Illinois Financial Disaster: Reactions to Budget Passed over Veto

by meep

There will be various people crowing about the financial disaster is over, it’s all Rauner’s fault, yadda yadda.

There will be people saying “Illinois Financial Disaster? What about Connecticut?” [yeah, I’ll be getting back to CT… later today for work.]

Not so fast. Let’s get the news.

GOVERNOR VETOES BUDGET, GENERAL ASSEMBLY OVERRIDES

Illinois finally gets a budget — but it’s still in big financial trouble

The two-year budget stalemate in Illinois is finally over — but the state’s daunting financial troubles haven’t gone away.

Cash-starved Illinois enacted its first budget since 2015 after the House voted on Thursday to override Republican Governor Bruce Rauner’s veto of the plan.

The Illinois Senate had previously voted on Tuesday to override the veto from Rauner, who fiercely opposed the 32% tax hike contained in the new budget.

…..

Despite the $36 billion budget getting pushed through, Illinois remains in a financial mess following decades of mismanagement and the recent budget fight. The state has racked up $15 billion of unpaid bills and owes a quarter-trillion dollars in pensions to state workers when they retire. [ARGH THIS ISN’T CORRECT]Unfortunately, the budget compromise may not be enough to put Illinois back on a sustainable fiscal path.

Despite the $36 billion budget getting pushed through, Illinois remains in a financial mess following decades of mismanagement and the recent budget fight. The state has racked up $15 billion of unpaid bills and owes a quarter-trillion dollars in pensions to state workers when they retire. Unfortunately, the budget compromise may not be enough to put Illinois back on a sustainable fiscal path.

I’m sorry, I’m breaking into address the unfunded pension liabilities item. I’m tired of this shit.

I am not digging up the full valuation of the Illinois state pensions. Let’s assume, for argument, that the official unfunded liability is about $250 billion (for whatever plans thrown into the mix); let’s assume, as well, that all the valuation assumptions are correct (I will address that problem another time).

The $250 billion would be what the state owes right now to the fund. Not what it owes to retirees when they retire.

Because, you see, that $250 billion is predicated on:

1. That the non-retired workers retire when you expect them to

2. That the assets are growing at the rate you expect them to

You assume some of those workers will be retiring tomorrow, some will be retiring decades in the future, at which point the assets will have grown at 7% per year (or whatever)… that $250 billion would be a lot higher if we’re only counting the cash flow. It is not an everybody retires tomorrow assumption.

Get it right, dammit.

ILLINOIS LAWMAKERS PASS PERMANENT INCOME TAX HIKE, OVERRIDE RAUNER’S VETO:

The Illinois House of Representatives has completed an override of Gov. Bruce Rauner’s veto of a budget plan, including multibillion-dollar tax increases.

Members of the Illinois House of Representatives passed into law the largest permanent income tax hike in state history July 6, successfully overriding Gov. Bruce Rauner’s July 4 veto of a larger budget package.

The override vote with respect to Senate Bill 9, the revenue portion of the budget that includes a tax hike, passed on a 71-42 vote. Ten House Republicans voted yes.

The override passed the Senate July 4 on a 36-19 vote, with one Republican voting yes, state Sen. Dale Righter from Mattoon. Righter also voted in favor of the tax hikes in order to send the bill to the governor in the first place.

So here’s my question: Rauner vetoed the bill, sure. And the General Assembly overrode the veto.

They could have done that any time in the last two years. But no, they’ve got to go the brinkmanship route. It’s not Rauner’s fault you didn’t have a large enough contingent to override his veto. You could have done it before.

GET A GRIP: THE ELECTORATE HASN’T DONE SQUAT

Contentious End to Illinois Budget Impasse Turns Threatening

CHICAGO (Reuters) – A rage-filled electorate lashed out at Illinois’ public officials as a two-year fiscal impasse ended on Thursday with a tense security lockdown of its Capitol and fallout from a death threat against a state legislator.

Ooooh, was there a mass uprising? People with pots of tar ready to go, and bags of feathers? The pitchforks out on the Capitol steps?

Did… shudder… any career politicians get threatened with being thrown out of office?

Minutes before the scheduled House votes on a contentious budget plan, the statehouse was shut down after a woman threw a powdery substance in the offices of the governor and lieutenant governor and in the House gallery.

The powder was determined later to pose no hazard.

Authorities did not identify the woman nor was it clear whether she would face criminal charges for the scare that lasted nearly two hours and delayed the votes.

Look. I know that one person can be a real threat to life. Not going to disagree.

But one person doesn’t make for an “enraged electorate”. If anything, given how long many of these career politicians have been in the ILGA, I don’t see much proof that the electorate is paying much attention at all. As mentioned before, Madigan has been there longer than I’ve been alive… and I’m middle-aged.

Oh wait, here’s another:

A Republican House member this week revealed he had received a death threat on Sunday from someone who posted on his Facebook page, “I’m coming for you.”

Again, a single person recently went after Republican politicians in D.C. So the death threat could be credible.

But one death threat doesn’t make for an enraged electorate.

