Divestment and ESG Follies: The Case for Divestment in Public Pension Plans

by meep

While I have generally been against divestment policies for public pensions (especially when they come from outside parties with no fiduciary duties), there are some sectors where divestment makes a lot of sense.

Let me start with private prisons because this is actually one of the strongest divestment cases for government pensions.

It’s because there’s the political risk of private prisons being shut down. That privately-run prisons exist is obviously the result of government policy. If it becomes politically unpopular to have private prisons, then duh, they go away.

Public pensions, which are already exposed to a lot of political risk, shouldn’t pile on more political risk by investing in private pensions.

June 21, 2019: Warren pledges to ban private prisons

White House hopeful Sen. Elizabeth Warren (D-Mass.) on Friday announced she would ban private detention centers if elected president.

In a Medium post, Warren called for the abolition of private prisons and private immigration facilities “by ending all contracts that the Bureau of Prisons and ICE [Immigration and Customs Enforcement] have with private detention providers.”

…..

In her proposal, Warren painted a picture of private detention facilities rife with corruption, mistreatment of inmates and support from lobbying efforts in Washington.“We didn’t get here by chance. Washington works hand-in-hand with private prison companies, who spend millions on lobbyists, campaign contributions, and revolving-door hires — all to turn our criminal and immigration policies into ones that prioritize making them rich instead of keeping us safe,” she wrote.

In November [2018], Warren led a group of Democratic senators in demanding transparency from private prison operators.

Warren on Friday credited former President Obama with taking measures to wind down reliance on private prisons, but “these companies got their biggest break yet when Donald Trump landed in the White House.”

“With Trump, private prison companies saw their chance to run the same playbook for our immigration system,” she wrote.

Obviously, the federal government can only dictate the use of private prisons for federal detention. I don’t know the private detention biz enough to know what the balance of the mix between federal and state, immigration-related and criminal-related business is for these companies.

However, this does seem reasonable to decide as a public pension not to invest in an asset that is easy to lose all value due to a shift in public policy.

Unsurprisingly, after Warren said she would ban private prisons and other privately-run detention facilities, the stock price of the targeted companies tanked.

Private prison companies took another dive on Wednesday [June 26, 2019] after Bank of America announced it would no longer finance the facilities.

What’s happening: Shares of major private prison companies GEO Group and CoreCivic had another major selloff, slumping 4.2% and 4.4% respectively after the BofA news.

Reuters’ Imani Moise, who broke the news, also made waves in March with news that JPMorgan had made a similar declaration, and Wells Fargo also announced it would stop loans to the industry.

Background: Activists have stepped up pressure against the financing of private prisons amid heightened tension over immigration policies from the Trump administration and concerns about facility conditions. Private prisons account for about two-thirds of people held by U.S. Immigration and Customs Enforcement, according to S&P Global Ratings estimates.Earlier this month, the companies were rocked by an announcement from presidential candidate Sen. Elizabeth Warren, who tweeted about about her plan to terminate private prisons entirely.

That news sent GEO to its biggest intraday drop since March. CoreCivic fell by as much as 6%, the largest intraday decline of the year.

The big picture: GEO Group’s stock is up a little more than 3% year-to-date, but has fallen more than 16% since June 18.

CoreCivic’s stock is up 14% for the year, but has dropped more than 18% since June 18.

Of course, it would not only be private prisons where this could be the case.

I am thinking of a variety of subsidized businesses, where if the government subsidy went away…. hmmmmm. Put a pin in that one, and we shall come back later.

NOT JUST PUBLIC STOCKS, BUT PRIVATE EQUITY

Thing is, many politically sensitive businesses know better than to be publicly-traded. There is a reason private prison companies would go public:

The Business Model Of Private Prisons

Why Would a Private Prison Need to be Publicly Traded?

As a business grows it can make the choice to go public. Essentially, this does a few things for the company that it can’t do as a privately held business.

With most businesses, exposure is the key to growth. The more people that know about the company, the more sales they can do. However, with a private prison exposure isn’t something they really need. Instead, they need capital boosts for two other reasons.

If a prison can “mark up” a prisoner $50 per day, that means their prison can theoretically earn $50,000 per day on a prison that houses 1,000 inmates. If they can land another contract with the government to build a prison in the neighboring state, they could start earning an additional $50,000 per day by maxing out that prison. By going public, they can see a sudden influx of money that would allow them to build that second prison.

