Taxing Tuesday: Election Year Impact of Tax Bill?

by meep

Brookings Institution: The ‘Tax Cuts and Jobs Act’ and the 2018 midterms: Examining the potential electoral impact

What role will the TCJA play in the 2018 midterms? Political science has a great deal to say about how voters interpret and respond to public policy. Combining this literature with recent public opinion data on the bill provides a useful framework for predicting the legislation’s electoral impact.

This paper follows the following structure. First, I examine how economic conditions have historically shaped electoral outcomes in the United States, and apply that research to the case of the TCJA. Second, I discuss how partisanship interacts with public attitudes about policy, and assess the likelihood that public perceptions of the TCJA will influence voting. Finally, I report what we know about the role of money in politics, and how the TCJA might change the money available to different political interests both in the near and long term.

So here’s the deal: the high tax places screwed by the SALT cap are already fairly Democratic-Party-dominated.

So they will re-elect their Dem senators and representatives… no net change there.

BUT they may donate more money.

Not me – I don’t do political donations now, except to the NRA.

So let me see what they’ve got in this report.

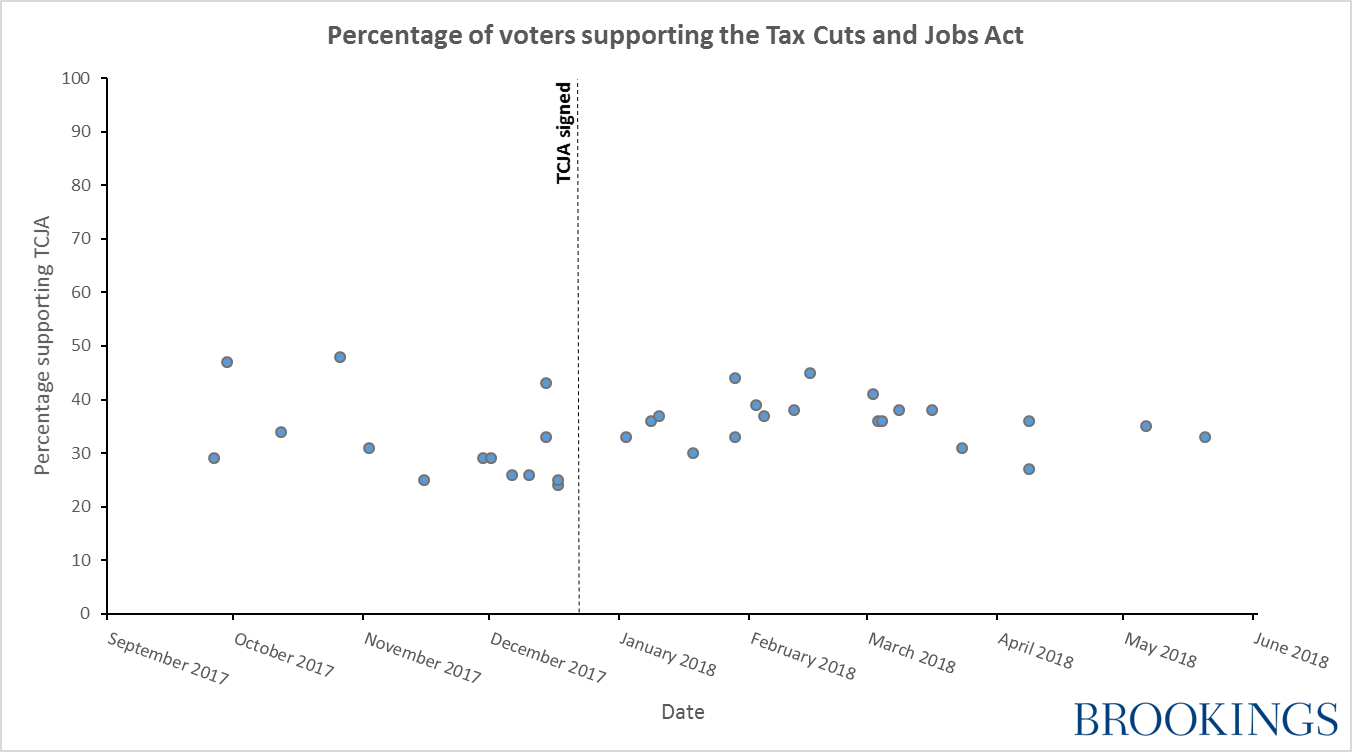

First, polled support for the TCJA (Tax Cuts and Jobs Act, from 2017):

Okay, I have multiple problems with this graph — these are opinion polls, so you should give me error bars on each point – then we can see if there’s any real trend.

Here’s a bit:

Voters are also remarkably short-term in their economic thinking—they tend to reward presidents for good economic times in the period immediately prior to the election. The TCJA will likely have some small stimulative effect in 2018; the Tax Policy Center has estimated that the law will increase US GDP by 0.8 percent in 2018, while the Congressional Budget Office estimated a 0.3 percent boost in 2018 GDP.

Let’s see what GDP growth has been like!

Interesting.