I think the Illinois electorate may still be a bit torpid, assuming the U.S. cavalry will be along any minute to fix it all. Once they realize they are truly stuck with the bill, they may get enraged.

I am not seeing that the Illinois electorate is getting anything other than what they’ve repeatedly voted for.

This columnist seems to agree with me

Are Illinois taxpayers finally waking up?

by Kristen McQuearyProperty taxes on the climb.

An income tax hike debated in Springfield.

An unpopular soda tax in Cook County.

Residents with their pockets inside-out in Chicago.

It appears there’s an awakening among Illinois voters. And it’s about time, after decades of risky borrowing, faulty promises, weak-kneed politicians.

Springfield officials predict they’ll need nearly $8 billion for the upcoming fiscal year to make a pension payment to the funds that support retired teachers, university workers, judges, politicians and state workers.

It won’t be enough.

…..

You know the scene in the movie “Goodfellas” when Henry, actor Ray Liotta’s character, is worried about the pasta sauce, but drug enforcement helicopters are circling his house? That’s Illinois. The Too Late State.Elected officials knew this was coming. They watched as liabilities in their own employee pension funds rose, even as the statutorily required payments were made. That rising liability was a neon sign that the pension systems eventually would topple, but it sure is hard to spot clues when you’re spinning like the Tasmanian devil from one carefully messaged election to the next.

Years ago, when former Gov. Rod Blagojevich created a pension task force to study the state’s five funds, the report that emerged illuminated the insurmountable strain of pension costs on the state budget.

I remember approaching former state Rep. Robert Molaro, D-Chicago, who served on the task force, about the findings. I was alarmed. He was not. In fact, he sponsored several bills that sweetened the pensions of city and state workers, and teachers. This was in the early 2000s.

What a dope I must have seemed, earnestly questioning him about why he would sponsor legislation he knew would cause more damage to the pension systems.

This was around the time Senate President John Cullerton sponsored a bill to give local governments more tools to borrow money. He joked, as he introduced it, not to ask him any hard questions. The bill had been written by bond interests. The Tribune’s 2013 “Broken Bonds” investigative series revealed that Chicago Public Schools by 2007 had issued around $1 billion in risky bonds made possible under that bill.

Mayor Emanuel’s City Hall has continued to use high-cost borrowing methods to “balance” Chicago’s books. Emanuel and the City Council routinely rely on borrowing to pay off debt. Emanuel has promised that those habits will phase out. But the damage is done.

And yet there they all are, each an Eddie Haskell impostor: “Who me? I am only trying to be reasonable and cooperate, Mrs. Cleaver.” Emanuel blames Gov. Bruce Rauner. Rauner blames House Speaker Michael Madigan. Madigan blames Rauner. Cook County President Toni Preckwinkle blames Republicans.

I blame us.

Thank goodness I’m a “them” and not an “us” in this situation.

But, =phew=, that’s over with. Illinois can go back to fiscal sanity, right?

RATING AGENCY SAYS: NOT SO FAST

Moody’s throws curveball into state budget debate

Moody’s Investor’s Service has thrown a bit of a curveball into efforts to pass the first state budget in three years, suggesting that Illinois still might hit junk level despite an income tax hike that’s part of the deal.

As Illinois House members prepare to return to Springfield to override Gov. Bruce Rauner’s veto of the budget package, Moody’s issued a somewhat unusual statement. The ratings agency said it’s continuing to review the state’s current Baa3 level for a possible downgrade despite “legislative progress towards a fiscal recovery plan based on permanent income tax rate increases.”

Moody’s Investor’s Service has thrown a bit of a curveball into efforts to pass the first state budget in three years, suggesting that Illinois still might hit junk level despite an income tax hike that’s part of the deal. As Illinois House members prepare to return to Springfield to override Gov. Bruce Rauner’s veto of the budget package, Moody’s issued a somewhat unusual statement. The ratings agency said it’s continuing to review the state’s current Baa3 level for a possible downgrade despite “legislative progress towards a fiscal recovery plan based on permanent income tax rate increases.”

First, the House has to override the governor’s veto, Moody’s said, though it conceded that is likely. Then there’s “the likelihood of further deterioration in Illinois’ most pressing credit challenges: its severely underfunded pensions and a backlog of unpaid bills, which has doubled during the past year.”

So… does that budget look like it will make a dent in the bolded item?

No?

Why might that be?

Back to the piece:

Bipartisan, and not just Democratic, support will be needed if further steps are required, and state tax collections are weakening, the agency warned. “The state anticipates addressing its approximately $15 billion backlog of payments owed partly through a bond offering that probably will rank among the largest in the state’s history. This component of the state’s broader fiscal plan leaves Illinois not only dependent on market access to ease liquidity pressures, but also facing a significant increase in its tax-supported debt burden. Moreover, the effectiveness of the state’s strategy to contain and reduce its deferred bills, once the backlog-financing debt has been issued, remains to be seen,” it concluded.

So, let’s think about this, separate from the pension issue (don’t worry, I’ll get back to the pension issue).