Still, there is a seedier reason to go public for a private prison. In order to stay in business, these prisons need a constant stream of inmates coming in to replace those that have served their sentence. This means that laws have to be enforced, contracts renewed, and in some cases, laws more strictly enforced. To do so they have to buy politicians. This process is called lobbying and is often frowned upon.

Look, privately-held companies can also lobby. Especially if they’re in the private equity portfolio of various public pensions.

The point of private v. public is how one can raise capital, and the pool available to one. But private equity has had a huge pool of money available via public pensions desperate for returns.

How Private Equity Is Turning Public Prisons Into Big Profits

Today, a handful of privately held companies dominate the correctional-services market, many with troubling records of price gouging some of the poorest families and violating the human rights of prisoners. But the problem doesn’t end there. These companies are often controlled by private-equity firms, which through financial alchemy transform the prison-industrial complex into lavish returns for pensions, endowments, and charitable foundations. And, as successive administrations have ramped up immigration enforcement, they’ve also squeezed money out of immigrant detention.

….

In 1833, two years before Alexis de Tocqueville published Democracy in America, he helped write a lesser-known study, On the Penitentiary System in the United States and Its Application in France. The report was generally damning (“the prisons…offer the spectacle of the most complete despotism”), and Tocqueville noted America’s penchant for inviting private profit-making into public prisons. Contractors who exploited the prisoners for labor also profited from selling them essential items:

….

In 1887, Congress passed a law eliminating contract labor in the federal system, and the states soon followed. The market described by Tocqueville collapsed, and for the first half of the 20th century, public correctional agencies assumed nearly all aspects of management for adult prisons, from food and clothing to the commissary and health care.

….

Some 1,400 miles away, just across from the Four Seasons Hotel in downtown Miami, a 35-story office building angles skyward, covered in missile-resistant glass the color of the Bay of Biscayne. The building is home to a number of financial companies, including a private-equity firm called HIG Capital, which manages more than $30 billion in assets. HIG has one of the more unusual side hustles of any private-equity firm: Over the past decade, it has quietly helped consolidate correctional phone, food, commissary, and health-care companies into behemoths that dominate their markets and, according to critics, drive prices up for families while lowering quality.

….

While HIG has spent the past decade carving out a niche in the prison commissary and health-care sectors, it’s far from the only private equity firm with stakes in the corrections business. Indeed, when Bianca Tylek was sifting through the 3,100 companies in her Corrections Accountability Project report, she noticed a peculiar trend: “On a systemic level, the thing that really emerged is how active private equity has been in shaping the prison-industrial complex and how many of the biggest actors in the field are owned by private-equity companies.” She paused. “In fact, almost all of them are.”Tylek said private-equity-brokered roll-ups—deals like HIG’s that bundle fragmented regional players into national conglomerates—have profoundly reshaped the correctional-services industry; “without PE shops, these companies could not have become as big and as exploitative as they are today.”

It took me only a few Google searches to grasp how difficult it would be to prove Tylek’s intuition about private equity’s negative effects on the correctional system. Anyone looking for insight faces three layers of opacity: Most correctional-services companies are privately held, meaning financial information is hard to come by; private-equity firms are lightly regulated, with few public-reporting requirements; and the correctional system is notoriously hostile to outside scrutiny.

At a loss, I called a friend who has worked in private equity, who said corrections is a niche industry that cuts across business sectors, so there are no analysts who look at it as a whole. He suggested calling Wall Street analysts who cover publicly traded private-prison companies, whose dealings are less hidden from view; none could offer any insight. I looked to academia, but several economists said no one studies the role of private equity in corrections.