I agree that voters have forgotten about the TCJA and have no clue exactly what’s in it, or the effect on their own net income. But they can notice if there are some good effects in the economy in general.

But back to the opinion polling – how about split by party?

Again, there needs to be error bars on the points. And what about independents?

Self-described independent voters are not the moderate, persuadable, election-deciding voting bloc they are often portrayed to be. Most independents report they “lean” toward one party or the other, and these “leaners” display voting behavior that is largely indistinguishable from people who describe themselves as Democrats or Republicans. As a group, self-described independents are not especially moderate, nor are they especially open to persuasion. Even the 10 percent of the public that claims not to lean to one party or the other has become “as reliable in their party support as strong partisans of prior eras.” The frequency of “swing voting”—that is, voting for one party and then the other in consecutive elections—has collapsed. What is different about “independents” is not their partisan loyalty, but their likelihood of voting. True independents are not reliable voters; they vote about half as often as partisans do.

Ah, so are the Democrat-leaning independents more likely to show up for a midterm election?

Could the Tax Cuts and Jobs Act be the Republicans’ Affordable Care Act? There are certainly political parallels. Attitudes about the ACA were a mirror image of the TCJA; 12 percent of Republicans favored the legislation, compared to 61 percent of Democrats. The roll call votes were also similar, with absolute opposition from the minority party and only a small number of defections from the majority party. But controversial and partisan pieces of legislation do not always result in electoral blowback. For instance, Democrats do not appear to have suffered as much electorally in voting for the economic stimulus bill known as the American Recovery and Reinvestment Act.

So… maybe neither the Democrats and Republicans will be motivated by the bill to come out to vote.

So their primary leg is the amount of political campaign spending/donations will go on:

If the TCJA were to influence the campaign donation patterns of wealthy people, it would likely redound to the benefit of Republicans. First, though there are rich people in both the Democratic and Republican parties, wealthy people are more likely to be Republicans. Second, the cap on the state and local tax deduction in the TCJA was intentionally structured to provide less of a tax cut to wealthy people in high-tax blue states, where many rich Democrats reside. Finally, the wealthy are economically conservative, so the political incentive created by the legislation is more likely to motivate Republican donors to support their party, rather than to encourage Democratic donors to invest more than they otherwise would. News reports confirm that some Republican donors did threaten to withhold their campaign support if a tax bill were not passed.

Okay, I’ve tried looking at the data at Open Secrets, and it’s not arranged in a convenient way for me to do digging. So I will just let that pass for now. I do know that Republican fund-raising has been doing pretty well, as far as I can tell.

But then:

In thinking about the impact of any TCJA-inspired donations in 2018, however, it is important to recognize that money does not always buy electoral success.

In fact, though having a spending advantage during the campaign correlates with winning the election, political scientists have struggled to identify a clear causal connection between spending more money and winning more votes. How can that be? First, there are the confounding factors: many traits that make a candidate successful with voters (like charm, strong community ties, or a famous name) also make them successful with donors. Then there is the chicken-and-egg problem, as donors often jump on the bandwagon of an already successful campaign. Finally, a truly extraordinary amount of campaign money is wasted.

I could say that’s why I stopped donating, but it’s more that my company has its own limits on political donations, so it doesn’t look like we’re involved in pay-for-play. Some financial institutions do that… and I’m just fine with having to tell the money-grubbers that no, I can’t give them any money.

Oh, the end of the piece provided the polls/surveys they used… but again, I see no error bars on any of them. Get it together, y’all.

OTHER TAX STORIES

Wirepoints: Botched Cook County Property Tax Relief Backfires On Working Class, Minorities

This one was so easy to see coming we can only say, “Duh,” instead of our usual “Told you so.”

Last year, Chicago lawmakers wanted a way to soften the blow of the city’s recent property tax increases, or at least make it look softer. Singling out the city wasn’t workable, so they got Springfield to pass increases in the homeowners and senior exemptions for all of Cook County.

The Chicago Tribune last week detailed the actual results. The broadened exemptions merely shifted the tax burden to to other properties. Many properties were taken off the tax rolls entirely, leaving the remainder to pay the bills. The levy — total taxes raised — didn’t drop. The consequence has been a “perfect storm,” the Tribune says, for many communities already in a property tax catastrophe.

Governing: Tax Hike for Teachers Kicked Off Arizona Ballot

In a surprise ruling in Arizona, a proposed income tax hike to restore education funding has been knocked off the November ballot. Had the measure gone before voters and passed, it would have nearly doubled the state’s income tax rates on the wealthy and made Arizona the first red state to pass a millionaire’s tax.

Instead, the Arizona Supreme Court ruled this week that the wording in the petition to get the measure on the ballot was misleading because it termed the tax increase as a 3.4 percent and 4.4 percent hike. A more accurate portrayal would have been to say the tax rate would be raised by those amounts in percentage points. “When you go from 4.5 percent to 9 percent, that’s a 98 percent increase,” says Garrick Taylor of the Arizona Chamber of Commerce. “Had that been disclosed to voters, I’m not so sure it would have [as much] support.”

Yup, muddying the difference between percentage point increase and percentage increase are often done in public finance.

