Chicago Followup: How did those bonds do?

by meep

….and who bought them?

As per yesterday’s post, there was a bond offering from the Chicago Public Schools.

(Reuters) – Yields topped out at [b]5.63 pct for bonds due in 2039 in a $295.7 million Chicago Board of Education general obligation debt sale[/b] on Tuesday, according to an initial pricing scale obtained by Reuters.

The yield was [b]285 basis points over Municipal Market Data’s benchmark triple-A scale[/b]. The financially struggling public school district is selling the debt through lead underwriter PNC Capital Markets after its ratings with Moody’s Investors Service and Fitch Ratings were lowered last month to one notch above the junk level. (Reporting By Karen Pierog)

285 basis points, huh? 5.63%?

Maybe you don’t know if that’s high or not.

Here is recent piece on high-yield municipal bonds:

The average 12-month yield for Morningstar’s high-yield muni category is 4.34%, compared with 2.53% for intermediate municipal bonds. A 4% or 5% payout is impressive enough when the 10-year Treasury yields 1.9%, but for investors in the top bracket, that’s equivalent to a 7% yield.

By the way, “high-yield” is one way to say “below investment grade” or “junk” in the bond community. Just so you know.

Back to the article:

Municipalities, even those with below-investment-grade debt, still have much lower default rates than comparably-rated corporates. Miller is optimistic, noting that state and local tax collections are rising, and economic conditions in most cities are improving. Moody’s Investor Services says municipal finances are better than they were during the 2008 financial crisis or in 2013 when Detroit’s bankruptcy and Puerto Rico’s financial woes rattled the sector.

Yes, but when they default…. yeah.

Look, not all munis are created equal. Meredith Whitney was not exactly on the money when she predicted massive muni bankruptcies.

Some munis are in a very good position. But then, you’re not going to be getting much yield on them, and a big part of the draw is not only the low default rate, but that there can be tax advantages to holding them.

But let’s go to what Bond Buyer had to say before the offering, and where they predicted the yield would be:CHICAGO – Peel away the layers of negative headlines and patient investors will find low default risks and underlying credit strength in this week’s $300 million Chicago Board of Education deal, according to Municipal Market Analytics.

“BOE debt is well insulated from default risk by significant ‘belt and suspenders’ protections,” MMA wrote in a market piece authored by Matt Posner & Kevin McGuigan Friday. “We understand that negative headlines, downgrades and Chapter 9 speculation have all damaged value but believe the case can be made for a considerable underlying credit strength that exists for patient investors.”

…..

Steep yield penalties are expected as the district’s long term yields have jumped 140 basis points due to recent negative news with trading of between 200 and 300 basis points above the Municipal Market Data and MMA triple-A benchmarks depending on maturities.Preliminary pricing figures showed the deal potentially offering yields of between 5.30% and 5.60% depending on their coupons.

The double-barreled bonds carry the full faith and credit of Chicago Public Schools as well as an alternate revenue pledge in the form of a statutory lien on its state aid.

Much of the district’s $6 billion of debt carries an alternate revenue pledge. State aid goes first to the trustee to cover repayment.

…..

In preliminary pricing indications on the series for $275 million, the 2035 maturity for $194 million was initially offering yields of 5.53% with a 5.25% coupon and 5.38% with a 6 % coupon, 281 and 266 basis points, respectively, over the MMA benchmark.The 2039 maturity for $81.5 million was offering yields of 5.62% with a 5.25% coupon and 5.32% with a 6.25% coupon, 279 and 249 basis points over MMA.

So the new yield has come in higher than the prior issues, even if only one basis point.