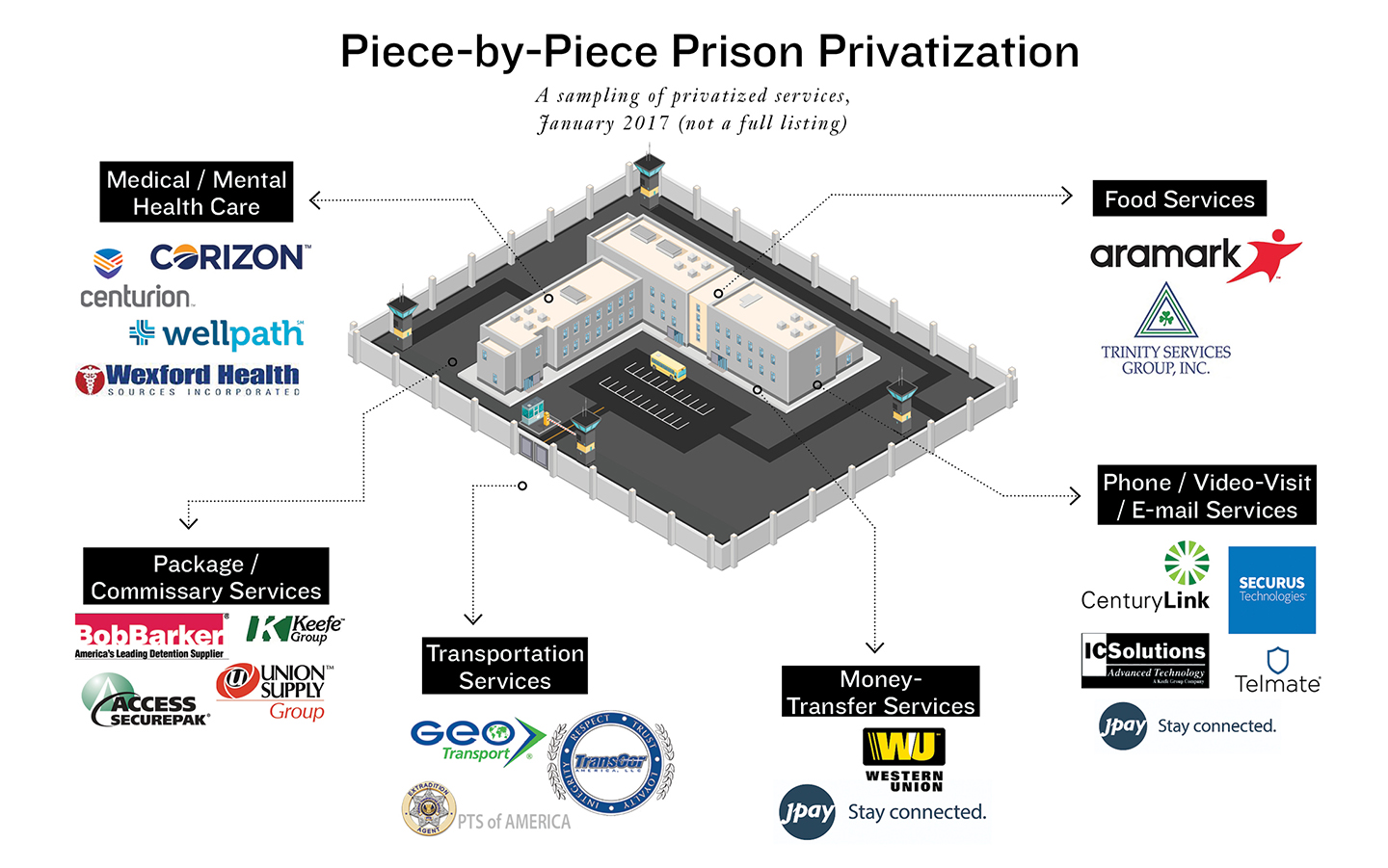

Let’s take a look at some of the sectors involved:

Note a few of those names you may have seen elsewhere — like Aramark. They do institutional food services in places like universities, K-12 schools, and even companies — I can believe they may have a division just re: prison food services, but it’s not much different from schools like I went to.

I went to a public boarding school, and unlike regular K-12 schools, nobody paid anything for the meals (except the taxpayers of North Carolina). It was a privately-run company, and we students were part of the labor… not much different from a prison operation, if you think about it. We were not as well-supervised as a prison…back then. Current students probably find it difficult to get out & back in without detection, as some did back in my day. They probably also don’t get away with using pudding to cement bowls to the underside of tables anymore. But I dunno. They are a pretty smart group of kids.

