San Diego City ERS Has No Business Giving Out 13th Checks

by meep

It was brought to my attention that there was a record level 13th check given out to San Diego City (as opposed to county) retirees.

‘13th check’ bonus for retired city employees hits record again

More than $6.7 million went to retired San Diego city employees at the end of November in the form of a “13th check,” setting yet another record for the holiday bonus program.

The payments, which go beyond city pensioners’ usual 12 monthly payments, ranged from $17 to $2,023 each.

The San Diego City Employees’ Retirement System, or SDCERS, reports that more than 9,700 eligible recipients — another record high for the three-decade-old benefit— received a check that averaged $687 per person.

The “13th check” program was launched in 1980, when pension fund investments were doing well and city retirees had struggled through years of inflation. It has become a source of conflict as the city’s pension system faces a $3.1 billion shortfall in promised payments, which remains a taxpayer burden and has led to City Hall budget crises in the past.

Yes that $3.1 shortfall (not in contributions, but balance sheet) is quite big… isn’t it?

Hmmm. exactly how funded is this plan?

SAN DIEGO CITY ERS PENSION NOT IN A GOOD PLACE

I am going to walk you through the San Diego City ERS plan info.

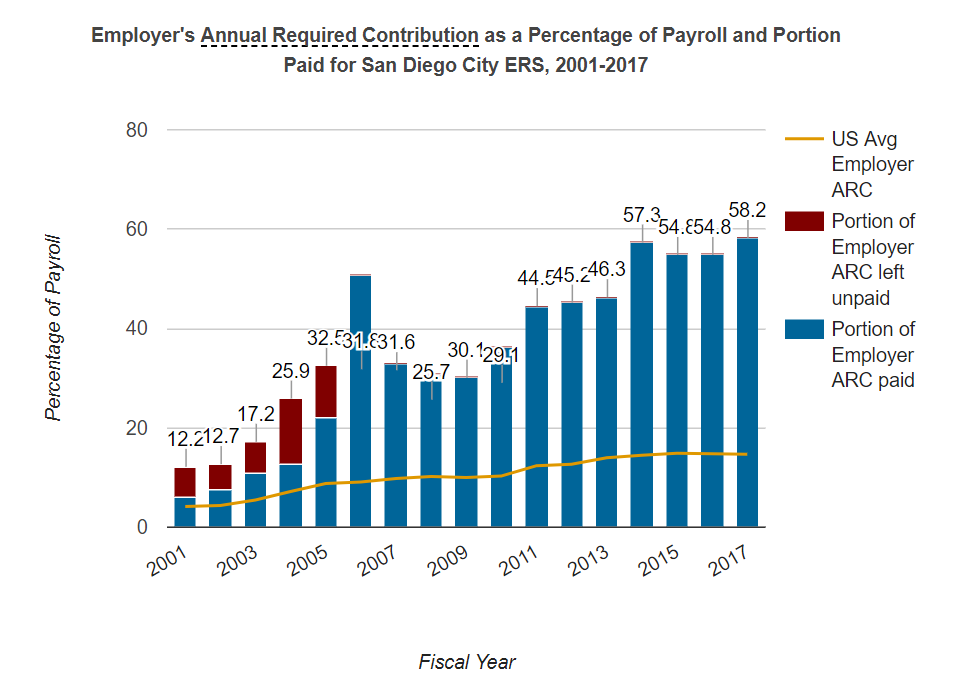

Let me start with the required contributions. Brace yourself. This is the “required contribution” – that is, the part that covers the new benefits accrued (i.e. retirement benefits earned due to work done in that fiscal year) plus a portion of the unfunded liability (i.e., paying off a bit of the benefits that were earned years before, but weren’t sufficiently contributed for.)

You ready?

58% of payroll.

Holy shit.

That’s insane.

Even Police & Fire pensions, which tend to have high contribution rates (for a variety of reasons) tend to have rates far below that.

See that yellow line waaaaay below the blue bars? That’s the average ARC as a percentage of payroll, and nationally, it’s about 15% for peer pension groups. 58% is insanely high.

So… why is the ARC so high?

Let’s check that out, shall we?

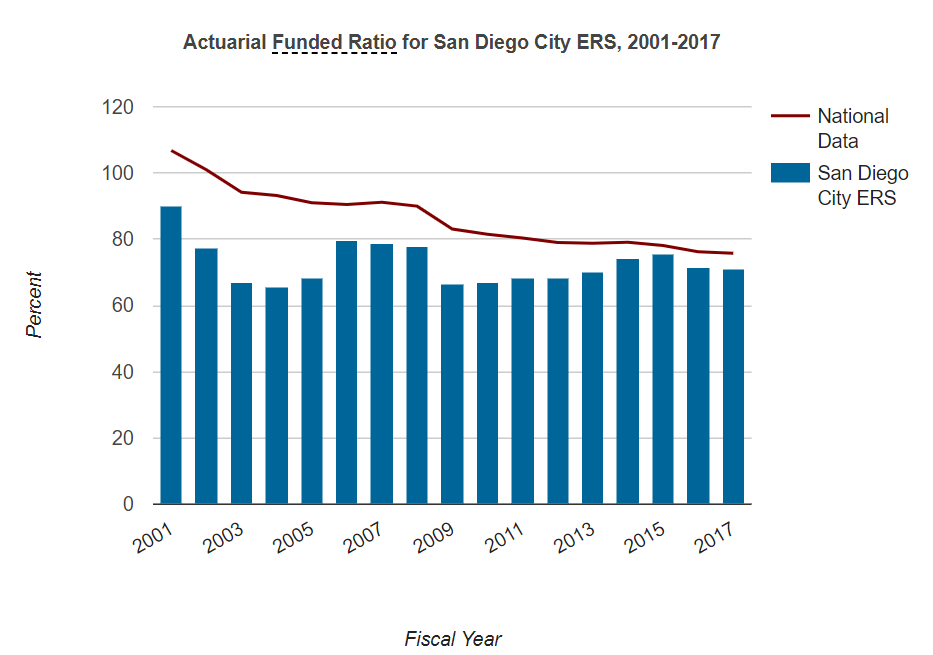

Here’s the funded ratio trend:

