Los Angeles Teacher Strike: Pensions are a Driver

by meep

I will get to the pensions-specific aspect in a moment.

Here is the basic news of the LA Teachers Strike:

Head of Striking Los Angeles Teachers’ Union Aims to Resume Talks ‘Soon’

The head of the Los Angeles teachers union said he hoped to resume talks “very soon” as a strike that has interrupted classes for some 492,000 students in the second-largest U.S. public school system ticked into a third day on Wednesday.

More than 30,000 educators have walked off the job demanding higher pay, smaller classes and more staff, requests that the county’s independent school district has described as unaffordable. The two sides have not held formal talks since the strike began on Monday.

Los Angeles Mayor Eric Garcetti and California Governor Gavin Newsom, both Democrats, have urged the two sides to return to the bargaining table. The school system does not answer to either of the two executives.

….

Beutner said the district had offered staff increases that would cost $130 million a year – more than county officials have said is available – while the union’s demands would cost $800 million.

Beutner on Tuesday offered to accompany teachers in lobbying state lawmakers to increase education funding.

The union wants a 6.5 percent pay raise. LAUSD teacher pay currently averages $75,000, according to state figures. The district has offered a 6 percent hike with back pay.

I wanted to highlight the “both Democrats” part. This is not just a California thing — you will also be seeing such phrases in Illinois and New Jersey this year… and for the same reason. Because Democrats run everything in those states, in terms of the legislatures and governorship. And all three states have some serious financial weaknesses.

Mainly due to pensions… but even if the pension issue weren’t there, they still tend to overpromise/overextend for their tax base.

SUPERINTENDENT SPEAKS

Here is what the superintendent of the LA Schools wrote for the Wall Street Journal:

L.A. Schools Have a Math Problem

Here’s a problem that a high-school economics teacher in Los Angeles would relish under different circumstances: Farmer Bob has been growing potatoes for decades, but now the market is shifting, and Bob’s $8 billion business is losing nearly $500 million a year. Bob agreed years ago to provide his workers generous health-care and pension benefits in exchange for paying them lower wages. Bob’s employees have gone on strike, demanding more money and additional workers.

How does Bob’s farm stay in business?

As superintendent of Los Angeles Unified School District, I face the same question. Staggering pensions and health-care costs are battering public schools in California like a spring blizzard, while competition is drawing away students and money. Except that storms pass and this financial crisis isn’t going away anytime soon.

….

The teachers union’s demands would cost an additional $3 billion during that same three-year span. That would end one way: bankruptcy and a state takeover of the school district, which would be catastrophic to everyone involved. The 2012 takeover of the neighboring Inglewood Unified School District resulted in substantial layoffs and frozen wages.

….

In our most recent proposal, we offered to give teachers a 6% raise and to add 1,300 educators. This is more than the independent, state-appointed fact finder recommended in his December 2018 report.To get the money to boost wages further and hire more teachers, we need to end the strike and unite to increase funding for our public schools.

—-

Mr. Beutner is superintendent of the Los Angeles Unified School District.

So, the superintendent is also asking for more money for LA Schools. But he can’t exactly control that. He can ask for that. But…

THE PENSION DIMENSION

This is hardly surprising.

WSJ: Unions in La-La Land

The 33,000-strong L.A. teachers’ union went on strike Monday as the Los Angeles Unified School District (LAUSD) slouches toward insolvency due to unaffordable labor contracts. Despite a putative $1.8 billion reserve, the district is spending about $500 million more each year than its annual revenues and will be broke within two years, which could prompt a state takeover and bankruptcy.

Los Angeles teachers earn on average about $75,000 per year — about $6,000 less than the statewide average — though compensation including health and retirement benefits exceeds $110,000. One problem is the region’s high housing costs make it harder to retain teachers while more and more money is diverted to benefits and pensions.

….

Nearly all California school districts are also being squeezed by rising pension payments that the state Legislature has mandated to shore up the California State Teachers’ Retirement System (Calstrs). School district pension costs have more than doubled since 2014.Recall that in 2012 public unions and Democrats championed a tax referendum to soak the wealthy — putatively to raise money for schools. Voters in 2016 extended the tax hike through 2030. Well, state K-12 spending has increased 70% since 2012, yet pensions have swallowed the tax windfall.

It’s not just the WSJ mentioning this.

Washington Post: Strike or no strike, pensions problematic for LA schools

Strike or no strike, after a deal is ultimately reached on a contract for Los Angeles teachers, the school district will still be on a collision course with deficit spending because of pensions and other financial obligations.

School systems across California are experiencing burdensome payments to the state pension fund while struggling to improve schools.

The problem is especially acute for districts like Los Angeles Unified that will see a financial hit in part because of steadily declining enrollment.