In any case, some of the specific private services are not ones that have a broad base of customers outside prison. Even if the state/feds operated the usual detention operations re: guarding, prisoner transport, etc., they still would likely go with the private food service.

In many cases, having a government-run service – such as medical care – is not necessarily going to be better than the privately-run one. Look to the VA medical system, and you know that will be the case.

But let’s put that aside for now. The question is: should public pension funds be investing in these companies, whether the publicly-traded ones or the ones funded via private equity.

A number of public pensions have invested in the HIG fund that controls Wellpath, including ones from Tennessee and Orange County, California, as well as the Ohio Highway Patrol’s. A wide range of organizations have invested in the HIG funds controlling the Keefe Group, including the Knight Foundation, the Sherman Fairchild Foundation, the Ford Foundation, the Police & Fire Pension Association of Colorado, and the Producer-Writers Guild of America Pension Plan.

In an unexpected twist, the State of Michigan Retirement Systems, which pays out correctional officers’ pensions, has $25 million in one of the funds that control Keefe and Trinity Services Group, according to a 2015 quarterly investment review and confirmed by Ron Leix Jr., the deputy public information officer at the Michigan Department of Treasury. Leix played down the multimillion-dollar investment, calling it “tiny.” Nonetheless, because the Michigan Department of Corrections contracts its commissaries and care-package service to Keefe, and previously contracted its food to Trinity, the department’s staffers, however indirectly, have benefited from the fees that Keefe charges prisoners and their families, and from the profits Trinity made from running the prison kitchens.

I called up David Angel, the retired Michigan kitchen officer, to ask him how he felt about having his pension paid out in small part from companies that also profit off of prisoners. “I don’t like it all,” he said. “You have them investing in something that could potentially be a conflict of interest.” He added that, if officers had known their pensions would be partly paid with profits from Trinity, the company that ran their kitchens into the ground, “we’d have maybe put pressure on the pension system to pull their pin on that.”

Then there’s the bigger question of whether public pensions should be in private equity to begin with.

But that’s for a different time.

Other private prisons-finance-related stories:

- Bank of America will no longer do business with companies that run detention centers

- Pensions commit to $8B fund of prison-phone magnate

- California State Controller Eyes CalPERS Private Prison Divestment

- NYC Pensions to Expand Prison Investment Ban With Platinum Equity

- Pension board OKs $300 million investment in private equity firm connected to prisons, student debt

- New York State Teachers’ Pension Invests in Companies That Operate ICE Centers

- Oregon’s Public Pension Fund Invests in the Immigration Detention Centers That Residents and Politicians Say They Hate

I’ll drop other divestment-related stories below.

TOBACCO DIVESTMENT

U.K.‘s NEST to divest from tobacco

National Employment Savings Trust, London, is divesting from all tobacco investments, a spokesman said.

The defined contribution multiemployer trust currently has £40 million ($50.8 million) invested in tobacco across its portfolio. It has set a target of two years for the portfolio to go tobacco-free but anticipates full divestment will occur before the deadline.

This decision was made after NEST concluded that tobacco would generate poor long-term returns due to stricter global regulations against tobacco products, increasingly aggressive legal action by governments against the tobacco industry and declining smoking rates globally.

“In our opinion, tobacco is a struggling industry (that) is being regulated out of existence,” CIO Mark Fawcett said in a news release.

That is a reasonable decision, too….if tobacco companies were always going to vend tobacco and only tobacco. That’s the issue. If the industry gets regulated out of existence for tobacco cigarettes, do you think they will avoid getting involved in ever-more-legalized marijuana? Or, say, just pure nicotine products, as per vaping? [yes, I know about the most recent moral panic over vaping]

Seems silly to me to divest totally from “tobacco companies” when they may be doing a variety of things, not just tobacco.

But yes, vaping is also currently on the rocks, and we will see how that one shakes out.

ON ALTERNATIVE ENERGY DIVESTMENT

Now, this is me having fun.

I came across this piece on wind and solar… and tax breaks:

So What if Tax Breaks Are Cut for Wind and Solar Power?

Higher demand and other financial sources should fill the gap, eventually.

Washington is trimming federal tax breaks for solar and wind energy, whose growth these incentives spurred. At first blush, that appears to be bad news for these renewable power sources. But in spite of the loss of federal help, which may retard them a bit, their future appears to be solid.

