Show Me (the Money) State: Missouri Tries a Pension Buyout

by meep

Missouri is trying something to help reduce its pension liability: buying out a bunch of people to get their associated liabilities off the books.

Buyout coverage:

- Press release from MOSERS: MOSERS Notifying Former State Employees of Lump-Sum Option

- MOSERS buyout plan calls for half of eligible members to take offer, saving $100 million

- Missouri has launched a limited pension buyout

- MOSERS Offers Lump-sum Payment Option to 17,000 Former Employees

Here is an official video from MOSERS:

Here is the official site for people pondering the buyout.

The nutshell version:

There are about 17,500 people who have earned pensions in MOSERS (the state employees plan, but not including the teachers), who no longer work for Missouri and who haven’t started taking retirement benefits.

The state is offering lump sum payouts to these people — cash right now, and no future pension to be paid.

The amount being offered is 60% of the actuarial present value of the earned retirement annuity.

I will come back to that 60% figure later in this post.

The state assumes about 50% of those offered the buyout will take the offer.

From their press release, here are some stats on those getting offered the buyout:

Average years of service – 9

Average [future] monthly retirement benefit – $450

Average age when left state employment – 39

Average age now – 48

Average age at normal retirement eligibility – 62

Average lump-sum one-time payment – $18,450

Obviously, there will be some variability around those averages.

SNAPSHOT OF MISSOURI PENSIONS

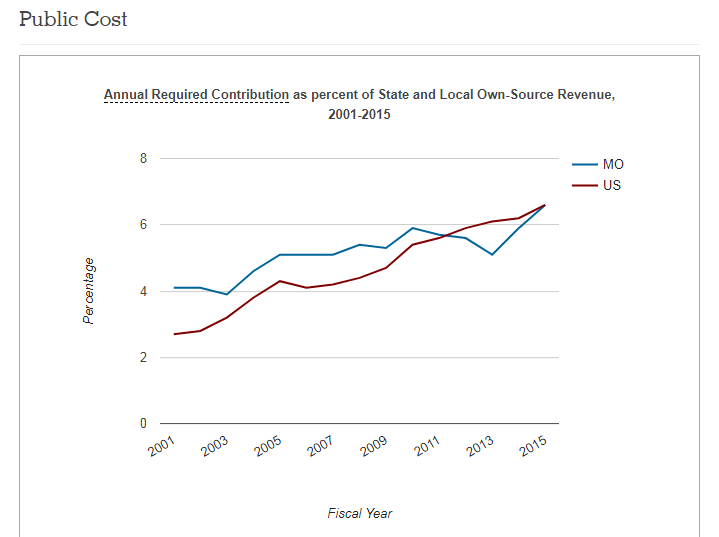

How bad are they, really? If we look at the cost, they seem on a par with the rest of the U.S.:

But let’s just focus on MOSERS itself (there are issues with other plans, too, but let’s focus on the plan doing the buyout).

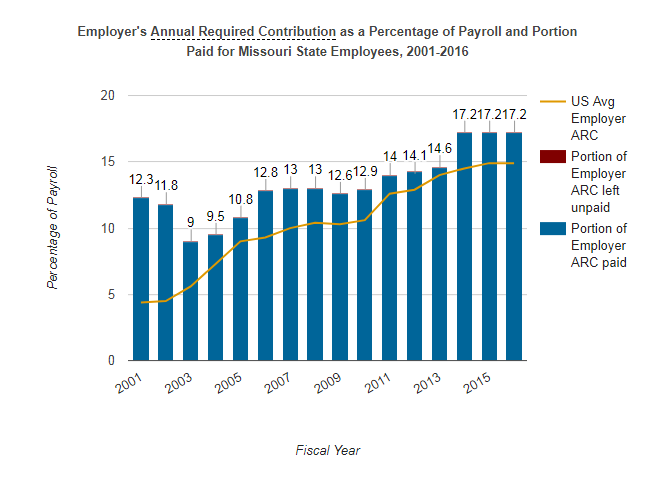

Here are the payments:

Note, they’ve always made “full” payments.

