Kentucky Pension Assets: Trends in ERS, County, and Teachers Plans

by meep

In my last Kentucky thread, I looked at a flurry of legislation the new Republican legislature had passed. They commented that they’d hold off on pension issues til the fall session, but that’s no reason for us to wait to look at things.

KENTUCKY PENSION ASSETS: OVERVIEW

I’m going to be a bit unfair to begin with, in combining the three Kentucky pension plans sitting in the Public Pensions Database. But don’t worry — I’ll break out the plans to each on their own before long.

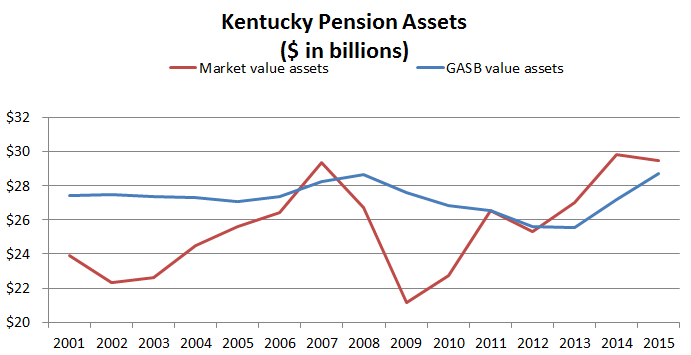

I’ve graphed two things here: the market value of the assets, and the “smoothed” value used in accounting (labeled GASB). I don’t have a huge issue with the smoothing (and I was being deliberately tricky in messing with the vertical asset to emphasize volatility).

But you can see why, for all sorts of reasons, “smoothed assets” are desired in showing the financial condition of pensions. It’s a bit scarier when you see the huge swings volatile assets cause. Push that thought back into your mind for a moment.

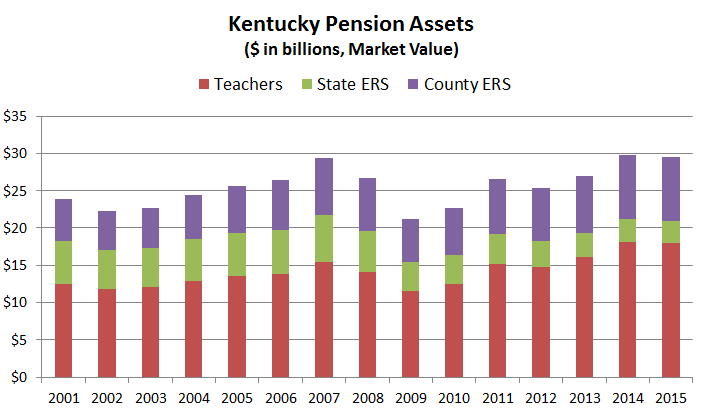

There are three plans: Kentucky ERS, Kentucky County, and Kentucky Teachers. If I split out the market value of assets graph by plan, you can see these three do not make similar impacts in terms of asset amount.

Teachers, unsurprisingly, make up more than the other two. This is because there tends to be far more teachers than any other category of government employee. If we look at the market value of the Teachers plan assets by themselves, it doesn’t look too bad:

Yeah, it went down, but the total asset amounts have recovered pretty well.