Thanks to a 2015 vote in Congress, production credit for wind farms will be trimmed to 10% in 2022, tapering down from the current 30% level. The tax break for solar panels also is 30% today, and will be gradually lowered, as well. In three years, it will be at 10%, too, but only for commercial facilities. Homeowners get zero.

Federal help for renewable energy has been a long-standing target for Republicans, and the Trump White House is no fan of them. Tax credits, wrote Katie Tubbs, a senior policy analyst at the conservative Heritage Foundation, is “a popular way for government to award special treatment and artificially attract private sector interest to politically connected and well-connected industries.” Result: Don’t look for a reprieve of the wind and solar tax breaks anytime soon.

Now, this writer is sunny on the future prospects of this industry, but this is a warning to public pensions re: investing in anything requiring government subsidies to be viable.

Long term, though, wind and solar should be increasingly viable, and displace fossil fuels. At the moment, coal and natural gas are cheaper. Given the pace of technological advancements for both renewables, Bloomberg New Energy Finance estimates, the expense of electricity generation will fall to around $20 per megawatt hour in 2050, from $70 for solar now and $45 for onshore wind (the most prevalent). Gas and coal, which require major extraction outlays, will be slightly more costly than today.

Well, could you project fracking, Bloomberg New Energy Finance? My understanding is that fracking did reduce extraction costs.

Sources of Funding Beyond Government

In light of the need for non-carbon energy to combat climate change, it’s notable that pension funds and other institutional investors are putting money into the endeavor. The question is whether what they’re investing will be enough, in the US at least, with federal help diminished. Some $1.7 trillion in investment is needed by 2030 to meet global renewable energy targets aimed at mitigating climate change, the International Renewable Energy Agency figures.

Institutional investors will double their renewables portfolios to $210 billion over the next five years, Octopus Group researchers found in a survey. For instance, Canada’s $230 billion pension fund, Caisse de dépôt et placement du Québec (CDPQ) has a strong commitment to renewable energy, and is helping build a $4.7 billion light rail system to open in two years in the Montreal area. The fund has a 2020 target of $26 billion invested in low-carbon activities worldwide, with an emphasis on solar.

Many large asset managers have renewable energy funds that feed solar and wind investments, like Blackstone, which research firm Preqin says is raising $40 billion for this purpose.

One approach, instead of ponying up government largess for renewables, is to mandate their use. That’s what’s happening in California, where starting in 2020, newly constructed homes must have solar panels. And that could be expensive for homeowners, tacking on $8,000 to $10,000 to the house purchase price, the California Energy Commission calculated. On the other hand, the agency figured, each home will save an average $80 monthly on lighting, cooling, and heating bills. At that rate, it would take 10 years to pay off the solar installation.

That would be a sweet trick — investing in companies, and then mandating people have to buy their stuff.

You know, maybe, just maybe, people will get pissed at the politicians for this crap, throw out the politicians and not buy the mandated stuff. That’s a possibility. Or the real estate market craters in California.

But again, let’s think this through: any industry which is heavily subsidized via explicit government policy may run into danger should that policy change. One may bet that now-and-forever the Green-New-Dealers will have the upper hand… but you bet for Hillary Clinton to win as a sure thing in 2016, too, didn’t ya?

My point here is that while many look to fossil fuel divestment due to government policy, and see the political risk there, any major sector involving large political risk is suspect for a public pension portfolio.

One needs to think of the political risk of funding levels for the pension fund on one side, and which asset-side political risks exist. It exists well beyond guns and fossil fuel.

DIVESTMENT AND ESG STORIES

I last posted about divestment/ESG issues in April, so here are the stories I’ve amassed since then that weren’t covered above.