They’re going to have to offer bonds to pay their vendors? You mean to cover operational costs?

And I’m supposed to believe they’re not going to just add to the tab next year?

They can hike tax rates, but that doesn’t mean they’ll get the tax increase they want in amount. The income tax rates may have been hiked by a third… doesn’t mean the revenue increase will be a third.

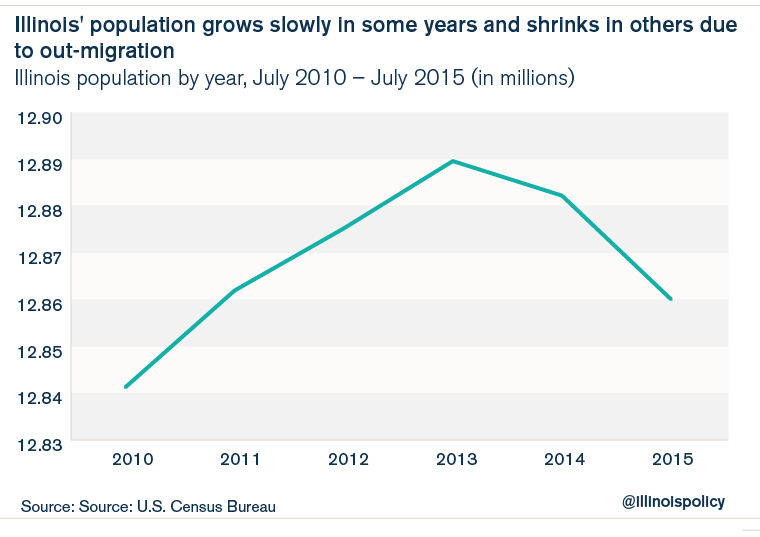

I assume the revenue will increase, for one year, at any rate. This may not be so (looking above on the migration issue)

Anyway, when there’s a credit review, it takes some time before the rating agency renders a verdict. By the time they decide whether to downgrade (or provide negative outlook, or whatever), we’ll know where we stand re: Illinois actually bringing down its outstanding bills.

Here is the Moody’s press release:

Rating Action: Moody’s Places Illinois’ GO and Related Ratings Under Review for Possible Downgrade

Global Credit Research – 05 Jul 2017

New York, July 05, 2017 — Summary Rating RationaleMoody’s Investors Service has placed the general obligation rating of the State of Illinois, currently Baa3, under review for possible downgrade following the state’s failure to fully enact a timely budget for the fiscal year that began July 1, and its failure to achieve broad political consensus on how to move toward balanced financial operations. The review also applies to several related state debt ratings: the Baa3 assigned to sales-tax backed Build Illinois bonds and the Ba1 ratings assigned to Illinois subject-to-appropriation bonds, the convention center bonds issued by the Metropolitan Pier and Exposition Authority and bonds issued under the state’s Civic Center program. Illinois has outstanding debt of about $32 billion, of which 82% is general obligation.

…..

So far, the plan appears to lack concrete measures that will materially improve Illinois’ long-term capacity to address its unfunded pension liabilities. A June 30 order from a federal judge that the state accelerate payments owed to Medicaid managed care organizations and service providers cast doubt on the state’s immediate ability to keep up with its statutory pension contribution schedule while also meeting obligations for debt service, payroll and school funding. The state anticipates addressing its approximately $15 billion backlog of payments owed partly through a bond offering that probably will rank among the largest in the state’s history. This component of the state’s broader fiscal plan leaves Illinois not only dependent on market access to ease liquidity pressures, but also facing a significant increase in its tax-supported debt burden. Moreover, the effectiveness of the state’s strategy to contain and reduce its deferred bills, once the backlog-financing debt has been issued, remains to be seen.

The Chicago Board of Education, IL (CPS) GO rating is also under review. Moody’s isn’t particularly impressed with CPS needing to issue short-term paper in order to make its pension contributions.

Funny that.

ABOUT THE PENSIONS

So, about that $250 billion hole in the pension funds.

