On New York (and Chicago and Connecticut and Boston) Values

by meep

Everybody was getting all wee-wee’d up over Ted Cruz taking a swipe over NY values.

Everybody forgot to mention this key value:

Never pay retail. #NewYorkValues

— Mary Pat Campbell (@meepbobeep) January 16, 2016ERSATZ SOUTHERNER, ERSATZ YANKEE, ALL AMERICAN

I don’t get into personal details too often on this blog (that’s what livejournal is for), but a very quick precis of where I’ve lived:

South Carolina (1 year), Georgia (11 years), Maryland (3 years), North Carolina (7 years), New York (20ish years and counting).

Yeah, I’ve moved around. And if I listed where my mother lived before I was born — well, two key places for her were Minnesota (where she was born) and Connecticut (where I think her accent is mostly from).

I don’t like grits or sweet tea. I’m not fond of bagels. I grew up Roman Catholic in the Bible Belt (along with evangelical relatives on my dad’s side), and while I can speak with a credible Carolinian accent, it was never very strong. My y’all is authentic, but that’s about it.

Loving fried chicken and proper barbecue ain’t no thing. Everybody loves those.

But NY is my home now, and I do love being here. I had a great time when I lived in Manhattan, and then Queens, but I preferred to have a bit more space than a two bedroom apartment that I had for my five-person family (now with large dog.)

NEW YORK CITY: THE MOST COSMOPOLITAN AND MOST PROVINCIAL PLACE IN THE WORLD

I love New York City because I love people. There are loads of people there, and most of them are from somewhere else. Other countries, obviously, but also other places in the U.S. The “native-born” get crowded out, but it’s not really a place most people stay for a long time. Having a family there can be done, and obviously a lot of people do it, but it’s cheaper and more convenient for most people to do it elsewhere. This is especially true of Manhattan — most places in Manhattan, having children is a luxury good.

Many of my neighbors here up in Westchester are NYC escapees, some from the Bronx or Queens originally, some from somewhere else again.

One thing I noticed about the “native” NYers, though, was how provincial they were. They were some of the most geographically and culturally ignorant people I have ever met.

Part of it is that they really don’t have to learn other people’s cultures. Don’t know Christianity? That’s okay in NYC. What would you need to know that for? You only need to know the religious holidays inasmuch the parking rules are suspended and/or adjusted, and maybe some of the more observant people won’t show up for work, but the only time I saw someone embarrass themselves over that was when they scheduled an important company event during the High Holy Days. That’s a noob mistake.

But that’s just administrativia. You don’t need to know what people actually believe to keep up with that.

Anyway, I had fun needling my NY colleagues with Dumb Yankee jokes. I don’t remember anybody getting mad about it, esp. since they could do Dumb Southerner jokes if they wished.

The funniest convos I had with Yankees, though, is about how Southerners are so fake in their supposed niceness. Hahaha, just because we smile a lot doesn’t make us suckers, rubes. For supposedly paranoid sophisticates a la Seinfeld, you sure are simple.

That said, I like NY brashness just fine, and I’m just at home here. A couple things I like about NY are the speed and the cold. It works well with a goal-oriented nature. I explained it to an airport cabbie in Dallas (who was from Kuwait originally, I believe): it’s not so much that NYers are rude when they yap at you when you’re standing in the middle of the sidewalk. You’re the one breaking the rules — it’s not personal, it’s just that we have someplace to go and you’re in the way.

It’s just like with driving. If you stopped your car in the middle of the highway to have a leisurely look around, people will get rightfully angry at you.

Get your shit together before you step out on the sidewalk in Manhattan. Those are major thoroughfares. If you need to orient yourself, step up against the building and figure it out. Or even ask — lots of NYers are proud about giving directions. Even in the days of google maps, you sometimes need a little human help.

So kwitcher bitching, Kevin Williamson, Trump, and others.

Many NY conservatives are like me — it was the very NY values we were surrounded by that made us go conservative. I was a liberal in NC, and became conservative in NY. This is not because I held the same position in both states and was really a moderate, just different from the median in both states (though this is partly true). It’s because I get annoyed by consensuses that are driven by assumptions I believe are wrong. And so I started questioning my prior views, and changed my mind.