- You’re On The Hook For Trillions In Pension Overpromises, And Divestment Is Making It Worse

- WHO DO PENSION FUNDS WORK FOR

- University of California Endowment, Pension to Divest All Fossil Fuels

- Banks’ Pledge to Fight Climate Change Isn’t Universally Lauded – bwa ha ha ha

- Maryland Comptroller Peter Franchot Urges Divesting From Alabama Over Abortion

- Long Island union claims divesting state public worker pension funds from fossil fuels will be costly

- New York State Pension CIO Opposes Fossil Fuels Divestment Bill

- NY Pension’s Fossil Fuel Divestment Efforts Facing Stalwart Opposition

- NY Senate to hold hearing on fossil fuel divestment

- California Pension Fund Invests in Cannabis While Shunning Tobacco

- Should public pensions invest in Uber and Lyft? Sure, says the man who pushed to divest in guns

- Norway’s Pension Giant Revokes Walmart, Rio Tinto Exclusions

- CalPERS can’t afford to put social strategy above returns

- Ontario Teachers outlines climate change investment policy in new report

- CalSTRS Teams Up with Pope Francis on Climate Action

- Spotlight on California as Pension Funds’ Climate Risk Reporting Deadline Approaches

- WHO DO PENSION FUNDS WORK FOR?

- You’re On The Hook For Trillions In Pension Overpromises, And Divestment Is Making It Worse

- CA Pension Fund Faces Crisis After Shunning Guns, Tobacco

- Calpers’ Dilemma: Save the World or Make Money?

- CalPERS using more ESG in investment strategy

- As N.J. Cuts Hedge Fund Ties, Chatham Shows That Can Take Years

- California moves to divest from Turkey over Armenian Genocide despite pension fund objections

- It’s Proxy Season And Here’s Why That Matters For Public Pensions

- Another Voice: State pension funds shouldn’t be captive to politics

- New York Comptroller Aims to Double Pension Plan’s ESG Funding

- Letter: Challenge validity of pension study

- Third Swedish Pension Plan Divests from Nukes and Tobacco Companies

- Put retirees first: Peduto’s politics shouldn’t drive city pensions

- Norwegian Pension Fund Sheds Gaming Stocks from Portfolio

- US Universities And Retirees Are Funding The Technology Behind China’s Surveillance State

- Pittsburgh Mayor Asks Pension to Divest Guns, Fossil Fuels, Private Prisons

- California moves to divest from Turkey over Armenian Genocide despite pension fund objections

- Maryland’s Pension Fund Wages War: The $52 billion state retirement system could cut ties with Alabama firms over restrictive new abortion laws.

- UPDATE 1-British lawmakers demand their pension fund divests fossil fuels

- Calif. Gov. Newsom Announces Executive Action to Leverage State’s Pension Investments, Transportation Systems to Strengthen Climate Resiliency

- University of California to dump fossil fuel investments

- Executive order N-19-19 on using pension funds for climate change agenda

- The University of California Divests: Giving up higher investment returns for climate-change piety.

- Pension Funds, Insurers Commit to Carbon-Neutral Investments by 2050

- Danish Pension Funds Sign $52 Billion Green Pledge

- Green campaigners target Europe’s biggest pension fund

- Danish pensions to put $50 billion into green investments

- California Pensions Could Be Mandated to Divest from Turkish Assets over WWI Atrocities

- Gavin Newsom tells CalPERS, CalSTRS to favor green investments in climate change order

- NY pensions deserve protection

- Dutch Pension Funds Look to Transform How Real Estate Investors Decarbonize

- UC to dump fossil fuels holdings in pension and endowment funds worth $83 billion

- Op-Ed: Frustrated by the lack of action on climate change and gun violence? Divest

- Bill passes moving CalPERS, CalSTRS closer to divesting Turkish investments

- UK pension funds sign new climate charter

- US Pensions Under More Pressure to Divest From Chinese Securities

- ExxonMobil, Shell Among 10 Oil companies Dumped By Danish Pension Fund

- Amazon fires: Norwegian pension fund demands action

- Giant Norway pension fund weighs Brazil divestment over Amazon deforestation

- NJ TREASURY DETAILS PENSION SYSTEM’S GUN-INDUSTRY CONNECTIONS

- WHY IS STATE’S PUBLIC PENSION SYSTEM STILL INVESTED IN GUN INDUSTRY?