As fewer students enroll, public schools get less in per-pupil funding from the state, said Helen Cregger, an analyst and vice president at the financial services company Moody’s.

….

The LA district’s contributions to the state’s two large pension plans — California State Teachers’ Retirement System and the California Public Employees’ Retirement System — amounted to about 5.5 percent of the budget in the 2014-15 school year. By last year, that number had climbed to nearly 8 percent, according to an Associated Press analysis.

FYI journalists needing some help with regards to this 2.5 percentage point increase: this represents a 45% budgetary increase (assuming that the overall budget didn’t increase… so if it increased, the percentage increase is even larger)

David Crane, president of the advocacy group Govern for California, said there’s nothing an individual school district can do about its rising pension costs. He said state aid — like a plan that new Gov. Gavin Newsom introduced Thursday in his budget proposal — could reduce the burden for districts, though.

State aid. Hmmm. Let’s see what Gavin Newsom mentioned.

Newsom, a Democrat, wants to make a $3 billion one-time payment to California’s teacher pension fund on behalf of schools to help districts that are seeing more of their budgets eaten up by pension obligations.

Okay, is that a real payment or a pension obligation bond “payment”?

Also: what exactly is the Calstrs hole?

I’ll get that back to a bit in a moment, but I wanted to grab this from the WaPo piece:

Since 2014, California schools have been required to contribute an increasing amount of money to secure the pensions of current teachers and to pay down unfunded liabilities for retirees.

In 2013, schools put in 8.25 percent of a teacher’s earnings to help fund pensions. That rate will more than double to 19 percent by 2020.

Ah, a journalist who knows to compare the rates appropriately.

So, again, assuming the payroll base doesn’t increase (ha ha), the pension contributions would have to increase 130% from the 2013 rate.

THE STATE OF CALSTRS

I’ve written about Calstrs before, but mainly about the divestment inanity all the Californians (and New Yorkers and…) are caught up in.

Here is where I noted David Crane for an 80% hero, but let’s see what I saw about Calstrs then:

‘Lawmakers in June [2006] rejected Crane’s appointment to the teacher retirement board by Schwarzenegger, after he had served almost a year. State Senate leader Don Perata (D-Oakland) said the job of trustees is “only to protect members’ benefits” — not to worry about the long-term effects of the benefits on the state budget.’

Okaaaaaay, then.

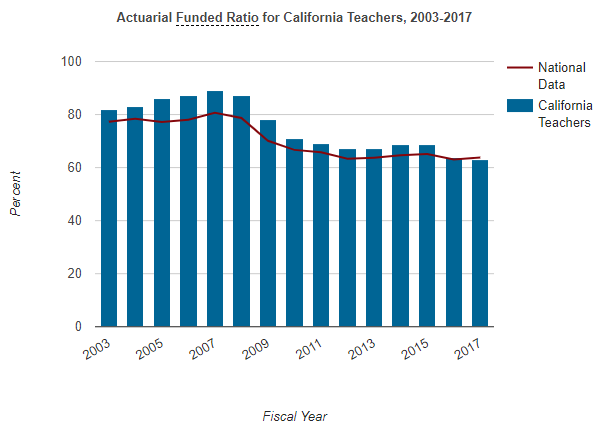

That was ten years ago. How’s the funded ratio doing now, guys?

In 2006, the plan was 87% funded.

In 2015, it was 69% funded.

A drop of almost 20 percentage points.

So, I wrote that bit a few years back. I also noted the gross underfunding pattern Calstrs had.

Would you like to see the current numbers?

Funded ratio: 63% for FY 2017

This contribution pattern may give an idea of what’s up:

It will surprise nobody that even the elevated 2020 amount noted is still significantly less than the Actuarially Required Contribution.

This is ugly.

MORE LA STRIKE NEWS

- L.A. teachers bask in support for strike, but pressure grows to settle amid financial losses

- The Latest: Los Angeles teachers strike enters 3rd day

- Los Angeles teachers union hints at new talks during strike

- New teachers group joins Los Angeles educators in strike

- Teachers strike at L.A. charter schools too, a first for California

- Los Angeles Teachers Strike For Smaller Classes, More Nurses And Librarians

I don’t envy any of the negotiators. Y’all don’t have many levers.

As in – when the person looking at the money sees there’s not enough money there, and you’re shouting MORE MONEY! Well. That person can’t even meet what you’re asking for.

And a lot of the reason that is so is due to decisions made decades ago to deliberately underfund the teachers pensions.

Related Posts

GameStop Follies: Hedge Funds, wallstreetbets, and Public Pensions

Taxing Tuesday: The SALT Cap Battle Continues

A Proposal for Public Pension Reform: The Idea and Coming Attractions