Thanks, NY! I probably wouldn’t have been conservative if I had stayed in North Carolina.

Comments such as the “boob vote” about Southerners when I know the ignorance is just as deep among people who have the resources not to be… yeah, that just proves the point about “NY values”.

But rather than focus on the “cultural conservatism” issue that the “NY values” always seem to have trouble with, let’s look at a different value: really high taxes.

CULTURE OF HIGH TAXES

When I transcribed a presser by Gov. Rauner of Illinois, one thing popped out at me:

[Reporter 6] Do you think the way this can work is take what DuPage County got a few years ago, and expand that statewide, and let those local areas what they can consolidate?

[RAUNER] That’s a big part of it, and you’ll see that when you study the report, that’s exactly one of the reasons that Chairman Cronin has been such a great leader for this process. They’ve gone through many of these battles, and change is hard. Even small changes are hard. And some of these are pretty large changes.

I’m a believer in two things: getting the power back to the people of Illinois, so the people can decide, not Springfield.

And then, sharing information about best practices. What’s worked. What hasn’t worked. What’s been tried and failed. Why did it fail? and lessons learned. In business, that’s how you make progress, and in government we can do the same thing. We can learn what worked and what didn’t work in DuPage County.

(8:28)

[RAUNER] And we can learn from around the state and share, we’re gonna have a website, and we’re gonna have digitized all this information so other elected leaders can learn what’s worked, and we’re gonna work every day to get the Springfield interference in local government off and let each community to decide for themselves.

And this is the most important things you in the media to understand, I’m not trying to force my will, I have a philosophy, I’m for limited government, low tax, individual liberty, I believe.. okay? But I’m not trying to force my will on any community in the state. I just don’t want other communities to force their will on the communities that don’t agree with them. That’s it.

I’m not trying to say “Everybody has to do what I say”, but I don’t want every community to have to do what anybody else says. I want each community freed up to do its own government, its own schools, the way it wants to.

(9:15)

[RAUNER] There are some school districts in some communities who love, they’re fine with higher construction costs for prevailing wage, they’re fine with powerful internal groups in the government and higher property taxes as a result, I’m saying “Keep it!” If you want to collectively bargain everything, do it.

But why should one community that likes that tell another community that doesn’t like it, and wants to run their community differently, why should one tell the other what to do?

That’s the critical thing. Free up each community to decide for itself.

Now you may think the “willing to pay high prices” bit is being snide, but given that I live in such a community, I think he’s on the level. I bet Rauner lives somewhere with very high taxes, with collectively-bargained construction contracts, etc. He chose to live in such a place… as did I.

I live in the highest property tax area in the country. On purpose. I knew what I was getting into when I moved here. There will be a point where I can’t afford such costs, but I’m a highly-paid person who values what I get for my tax money (currently).

As an individual, I expect good local services, and I do have them and get them. For now. But if too much of that tax money is eaten up paying for past services (i.e., unfunded pension liabilities) and not current ones, I will not be getting the value I’m paying for. And I will have to consider alternatives.

COMPANIES MAKE THE SAME CALCULATION

One of the big local news pieces lately is on GE moving its headquarters to Boston:

The world learned Wednesday that Boston beat out some 40 competitors. Chief executive Jeff Immelt trumpeted the region’s concentration of innovative companies, elite universities, and educated workforce as a place for his century-old firm to transform itself in a digital age.

But that wasn’t all that mattered. The state’s financial stability, quality of life, and ease of travel factored into where GE would relocate hundreds of its most senior employees from suburban Fairfield, Conn.

“It was the total package,” said Ann Klee, head of GE’s site selection committee. “When we looked at our subjective and objective criteria, Boston was a great fit.”

Fairfield is right across the border from my town, North Salem. The whole northeast is an expensive location in which to site — it’s not like Boston is a low-cost, low-tax alternative to Connecticut.

But.

Let’s see what GE itself had to say:

City and state officials are offering what could be one of the richest incentive deals in the state’s history — together valued at as much as $145 million — to lure the company here.

