The End of an Era: Where are the 80% funding myths of yesteryear?

by meep

I noticed a bunch of people signed up for my substack recently (It’s free! Yes, you can pay, but you don’t have to. The only difference is paying subscribers can leave comments.), and, given the “end of summer” in the week before Labor Day, I thought I’d revisit some of my main blog themes this week.

Today’s is the 80% funding myth with respect to public pensions in the U.S.

An explainer of the 80% funding myth

The funded ratio is one metric in measuring how adequate the assets are for paying for the pension liabilities already accrued. That is, the benefits already earned by current retirees, active employees, and anybody with vested pension benefits but not yet taking those benefits.

The funded ratio is just taking the value of the assets (and sometimes that’s difficult to value, depending on the type of assets) divided by the value of the liabilities (that’s really difficult to value).

Every year, the assets do their thing (assets sold, purchased, throw off cash from bond coupons, etc., market values change), the liabilities do their thing (as active employees accrue another year of service, new employees are hired, some leave employment, some retirees die, etc.), so this funded ratio goes up and down driven by these various factors.

The 80% funding myth is when any journalist (bad), politician (worse), or pension official (worst) compares the fund’s current funded ratio – or, worse, target funded ratio – to 80%, instead of 100%, which is the proper measuring stick. Usually, they use words such as “80% is generally considered a healthy funded ratio” or some such. That will get you into the Hall of Shame.

Back in 2012, the American Academy of Actuaries put out a brief explaining that the 80% value was meaningless and that 100% is the only meaningful measure. (To be sure, 0% is also meaningful, but generally you don’t have to explain that to people.) In 2014, they updated the brief.

[By the way, an 80% funded ratio may be good or may be bad for a particular pension plan. As the Academy briefs state, looking at that metric at one point in time by itself does not have enough context to judge. I often have to dig into what the longer-term trend of the ratio is, what assumptions were used in valuing the pension liability, and sometimes even the actuarial valuation method.]

For a while, I used to bug the staff at the Academy every time I saw the 80% myth in the news, but it didn’t seem anything ever came of it. Maybe they contacted the journalists, maybe the journalists didn’t care, or maybe nothing at all was done.

So I started blogging about it in November 2014.

Since November 2014, I’ve had over 50 blog posts touching on the subject. I have a dedicated news search on “80 percent pension”, and people helpfully email me (marypat.campbell@gmail.com) when they come across such stories. My news search doesn’t necessarily find all of them.

Recent 80% myth stats: is the myth dead?

The last 80% funding post was done in May, but it was just to repeat a post from November 2014, at the beginning of blogging about the myth, to explain why the 80% figure is harmful to public pensions.

I’ve kept a spreadsheet with all the 80% myth sightings, and my last sighting was July 2, 2020: Greg Hinz at Crain’s Business Chicago:

Fiscal watchdogs generally want pension systems to have a funded ratio of at least 80 percent, and preferably 90 percent.

PREFERABLY 100 PERCENT DAMMIT (and actually higher at the end of a long bull market run). I am amazed Hinz didn’t know better.

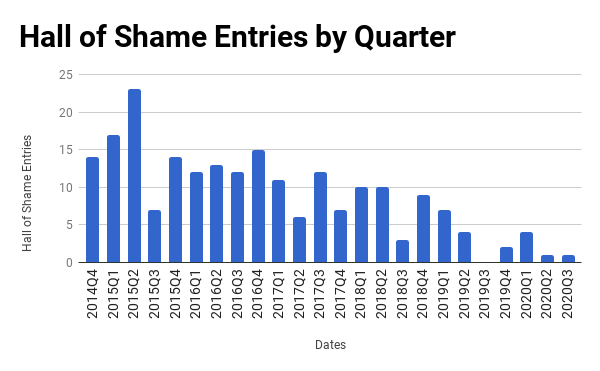

Going back to October 2014, I have 216 entries in the 80% Funding Myth Hall of Shame, but I also have other lists: ambiguous (usually mentions 80%, but not necessarily a fully-fledged myth quoter), Never Fully-Funded List of Evil, and the Heroes List.

