Taxing Tuesday: Texas Tax Cut and Twitter round-up

by meep

I will be getting back to the mortality updates soon enough, but to cheer myself up, I’m going to look at some tax news!

Texas to cut property taxes

NBCDFW: Texas House, Senate agree to ‘biggest property tax cut in Texas history’

After weeks of quarreling, the Texas House and Senate say they have agreed in principle on an $18 billion plan that will “deliver the biggest property tax cut in Texas history.”

The offices of Texas Lt. Gov. Dan Patrick ® and House Speaker Dade Phelan ® released a joint statement Monday morning saying they’ve come up with legislation that not only reduces the school property tax rate and increases the homestead exemption, but also includes relief for small businesses.

….

The House was pushing for property tax relief through compression of the school tax rate and included relief for small business owners but didn’t include an increase to the homestead exemption, a nonstarter for the Senate. The Senate insisted any approved legislation must raise the homestead exemption from $40,000 to $100,000.

The additional exemption could save homeowners several hundred dollars per year on their property tax bill, though that amount varies because tax rates vary across the state.

As a reminder, Texas is one of the states without a state income tax.

People forget that doesn’t mean Texas is necessarily low tax.

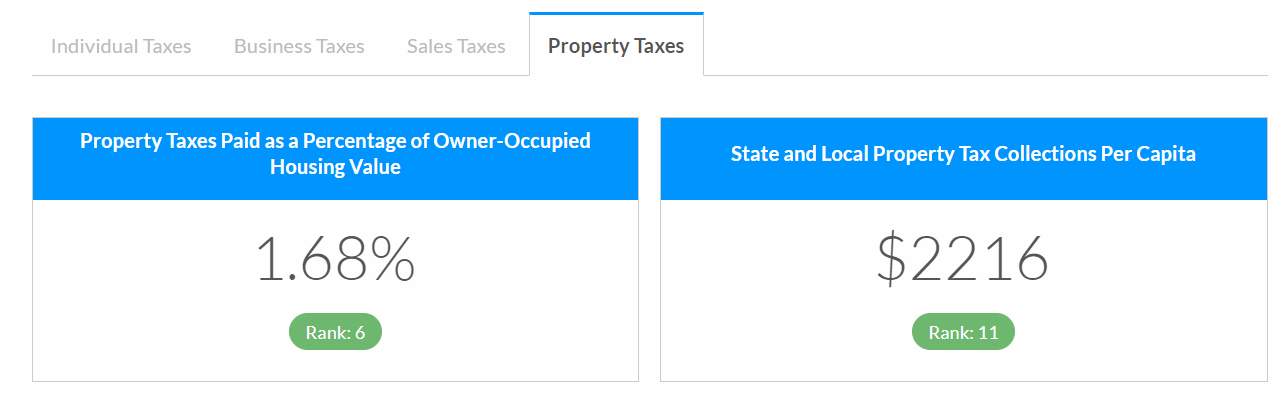

If you check the Tax Foundation’s page on Texas, its property tax levels are not low:

A rank of 6 for the rate means it’s high, not low.

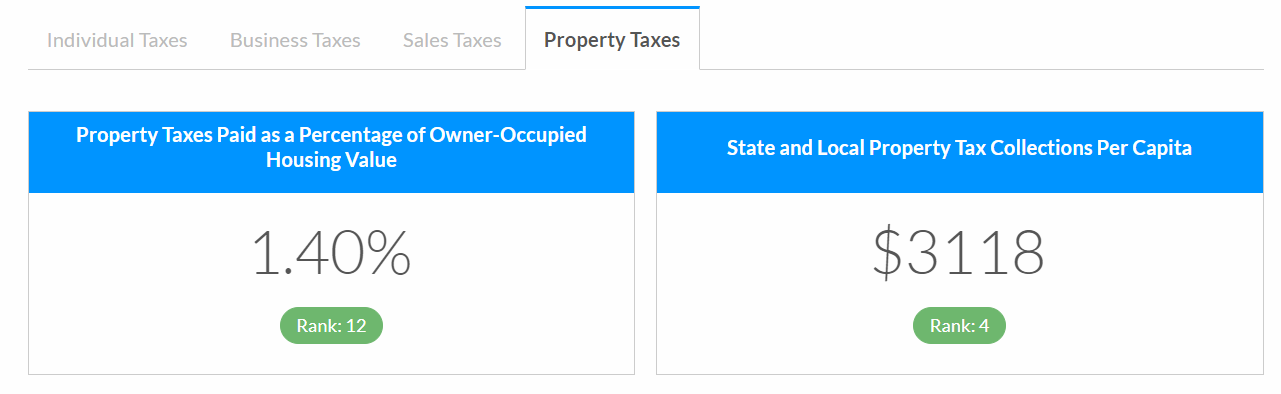

Here is the same for New York, in comparison:

New York, of course, has a fairly high state income tax, which adds to the property taxes. On an overall tax burden basis, New York is much worse than Texas, don’t worry.