But GE officials pointed to Greater Boston’s concentration of elite universities and nimble tech firms as the main draw.

“We want to be at the center of an ecosystem that shares our aspirations,” chief executive Jeffrey R. Immelt said in a statement.

Immelt is in the midst of a protracted effort to transform the 124-year-old company, selling most of its finance businesses to focus on industrial lines such as power and clean energy, aviation, and health sciences. Many of those sectors are becoming increasingly reliant on advanced software and communications technology.

GE, which has a market value of nearly $290 billion, said it will move some employees to a temporary space in Boston starting this summer. The full move from Fairfield, Conn., will take place in several steps through 2018.

Yes, there’s the upfront monetary enticement, but one-time moving costs are pretty high, too. Connecticut supposedly has a few elite-ish schools in its borders: Yale (meh) and UConn (rah! rah! (I work there part-time)). I may be forgetting some others, but it’s not like MIT, Harvard, and the hundreds of colleges in the Boston area. Both Boston and NYC are cultural draws and have a very dense packing of very smart, driven people.

There are a few dapplings of such in Connecticut, but Connecticut doesn’t have the density of draws that NY and Boston have. Yes, much of CT is very pretty (I drive through some really lovely country on my commute), but so is much of upstate NY and MA.

And MA is not threatening to up taxes.

CONNECTICUT MAKES ITS FISCAL BED AND IT’S STILL A MESS

A piece on the Connecticut situation:

The next move after General Electric’s decision to quit Connecticut for Boston is to hold Governor Malloy and the Democrats accountable. That will require maintaining a clear distinction between GE’s reasons for leaving Connecticut and its reasons for heading to Boston. The reasons are different.

GE is leaving Connecticut because of Connecticut’s high taxes, its business-unfriendly environment, and its frightening fiscal and economic outlook. What attracted GE to Boston only matters to GE and Beantown.

Don’t let Mr. Malloy and the Democrats switch it up, saying that GE is not leaving Connecticut because of its high taxes but rather to relocate to a research and high-tech oriented urban environment. Don’t let them convince you that high taxes and an unfriendly business environment can’t be the reasons that GE is leaving , because “Taxachusetts” is just the same. Massachusetts taxes are lower and they have been going down, as The Wall Street Journal has reported.

The Sequence is important. GE began considering a move when Mr. Malloy and the Democrats jacked up corporate taxes summarily and retroactively last June. Thereafter, GE examined its future needs and settled upon a research-tech-urban environment as the most desirable for the future.

More at the link. I have mentioned before that CT’s state finances are a mess. Its biggest problem, other than the huge financial hole it has in its pensions, is that it is dependent on a very few extremely rich people. You may know that extremely rich people have the wherewithal to move somewhere else.

There are loads of pretty places with nice coastlines that will not see an increasing of taxes for a reduction in services.

CHICAGO IS ALSO NOT INVITING

Similarly, Chicago made some tax moves that would give GE pause. For instance, Chicago has its own special cloud services tax:

Like shoppers getting a post-holiday credit card bill, tech companies are suffering sticker shock after finding out what the city’s cloud tax will cost them.

Companies such as Amazon Web Services are warning their customers in Chicago that they’ll be collecting the city’s new 5.25 percent tax on their bills in the new year. For some companies, that could mean an annual tax in the six figures that will pinch profits or increase their burn rates, which could cause them to slow their rate of expansion.

“The tax will siphon revenue away, and we’ll be able to hire fewer people this year,” said one CEO who declined to be named for fear of putting a target on his company. “It’s a ton of money that we hadn’t budgeted for.”

Although there’s an exemption for startups that are less than five years old and that have under $25 million in annual revenue, it won’t apply to some of the city’s growth-stage tech companies, which have 100 or more employees and are just beginning to hit their strides.

When word of the tax—technically a clarification that the city’s existing personal property use tax applies to cloud software and services such as hosting—broke, the startup tech community howled.

After months of negotiations between City Hall staff and representatives from the tech community, the tax was reduced from 9 percent to 5.25 percent.