I will talk about some of the frequent fliers on my lists in a bit.

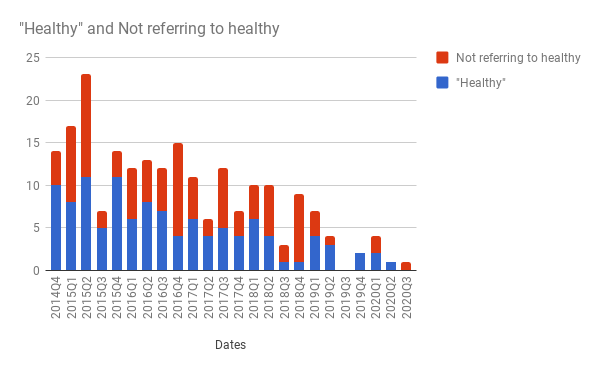

I have kept tabs on these, including people specifically referring to 80% fundedness as “healthy”.

Here are some graphs of number of entries by quarter:

And the healthy breakout:

You can see that the stories have died away.

But why has the myth mainly disappeared from articles about public pensions?

When 80% is aspirational, the goalposts have to be moved

At the end of 2019, I noticed the stories were dying off.

As much as I’d love to take credit for this trend, I know this is not the case. As I said in December 2019:

But let me be realistic: almost definitely this is being driven by stagnating funded ratios, where 80% is aspirational.

Various officials and politicians pointed to 80% when funded ratios were bobbing around that level.

Then some moved the goalposts to 70%. (and by “some”, I mean Dean Baker. And Fitch Ratings, kind of but not really.)

But once you start dipping below 70%, it is really tough to get even the vaguely numerate to believe that 60% or 50% is a perfectly peachy funded ratio. People know that’s a failing grade in school. 80% might be a B – that sounds good. 60% is a D… and 50% is F.

[unless you majored in physics, as I did. 60% was an A.]

The fiscal year results are coming out now (usually ending June 30 for government plans) – I’m seeing the June 30, 2019 – June 30, 2020 investment results for pension plans come out, and, while they’re not negative, they’re way below target rates.

Funded ratios will be dropping for FY2020. 80% fundedness is ever farther away.

Indeed, considering that people are talking about potential state bankruptcies or federal bailout of state pensions, no, we’re not going to be hearing much about 80% funded ratios right now.