- SWEENEY SUPPORTS BAN ON PUBLIC PENSION INVESTMENTS IN GUN INDUSTRY

- Lawmakers, environmental advocates renew call for DiNapoli to divest NY state pension fund from fossil fuel companies ahead of climate march

- Senators Demand US Government Pension Fund Reject China Investment

- Senators Demand U.S. Pension Fund Reject China Investment

- Despite State’s Hardline Stance, Tennessee Pension Holds Marijuana Stocks

- It’s not just Colorado that has questionable pension fund portfolios

- Public Pension Supporters Reconsider Socially Responsible Investing

- Try this, Mr. Mayor: Activist investing is better than dumping stocks

[An aside: while doing my news search, I came across an article from one of my business news feeds with this title: “Oil, gas sector cannot afford to lose women as it grapples with gender diversity “ ….. IS THIS A REAL PROBLEM. This seriously sounds like a bullshit problem to me. I could start getting into it, but let’s be real: pretty much all the oil/gas sector where women are employed will likely be the support depts (HR, etc.) and

marketing/sales.]

VIDEO FROM MY STATE’S COMPTROLLER

Because New York is Important.

END OF THE ROAD FOR DIVESTMENT AT STUMP

And sorry, guys, as with the ACA posts I used to do, I’m going to have to stop with the divestment/ESG posts, as it’s something I now have to compile and analyze for people who actually pay me. So enjoy! You’ve always got my archives to dig into:

In no particular order:

- April 2019: Divestment and ESG Follies: Where’s My Dark Money?

- March 2019: Divestment and ESG Follies…and Heroes: YAY for President of Brown University, Oil, and Private Prisons

- Nov 2018: Divestment and ESG Follies: A Lack of Humility – Tobacco, Climate Risk, and More

- May 2018: Divestment and Activist Investing Follies: What’s Next? My Lunch?

- Dec 2018: Divestment and ESG Follies: Mandating Women on Corporate Boards

- April 2018: Divestment and Activist Investing Follies: Hey, No Fair! Climate Change, Guns, Knives, and Consequences

- April 2018: Divestment and Activist Investing Follies: Shooting Yourself in the Foot?

- March 2018: Divestment and Activist Investing Follies: Don’t Let the Evil Ones Bank! Also more Pension Divestment Idiocy

- Sept 2018: Shoe Is On the Other Foot: Police Unions Call for Nike Divestment (and other divestment follies)

- Feb 2018: Dirty Divestment and Clean Investment Follies: There Had Better be Returns

- April 2018: Divestment Dumbassery: Know What You’re Protesting

- March 2017: Stupid Public Pension Trends: Divestment Expands

- Jan 2017: Setting the Stage for 2017: Questionable Pension Asset Management Practices

- March 2018: More on Divestment: Your Money? Go For It. Other People’s Money? Be Careful.

- Dec 2017: More Divestment Follies: the Iffy Priority, the Sensible Strategy, and the Lack of Fiduciary Duty

- Sept 2018: Divestment Follies: An Actual Cogent Case…Kind Of

- June 2018: Around the Pension-o-Sphere: MEPs, Illinois, and Divestment

- Aug 2017: Public Pension Assets: Divestments for Everybody!

- June 2018: Around the Pension-o-Sphere: Divestment, Janus, and More

- Oct 2018: Divestment Follies: Going After Facebook…. Again

- Nov 2015: A Week of Bad Pension Ideas: Finally, Divestment

- Oct 2015: Public Pension Follies: Divestment! Divest from All the Dirty Things!

- May 2017: Priorities for Pension Funds: Climate Change or Solvency?

- March 2018: Around the Pension-o-Sphere: Fiscal Reporting Bootcamp, Transparency, Divestment Hero, and More

- Feb 2018: Around the Pension-o-Sphere: Let’s Divest from Guns, New Interpretation of Pension Spiking, and More

- Dec 2016: Calpers: Moving Targets, in More Way than One

- Oct 2018: Calpers Quickie: President Pushed off the Board Due to ESG Over Pension Security

- Oct 2018: Public Pension Fund Governance: Who Are the Funds Being Managed For?

- June 2018: Mornings with Meep: Gathering Info and Around the Pension-o-Sphere

- July 2019: Trump Tweets and Public Pensions: Is CalSTRS really a long-term investor?

Hmm, I didn’t realize I had so many…

We’ll always have death and taxes!

Related Posts

When the Money Runs Out: Some Thoughts on Public Finance and Pensions

Taxing Tuesday: Where Are the Highest Taxes?

Taxing Tuesday: ALL YOUR ASSETS ARE BELONG TO US