Ah, looks like this plan has been managed to the “80% is good!” standard. It wasn’t over 100% funded in 2001, unlike most public pensions in that year. And given they were in a weak position at the top of the market, is it any wonder that they were only 71% funded for fiscal year 2017?

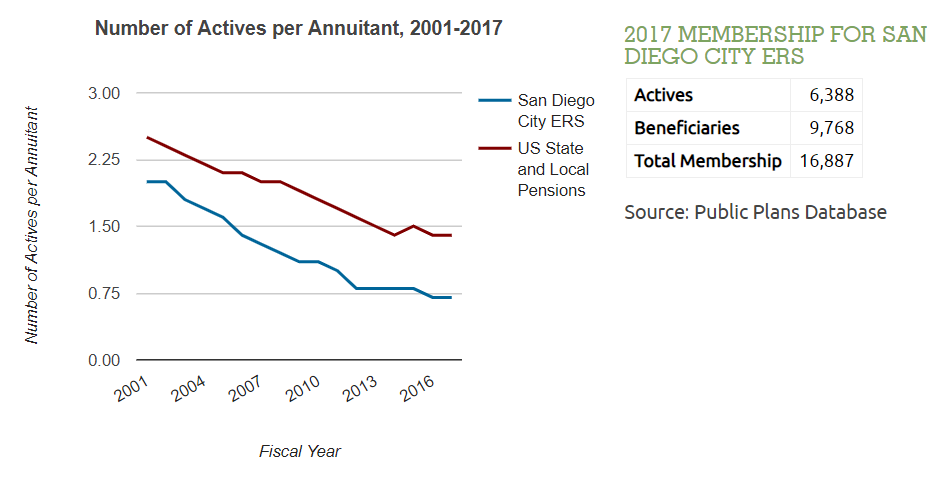

But here’s another nasty fact: the number of active employees compared to retired beneficiaries is pretty bad —

Retirees outnumber active employees by quite a lot, unlike public plans nationwide. Actives are only 70% of retirees, or, to put it another way, there are 43% more retirees than active employees.

(If you didn’t understand that math, journalists… think why you don’t and how you might fix that.)

Separately, I will note that the assets are outperforming their peers:

Of course, the 10-year returns are much lower than the assumed returns used in pension valuations… so they’re really probably a lot less funded than 70%, if they used a more realistic discount rate.

But let’s get back to the news piece and see why 13th checks were paid.

ONE YEAR RETURNS LEAD TO 13TH CHECKS

Here’s the piece again:

According to Susan Youngflesh, associate general counsel, 13th-check payments are made only when pension fund investments meet certain earnings thresholds compared to agency expenses.

“When there’s sufficient earnings, members get this calculated benefit,” said Jim Baross, president of the City of San Diego Retired Employees Association. “It’s certainly helpful around the holidays. Some years we don’t get it, and that’s a hardship for folks.”

You know what will be a real hardship?

NOT GETTING YOUR FULL 12 CHECKS TO BEGIN WITH.

Ahem.

This is a long-term liability. San Diego has actually been a bit more conservative in setting the assumed return on assets than other California plans – I see the FY2017 assumed return was 6.75%.

I don’t know the trigger for those 13th checks, but if you were assuming a 7% return, say, the point was that up and down years would offset.

But say you earn 8% one year… so you give the gains away that year? What about hedging against the down years that will surely come in the future?

It seems to me that if you’re assuming a return of 6.75%, the trigger for “13th checks” should be extraordinary returns … say 40% in a year or so.

And no, I’m not joking.

If you don’t want variability in your payouts, then you should have triggers that are far more extreme than merely exceeding the “expected” amount.

Checks have gone out every year since 1984 except for 2003, 2009 and 2012.

WHAT.

What does it take not to issue a 13th check? There was a huge loss in FY2009, and a minor loss in FY2008. Yes, there was a low, positive return in FY2012, but they didn’t get a check…

AND THERE WAS A SIMILARLY LOW RETURN FOR FY2016!

And yet they got a 13th check that year.

Do you understand how the supposedly well-funded Detroit pensions with their 13th checks got “whacked”? (and they weren’t whacked… much.)

And I don’t even know what’s going on here:

According to a 2004 review by the city’s Pension Reform Committee, the 13th check policy was awarding bonuses that were higher than some recipients’ benefits over the course of an entire year. City officials scrambled to place a cap on how much each person could receive, and the change resulted in a legal battle and subsequent settlement of nearly $10 million.

I really want to see what benefit formula they’re using.

Because really?

Anything less than 100% funded should result in no 13th checks.

Related Posts

Testing to Death: Which Public Pensions are Cash Flow Vulnerable?

Kentucky Pensions Even Closer to the Brink: New Assumptions, New Report

The California Rule Court Case: What Can Be Changed on Public Pensions?