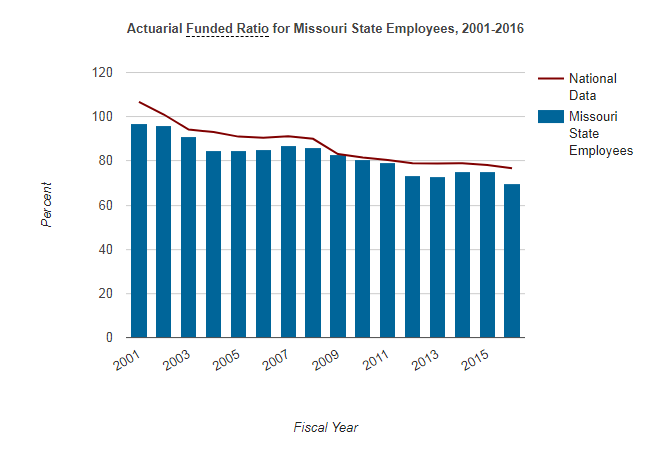

The resulting funded ratio:

100% ARC payer, and decreasing funded ratio. Where have I heard that one before?

MOSERS ASSETS: A MOMENT OF ‘HOLY CRAP!’

So what exactly may be the problem?

This study on alternative investments may give a clue:

Boston College’s CRR On Alternatives In Pension Portfolios

The Center for Retirement Research at Boston College has put out a white paper about public pensions and alternative investments. It asks two questions: which plans have made the largest shift into alternatives? And, how has that shift mattered to their returns and risk?

The report begins with the observation that state and local plans in general began to increase their involvement in the alternatives world significantly around 2005. The shares of pension assets in these classes increased as a consequence of the crises in 2008-09, but the report treats this fact as arithmetical rather than strategic.“Almost by definition,” the authors write, “the precipitous drop in equity values compared to other assets … led to further increases in the shares held in all other asset classes.”

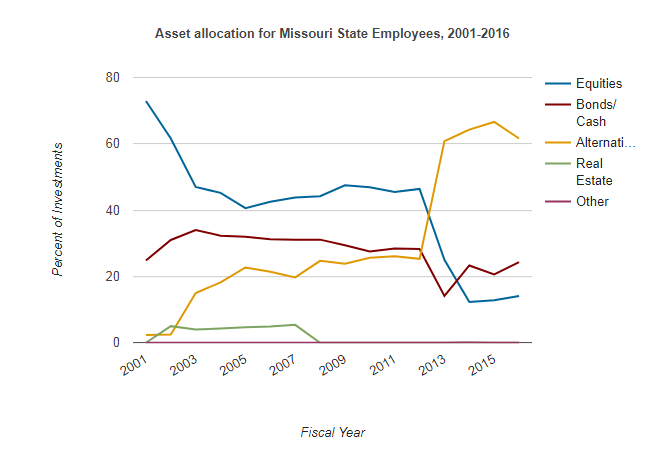

By the time the dust had settled, though, pension fund managers were “comfortable with the idea of alternatives,” so state and local plans steadily increased their presence. Alternatives were 24% of their holdings in 2015 (from only 9% in 2005).

…..

According to the authors’ calculations from Public Plans Database, the highest allocation in 2015 was that of Dallas [TX] Police and Fire, which had 68% of its assets committed thereto. The Missouri State Employees’ pension is also in this elite more-than-two-thirds club (67%). Two other heavy hitters are Arizona pensions, the AZ State Correction Officers and the AZ Public Safety Personnel (59% each).

Uh.

Uhhhhhhhh.

TWO-THIRDS?!

I just…..

TWO-THIRDS?!

ARE YOU KIDDING ME?!

Dear Lord, they’re not kidding. WHAT THE HELL, MOSERS

It looks like they replaced their equities with alternatives. What exactly are they?

Looking at the 2016 CAFR, I see they’ve got private equity, hedge funds, and repos (oh my!) I mean, a little exposure to these asset classes is okay… but 2/3 of the portfolio in illiquid assets?!