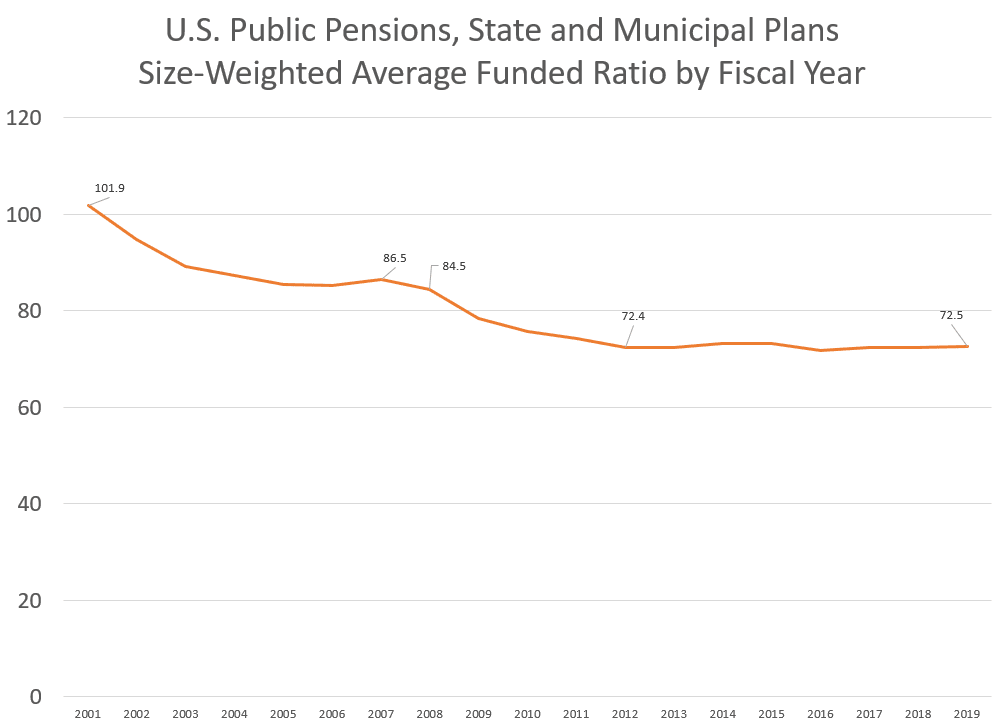

A reminder that before COVID-19 hit, the overall funded ratio in the U.S. looked like this:

U.S. public pension plans, in general, have been hanging out around 72.5% fundedness since FY2012.

That’s liability-weighted. Here’s just count of plans from FY2017:

There are actually some plans that look well-funded compared to 100%, but again, a lot goes into the metric. I will do another post later to look at the information I have via the Public Pensions Database, as I recently downloaded the data to update several things. There are some plans reporting FY2019 in there, but far more for FY2018.

By count, 80% funded was at the 67th percentile in the distribution of the plans with info for the Public Plans Database.

100% funded was 96th percentile.

Hall of Heroes notables

Just to take a moment to recognize the heroes, as I have found them. They need not mention 80% at all (I’d rather they not mention it, because people get stuck with that arbitrary number in their heads) — just to indicate the proper number to compare against is 100%. That’s the only meaningful reference point.

Daniel Borenstein at the Contra Costa Times (alas, my old links to his piece are dead) kicked off the Hall of Heroes in 2015 by taking the 80% funding myth on:

Public employee unions repeatedly insist that workers’ pension funds need not be fully funded, that a target of 80 percent is fine.

So it wasn’t surprising that a retired labor leader advocated that position at a recent talk I gave in Oakland. It was, however, disconcerting that the city’s assistant city administrator went even further, saying 75 percent funding was OK.

They’re wrong. A goal of anything less than full funding unfairly forces future generations to pay for current workers’ pensions and leaves local governments vulnerable to large future rate hikes.

Of course, a goal of full funding with really “optimistic” assumptions for valuing the pensions can also leave governments vulnerable, but let’s leave that for another time.

The heroes have been less numerous than Hall of Shame entries: only 30 entries running from 2015 to 2019. Of course, as fewer people have mentioned the 80% funding myth, there’s less and less need for people to counteract it.

But it has been nice to see people ranging from The Civic Federation to Jack Humphreville of CityWatch to NJ Assemblyman Ned Thomson to Rob Fellner of the Nevada Policy Research Institute.

I do appreciate that I’m not alone in trying to make it clear that full-funding is the target, and comparing to 80% of the way there is meaningless.

Hall of Shame frequent fliers

Oh, this one is fun, because at least two people on this list have blocked me at one point (haven’t checked recently).

I used to email journalists directly about the 80% funded ratio myth, I would leave comments on the story (if I could), and sometimes I tweeted.

But I noticed particular people kept at the myth…. Of the 216 entries, 24 were on there multiple times. To be sure, most were only twice, and sometimes those two times were in quick succession. Once I remove the 17 people/editorial boards that showed up twice, I’ve got my top 7 offenders….

Keith Phaneuf of the CT Mirror: 8 times. When he hit entry number 8 in 2017, I had a bit of fun with it: Congrats to Keith Phaneuf, 8-Time 80 Percent Funding Hall of Shame Member!

As long as people like Keith Phaneuf never have to correct parroting idiocy, it will live on.