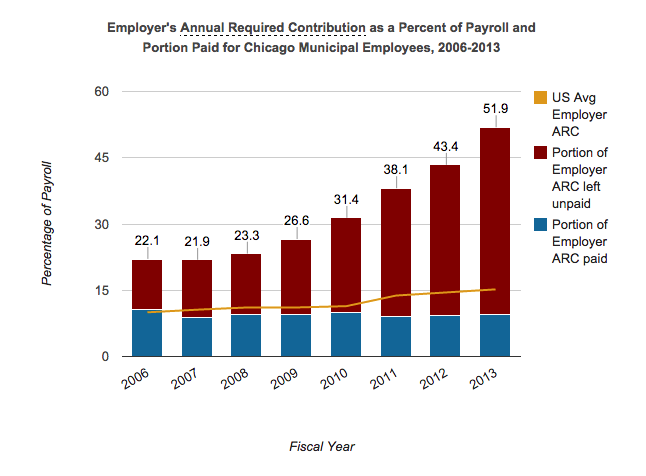

All in the know would see this lower rate as temporary… because, as before, Chicago is deep in the suck. It doesn’t have enough money now, and its cash needs are only growing.

Anyway, it’s very intelligent to tax services that CAN BE DONE ANYWHERE IN THE WORLD, in your two-bit town. Look to more of these start-ups moving to Boston or NYC. There’s nothing particularly enticing about being in Chicago. Sure, one is at a big airport hub, but that’s true of NYC and it’s not hard to go from Boston to anywhere.

THE BLUE STATE MODEL DIES WITH THE PAST

There is a reason that “blue states” such as Illinois, Massachusetts, and Maryland currently have Republican governors. For now, Connecticut and New York retain Democratic governors. We shall see if that persists.

The problem is that the past is catching up with these states, specifically in the form of pension liabilities, but also expensive operations beyond the pensions. These states are very dependent on income inequality, or more specifically, dependent on people who have extremely volatile incomes.

Incomes that may be very low for 2016, given what markets are doing. I’m not going along with RBS doom-and-gloom, but I agree with Mish that a recession seems likely.

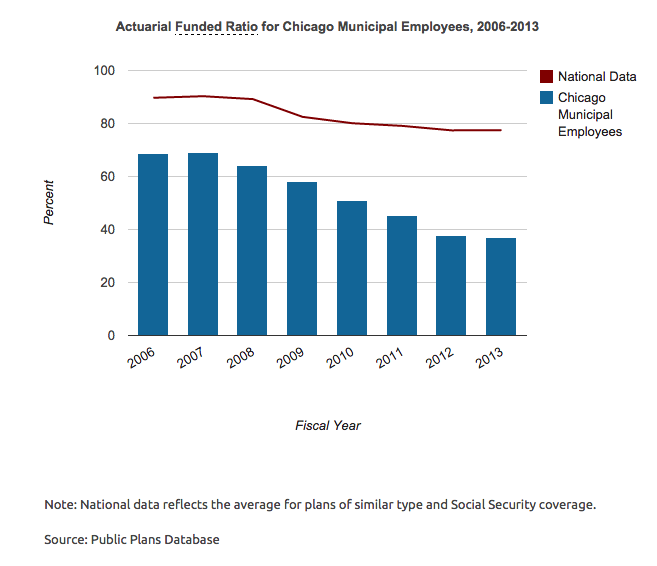

There have been 7-ish years of a bull market, and many of these states’ unfunded pension liabilities have only grown. What happens when the market falls?

It won’t be pretty.

So by all means, Trump et al, bitch about NY values being mocked. We know it’s fake offense to begin with (since when have NYers cared about what Texans say?), but the fiscal pain that will be hitting the city right now, in addition to its other issues, will not be exactly inspiring to the rest of the country.

And no, the City won’t get a bailout. Neither will Chicago. Or Connecticut.

Enjoy those market values.

Related Posts

Divestment Dumbassery: Know What You're Protesting

What a Week: Meep, Music, and Mulling

Divestment Follies: Going After Facebook.... Again