Reading the News with Meep: Stalled Stimulus, Illinois, MEPs, CT pension payments, and More!

by meep

Howdy, welcome to what I’m reading on finance, pensions, and more. Until I get a new site working for collecting my news items, I will be making this a regular-ish feature.

But first — I am fundraising for the Movember Foundation, my fourth year doing so, as Stu was diagnosed with metastatic prostate cancer back in 2017. Stu is still with us, and so is his cancer (it’s in his bones), and it’s thanks to many of the treatments developed in the past decade. (I made the mistake of looking up historical survival rates for his diagnosis back then…. they were pretty grim, even for 1-year survival, forget about 5-years).

Before Stu was diagnosed, I donated to friends’ Movember campaigns, but I started doing my own fundraiser in 2017.

Here’s my fundraiser at the Movember site and here’s my fundraiser at facebook

Thanks to the kinds of treatments continuing to be developed, Stu is still with us, and we’ll be celebrating our 20th anniversary on Wednesday! Here’s to 20 more!

And now… onto the news.

The ever-delayed bailout: No, states and local governments will not get bailed out in 2020

This may be foolish on my part, with things changing immediately after posting… but oh well.

As a reminder, back in May, the House Democrats unveiled the MoneyPalooza Monstrosity, which they prefer to call the HEROES Act. It is larded up with quite a few things that have absolutely nothing to do with COVID. My coverage from May:- May 14: MoneyPalooza Monstrosity! Let’s Check Out the State Aid in the $3 Trillion Bill

- May 15: MoneyPalooza Monstrosity! Looking at the SALT Cap Provisions

- May 17: MoneyPalooza Monstrosity! Looking at the Multiemployer Pension Provisions

- May 18: MoneyPalooza Monstrosity! The Positioning for Asking for State Government Bailouts

The House passed the bill in mid-May, and it was dead on arrival at the Senate.

Senate Republicans came up with their counter-offer in September, which did not include SALT cap removal, state/local govt aid, or all the other lard shoved into the HEROES Act. Tales of woe from unbailed-out cities erupted yet again.

But for some reason, none of the “WON’T ANYBODY THINK OF THE POOR GOVERNMENT, STARVED OF TAXES” tales of woe seem to have gotten much of anywhere. People are talking more about a fly landing on VP Pence’s head than any of this finance jazz.

Elizabeth Bauer has been keeping on top of this at Forbes, and her latest piece might explain why none of this is going anywhere: What’s Fair, What’s Unfair, In A HEROES Act State And Local Bailout?

Recall that Illinois had, quite some time ago now, gotten the ball rolling on bailout requests all the way back in April with its $41.6 billion request. And, to be fair, the HEROES Act, in terms of money directed specifically to states, allocates a fair bit less than this. But let’s look at how it’s doled out:

…..

In the HEROES Act, money for states is allocated based on the proportion of unemployed workers (p. 45). The only contingency is that that money be used to cover direct covid costs or economic impacts or to make up for lost revenues. Given that the HEROES Act is itself full of endless appropriations which repeat the magic words “offset the costs of impacts due to the coronavirus pandemic or public health measures related to the coronavirus pandemic,” to justify all manner spending from child abuse prevention to the Super Cryogenic Dark Matter Search (p. 38), this hardly seems like a restriction with teeth.In addition, of the local government money, $63 billion would be allocated to cities over 50,000 in population (that is, “metropolitan cities” per the HUD definition), based on a formula which is partially proportionate to population but primarily based on poverty rates. $27 billion would be given over to states to allocate by population, and $90 billion would be paid to counties in proportion to their population.

