

But it turns out, they don’t necessarily.

What they can do is lose a lot more than publicly-traded stocks and bonds rather rapidly, because their true value can be hidden in their illiquidity.

While that can be very abstract for many people, this is the part that’s not abstract:

“While the retirement fund suffered losses, Tettamant and the developers kept making money.

“The board awarded Tettamant $78,300 in incentive pay and a $25,000 bonus on top of his $270,000 salary in 2012, before board members became aware of the severity of the losses.

“Pension officials have kept Knudson’s company on to oversee the ultra-luxury homes as it tries to unload them. The fund has paid him more than $300,000 a year plus percentages of rental income and sales. As part of his job managing the homes, Knudson has lived in them.

“The fund has paid Criswell’s company a total of $3.6 million so far to consult on the Napa projects.”

This is why people like David Sirota and Ted Siedle have been focusing on the fees paid to hedge fund managers and the like (including the kickbacks such as nice trips to Napa for pension fund managers). That’s something people understand concretely — that those managing the funds may have incentives that are more about benefiting themselves than benefiting the pensions.

It doesn’t require outright fraud. It only requires not looking too closely at what one is investing in, because one doesn’t have much interest in looking very closely.

Let’s go back to the HuffPo piece and look at this:

Together, the defendants “chose to cover up the true extent” of the pension plans’ financial shortfalls and to “take longshot imprudent risks” in an effort to make up for the funding problems, the suit contends.

Yes, the hedge funds have underperformed, but the underperformance hasn’t cratered the Kentucky ERS assets.

THE EFFECTS OF DELIBERATE UNDERFUNDING

Years of underfunding has.

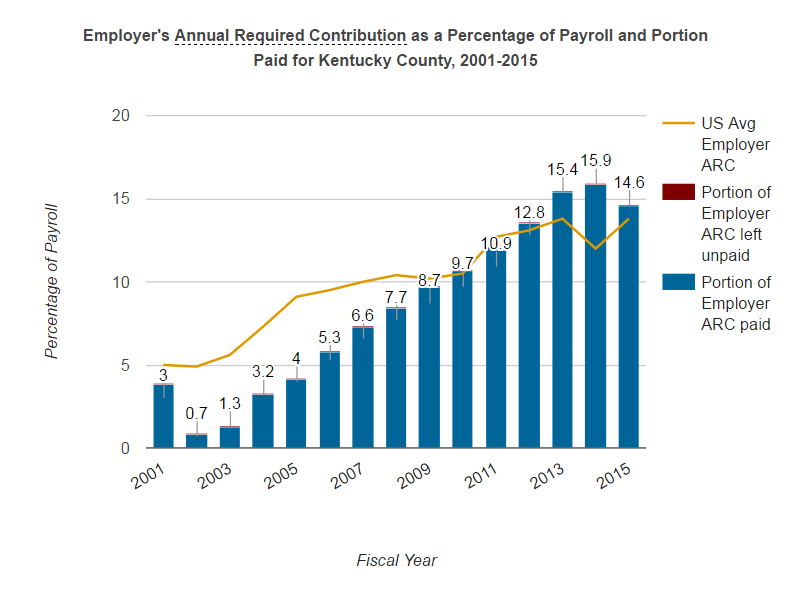

That graph shows how much was put into Kentucky pension funds versus what was “supposed to” be put into. Note that the County plan has always contributed at least 100% of what it’s supposed to.

The other two have not.

The hedge funds – and they are high for Kentucky ERS:

And were growing over time:

The teachers plan has not had a high allocation to alternatives, and it, too, sucks in funding ratios.

What the Kentucky ERS and Teachers plans have in common: years of deliberate underfunding, even with very rosy valuation assumptions. (The reason the County plans have dropped to less than 60% funded is the rosy valuation assumptions in addition to investment underperformance.)

So let’s go to the person who is suing over the real big problem Kentucky plans have: underfunding.

SUING OVER PENSION UNDERFUNDING

Meet the teacher who keeps suing the state of Kentucky to get pensions fully funded https://t.co/llRlxfoPBE

— Chris Tobe (@tobecb) December 31, 2017

Yup, not fully-funding pensions is signalling that the state is not intend to fully pay pension benefits. https://t.co/Y0TRmfIqq2

— Mary Pat Campbell (@meepbobeep) January 1, 2018

Let’s read about this lawsuit, as linked by Chris Tobe:

Meet the teacher who keeps suing the state of Kentucky to get pensions fully funded

FRANKFORT

Kentuckians will watch this winter as Gov. Matt Bevin and the General Assembly struggle with an estimated $41 billion public pension shortfall. Retirement benefits for public workers are likely to be cut. The rest of the state budget — education, social services, public safety — will get squeezed.Randy Wieck wants to know why everyone is just now starting to take this mess seriously.

Wieck, 63, teaches American history at duPont Manual High School in Louisville. Over the last four years, he has filed three lawsuits related to Kentucky’s teacher pensions in state and federal courts. Sometimes he challenged the state’s massive under-funding of the Kentucky Teachers’ Retirement System. Other times he fought to get KTRS to fully disclose its investments in higher-risk, higher-fee private equities — or simply to get out of those funds altogether.

So far, all of Wieck’s litigation has been dismissed by judges, gaining him nothing but a reputation as a malcontent at the state Capitol, with KTRS and among his own teachers’ unions, which he sharply criticizes for not doing enough to protect the retirement security of their members.

…..