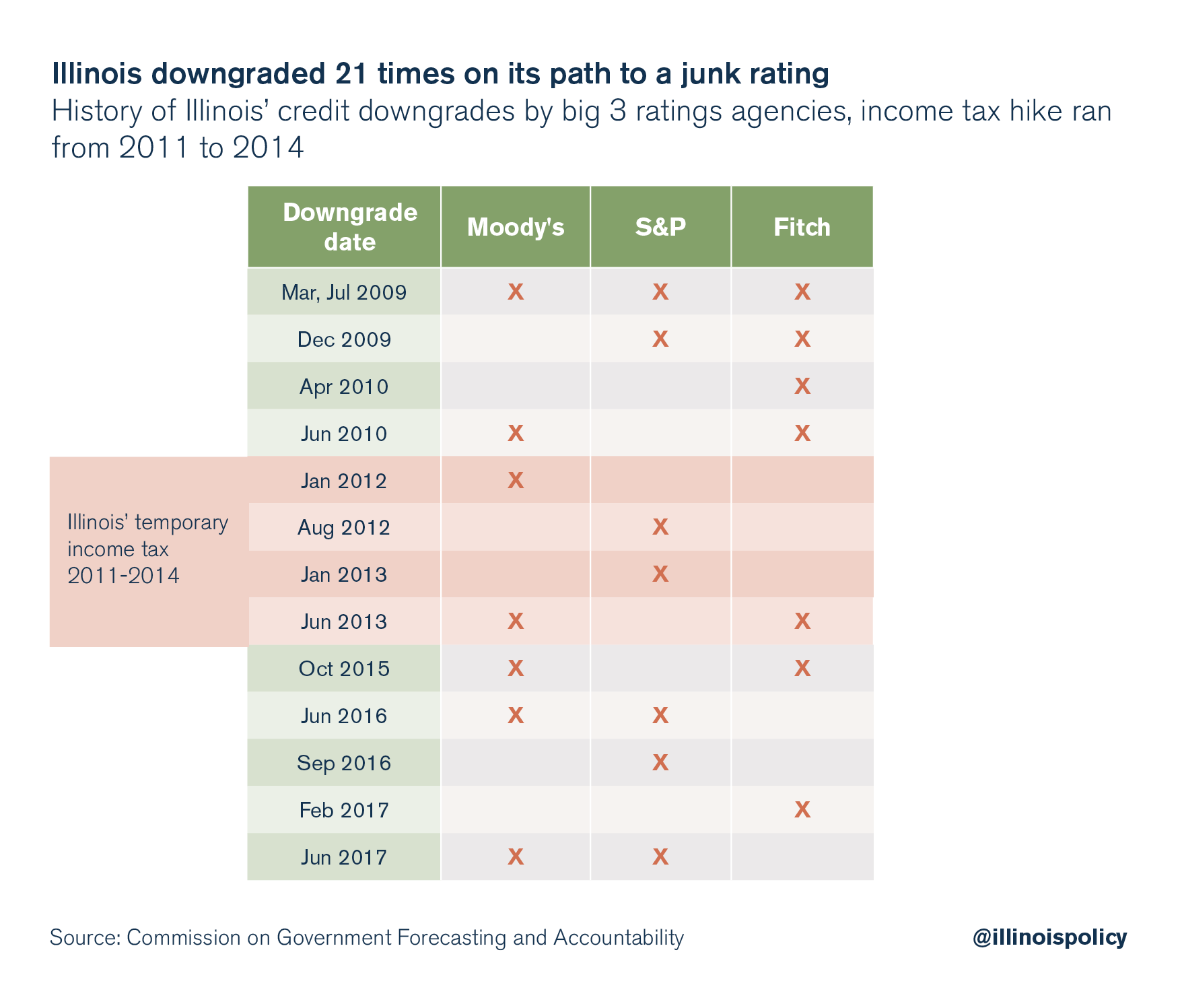

Moody’s Investors Service cited Illinois’ $250 billion in pension debt and the lengthy budget impasse as reasons for its one-notch credit downgrade.

The credit rating agency Moody’s Investors Service has downgraded the state of Illinois’ credit rating to Baa3, just one notch above a noninvestment-grade, or “junk,” rating. Moody’s has also placed the state rating on “negative” watch, meaning the agency could downgrade Illinois again in the near future.

This downgrade came June 1, the day after the Illinois General Assembly’s spring legislative session ended. The rating agency acted because the General Assembly failed to pass a budget for fiscal year 2018, which begins July 1. S&P Global Ratings also downgraded the state on June 1.

…..

Moody’s ended its report by criticizing Illinois’ record of poor governance over the past decade: “During the past decade, the state’s governance framework has allowed practices that greatly offset [the state’s] strengths.”

Here is a record of the downgrades:

I am going to do an extremely rough estimate.

Let’s assume the $250 billion hole, and that the accrue no further underfunding. Let’s assume a 7% valuation rate.

What it would take to pay off that debt in 30 years: $20 billion per year.

That would be on top of the 100% full payments of normal cost they would have to make.

You think those payments will be made? If they’re needing to issue a bond to cover $15 billion in overdue vendor bills?

Hell, do you think they’ll be able to cover the vendor bills from this year with the current budget?

We’ll see what happens, eh?

COLLATERAL DAMAGE

I will be revisiting the pensions later (like, say, when the cash could run out if that hole doesn’t get plugged).

But there have been many third parties hurt by this budget wrangling… and they may not be salvageable, because they are dependent on Illinois finances, and those haven’t even been begun to be fixed.

Deadbeat Illinois’ new budget won’t fix what’s broken for nonprofits

The passage of a state budget won’t answer all the questions nonprofits have, particularly those whacked by the two-year budget impasse.

“How are they going to pay everybody?” said Merri Ex, CEO of Family Focus, which recently received enough funds from the state comptroller’s office to delay planned layoffs and program cessations. “It’ll take a long time before (the state) catches up.”

