Chicago (and Illinois) Watch: Don't Think You Can Escape to the Suburbs

by meep

In my prior post, I wrote about migrations within the U.S., possibly driven by high tax burdens, but also high costs of living (related to the tax burden) and low economic growth (ibid.) I was simply looking at this at a state level, not smaller geographic units.

Via Wirepoints, I see the Illinois Policy Institute takes a closer look at Illinois migrations:

Here’s the catch: Taxpayers with the means and flexibility to leave Cook County can avoid the ever-growing tax burden by simply picking up and moving, which is what many have done for 20 years.

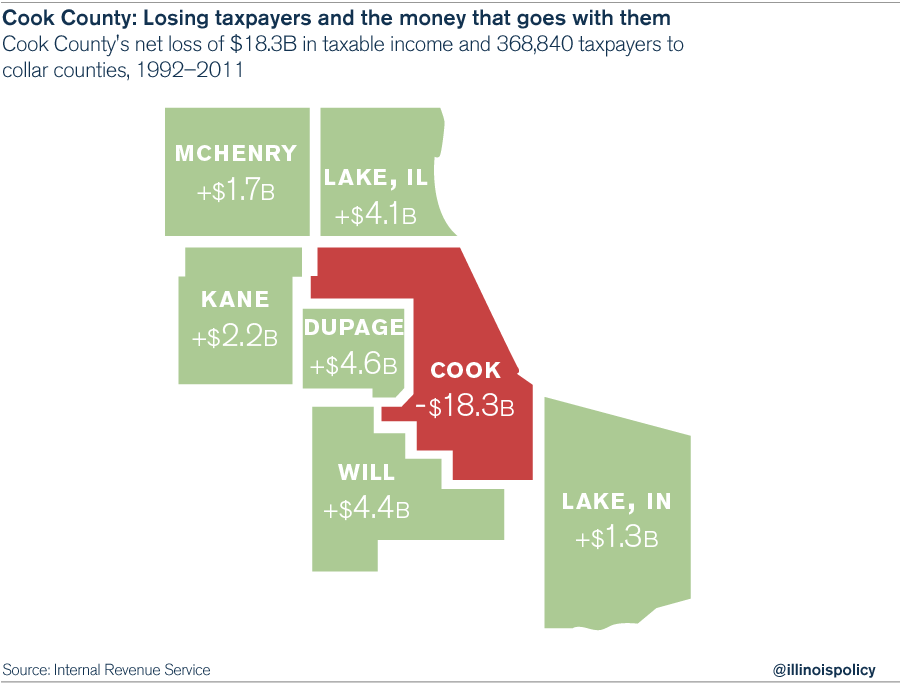

According to Internal Revenue Service data, from 1992 to 2011 Cook County suffered a net loss of 370,000 taxpayers to its collar counties and Lake County, Indiana. Those taxpayers took over $18.3 billion in taxable income with them when they left, creating an ever-growing hole in Cook County and Chicago’s budgets.

A review of the data shows the top six counties to which residents of Cook County have fled. It also reveals how much money those residents took with them:

- DuPage County won a net of 104,904 taxpayers who took more than $4.6 billion in taxable income with them.

- Will County won a net of 84,170 taxpayers who took $4.4 billion in taxable income with them.

- Lake County, Illinois, won a net of 67,906 taxpayers who took $4.1 billion in taxable income with them.

- Kane County won a net of 41,364 taxpayers who took $2.2 billion in taxable income with them.

- McHenry County won a net of 35,200 taxpayers who took $1.7 billion in taxable income with them.

*Lake County, Indiana, won a net of 35,296 taxpayers who took $1.3 billion in taxable income with them.And within Cook County, Chicago households are the worst off.

Not only are Chicagoans on the hook for the sales-tax hike, but they’re also on the hook for a mountain of debt and several nearly bankrupt pension plans, including those of the city, its sister governments and Cook County.

Here’s a nice graphic:

WHAT’S THE PERCENTAGE?

Now, again, we see a few contextless numbers here — as well as a little distortion. (I need to make a new category for contextless numbers)

For example, Will County is not receiving $4.4 billion more in taxes. It’s that households making $4.4 billion in taxable income moved there. Part of the point is that the income stays the same, but the tax rates differ, so talking about the tax hit may not be the proper analysis.

