Pension Quick Takes: Illinois Reactions, Quick Fixes to Illinois Pensions Disaster, and Coming Attractions

by meep

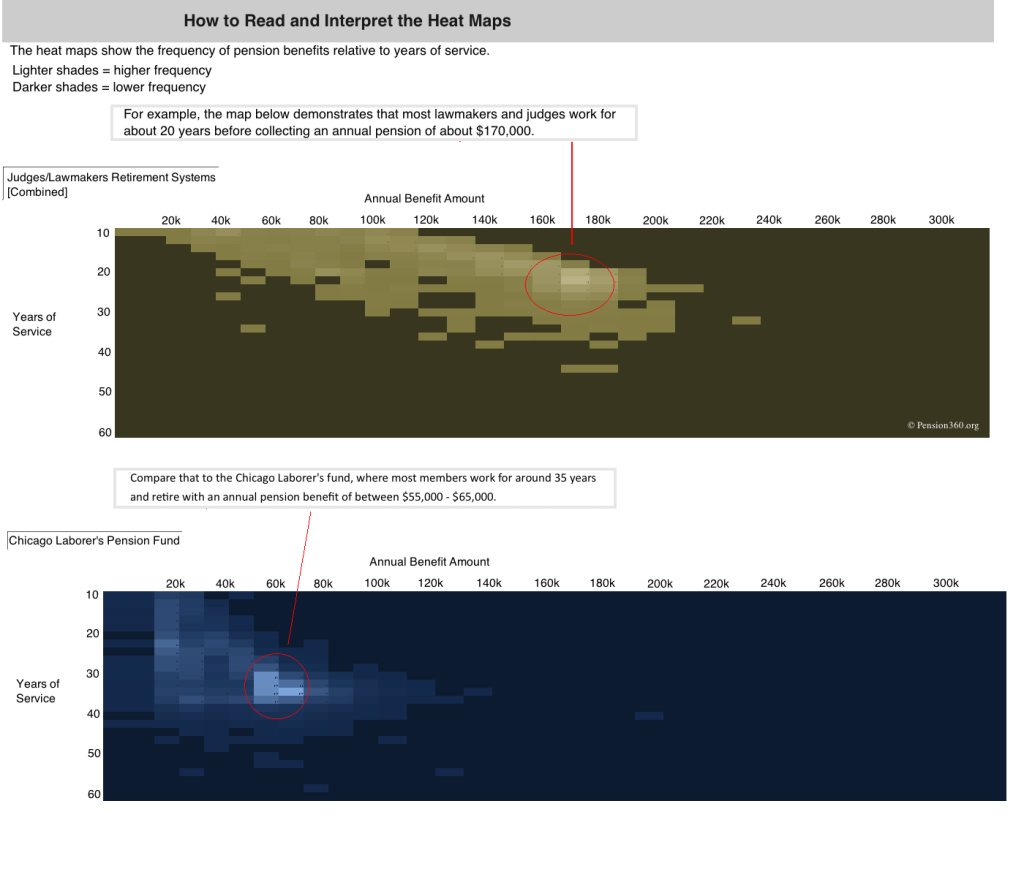

First, one taste of things to come: a visualization of Illinois pension amounts

I’m trying to see if I can get the underlying data for some more number-crunching, but even if not, there will be stuff to say.

Now, thanks to my top referrers for the past week:

And what a week it’s been, eh? I’ve gotten a lot of hits this week, and it’s not much of a surprise as to why.

Here are some of the search strings that landed people at STUMP this past week:

- Illinois pension blowup=

- consequence of pension decision in illinois=

- city of chicago retiree benefits

- bank of america interest rate swap

- here is God’s plenty in Canterbury Tales

[how did that one get in there?]

So there have been lots of reactions. Let’s check some of them out.

MEGAN MCARDLE

McArdle titled hers Save the Pensions: No Sudden Moves, Please

That probably sounds reasonable to a lot of readers; after all, employers shouldn’t be allowed to renege on pay promises (except in bankruptcy). But Jane the Actuary, a frequent commenter here, argues that what should actually be at stake is not benefits that have already been accrued for past work, but those that will be earned in exchange for future work. Private employers are not allowed to take back benefits you already earned, and governments shouldn’t do this either. But private employers can tell you that the pension fund is closed and you won’t accrue any further benefits, or that benefits accrued in the future will be smaller. Should governments be able to do this too?

There are a few issues that we need to unpack here. The first is what, exactly, we owe to workers who have been at it a long time. Pensions are another form of compensation, like health care benefits or wages. But they’re a strange form of compensation, because they’re so heavily back-loaded. That can have benefits for both employer and employee (for example, in reducing turnover). But it also has very high costs. They reduce the mobility of workers, and can make a mid-career job loss catastrophic. Meanwhile, they create enormous difficulties for any employer who sees a shortfall in the pension just when the employer itself has fallen on hard times — as is apt to happen during a bad recession. The problems are even worse for states and local governments than for businesses. Many of the public pensions used lax accounting standards to hand out generous benefits far in excess of what their accrued investments will support.