Ex pointed to court orders for payments: On June 30, U.S. District Judge Joan Lefkow ordered the state to pay $586 million a month in Medicaid payments. Another federal court order mandates payments to Family Focus and other social-services agencies that have contracts with the Department of Children & Family Services. Ex also is wary of contracts not backed by appropriations. “Even though it’s in the budget, is the money there?” she said. “The takeaway is, people don’t feel secure. They just don’t.”

The presence of a budget “matters a great deal,” said Andrea Durbin, chair of Pay Now Illinois, a coalition of nonprofits and for-profits suing the state for breach of contract. In June, the Illinois Appellate Court dismissed a case filed by Pay Now Illinois. The coalition plans to petition the state Supreme Court to take its case.

“Being able to give providers certainty going into fiscal 2018, knowing there’s appropriations to pay them and money behind the appropriations allows directors and CEOs to plan and act as responsible financial stewards for their organizations,” Durbin said. Durbin is also CEO of the Illinois Collaboration on Youth, which is owed $300,000 by the state. On July 1, ICOY and the Child Care Association of Illinois merged to form one entity.

What the budget lacks is full funding to pay back bills from 2016 and 2017, Durbin said, adding that the coalition has been told that a combination of fund sweeps and bonding will be used to pay the bills.

Aetna threatens to exit Illinois Medicaid over budget crisis

Aetna Better Health, which the state of Illinois owes at least $698 million, has had enough.

The subsidiary of the national insurance giant has given the state notice that it plans to terminate its Medicaid contracts, Aetna spokesman T.J. Crawford wrote today in an email.

“We have filed notices of intent to terminate our contracts but hope those terminations will ultimately be unnecessary upon resolution of the current Medicaid funding crisis,” Crawford wrote. “In other words, no final decision has been made.”

Aetna’s exit would be the latest casualty of a chaotic state budget standoff that has left $14.7 billion in overdue bills. Universities have laid off thousands of people. Roadwork has stalled. Nonprofits are cutting back services or closing.

For Illinois Medicaid, the loss of a big insurer would mean a major shift. The roughly 235,000 low-income and disabled recipients Aetna covers would have to be moved to another health plan that might not have the same network of doctors and hospitals.

Laurie Brubaker, president of Aetna Better Health, warned last month that the insurer would make this move if the state didn’t pass a budget by July 1, or if a federal judge didn’t order the state to significantly chip away at the combined $3 billion owed to Illinois Medicaid providers.

Illinois Universities in Jeopardy of Losing Accreditation

Illinois’ state budget impasse might affect more than just funding for higher education.

June 28, 2017, at 6:36 p.m.

SPRINGFIELD, Ill. (AP) — Illinois’ state budget impasse could affect the accreditation of universities in the state that have seen deep cuts in state funding in the nearly three years lawmakers have failed to agree on a spending plan.

The Higher Learning Commission, which accredits schools in the Midwest, recently issued a letter cautioning lawmakers that a lack of funding places Illinois universities at risk of losing their accreditation. The commission is obligated to sanction schools that are unable to provide necessary academic programs and financial aid.

The commission’s president, Barbara Gellman-Danley, wrote that the budget crisis has led to increased tuition, delays in grants for financially needy students, staff reductions and canceled capital projects. She said diminished cash reserves will hurt students.

I don’t think the budget fixes any of that. After multiple years of not getting funding that can be relied upon, and being so dependent on that source for funding, I wouldn’t be surprised that various entities will have to fold.

COMMENTARY

Here are what various people are saying about this situation.

Illinois Taxpayers Will Pay Billions For Political Dysfunction

Sometime during the third year of Illinois’ downward spiral, the market began treating the state as a junk credit.

Now, ratings agencies are warning of a downgrade to speculative territory as soon as next week without a budget. Lawmakers are scurrying around Springfield to try to reach a deal with Governor Bruce Rauner ®.

But investors have already made up their minds. Political dysfunction costs money. And taxpayers will pay the price.

Lawmakers are negotiating a roughly 32% income-tax increase as part of a budget deal, estimated to raise $5.4 billion of new money annually. A good chunk of that will end up going toward debt payments that are higher than they should be due to the state’s unprecedented political gridlock.

Even if politicians manage to stop the downward spiral and craft a budget deal this week, taxpayers will be paying for this gridlock for decades. The municipal market moves more slowly, and has more political risk, than other markets. It takes a long time for a government to get to the brink of junk. The recovery, even when politicians are willing to make unpopular decisions, can take just as long.

A back-of-the-napkin estimate shows the market penalty from just one bond deal, in 2016, could cost taxpayers $712 million over the next 25 years.

In 2014, the state sold $1.025 billion of general obligation bonds, seeing a spread to a top-rated municipal bond of a mere 16 basis points (bps) for the nearest-term bonds and about 129bps for the debt maturing in 2039, according to Daniel Berger, senior market strategist at Thomson Reuters Municipal Market Data.

How Illinois became America’s most messed-up state

NEW YORK (CNNMoney) — Politicians are notorious for making promises they can’t keep. But they really outdid themselves in Illinois — and now the state is paying for it.