But, ya know, the IRS data should have the total taxable income for Cook County. What percentage of taxable income is this?

I am sympathetic to the IPI’s message, but let’s do this properly.

Here’s the IRS county-level tax stats. For some reason, I’m having trouble getting the 2012 data though it sounds like it should be available, but 2011 tax year data are here.

Downloading the spreadsheet, I see AGI for Cook County being $154.2 Billion, but also a taxable income of $108.9 billion. Using either as a denominator, $18.3 billion in taxable income leaving is a sizeable percentage. As these were the amounts in 2011, to get percentage change from 1992, I need to add back the amount lost.

So we can go with the taxable income for a 14% drop in taxable income in 20 years.

I assume these are nominal dollars, so this is a tremendous change.

BUT YOU’RE NOT OUT OF THE WOODS, SUBURBANITES

Nick Binotti at Reboot Illinois looks at some of the non-Chicago locales for pension debt pain:

Illinois pension debt at all levels causes trouble for state, city governments

Cuts. We all feel them. In some places, they run deeper than others.

Even my hometown of Oak Park, the land of the $37 million pool, is susceptible to cuts. According to the Better Government Association, Governor Rauner wants to cut the share of state income taxes distributed to municipalities through the Local Government Distributive Fund (LGDF) from 8% to 4%. So Illinois’ financial crisis has hit home for all of us, quite literally. Oak Park will indeed be hit hard by this measure. According to Voices For Illinois Children, this would specifically cost Oak Park a potential $2.5M for fiscal year 2016. And in a recent letter to the editor in my local paper, the author mentioned this, along with a myriad of cuts proposed by Governor Rauner that would harm working families, calling for residents to “stop the chop.” But this particular “chop” seemed a bit excessive. What on Earth could we innocent Oak Parkers have done to deserve such treatment from the state?

Good rhetorical, albeit loaded, question. What local expense has ramifications at the state level yet the state has little control over? Pensions! In my pension research, I am reminded of a few gimmicks the unions have used to “legally” inflate their pensions, thereby costing the state more money than it should. I wondered if my own leafy village was guilty of such behavior. Then I came across this clause in Oak Park’s District 97 budget regarding educational funding from 2002-03 that sheds some light on reaping what we have sown: 2X20 salary retirement benefits (a contractual commitment to increase retiring certified salaries 20% for each of the last two years of employment) are included with salary budgets. The cost of the salary benefit is $470,000 for 28 staff members.

Now, Oak Park is in Cook County, but this is not something limited to Cook County towns.

Back in May, I also covered such spiking:

To be sure, the school district that’s paying the penalty has less to play with for other things, but when it’s Other People’s Money, the answer is always to raise taxes. Not to stop doing the behavior in the first place.

The Chicago Tribune published a database of the penalties by school district, but that’s really for those who want to look up their own town, county, or district to see how much they’ve been getting soaked for.

They have a nice graph showing how these penalties have accumulated over time:

I made a nice little spreadsheet with the info in the article, and dug into some of the statistics.

Here’s the numbers for Oak Park, btw:

That penalty of about $3K per educator is actually lower than the average – whether mean or median.

High level statistics:

- The average penalty per educator was $5K

- There were a total of 7,618 educators involved – Looking at the 2014 CAFR, that represents about 15% of TRS retirees in the past decade

- That comes to a total of $38 million over about a decade of these penalties being applied

- This is very small compared to the about $60 billion unfunded liability for TRS — less than 0.1% of the UL

So yes, let’s get a grip — these penalties themselves are barely adding to the costs.However, the spiked pensions do have a cost. Obviously, a pension that is 10% higher than it otherwise would have been is boosting the liability by 10%.