The problem is, as John Bury points out in a post like this one, some of the worst pensions can’t cover current retirees with cash on hand, forget about accrued benefits for current employees.

When you’re having to cut pensions of current retirees, forget about employees being made whole on past service.

The problem with the “No Sudden Moves, Please” request is that the system is set up so that the only way one is allowed to adjust is when you hit catastrophe. That’s not a robust failure system.

WALL STREET JOURNAL

In an editorial titled Why Chicago’s Bonds are Junk:

Illinois’s domination by public unions has the state dancing on the edge of fiscal freefall. The state Supreme Court ruled last week that Springfield can’t alter pension benefits, prompting Moody’s this week to downgrade the debt of the city, its public schools and park district all to junk status. Now the Chicago Teachers Union wants to make another contribution to the collapse.

In May the union filed an unfair labor practice complaint with the Illinois Educational Labor Relations Board, accusing the school district of failing to bargain in good faith and rejecting mediation to reach a new contract. The union’s complaint? The school district wants teachers to chip in more for their pensions. The horror.

The dispute goes back to 1981, when in lieu of larger pay raises the district agreed to pick up seven percentage points of the teachers’ contribution of 9% of their salaries to their pensions. This is on top of the district’s own contribution. Teachers have since become accustomed to paying only 2% of their salaries for pensions, about $1,496 a year on average.

…..

Union President Karen Lewis called the city’s proposal “reactionary and retaliatory” because the union backed incumbent Rahm Emanuel’s challenger in the recent mayoral race. The better description is inevitable. The district faces a $1.1 billion deficit in the next fiscal year, the city’s teachers pension has an unfunded liability of $9.6 billion, and the district will have to make a roughly $700 million pension payment for teachers in fiscal 2016. Maybe Ms. Lewis can get one of Chicago’s teachers to do the math for her.

I wouldn’t bet on them being able to do that.

MARK GLENNON, WIREPOINTS

“We will just have to pay up.” That’s the conclusion many are now saying we must accept after the court decision invalidating Illinois pension reform.

No. We shouldn’t, we won’t, and we can’t.

….

They wallow in the sanctimony of a duty to honor obligations. That duty ends where ability to honor more important ones is undermined. Their opposition to the slightest reforms in any pension imperils even the smallest ones, which is all that will separate many pensioners from destitution. Total unfunded liabilities grow by tens of millions of dollars each week. Many pensions have less than a third what they need. Their chances of paying even the modestly sized pensions grow ever bleaker. Basic services and safety nets — core obligations of any modern government — go increasingly unmet while pension appetites grow ever larger.We are appalled by opposition to reform under the mantle of progressivism. The poor and middle class are ravaged most by the profligacy they defend. Their first victims were Chicago public school students. Property tax rates on some homes have reached confiscatory levels and rise with no end in site, especially on those with the least ability to pay. Waukegan, 5.5%. Harvey, 9%. Their homes have been seized. To the richest among us, they say “give us more money, you rapacious capitalists,” blind to the reality that they, the taxpayers we need most, are, in mass, changing residence or simply leaving.

We’re stunned that public unions, whose members are just five percent of the state’s population, captured so much control over a democracy and inflicted such harm. They’ve poisoned the work ethic and waged an exceptionally dishonest campaign against reforms and people who stand in their way. They’ve rigged a pension system so complex and so easily corrupted that sane fiscal management and informed oversight are impossible.

Actually, I can definitely understand how 5% can take over the government.

Heck, aren’t people whinging about the 1% all the time? 5% is five times more powerful!

INVESTOR’S BUSINESS DAILY

In the annals of catastrophic court decisions, the one reached late last week by the Illinois Supreme Court to invalidate pension reform in the Land of Lincoln is right up there at the very top of the list.

In 2013, the Illinois legislature and then-Democratic Gov. Pat Quinn — a friend of the public employee unions — enacted a law to try to rein in the costs of a government-employee pension system that today has an unfunded liability estimated at $128 billion.

The improvements were baby steps: putting new workers in a defined contribution system, slowly raising the retirement age and making gradual changes to cost-of-living allowances. But the court ruled these modest changes were illegal and, with a stroke of the pen, added tens of billions of new liabilities onto the shoulders of Illinois residents.

…..

Who does the court think will make up the $128 billion shortfall? Taxpayers, that’s who. The court said the legislature “made no effort to distribute the burdens evenly among Illinoisans” and could “have sought additional tax revenue.”Illinoisans already absorbed a record $30 billion temporary income- and business-tax increase under Quinn, with over half of the funds used to try to plug at least the short-term holes in the pension program.

The state is already one of the most overtaxed in the country, and citizens are leaving year after year to avoid high taxes and subpar services. It already has one of the worst bond ratings of any state outside California.

….

The Illinois pension catastrophe and the fiscally ruinous verdict by the courts should be a wake-up call for every other state to fix pensions immediately. At the very least it means bringing all new employees into fully funded 401(k) plans that don’t put future taxpayers on the line for liabilities that can never be met.Illinois, meanwhile, is now officially run by and for government employee unions and workers who are supposed to be “public servants.” In fact, the citizens are now the servants and union bosses the masters.