Illinois is on the verge of becoming America’s first state with a junk credit rating. The financial mess is the inevitable result of spending more on pensions and services than the state could afford — then covering it up with reckless budget tricks.

After decades of historic mismanagement, Illinois is now grappling with $15 billion of unpaid bills and an unthinkable quarter-trillion dollars owed to public employees when they retire.

The budget crisis has forced Illinois to jack up property taxes so high that people are leaving in droves. Illinois may soon have to take the unprecedented step of cutting off sales of lottery tickets because the state won’t be able to pay winners.

It will get worse if lawmakers can’t reach a budget compromise by Friday. This would be the third year in a row that America’s fifth-largest state has failed to pass a constitutionally required budget.

“Illinois got to this financially treacherous place by ignoring the long-term consequences of short-term decision-making,” said Laurence Msall, the president of Civic Federation, a budget watchdog organization.

Illinois, Chicago, and the meaning of fraud

Looking at the dictionary definition, and considering how state and city officials have sold ‘balanced budgets’ to their citizens while spending beyond their means, it looks like some of our governments may have been committing fraud.

….

Here’s one provision in the Illinois Municipal Code that includes the word ‘fraudulent:’“The corporate authorities of each municipality may suppress bawdy or disorderly houses and also houses of ill-fame or assignation, within the limits of the municipality and within 3 miles of the outer boundaries of the municipality. The corporate authorities may suppress gaming, gambling houses, lotteries, and all fraudulent devices or practices for the purpose of obtaining money or property and may prohibit the sale or exhibition of obscene or immoral publications, prints, pictures, or illustrations. “

Granted, this may be a bit wacky, but let’s think this out, step-by-step.

Might the buildings called home by the Illinois state legislature or the Chicago City Council be called ‘bawdy or disorderly houses?’

Do these folks conduct ‘gaming’ practices? Do they operate ‘gambling houses’ or ‘lotteries?’

Do they use ‘fraudulent devices or practices for the purposes of obtaining money or property?’

Could their budget and other financial reporting documents be labelled ‘obscene or immoral publications?’

If my house is ‘disorderly,’ could they take it away and sell it, along with all the other messy houses, and use the proceeds to fund government pensions?

Pushing the envelope a little here, but a ‘yes’ answer is possible for all these questions.

Who Knows What’s In the $36 Billion Spending Plan Illinois House Just Passed? – Wirepoints Original

Here’s a test: Read the 638 pages linked here and decide if you’d vote for it. You have four hours, during which you also have listen to the debate on a $5 billion tax increase and cast your vote on that.

Aside from the $5 billion tax increased passed yesterday, the Illinois House also passed a $36 billion spending plan — the budget, basically.

But it was new, and was popped on the House in mid-afternoon, just hours before the vote. “We have no idea what’s in it,” said House Minority Leader Jim Durkin at the time.

It came in the form of an amendment to Senate Bill 6 — but an amendment that’s 638 pages long.

“The Democrats made matters more complicated by filing a new spending bill within the last 15 minutes,” said Durkin, who was visibly agitated according to Illinois News Network.

You may recall that House Speaker Michael Madigan said on Saturday no votes would be taken over the weekend, but changed that later in the day to say the vote on the tax increase would be held on Sunday. He did not say the spending vote would be taken.

We now know at least one thing in it, a “boobytrap” for Governor Rauner, according to Capitol Fax, a publication that’s not generally friendly to him.

Here’s how the boobytrap works: It blocks the flow of money from the state to schools unless Rauner signs the school funding bill Democrats want. That’s Senate Bill 1, which recently passed the General Assembly but is opposed by many Republicans and is criticized as a bailout of Chicago schools. So, Rauner would have to sign Senate Bill 1 or face the charge by Democrats that he’s cutting off all school funding.

What else is in the spending plan? I’d say “God only knows,” but he’s definitely not who drafted it. House Speaker Michael Madigan knows, along with some other key Democratic legislators and staff, but that’s probably it.

Cramming complex bills through the House in the final hours is a tradition with Speaker Madigan. His party and many Republicans go along without objection. The spending plan passed 81 – 34 with significant Republican support.

$36 billion.

$36 billion. Do they have room for a $20 billion contribution to fill the pension hole in there?

ALL YOUR MONEY ARE BELONG TO ILLINOIS

Well, if you’re in Illinois, they grab your money. Any way they know how.

