Chicago Pensions Watch: What does Chicago Say About Its Own Pensions?

by meep

While we wait to see if Chicago Public Schools can make its pension contributions, and what Rauner will do with the bill on Chicago pension contributions, let’s take a little look around at Chicago’s pensions.

In my Public Pensions Primer post exploring the updated Public Plans database, I used Illinois and Chicago pensions as my main examples for exhibits.

But what does Chicago itself say about the situation?

What Are Acceptable Funding Levels?

When a Fund’s assets are at a level that when invested they are sufficient to pay all the projected future benefits, the Fund is said to be “100%” or “Fully Funded.” A fully funded pension plan means each generation pays the full cost of the services its public employees provide.

Below 80% funding, a pension plan is vulnerable to swings in investment earnings and can rapidly burn through its assets in order to fund benefit payments.

What is the City’s Current Unfunded Pension Liability?

An unfunded pension liability is the difference between the value of the promises made to retirees and employees for services already rendered and the funds available to pay for those promises.

Currently, the City’s six pension funds only have 50% of the funding needed to support the current pension system.

Well, 50% is a little stale (I see 2012 referenced in a few places on the site, so you know it doesn’t have the most recent numbers). Going to the Illinois page for the pensions, you’ll see only three of the Chicago plans are there and the webpage mentions six. The ratios I see for those three are all under 50% (though the Teachers plan is close), so I’m guessing the ratios have worsened since 2012.

The 80% here is somewhat bullshit, but it’s not as much bullshit as one normally sees. One of the reasons a low funding ratio is bad is that one starts to have to liquidate assets to pay current benefits. It does not necessarily start at 80%.

Thing is, you can be in that situation at 100% fundedness, but yes, if a plan is woefully underfunded, it can go into an asset death spiral, where more and more has to be liquidated, until the funds are exhausted and one is trying to cover benefits as a pay-as-you-go concern.

Which generally collapses with an aging population.

Which is what we see in the Chicago pensions.

RETIREE TO ACTIVE RATIO

Let’s look at the three plans we do have data for:

Chicago Police

Chicago Teachers

Chicago Municipal Workers

They’ve all got an increasing ratio of plan beneficiaries to active employees, and in the case of Chicago Police, they’re upside down.

If the plans were well-funded, that there are more retirees than actives would not necessarily be concerning. But they are far from well-funded. Chicago has underpaid for the pensions for all the years represented in the Public Plans Database graphs.

And the result has been decreasing funded ratios.

FUNDED RATIOS

Let’s take a look at the funded ratios:

Chicago Police

Not sure why this goes back to only 2007 in the graphs, because I see data in the system going back to 2001. In 2001, its funded ratio was 70.5%. Obviously, at 29.7% in 2013, it’s come way down.

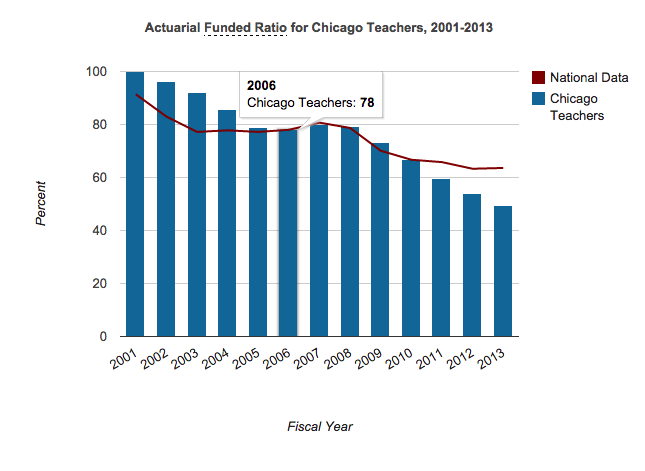

Chicago Teachers

Look at that! 100% funded in 2001! Pity they kept underfunding the plan. It was at 49.5% in 2013.

Chicago Municipal Workers

Another graph starting later than the data — looking at the result from the Interactive Data Browser, Chicago Municipal was 93.3% funded in 2001. Not all that bad.

Of course, it was sitting at 37% funded in 2013.

WHAT’S NEXT?

Of course, I, like many others, are keeping an eye as to whether Chicago will make its pension payments this year.

In any case, as with my series on the five Illinois state pension plans, I’m going to be reviewing these three Chicago plans at the very least (and may dip into the other three Chicago plans, especially the firefighters plans). Some of these plans I will be able to do similar analyses as you see here with Illinois TRS., though my data currently go back only to 2001 at best.

In what may seem like unrelated news, Greece is not repaying its debts in a timely way.

I don’t think Chicago has the option of seceding from Illinois and issuing its own currency, but seems like creativity is the current by-word for dealing with these enormous unfunded liabilities.

Related Posts

STUMP Classics: The Fragility of Public Pensions Due To Can't-Fail Thinking

Which Public Pension Funds Have the Highest Holdings of Alternative Assets? Has It Paid Off?

Cook County Soda Tax: The Current Mess