WHAT THE HELL MOSERS

They’re using a discount rate of 7.65% for liability valuation in the 2016 CAFR, but for 2012 – 2015, they used 8%, and before that, they used 8.5%.

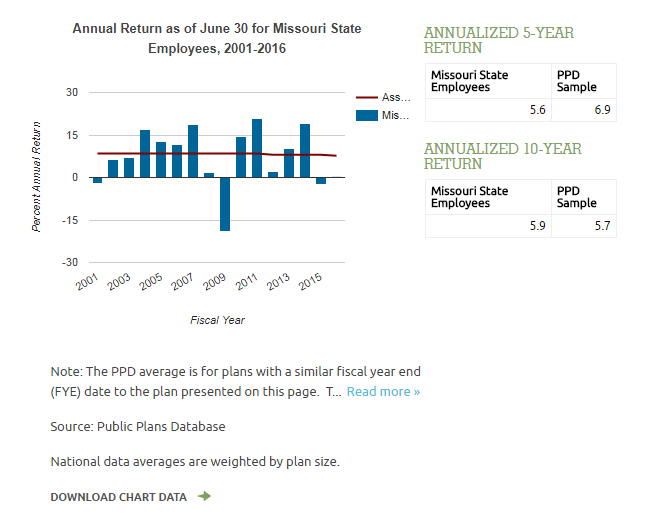

This is what their investments have done:

So…. yeah. Chasing return with alternative assets. I’m sure that will turn out well.

By the way, I decided to check out what the average return was from 2001 to 2016.

If you take an arithmetic average (which is WRONG), you get: 7.38%

If you take a geometric average (which is correct), you get: 6.87%

Both fall way short. And now they’re involved in hard-to-value illiquid assets. How are we to trust the return figures on those, exactly?

A recent story on MOSERS investment returns:

Missouri State Employees tops benchmark with net 3.52% for fiscal year

Missouri State Employees’ Retirement System, Jefferson City, returned a net 3.52% in the fiscal year ended June 30, said a report posted on the pension fund’s website.The $8.1 billion pension fund exceeded its policy benchmark of 1.64%.

For the three years ended June 30, the pension fund returned an annualized net 0.36%, below the benchmark of 2.35%; for the 10-year period, the pension fund returned an annualized net 4.45%, above the 4.22% benchmark return.

For the 12 months ended June 30, 2016, the fund returned a net 0.29%, below its 7.36% policy benchmark.

I believe that 7.36% is for the 2017 valuation — the plan is on a path to ultimately have a valuation rate of 7.05% by 2020.

PENSION CRISIS?

So, as with Kentucky, various people are talking up a crisis with the Missouri pensions.

- MOSERS Board Approves New State Budget Contribution Percentages, Actuaries debunk treasurer’s “crisis” warning.

- New report on state pension plan shows continued struggles, state treasurer says

- Missouri’s State Pension In Crisis

- MOSERS’ Officials React to Concern over Pensions

- Missouri’s $5B pension shortfall is ‘at our doorstep’

- Missouri employees’ pension plan underfunded by $5 billion

- Missouri’s $5 Billion State Pension Underfunding Shows Results of Faulty Accounting

Let me quote from that last piece:

Yesterday, Missouri State Treasurer Eric Schmitt announced that the state’s public employee pension plan was underfunded by $5 billion. That is an eye-popping amount, but the story is a sadly familiar one:

…..For politicians, such rosy projections mean more taxpayer dollars to spend elsewhere, as they create the illusion of the state’s pension contribution obligation being lower than it actually is.

But the can only be kicked down the road so far. Schmitt told state lawmakers that the state will need to increase its employer contribution by $15 million to $30 million in the next year to help get the pension system back on its feet.

However, the state catching up to its pension contribution now doesn’t mean that taxpayers won’t be on the hook again in the future. Pension managers should calculate the state contribution using a discount rate based on a more conservative investment return projects, such as the 4.5 percent Missouri has achieved recently.

Furthermore, they should look for ways to shift away from a defined benefit system, which can translate into high liabilities for state taxpayers, and enroll new employees in either a defined contribution or hybrid system.