That said, after this tax bill, here is the estimate of reduction:

Jennifer Parker is President Elect of the Collin County Area Realtors. The organization took a front-row seat during months of disputes over property tax cuts.

“It’s very important to us to make sure that we’re protecting homeowners’ property rights,” Parker said. “And a part of that is the cost of their property taxes.”

She said it all adds up to significant relief.

“The market has been historic and now this legislation has been historic,” said Parker. “What it means is we’re going to see savings on an average between $1200 to $1500 per household.”

To be sure, the way this works, some get more relief than others. But it sounds like good old-fashioned political deal-making.

Here is some interesting commentary:

Texas Monthly: Could Texas Really Eliminate Property Taxes?

Recently Abbott has been talking up plans to wipe out all property taxes: all school property taxes and all taxes levied by cities, counties, community colleges, emergency service districts, flood districts, hospital districts, and many other local entities that provide essential services. “What we want to achieve in the state of Texas is to eliminate your property taxes. Make them go away!” Abbott said at a June “fireside chat” at the Congress Avenue headquarters of the conservative Texas Public Policy Foundation. “Zero is what we want you to pay for your property taxes in the state of Texas.”

So… then what? Where is the revenue for the state government going to come from?

Lieutenant Governor Dan Patrick, no stranger to flights of fancy, has emerged as the most aggressive critic. Clearly relishing his new role as the Voice of Reason, Patrick has been pointing out that there is simply no way to finance government without property taxes. The numbers are stark. In 2021 property taxes yielded about $73.5 billion in revenue. That’s more than half of all state tax revenue. Meanwhile, all other tax sources—the state sales tax, the tobacco tax, the business-franchise tax, oil and gas taxes, et cetera—produced $71.9 billion that year. Public education alone costs at least $64 billion a year.

“If we eliminated property taxes in the next two years, we would spend every dollar of our budget,” Patrick said at a press conference in June. “There would be no funding for education, no funding for health care, no funding for law enforcement.”

Look, you’ve foregone income tax as a revenue source… some people are getting high on their own supply.

Twitter Tax Round-Up

Just a few tax tweets:

Texas taxpayers were robbed of a historic opportunity to eliminate the school property tax.

— Don Huffines (@DonHuffines) July 11, 2023

How is this a congestion tax when not levied on electric vehicles?

— Malcolm Roberts (@MRobertsQLD) July 11, 2023

All cars contribute to congestion

It’s a petrol & diesel tax

Another unfair tax based on climate fraud

Another tax on fuel on top of excise & GST

UN sustainability sounds nice. It’s just a BS lie to control pic.twitter.com/gKp6JoUNTh

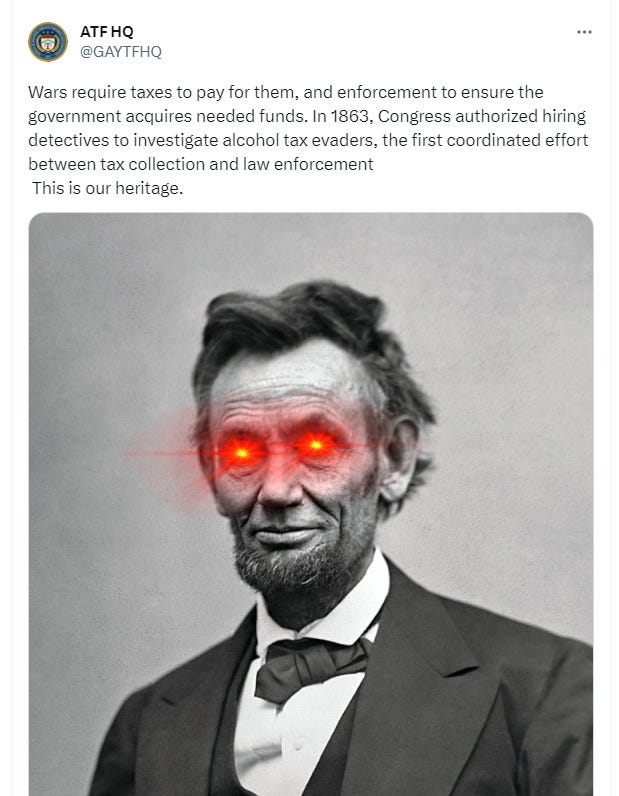

https://twitter.com/GAYTFHQ/status/1678781141728526338

I’m telling you it would be a hilarious prank if one year everybody didn’t pay their taxes

— Danny Polishchuk (@Dannyjokes) July 11, 2023

Big investors backed by Wall Street buy up homes, driving up prices & making it harder for first-time buyers. Then they jack up rent, neglect repairs, and threaten families with eviction.

— Sherrod Brown (@SenSherrodBrown) July 11, 2023

They shouldn’t get tax breaks for making homes more expensive.https://t.co/K23UBne0x4

Alas, for the days of soda taxes…. well, maybe they will come again…

Related Posts

Taxing Tuesday: California Wants All the Money, Chicago Needs All the Money

Public Finance Spotlight: Liz Farmer

More Soda Tax Idiocy: This Time, It's Seattle