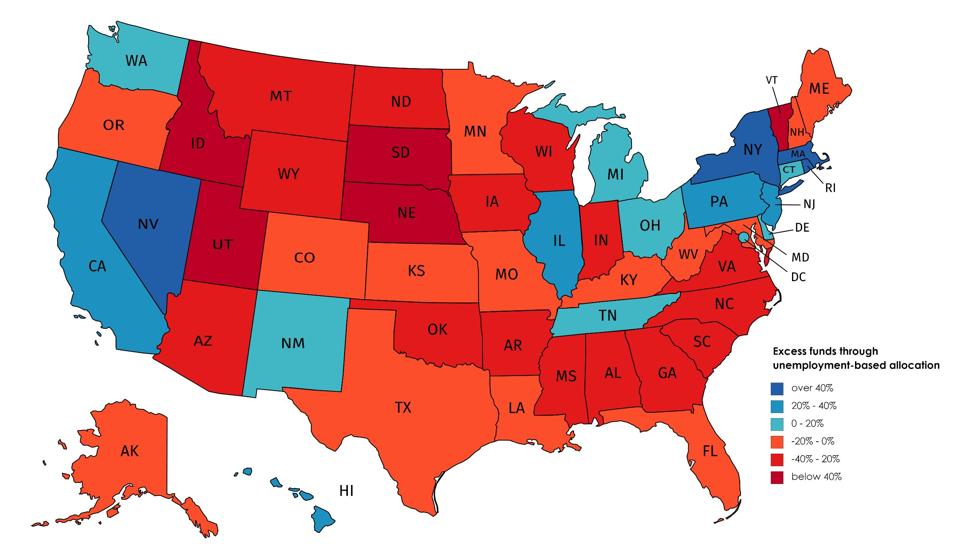

Now, the metrics for the local government and school spending money are not easy to replicate, but unemployment numbers are easy to find, and it’s a simple matter of math to compare the winners and losers of using an unemployment-based allocation instead of a population-proportionate allocation. Here’s a map, based on August unemployment data:

Bauer’s color-coding is such that the deeper red the state is colored, the more it’s short-changed, on a per capita basis; the deeper blue the state is colored, the more it gets compared to its population.

Go to Bauer’s piece to see a complete ranking table at the bottom.

Maybe, if Democrats run the tables in the November election, all their bailout dreams will come true… in 2021. But if Trump is still President, and/or the Republicans retain control of the Senate, well, good luck to all that.

Here are a bunch of bailout/stimulus stories which I hope won’t be outdated by the time I post:

- The Hill: Top Fed official warns failure to pass more COVID-19 relief could slow recovery

- Bauer: Trump, Pelosi, And McConnell Are All Failing Multiemployer Pensions – And The Rest Of Us – this is more about the bailout bill(s) than MEPs

- Newsweek: Why Another COVID Bailout Is Still Stalled in Washington | Opinion – dear god, this is incoherent. But sometimes I want to capture idiocy.

- Amtrak tells Congress it needs $4.9B bailout to avoid service cuts, layoffs – I love trains, but…. can’t we just let Amtrak die? Now?

- Pelosi, Mnuchin signal openness to $25B bailout for US airlines after Trump reverses course on stimulus – as noted by a speaker at a conference I attended last week, this would be bailing out creditors, who should have known better.

- A breakdown of whether the Democrats’ stimulus bill is actually a ‘bailout’ of blue states – I trust Bauer’s analysis more.

- CNBC: Lawmakers have been discussing second $1,200 stimulus checks for 5 months. Why those payments are still uncertain – no, the impasse is not about Covid testing and tracing, as the article ends, though I guess that’s just quoting Pelosi. Still, she’s gone in some weird directions lately.

- The Hill: Removing the bone in our throat: Senate must advance the stimulus bill – more incoherency. What is up with these people?

I had best hurry and post this before everything gets overturned again with a Trump tweet.

Illinois finance and pensions

Containerized for your protection. Most current activity surrounds the “fair tax”, aka graduated state income tax state constitutional amendment, which is on the ballot. The argument is: “Hey! We can tax the rich people more!” without making the very obvious observation that in a couple of years, “rich” will be redefined way downwards so the Illinois pol appetite for sweet sweet revenue gets closer to being fulfilled.

- Bauer at Forbes: Pension Failures, Governance Failures – Illinois Once Again Is The Poster Child

- Jim Dey: What a tangled web politicians weave when they tell the truth: “This past summer, Frerichs said a progressive income tax would make it easier for legislators to tax currently un-taxed retirement income.”

- Pantagraph op-ed: Varner: What’s unfair about the fair tax

- Wirepoints: No shame: Illinois set to borrow from Fed’s “lender of last resort” facility a second time. – I don’t know why they didn’t max it out the first time.