To be fair to Phaneuf, I have not caught him out referring to the 80% myth since July 2017. Maybe I influenced him, or… well, CT finance has been totally screwed and 80% is a bit out of reach. Phaneuf is one of the main people I follow for reporting on CT finances.

Hilary Russ at Reuters: 5 times

Debby Woodin, Joplin Globe: 4

Karen Pierog, Reuters: 4

Ralph Martire, Center for Tax and Budget Accountability: 4

Joseph Cranney, Naples Daily News: 3

Omaha World-Herald editorial: 3

I do want to talk about one other person on this list: Ralph Martire.

He is one of my nemeses (pretty one-sided, I’m sure), in that the “solution” he keeps coming up for Illinois is basically rearranging the band members on the Titanic while they’re playing “Nearer My God to Thee”. He often pops up in discussions of Illinois finances. Ugh, he was on board with a pension obligation bond for Chicago back in 2018. Anyway, he is just chock-full of support for ideas that will not change a damn thing in Illinois.

Martire’s last appearance on the 80% Hall of Shame was 2018, in which he tried to shift the blame of the myth onto the CBO. Again, nobody is talking about 80% fundedness in Illinois now (okay, except Greg Hinz, apparently. Someone needs to tell him to stop doing that.)

Reminiscing about the myth

Some of my favorite blog posts have been about the 80% funding myth.

Let’s look back at some highlights in my 50+ posts:

December 2014: 80 Percent Pension Funding Hall of Shame: Experts Say…. — I notice the weasel words of “experts say” rather than naming a specific source.

A “experts say” formulation is something that generally sticks in my craw in any kind of reporting. Put a name on it, dammit.

January 2015: 80 Percent Funding Hall of Shame: Oh THOSE Experts Say – I catch some groups/people being specifically named as sources of the myth, and I noticed Dean Baker moving the goalposts down to 70%.

September 2017: A New Category for the Public Pension Hall of Shame: Never Fully-Funders. Haven’t heard much from these folks recently. I would love to hear their points-of-view on the need for public pension bailouts.

December 2017:

Let’s Ring Out the Year with the 80 Percent Funders! – A general roundup, complete with animated gifs!

March 2018: Two Awful Tastes That Go Great Together: Pension Obligation Bonds and 80% Funding Myth. POBs are another big theme I have, but this one stood out because something supposedly said by an actuary:

I am extremely suspicious about the unnamed actuaries who supposedly want to see the pension funded at 75 percent or more.

If an actuary mentioned 75% at all, they may have been referring to what the credit rating agencies are looking for, when considering municipal credit ratings. Whether they should be happy with only a 75% funded ratio after so many years of a rising stock market…. well, I’m not at a credit rating agency.

Yeah, I’m not at a credit rating agency.

To round this out, an April Fools post from me:80 Percent Funding Hall of AWESOME: Experts Say….

EVERYTHING IS AWESOME!

EVERYTHING IS COOL AT 80 PERCENT

EVERYTHING IS AWESOME!

PENSIONS WILL BE PAID TO THE CENT

EVERYTHING IS BETTER WHEN YOU PARTIALLY FUND

IF THE PENSIONS GET WHACKED WE WOULD BE SO STUNNED

THEY’RE THE SAME, NEW JERSEY, CHICAGO, KENTUCKY, THE PENSIONS WILL ALWAYS BE……

EVERYTHING IS AWESOME!!!!!!!!!

WHEN YOU’RE LIVING THE DREEEEEEEEEAM

You can click through for quotes and animated gifs.

And here’s one just for you:

Enjoy!

80% Pension Funding Hall of Shame and Heroes List spreadsheet

Related Posts

80% Fundedness: An Excellent Example and The Usual Disappointments

At the Half: Updating the 80 Percent Funding Hall of Shame

Two Awful Tastes That Go Great Together: Pension Obligation Bonds and 80% Funding Myth