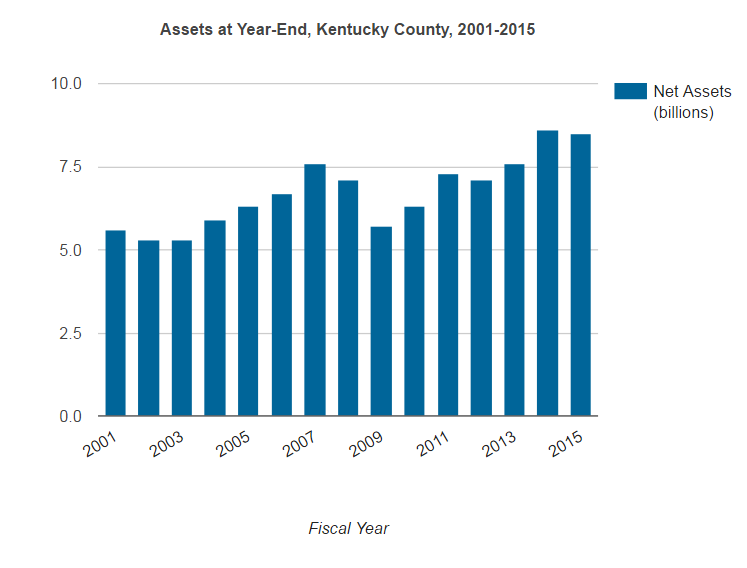

Similarly for the County plan:

Took a hit, and then recovered. Happened to lots of funds, not only pensions, so fine fine fine…..

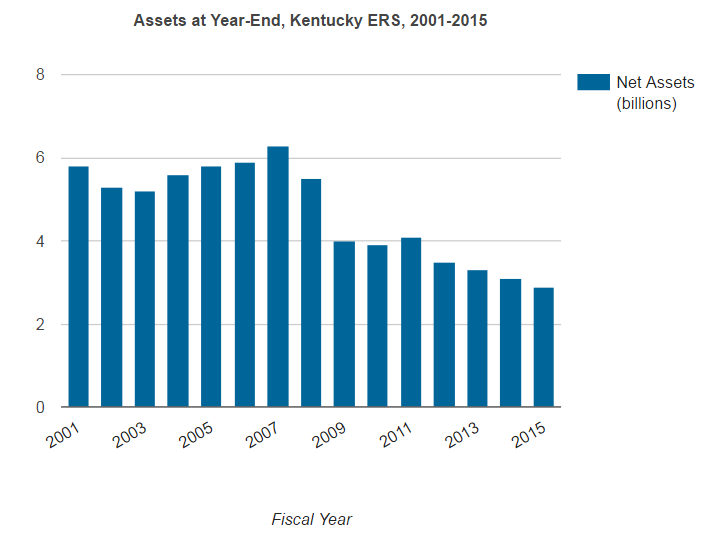

But wait — what’s this?

Ew.

That’s not fine at all.

KENTUCKY COUNTY PENSIONS: PLEASE DISASSOCIATE US FROM THOSE STATE PROFLIGATES

For a quick interlude, it seems that County & Kentucky ERS are managed together as funds. The above disparities may explain the following story.

‘We are tethered to the Titanic.’ Kentucky’s county pension system seeks to split from state.:

The Kentucky Association of Counties and the Kentucky League of Cities don’t want Gov. Matt Bevin or the Kentucky General Assembly to mess with the well-funded, solvent state County Employees Retirement System.

The two organizations especially don’t want the state to take money from the county retirement system, which represents about 75 percent of state pension system assets, to fix the more than $30 billion mess in state retirees’ pensions, according to state officials.

“It will be over our dead bodies if they take CERS money to shore up the system,” J.D. Chaney, deputy executive director for Kentucky League of Cities, said Wednesday at the December board of directors meeting of the Barren River Area Development District in Bowling Green.

The Barren River district, in a departure from previous years, hosted Chaney and Shellie Hampton, director of governmental relations for KACo, rather than the usual year-end meeting with local state House and Senate lawmakers to obtain insight about the 2017 legislative session.

Both Chaney and Hampton said the underfunding and structural problems of the Kentucky Retirement System could be taken up in a special session in 2017. The regular session is a short one.

Since 2013, when Senate Bill 2 passed, the county retirement system has seen its funding ratio increase and employer contributions trend downward, while the Kentucky Employees Retirement Systems has had a decrease in its funding ratio, the League of Cities noted in a position paper distributed to local officials.

“KERS is now the worst-funded system in the country,” the white paper stated.

That fact is not lost on Chaney.

“We are tethered to the Titanic. We have to break that chain,” Chaney said. “We are propping that system up.”