- Fox Illinois: Major revenues decline, including video gaming tax

- Illinois Policy (yeah, I have several of these): IF ‘FAIR TAX’ PASSES, EXPECT MORE SENIORS TO LEAVE ILLINOIS LOOKING TO AVOID RETIREMENT TAX

- Illinois Policy: PROGRESSIVE INCOME TAX WOULD CREATE 50.3% INCOME TAX RATE FOR SMALL BUSINESSES

- Illinois Policy: S&P: ILLINOIS FACES JUNK RATING, LARGE BUDGET DEFICIT EVEN WITH PROGRESSIVE TAX REVENUE

- S&P Global Ratings: Illinois’s Credit Faces Mounting Pressure as Stimulus Stalls – that was from September

- Illinois Policy: CTU ATTEMPTED TO BULLY PENSION FUND INTO HIRING MADIGAN LOBBYISTS – this is for the Chicago Public Teacher’s Fund, which is under 50% funded.

- Illinois Policy: PRITZKER REVENUE DIRECTOR SPONSORED BILL TO TAX RETIREMENT INCOME

- Wirepoints: Moody’s new estimate of Illinois pension shortfall increases to $261 billion – Quicktake

- Fred Klonsky: TAXING RETIREMENT INCOME? AN ISSUE CREATED OUT OF THIN AIR BY POLITICAL STRATEGISTS – also an issue created out of the desperate need in Illinois for tax revenue (because cuts are never never on the table)

- Fred Klonsky: LET’S TALK ABOUT THE GRADUATED INCOME TAX AMENDMENT AND RETIREMENT INCOME INCLUDING PENSIONS. – Look, Klonsky – Illinois pols will try to tax everything they’re allowed to.

- Doug Finke: Seniors push back on ‘misinformation’ about graduated tax

- CapitolFax: *** UPDATED x1 *** Yet another day, yet another failed lawsuit: IPI “Fair Tax” TRO denied

- Illinois Policy: PENSION APOCALYPSE? COVID-19 EXPOSES LONG-RUNNING FRAGILITY OF ILLINOIS PUBLIC PENSIONS

- Pritzker Is Keeping Illinois Locked Down Not For Health But For A Federal Bailout

- Greg Hinz: A pension reform plan that works—or a great white whale?

Let’s pull from that last one:

Looming in the background as Illinois voters prepare to decide on Gov. J.B. Pritzker’s proposed graduated income tax is whether the money inevitably would be sucked up by the state’s yawning pension debts. It’s a fair question, one the state one way or another has been debating for a decade now. It’s equally fair to assert, as I have on many occasions, that the current benefit structure is far too rich, granting retirees a 3 percent annual cost-of-living hike in a period of 1 percent inflation. That juicy perk over time has amounted to megabillions that state government just doesn’t have.

But wanting change and getting it are not the same. This leads to a detailed new proposal laid out by Wirepoints, a Chicago-based conservative research group.

……

Instead, the report urges the state to go around the Illinois Supreme Court, and I’m not sure that’s possible.

Yes, it’s possible. By amending the frickin state constitution. That’s really the only way to get started with the problem.

Given it’s been super easy, barely an inconvenience for Pritzker and the entire Illinois Democratic establishment to amend the state constitution in order to have a progressive state income tax, it seems to me they could also deal with the pension clause.

I asked a couple of labor groups for their thoughts, and they declined to comment. From their perspective, they have an absolute right to excessive benefits without concessions, and that’s troubling.

That… is one way of putting it.

The conclusion… what is this?

So take a look at the report, which includes some good research and ideas worth debating. But when you vote on Pritzker’s graduated income tax amendment, don’t assume that this proposal lands the whale.

Nothing lands the whale in Illinois without the will to look the problem in the face, and realize that yes, the money will run out for several Illinois pension funs (local and state), and that no, the state and localities will not be able to support these on a pay-as-they-go basis.

By the way, the white whale metaphor from Moby Dick doesn’t work for Illinois pensions, for many reasons.