Governing: Disney Walks Away From Millions in Economic Incentives

Earlier this month, the Walt Disney Company presented the city of Anaheim with a surprising request: It asked the California city to terminate two agreements that provide Disney with hundreds of millions of dollars in economic assistance.

The request comes as Disney’s relationship with Anaheim has grown increasingly strained in recent years. Critics, led by Anaheim Mayor Tom Tait, a libertarian-leaning Republican businessman who was elected in 2010, have criticized the city for agreeing to a 45-year moratorium on a gate tax and a $267 million economic assistance package for a new luxury hotel in the Downtown Disney District. Tait has argued that the money should instead be used to shore up the city’s bottom line.

In a letter to the mayor and city council, Disneyland Resort President Josh D’Amaro acknowledged “an unprecedented and counterproductive” level of animus between the company and the city that has hosted Disneyland since the theme park first opened in 1955. As a result, wrote D’Amaro, Disney had decided to ask the Anaheim “to join us in terminating” the two agreements at the center of the controversy.

Unsurprisingly, the city took Disney up on the offer.

As for Disney, it seems to view its decision to terminate its two most recent agreements with Anaheim as a one-off decision. In a statement released to Governing after the city council vote on Tuesday, Disney spokeswoman Liz Jaeger defended the practice of negotiating economic assistance packages. “These tax incentive policies, which are successfully and widely used across the country to stimulate economic growth and development,” she says, “unfortunately became counterproductive in Anaheim, prompting our decision to step away from them.”

Interesting.

Bloomberg: Republicans Consider Dropping Second Phase of Tax Cuts After SALT Backlash

House Republicans had planned to use a second phase of tax cuts to force Democrats into a difficult vote ahead of mid-term elections. Now, party leaders may drop the effort, fearing it could backfire by antagonizing voters in some hotly contested Congressional districts.

The proposal would make the individual changes in last year’s overhaul permanent — including the $10,000 annual cap for state and local tax deductions, one of the law’s most disputed provisions. That would put Republican lawmakers in high-tax states like New York, New Jersey and California in the tricky position of either supporting the cap, or voting against tax cuts backed by their party.

Yeah, while New York is overwhelmingly Democratic, it’s not 100% Democratic (similarly for Illinois and California). I can understand holding off. But seriously, most of us aren’t getting hurt with the bill – at worst, it’s a wash.

TAX TWEETS

This headline says it all.

"Eight months after signing tax cut into law, Trump cancels pay raise due to federal workers, citing cost," vialatimes</a>.<a href="https://t.co/1hkV3hK3A0">https://t.co/1hkV3hK3A0</a></p>— Tax March (taxmarch) September 4, 2018

Seems like a non-sequitur to me.

Manchester United manager Jose Mourinho 'fined €2m' in tax fraud case https://t.co/4cGEDbfCsf

— Sky News (@SkyNews) September 4, 2018

Ah, tax fraud.

This is why our tax laws need to be changed. Progressive tax rate for for people making over $100k and families making over $200k up to 90% rate.

— kvb1 (@kvb1) September 4, 2018

.

JBPritzker</a> wants to tax you for every mile you drive. <a href="https://twitter.com/hashtag/twill?src=hash&ref_src=twsrc%5Etfw">#twill</a> <a href="https://twitter.com/hashtag/ILGov?src=hash&ref_src=twsrc%5Etfw">#ILGov</a> <a href="https://t.co/tiV85Y8VUQ">pic.twitter.com/tiV85Y8VUQ</a></p>— Bruce Rauner (BruceRauner) September 4, 2018

Yeesh. Well, I wasn’t planning on driving in Illinois, but this would cement it. I do not want the state checking up on my driving habits, thanks.

Vectren has announced that because of the Tax Cuts and Jobs Act of 2017, customer bills will be reduced by $125 over a 12 month period.

— Randy Moore (@Randy14News) September 4, 2018

Vectren is a natural gas and electricity company.

Corporations don't pay taxes, people pay taxes. Andrew Gillum’s massive tax hike proposal would hit consumers & make Florida a less attractive place for business. https://t.co/jYxIFqWH7F

thehill</a></p>— ATR (taxreformer) September 4, 2018

I might look at Gillum’s tax plan next week. We’ll see. I don’t think there’s much of interest in it.

Allowing churches to operate tax-free is a clear violation of the establishment clause of the First Amendment. Tax those assholes.

— The Planet (@ShipInTheKnight) September 4, 2018

Hmm, he might want to look at what other entities are tax-exempt as well. Tax all the things!

One of Jon Kyl's big wins: Increasing the estate tax exemption and indexing it for inflation.

— Steven Dennis (@StevenTDennis) September 4, 2018

Jon Kyl is John McCain’s replacement in the U.S. Senate, and had been an Arizona senator before.

In any case, I don’t think tax is the hot topic right now. I hear tell there’s some sort of hearing going on in D.C. right now.

Related Posts

Divestment and ESG Follies: Mandating Women on Corporate Boards

Let's Bring Back Damnatio Memoriae

The Amazon Escape: On Negotiation and Leverage