I’m deliberately being a bit cagey showing only assets in this post. We will see just how solvent the County plan is when we take a look at the liability side in a later post.

There’s no doubt the level of the County plan assets is better than that of the state plan.

DOWN DOWN DOWN IN A BURNING RING OF ASSETS

What Kentucky ERS is in is the infamous asset death spiral of pensions — assets not throwing off enough investment income to cover retirement benefits (and insufficient contributions coming in) mean assets need to get liquidated in order to pay benefits…. and it can end very, very poorly.

I wrote about Kentucky ERS before, two years ago…and that death spiral is just continuing.

But here’s the deal: both the County and the State ERS plans have their assets managed together. Something odd is going on in the Public Plans Database, though — when I pull info, these funds are being given the exact same investment returns (that’s not the part that confuses me); but different asset class allocations (huh?!) Maybe there’s some issue with the Public Plans Database, but I don’t know.

I will get back to that mystery in a moment — let’s think about why you can be managing assets for investments for one big pot, they’re both getting the same returns – and yet one recovers, and the other doesn’t.

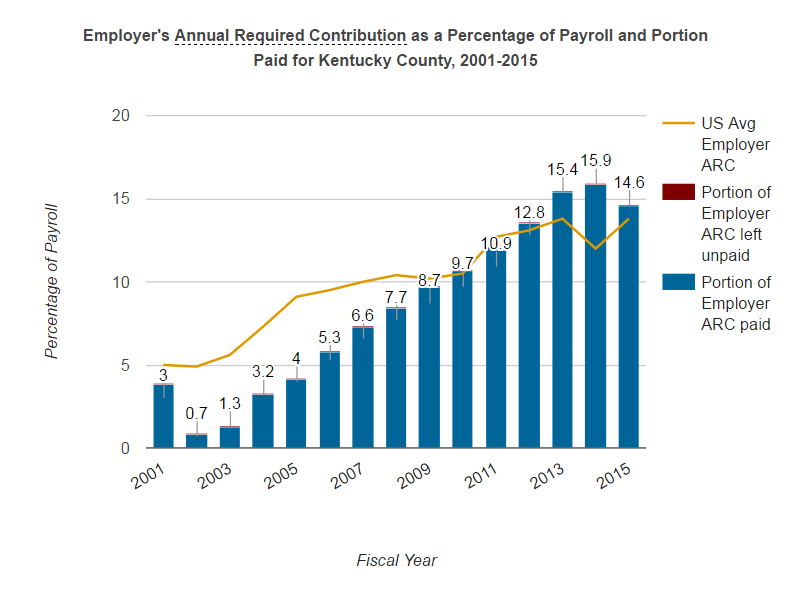

It’s the cash flows, duh — in particular, the County plans have made full, required contributions going back to 2001.

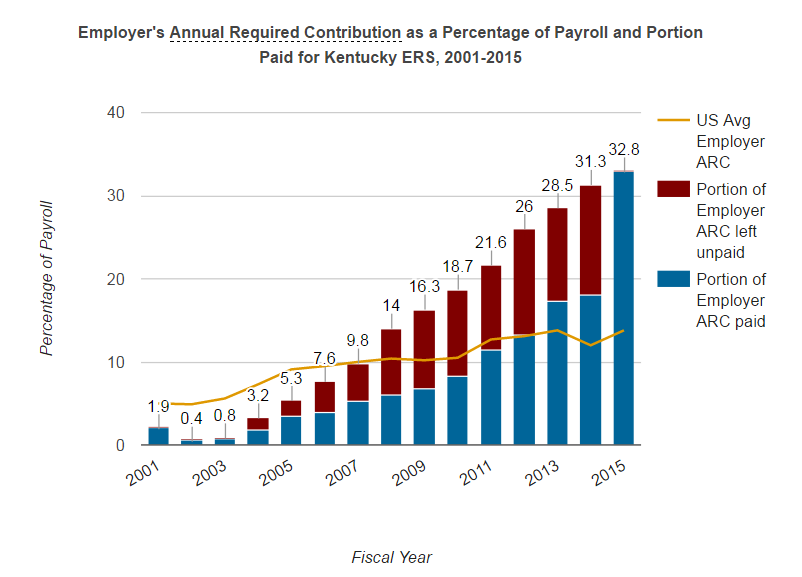

The Kentucky ERS…. has not.