I love Moby Dick, but you don’t need to have loved the novel or know all the details other than: Captain Ahab has a personal vengeance against a specific monster white whale which all the whalers call Moby Dick, which has wreaked havoc upon multiple crews. Ahab is missing a leg due to Moby Dick, and the end of the book involves Ahab harpooning the whale and the ENTIRE CREW GOING DOWN because the whale pulls them down (and they all die… except for the pseudonymous Ishmael, who is our first-person narrator, but I won’t get into how.) Moby Dick does not die. He goes on to kill again. This is SYMBOLIC, and Moby Dick is kind of an immortal force.

The thing with Illinois pensions: it does not require a vengeful person to bring them down. It will just take time. They are not an immortal force.

The money will run out. It doesn’t require anybody to do anything for that to happen. You could say that it brings down bondholders, taxpayers, and pension plan participants altogether, as if the Pequod were all these folks……. but in the novel, Moby Dick swims on. The way the Illinois situation ends…no, the pension plans won’t be swimming on. They all will go together when they go.

Multiemployer pensions

The ones in a bad place…. are still screwed. The semi-governmental fund that is supposed to provide a backstop for MEPs (at very low benefit levels) is still going to go bankrupt.

- Baron Hill: As we rebuild the economy, let’s address multiemployer pension plans – Baron Hill is an Indiana Democratic Representative.

- Ohio Teamsters Pension Fund Seeks Benefits Reduction

- 5500 – Central States – 2019

- National Association of Plan Advisors: Is There a Lame Duck Opening for Retirement Relief? – I am not sanguine, no matter who wins House, Senate, or Presidency

- The Multiemployer Retirement Plan Landscape: 10 DB Plan Takeaways

Let’s look at that last one. I just want to point out some stats:

At the end of the 2003 plan year, the ratio of inactive participants to active participants was 1.05. By the end of 2017, the median ratio had increased to 1.62. This is a significant demographic shift over the past 15 years.

….

Aggregate employer contributions have increased over the past 15 years, from $13.7 billion in 2003 to $30.8 billion in 2017. At the same time, disbursements have also increased over the past 15 years, from $24.3 billion in 2003 to $42.8 billion in 2017.

Note that “inactive” doesn’t mean taking retirement benefits. But still, those are participants who have earned retirement benefits in the MEP… and they get contributions only from active employees & their employers.

I want you to see the numbers in the second: contributions increased 125% cumulatively. Disbursements increased 76%. Okay, that doesn’t sound so bad….

…until you realize contributions are 72% of disbursements.

This would not necessarily be a problem if MEP funds were topped-up, and investment income and proper liquidation of assets covered disbursements. That’s true of some MEPs, but not of the failing ones, unsurprisingly.

CT Pension Payment: Drop in the Well

Several states have been making “record” pension payments… and said states have generally been fund short-changers in good times. Hmmm.

Let’s take a look at the contribution made in Connecticut: $60 million on top of the “normal” payment.

Here is a bunch of the local coverage:- Gov., treasurer discuss paying down CT pension debt

- Connecticut Makes Historic Payment to Pension Fund

- $60M used for pension obligations in first-ever transfer to pay down retirement debt

- Overflowing budget reserves results in added $62M investment in state pensions

- CT Hits Historic Fiscal Milestone With Extra Pension Payment

- State plans to use surplus to pay off small amount of unfunded pension liability

- Connecticut Uses $60M To Pay Down Unfunded Pension Liability

- Connecticut puts aside $62M for state employee pensions but $2B deficits loom this year and beyond

- Connecticut transfers budget reserve fund excess to the state employees’ retirement fund

I tried to avoid repeats, but even with differing by-lines, most are the same story: huzzah! A bigger-than-usual contribution was made!