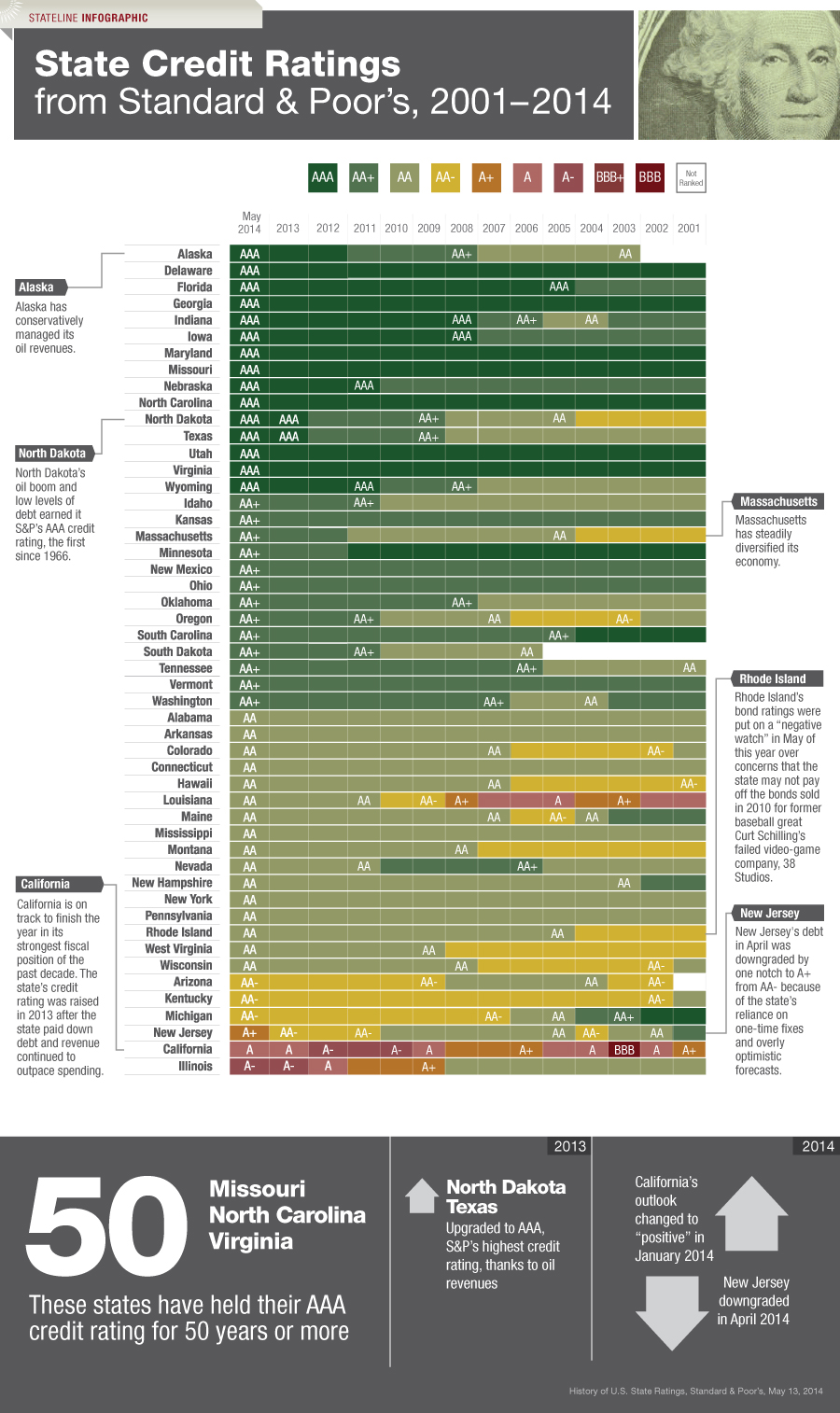

I don’t know how much security that alternate revenue pledge gives. Illinois itself is strained with regards to its finances. Having one credit-strained entity providing revenue to another…. yeah. It’s not only Chicago that has been downgraded.

Illinois is rock bottom there. Using state aid as a guarantee…. I’m not seeing that as much of a guarantee.

Anyway, I do wonder who bought the CPS bonds.

Related Posts

Public Finance: Guys, It's Not Really a Competition as to Who is the Worst

Puerto Rico Link Dump: World of Pain

Taxing Tuesday: A Retrospective of Stupid Tax Policy - Soda taxes, Amazon tax, SALT cap