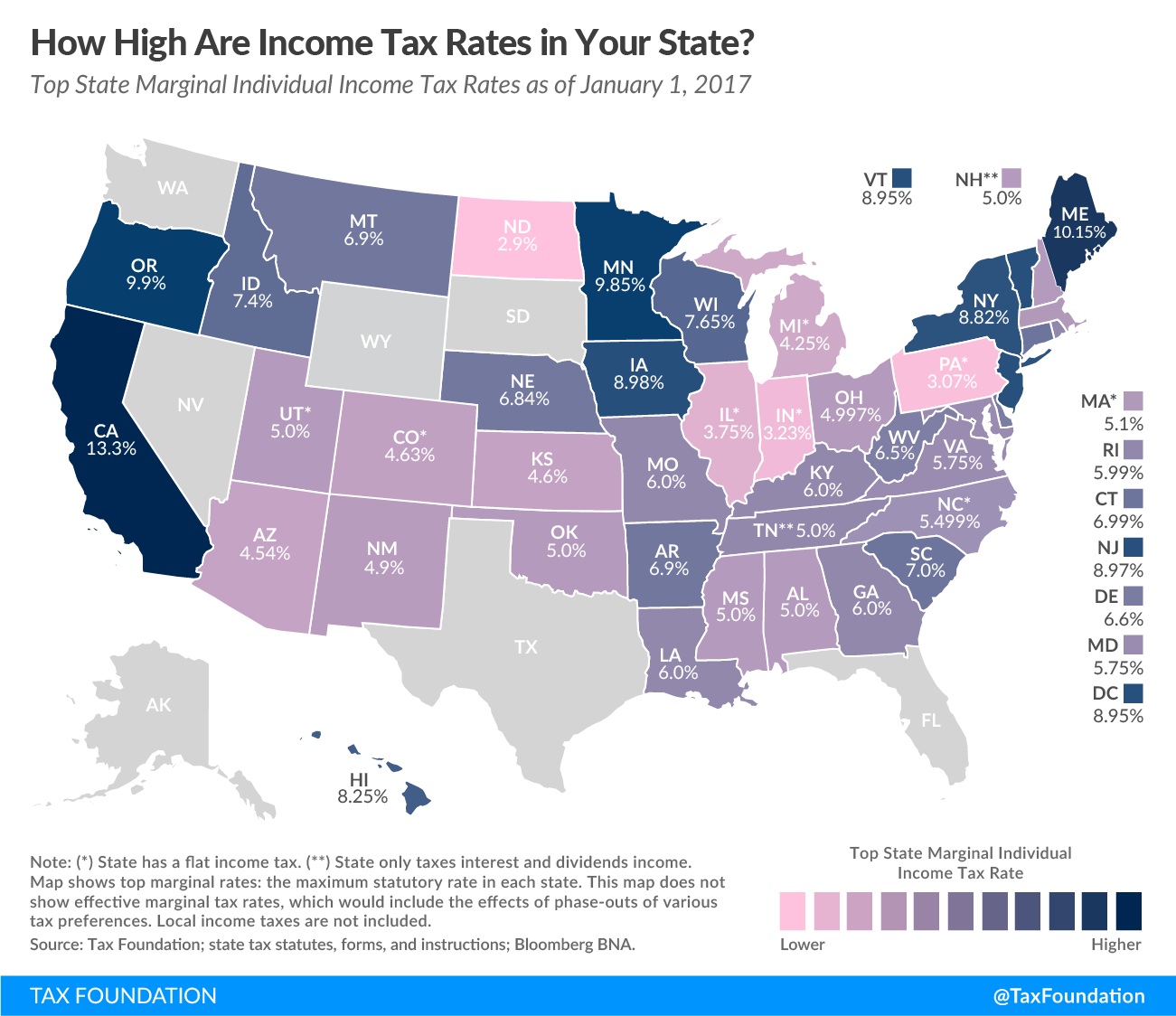

Here is a map of the 2017 state individual income tax rates, the highest marginal rate:

Here is a map of the 2017 state corporate income tax rates

Here is a map of the 2014 effective property tax rates from 2014

So. Looks like Indiana is going to be home to some tax refugees soon, I’m thinking.

And here is how Illinois’s revenue by source broke out (for FY 2014):

Property Tax 36.5%

Sales Tax 14.2%

Individual Income Tax 23.5%

Corporate Income Tax 6.3%

Other Taxes 19.5%

This includes state and local taxes.

Should be interesting to see how those percentages change.

FOR LAUGHS: MATH CLASS IS HARD, PUBLIC FINANCE IS HARDER

It’s very easy to change rates in law. It’s very difficult to make the money materialize.