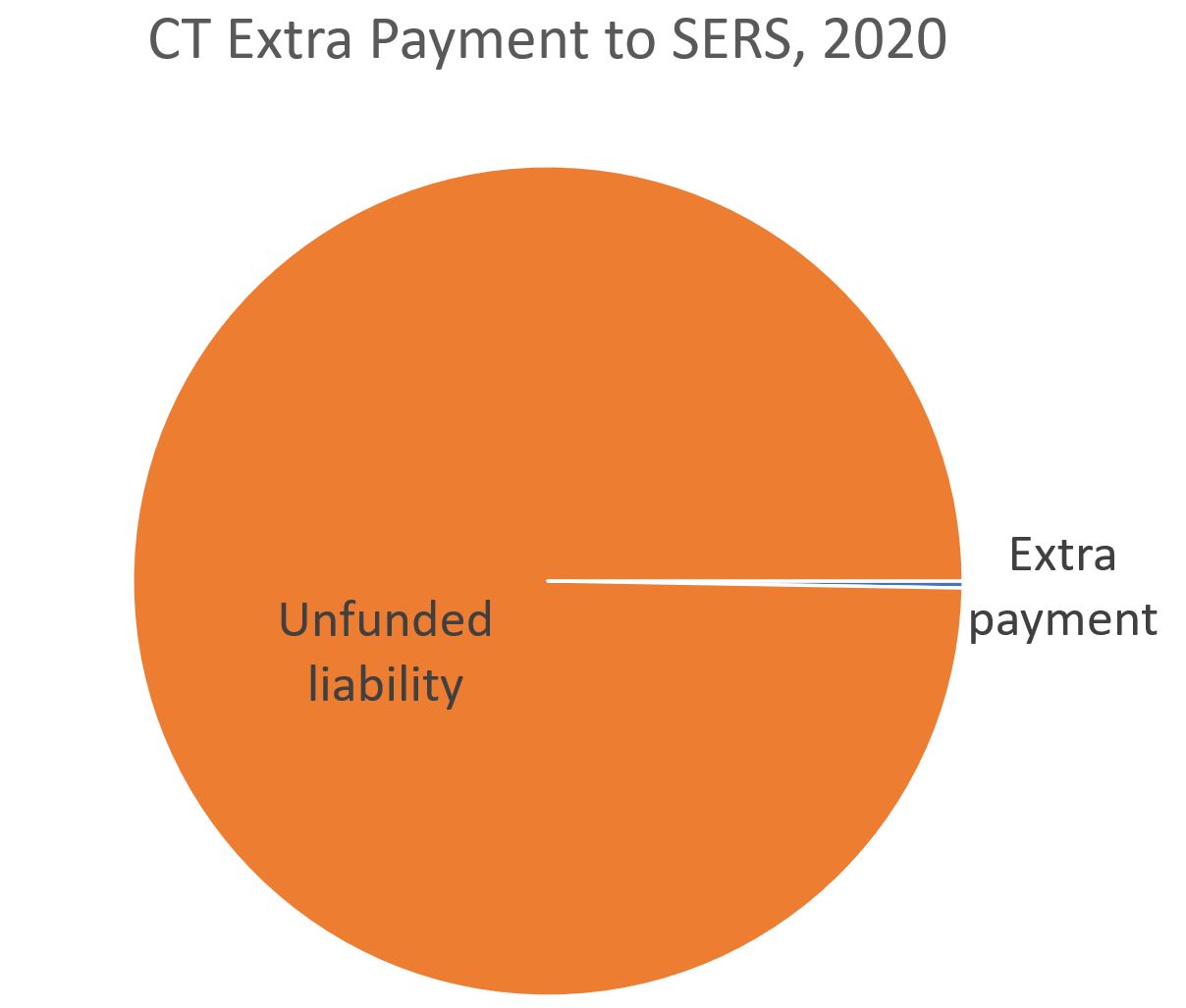

The pension plan involved is CT SERS. As of end of fiscal year 2019, they had $13.3 billion in assets, and that was 38.2% funded.

According to the actuarial valuation, the unfunded liability was $22.3 billion.

$60 million is 0.3% of $22.3 billion.

Let me demonstrate:

=squint=

I think the pie chart exaggerates the proportion, but we’ll let that pass.

This is a very temporary drop in the bucket. I am less than impressed.

Leftover finance and pension stories

This bit is long, as I no longer have the Actuarial Outpost as my external pension story repository. I am putting these here, as I will harvest them later for my own purposes:

- Eleven years of the Financial State of the States

- What Happens When States Cannot Pay Their Bills

- NY Post: Most NYC firefighters retired with $100,000-plus annual pensions last year

- Raising the federal retirement age a ‘deal breaker’ – they’re talking Medicare eligibility age, I’m guessing, because that’s the only thing attached to age 65 right now. I think SocSec old age benefit eligibility needs to be pushed above age 62, but what do I know?