Finally, lawmakers should require state pension managers to focus solely on increasing returns and maintaining pension plans’ financial health, and not use pension funds to advance political agendas that have nothing to do with securing public employees’ retirement.

MOSERS and the other Missouri pension plans have been long-time 100% ARC payers.

But those “required contributions” were based on optimistic valuation assumptions. So as experience comes clear, and assumptions are adjusted, MOSERS is now 60% funded (and that’s using the 7.36% valuation rate, it sounds like).

So that’s where the 60% buyout value comes from.

DECISION FOR INDIVIDUALS

I am not going to give personal advice to people as to whether to take the buyout. At this point in time, there is an estimate that MOSERS has 60% on hand for those obligations.

You were promised 100%. You could try to rely on getting that 100%. That 100% assumes certain aspects of retirement and death, of course. The pension value could be a lot higher than the current valuation (because they really should use a lower valuation interest rate, for example), but it could also be less for a given individual.

If an eligible person knows they’re going to die soon (and there are no beneficiary benefits), taking the lump sum is obviously better.

But even if an eligible person is not going to die soon, taking the lump sum may be a good idea — they can roll over the money into a qualified retirement account like an IRA, and accumulate it tax free while they’re still working. They may do better than the assumed 7.36% per year, and they may not. But they may also prefer the security of having the money under their own control.

I know some will just take the cash, and take the tax hit because they want to spend the money right now. Well, that may or may not be foolish. Depends on the circumstances.

I don’t like that people are being given only 2-3 months to make the decision. That’s really not enough time, especially if people need to talk with a financial advisor (and many should).

ESTIMATED SAVINGS

I’m going to use MOSERS own averages to check their numbers on savings.

Average lump sum: $18,450

That’s supposedly 60% of present value, so full present value would be $30,750, and the savings would be $12,300 on average for each person who takes the deal.

Half of about 17,000 people is 8500 – that leads to $104 million, which accords to the $100 million in saving they were talking about. That would represent about $261 million in liabilities removed for $157 million paid out in assets.

Let’s check the impact using 2016 numbers

Using the 2016 numbers (remember, the 2017 numbers are worse):

Total liability before adjustment: $12.751 billion

Total market value assets before adjustment: $8.109 billion

Funded ratio: market value assets/liab = 63.6%

Unfunded liability amount: $4.642 billion

Total liability after adjustment: $12.490 billion

Total market value assets after adjustment: $7.952 billion

Funded ratio: 63.7%

Unfunded liability amount: $4.527 billion

Uh, yeah. Not exactly the most impressive result. The reduction is about 2.5% of the unfunded liability.

And that’s using the 2016 numbers. The 2017 numbers are worse – so the savings will be an even smaller fraction of the unfunded liability.

WHAT IS THE DEAL, EXACTLY?

The deal is that the assets have underperformed, they’ve taken to chasing yield, and the liability valuation assumptions were rosy. Therefore, the full payments were always a lot less than should have been contributed.

Now they are starting to incorporate more realistic assumptions, and the ARC payments are increasing greatly.

It had been 17.2% of payroll of late.

MOSERS has declared that it will be 20.2% for the next year.

Now some think – hey, 3 percentage points. That’s not much.

But the real increase is 3/17.2 = 17% increase in pension contributions, assuming the payroll remains level.

(Aside: While this crib sheet for journalists may help journalists learn how to make certain calculations, I understand they may not be used to thinking quantitatively. Maybe I should do some online videos to explain to reporters how to think about numbers and report on them, especially with regards to public finance.)

And as the valuation assumptions still shift until 2020, that percentage could be climbing each year.

And while reducing liabilities by buying out vested, but not retired, members is something that really does reduce the unfunded liability, the number of eligible people and the eligible % of the liability is often very small — you can’t buy out current retirees (the IRS has said no to that), and buying out current workers is also iffy.

So good luck, Missouri.

Related Posts

A Week of Bad Pension Ideas: Just Make the Full Payments!

The Kentucky Pension Mess: Ain't Getting Cleaned Up Now

Happy Idea: Moving from Defined Benefit to "Defined Ambition"