They both have troublesome patterns of increasing required contributions, but we’ll get to that when we look at liability side issues.

If we look at fundedness levels, they both started out well-funded in 2001. But due to the hideous underfunding of ERS, it keeps falling behind — with contributions and returns insufficient to cover the liability outflows. So the asset amounts go down.

Again, just looking at asset performance issues, and not so much the liabilities or cash flows.

LET’S CHECK OUT INVESTMENT RETURNS

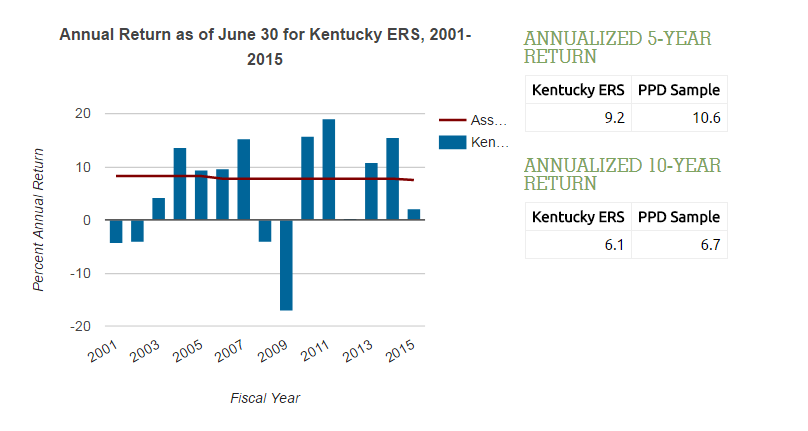

I’ll just take one cut at this one — the pattern isn’t much different between County/ERS and Teachers – the averages are a little different, but the 10-year average returns are essentially the same.

About 6% average returns. Decent… but in the long run really falls short of the current 7.50% valuation rate from fiscal year 2015.

And it falls really short of the 8.25% valuation rate in 2001 for County/ERS.

Interestingly, Teachers has been at a 7.5% assumption all along. Perhaps why it’s a bit more robust?

PENSION FUND GOVERNANCE

There were a bunch of pension fund governance brou-ha-has last year, which you can check out in the compilation of my Kentucky posts, and there are a few more things to note.

First, the governor had some consultants make a report on pension fund governance, with some recommendations that may raise eyebrows…. I started looking into it and… well… I don’t think it will fix much of anything for Kentucky.

The Kentucky pension funds, in terms of asset allocation (broad classes) and performance, haven’t really deviated from other public pensions of a similar nature. There’s something I don’t quite trust re: the pension database if County & ERS are showing different allocations, but the exact same returns every year…. but if they come from the reports…. I wonder about performance attribution.

But the main thing I note — the purely investment performance of the funds don’t seem any different than most other public pension funds. There may be iffy things going on in the asset management, but it seems to me there’s a really simple explanation for why Kentucky ERS is in an asset death spiral:

The state has been deliberately grossly underfunding it for years.

That has a huge impact, especially if one has been doing it for more than a decade.

There are lawsuits ongoing, I believe, regarding hedge fund use in Kentucky. Again, maybe there is something untoward going on there.

And maybe it’s simply politicians not wanting to deal with the reality of deliberate underfunding choices.

Related Posts

Nevada Pensions: Liability Trends

Kentucky Pension Blues: Let's Get This Fire Started

Around the Pension-o-Sphere: Mostly Kentucky, Some California, and Pew Rains on the Parade