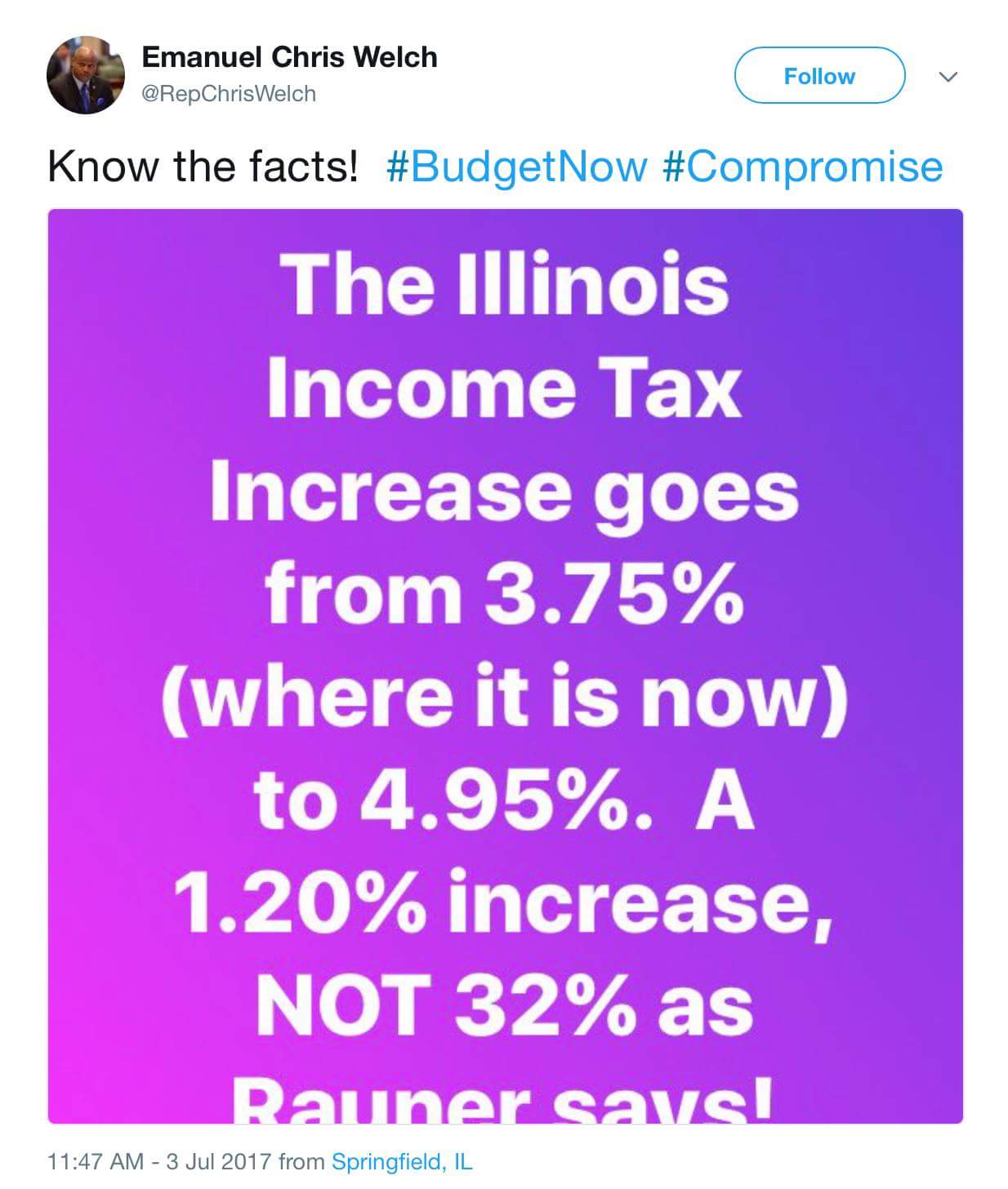

The 3.75% state income tax rate was just hiked to 4.95%.

Here is something that happened:

Math is Hard, Part Deux:

Real tweet fromRepChrisWelch</a>, who votes on IL financial matters, including taxes. <br>No wonder we are broke! <a href="https://t.co/zXEE7PO6Sc">pic.twitter.com/zXEE7PO6Sc</a></p>— Carol Roth (caroljsroth) July 3, 2017

‘Dying’! Math is WAY too hard for this Illinois Democrat

Do you guys want to point out the mathematical error or should we just let him continue to look like an idiot?

Cc:mchastain81</a> <a href="https://t.co/mEDup7zf8D">https://t.co/mEDup7zf8D</a></p>— Emily Zanotti (emzanotti) July 3, 2017

The tweet from the dumbass politician (you know, one of the financial geniuses who passed this budget over the Rauner override) was deleted, so the first tweet contains a screenshot. If you didn’t see it above, here it is:

This is a 1.2 percentage point increase, or a 120 basis point increase in the rate.

If I want to look at percentage increase, I do: (4.95% – 3.75%) / 3.75% = 1.2/3.75 = 32% increase.

On the nose.

So yay, the rate went up by almost a third. (Psst, NYT, ‘almost’ means that it is not equal, but close)

That doesn’t mean income tax revenue will increase by a third.

A few other reactions:

AAAAAAARGH I HATE THIS SORT OF THING

— Mary Pat Campbell (@meepbobeep) July 3, 2017

The deliberate confusion between percentage increase and percentage point increase. Or he's dumb as a post. Either way. https://t.co/6rv1XEMf1c

— Mary Pat Campbell (@meepbobeep) July 3, 2017

Yeah, I know it’s a real uphill battle for me to explain the meaning of unfunded pension liabilities and why 80% funded ratios are not good, when I’m trying to convince people like that.

Maybe politicians should be required to pass an arithmetic exam before they’re allowed to vote on budgets.

That’s my very modest proposal.

I doubt they could make quorum.

Related Posts

Cook County Soda Tax: Look Who's Come to Save the Day!

Taxing Tuesday: California to Tax Texts?

RIP, James Spiotto, Municipal Bankruptcy Expert and Advocate for Long-Term Solutions