Wieck said he can live with his unpopularity. He’s already preparing another state lawsuit to highlight the fact that the Kentucky legislature — for 10 of the last 11 years — paid many hundreds of millions of dollars less than the annual recommended contributions into KTRS. Largely as a result of this trend, KTRS now holds about $17 billion in assets, which is only 56 percent of what it’s expected to need for teachers’ future pension checks.“It’s not a mystery how we got here,” Wieck said in a recent interview.

“You try paying three-quarters of your mortgage for a few years and then see how the bank responds to you,” he said. “You try paying three-quarters of your restaurant tab and then walk out the door after dinner and see what happens. But the state of Kentucky thought nothing of paying three-quarters of what was due the teachers’ pensions for year after year. And we’re surprised there’s a problem now?”

Yup.

Let me make it even clearer.

Suppose you, as an employee, weren’t paid the full 100% of your paycheck promised via contract.

Instead, you were paid 60%, and the other 40% was a promise to make it up to you later.

I think it would be pretty clear there would be lawsuits all over the place, even criminal charges possibly.

That is essentially what employers are doing when they contribute only 60% of required contributions. They are underpaying the employees.

Of course, it’s worse than that — they use valuation assumptions so that the required contributions are a lot less than they would be if less rosy assumptions were used. So the employer is saying it’s paying 60% of what’s owed… when it really is paying 40% (or something similarly small).

And it gets worse every year.

The ultimate problem is that Kentucky (and many other state and local government employers) doesn’t want to pay the full price for its promises. The County plan, as noted above, has always paid at least 100% of “required contributions”.

But those required contributions were calculated assuming:

- certain investment returns (which the funds miss by quite a lot)

- certain increases in payroll

- certain mortality (and they had been using a really old mortality table until fairly recently)

I’ve written about it before, so I’ll just quote myself.

ASSUMING EVERYTHING IS CHEAP DOESN’T MAKE IT SO

But let’s ignore the exact calculations and think things through: when the assumptions are all off in the same direction – that is, they all say you have to pay less now than what actual experience has turned out to be – then yes, you can be making full required contributions every year and your funding status deteriorates.

It doesn’t require one year of awful investment returns to obliterate your funding status – if that were the case, most plans would be close to 100% again. We’ve had many years of very good results. The 5-year averages are about 9 – 10% annual returns (time-weighted)

It takes everything being off by just enough, all in the same direction, that the “experience losses” just compound. Your investment returns too low, your payroll growth too low, your retirees living too long, etc.

While mortality assumption was updated — who knows… that’s one of those “takes a long time to figure out if you’re wrong” sort of things. The return assumption may still be too high. Same for the payroll growth assumption.

And that’s why this happens:

The required contribution will keep climbing as each year you have losses.

Those are “actuarial losses”. The unfunded liability keeps growing as one keeps “underperforming” in the combination of investments, mortality, etc.

The problem is the state and county funds have been trying to chase returns with their use of alternative assets.

The alternative assets didn’t cause their crappy funded ratios – their crappy funded ratios caused the pursuit of investing in alternative assets.

AIN’T GOT THE MONEY OF?

I am interested in how these lawsuits play out, but it could be that they’re just dismissed. I don’t know – I’m not a lawyer. I do know that lawsuits are unlikely to make the Kentucky pensions better-funded – because you’re going to have to get buy-in from state taxpayers.

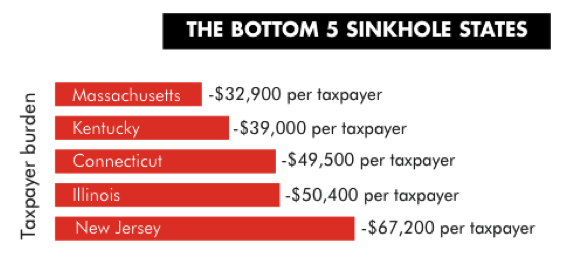

Kentucky is one of the 5 worst Sinkhole States, according to Truth in Accounting.

In Kentucky, total bills have increased by $7.7 billion while available assets have decreased by $362 million. The increase in bills is primarily due to the rise in pension liabilities. The plan with the greatest increase was the Teachers’ Retirement System, which saw their unfunded pension liability increase by $6.5 billion (26.6%), primarily due to changes in assumptions and a decline in investment income.

So here’s a question – that $39,000 per taxpayer burden is a point-in-time balance sheet item. It’s primarily pension debt, but it includes many other debt items.

So let’s say we’ll pay that down over time – let’s be “conservative” and say pay it down 30 years, at 5% interest. That’s about $2500 per year. And that’s assuming no additional debt is accrued.

What is the current tax burden in Kentucky?

Per capita individual income taxes: $1130

Per capita sales taxes: $710

Per capita property taxes: $737

Add them together and we get $2577 per capita (yes, this is per capita and the other is per taxpayer… I gotta go with the numbers I have….)

So if we want to add an addition $2500 per taxpayer per year….

That would be a really heavy lift.

This is just a very rough estimation – but every time I hear “We could just raise taxes more to cover increased contributions!”, I want to know what percentage increase it would actually take.

And how feasible it would be.

I don’t think a 100% increase in taxes is politically feasible.

Related Posts

Taxing Tuesday: Huzzah! Long Live the SALT cap!

State Bankruptcy and Bailout Reactions: No Bailout, Yes Bankruptcy Group

Mornings with Meep: Two Pension Stories and Skin in the Game