Well, if the people aren’t there to be taxed…. wait! I have an idea! Four ideas, even! (They’re other people’s ideas)

QUICK FIXES

“One neat trick” that fixes everything is a clickbait staple. I have found FOUR! quick fixes to the Illinois pensions blowup!

Fix one: Fire everybody

So if changes can’t be made, here is what Gov. Bruce Rauner should do: Lay off the entire state workforce, and close the pension system. Work with the General Assembly to open a different retirement plan for newly hired government workers, modeled after the nation’s most popular retirement vehicle: the 401(k). Then offer to rehire state workers under the new retirement plan.

It won’t be easy, and it won’t happen overnight.

State laws will need to be changed. Pension benefits earned to date will need to be paid.

The government unions will file lawsuits, and the legality of this strategy will be challenged. Understandably, some workers will turn down the new deal. Daily operations of state government will be disrupted — and potentially result in a government shutdown.

But even if all those things happen, the ultimate outcome will be better than what’s ahead if the state does nothing.

In fact, a government shutdown might be exactly what Illinois needs.

If you go to that piece, you’ll see a failure of “one neat trick” to fix costs:

In recent years, the state has attempted to save money by limiting the number of individual water bottles and water coolers bought for state offices. Many of these buildings have drinking fountains in the hall, so water coolers or individual bottles are unnecessary. But these savings never happened. Why? After AFSCME complained, an arbitrator sided with the union. The reason was appalling: It wasn’t because of health or safety concerns, or because there was anything wrong with the water from the fountains, or even a lack of water fountains. The arbitrator said that because the bottled water had been provided in the past, it could not be taken away. (Apparently bottled water, like pensions, cannot be diminished or impaired.)

I wonder what the supposed savings from that water would have been. I’m going to guess: minimal.

Fix two: CASINO!

Fraternal Order of Police President Dean Angelo on Monday urged Mayor Rahm Emanuel to impose a temporary property tax increase to shore up police and fire pensions that could be rolled back when the jackpot of revenue from a city-owned Chicago casino comes rolling in.

Fix three: Change the discount rate and/or go from asset-smoothing to market value:

- Most of the FY 14 jump in unfunded liability was due to those changes to assumed rates of investment return…

Despite the fact that the funds had great real-life returns…

During FY 2014 the total unfunded liabilities utilizing the actuarial value of assets increased to $111.2 billion from $100.5 billion in FY 2013. This equates an increase in unfunded liabilities of 10.6 % over FY 2013, due primarily to actuarially insufficient State contribution amounts and the lingering effects of the investment losses caused by the 2008 financial crisis. In FY 2014, market value investment returns for all five State systems were above the actuarially assumed rates of return, as shown below:

• TRS- 17.2%

• SERS- 17.5%

• SURS- 18.2%

• JRS- 16.8%

• GARS- 16.3%

- But…

While all systems earned positive returns on a market value basis, the asset smoothing approach, required by Public Act 96-0043, only recognizes 20% of the FY 2014 investment returns. FY 2013 was the last fiscal year that investment losses from the 2008 financial crisis were “smoothed” in the retirement systems’ annual actuarial valuations. With negative returns in the double-digits no longer being recognized, the investment gains of the last five years are now subject to smoothing. This has resulted in a cumulative market value of assets that is now higher than the actuarial value of assets, and therefore the funded ratio using the market value of assets is considerably higher than the funded ratio using the actuarial (smoothed) value of assets

Fix four, from the Actuarial Outpost: Reality show

Reality television show.

Three union members go on the show. The show’s host describes the full details of their benefits: how long they worked, their salary history, how much they contributed to their pension, how their pension benefits were calculated (e.g. spiking), OPEB benefits received, other benefits received at retirement (e.g. cashing out sick time), and the amount their benfefit would total assuming they lived a normal life expectancy for someone their age at retirement.

Each contestant defends their retirement package.

The audience votes on which member keeps his retirement benefit, and which two have their benefits reduced to the average private pension benefit for someone with their salary history.

Someone get Mark Burnett on the line!

COMING ATTRACTIONS

About that “quick fix” from Capitol Fax… sure, one good year will fix it all.

Until the next crash, oh sorry, “market correction”. Then they’ll remember why asset smoothing exists.

I think it’s cute when they point out only one good year for a decades-long pension. I’m working on a 30-year development of the behavior of these plans. I think you will find that one good year does bupkis.

Here is a foreshadowing (though using a Texas pension plan, my favorite bogey):

That Texas pattern is fairly common — gains from the late 90s leading to benefit boosts (wiping out all the investment gains) and then increasing underfunding in the past decade, just at the same time investments take a hit.

Related Posts

Tales of Pension Fraud: Hidden Deaths and Elder Abuse

Cook County Soda Tax: Persuasion and Comparisons - Why Not Tax Juice?

Chicago is a Big Ball of Bad Ideas