- Ireland: Is It Time To Put Compulsory Retirement Age Out To Pasture? – this is the sort of retirement age discussion in non-U.S. countries. Many are forced out of work at age 65.

- 64% in Japan willing to work beyond retirement age, survey shows – even in long-lived Japan, people are pushed out at age 65

- naked capitalism: CalPERS CEO Marcie Frost Says She’s Not in Charge and Lies to the Board About Receiving a Warning from the Fair Political Practices Commission

- CT News Junkie: OP-ED | Connecticut’s Perpetual Pension Crisis: Are We Up To Dealing With It?

- Andrew Biggs: Factcheck: Will Half Of Americans Over 55 Retire Poor? [spoiler: no]

- Pew: New Jersey to Make Largest Pension Contribution in State History

- Daily Voice Westchester: Mount Vernon Sisters Admit To Stealing From Dead Mother’s Pension

- P&I: Ohio Police & Fire allocates $30 million to private equity (out of a $15.5 billion fund…but this is the 4th private asset commitment in 2020)

- NJ Pension Fund Investments Almost Flat Amid Pandemic Economic Slump

- Raleigh News & Observer: Race for NC state treasurer will turn on health care plan, pension fund investments

- Two years later, local healthcare workers still fight for pensions – this is local to Albany, NY, and no, it’s still not resolved.

- Letter: Pension plan leaves taxpayers on the hook – this is Chico, California, and this relates to a Pension Obligation Bond and/or a bond securitized by Chico’s streets – the same letter-writer, a few weeks ago, recommended that the employees contribute more.

- UK Women Lose Court Challenge Against Pension Age Increase – the pension age increase was from 60 to 66.

- WPRI: Lawyers locked in legal battle over lien that stalled retirees’ pension checks – this story makes me think of various Dickens plots involving lawyers (he rarely made lawyers look good)… in particular, I’m thinking of Mrs. Bardell in Pickwick Papers, who gets locked up in debtors prison, because she won a lawsuit on contingency…. and Pickwick wouldn’t pay up. She still owed the lawyers, but couldn’t pay without the settlement.

- New Study Shows Financial Transaction Tax Would Cost New Jersey Pension Fund Billions of Dollars

- Bury Pensions: New Jersey’s pension plan costs too much

- Bury Pensions: Census Bureau Public Pension Survey – 2019

- Bury Pensions: PBGC Data Tables – 2018

- Traverse City, Michigan: ‘It’s no small thing to move from MERS’

- P&I: CalPERS board wrestling with how to delegate

- P & I: Lawmakers pass 3 bills to ensure viability of PennSERS, PennPSERS

- Berkeley Bans So-Called Junk Food from Checkout Aisles

This last item has a touch of the soda tax to it.

“Grocery stores larger than 2,500 square feet will no longer be allowed to sell unhealthy food and beverages at the checkout line, and instead will be encouraged to offer more nutritious food and drink,” the San Jose Mercury News reported. “Gone will be chips, candy bars, sodas and other sweetened beverages.”

The ordinance impacts around two-dozen stores in Berkeley, including Safeway, Whole Foods, CVS, Walgreens, and two independent grocers, along with all of their customers.

Which reminds me, Berkeley did pass a soda tax. How did that work out?

In 2014, Berkeley was also the first in the nation to adopt a soda tax. Predictably, that tax—which helped usher in a statewide ban on similar taxes—has reduced soda consumption in Berkeley. I’ve seen no evidence it’s achieved its stated goal of combating obesity and other nutrition-related diseases. That Berkeley sees the need to adopt the new checkout ordinance to, well, do the same thing—combat obesity and other nutrition-related diseases—doesn’t exactly suggest the soda tax is working.

Indeed, I wouldn’t expect it to (and neither this checkout line law) — I’m obese, and I don’t buy/eat candy bars or soda. I am pretty clear how I got fat (I love pasta! and bread!), and it ain’t junk food. You can get fat on regular old “nutritious” and “healthy” food.

Enjoy!

Related Posts

Taxing Tuesday: New Jersey Wants to Be Number One; More Federal Tax Comparisons

Taxing Tuesday: Do It Yourself Tax Migration Stats

Federal Tax Avoidance Follies: A Splash of Reality