The penalties themselves do not deter the behavior as they don’t fully reflect the extra cost of these benefits. These are in the state plans… and, well, let’s just puke out a few of my number-crunching on those:

- Teachers Retirement System

- State Employees Retirement System

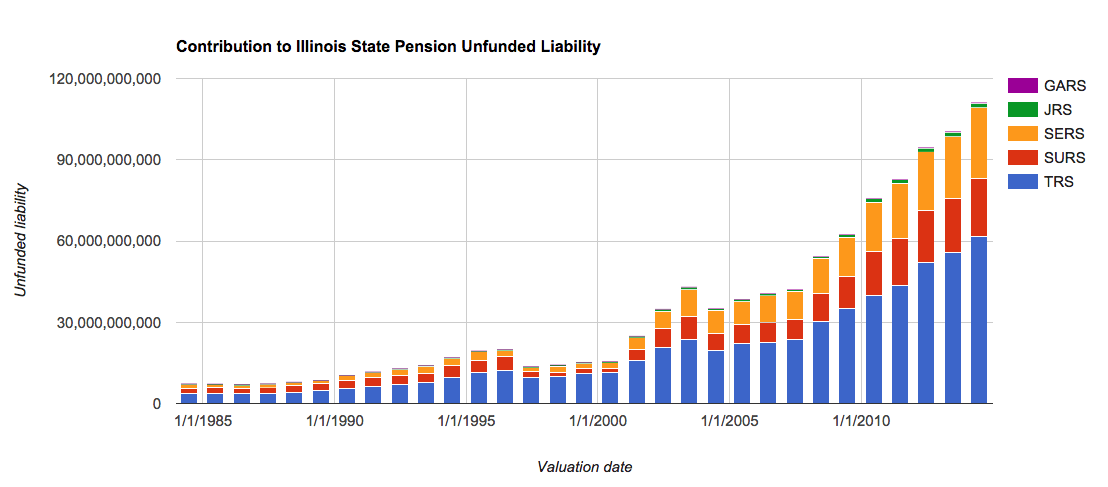

- Development of Illinois Unfunded Pension Liability

Those are ones with graphs, but I have a whole Illinois category to mine. Most of which is about the pensions.

PAIN IS STATEWIDE

Binotti may be looking specifically at his own town, and I’ve been having “fun” looking at Chicago’s implosion, but lots of the non-Cook County suburbs of Illinois are also getting hit.

Again, let’s look at that last post on unfunded liability:

A MATTER OF CHOICE

The Illinois state legislature chose to underfund the state pensions for decades. In every single year, going back to 1984, there was deliberate underpayment.

If I back out the impact of the 2004 pension obligation bond, the undercontribution history would look even worse than it does now.

And it’s still really bad, even if I do keep the POB in.

The pension obligation bonds did nothing for the pensions, other than to buy a little time by making the financial condition of the funds looks better while the overall state finances got worse.

Unfortunately for everybody involved in Illinois, it does not much matter the source of the unfunded liability at this time to fix the problem going forward. The only thing to note is that it’s mainly the result of deliberate choices on the part of elected officials, many of whom were elected with public union support to keep the gravy train going, and not just some bad investment results or too-high expectations of investment results (though that’s the number two reason).

If the state had required fully-funding the pensions all these years, even with too-high investment expectations, they probably would have been able to weather some of the resulting unfunded liability (and would not have escalated benefits, if they knew they had to pay for the increases in full).

But as we know, they didn’t.

This is what happened:

This is the entire state. The Chicago plans are separate.

As can be seen here, the largest contribution to the unfunded liability is the teachers plan:

But remember, the funded part of TRS is also the largest. It’s the largest fund, covering the most people.

GET OUT

You can google it yourself, but various people keep nattering about possibly bailing out Illinois. Via federal means.

HA HA HA

Yeah, good luck with that.

The most they may try for is Chicago, but even Detroit wasn’t bailed out. If Illinois gets its bail out, why not Rhode Island? New Jersey? California?

Those liabilities are so huge, not much can happen.

So the few things that a Illinoisian can do to try to escape the Illinois pension debt vortex is:

- Leave Illinois

- Divest yourself of Illinois Pension Obligation Bonds (I hope you’re not holding those anyway)

- Divest of Chicago bonds of any type, while you’re at it (really, you didn’t buy these, right? I don’t care how high the yields are)

- If you’re a state employee, make sure you have saleable skills for the private sector. The only job/career security is the ability to get another job.

Divesting of assets is the easiest move. As for career advice, I have found a lot of my teaching skills have transferred well to the corporate world. But you need to have an open mind. You’re not (necessarily) going to go to hell if you become a cubicle warrior.

But moving away from Illinois, especially if you’re from there and your extended family is there… yeah, that’s tough. I know lots of people who feel “stuck” in Illinois.

Just think about whether you can afford to stay. And whether you’ll die before the big bills come due.