Illinois Pension Watch: This is Why Your Pensions are in Trouble

by meep

I’ll give it away at the beginning: they’re in trouble because they’re not making the “required” contributions to the pensions.

Yes, there are all sorts of other reasons as well, such as spiking, early retirements, sluggish payroll growth, optimistic valuation assumptions, etc.

But ultimately the reason the pensions are so little funded is because the state didn’t put in enough funds.

And they knew it.

They knew it for years.

It’s not because of investment fees, though those should be more transparent. It’s not because of part-time board directors who get a lifetime pension for very little work, though that doesn’t help. (I’ll address why these aren’t significant problems in a later post.)

DON’T PAY THE BILLS, THE DEBT GETS LARGER

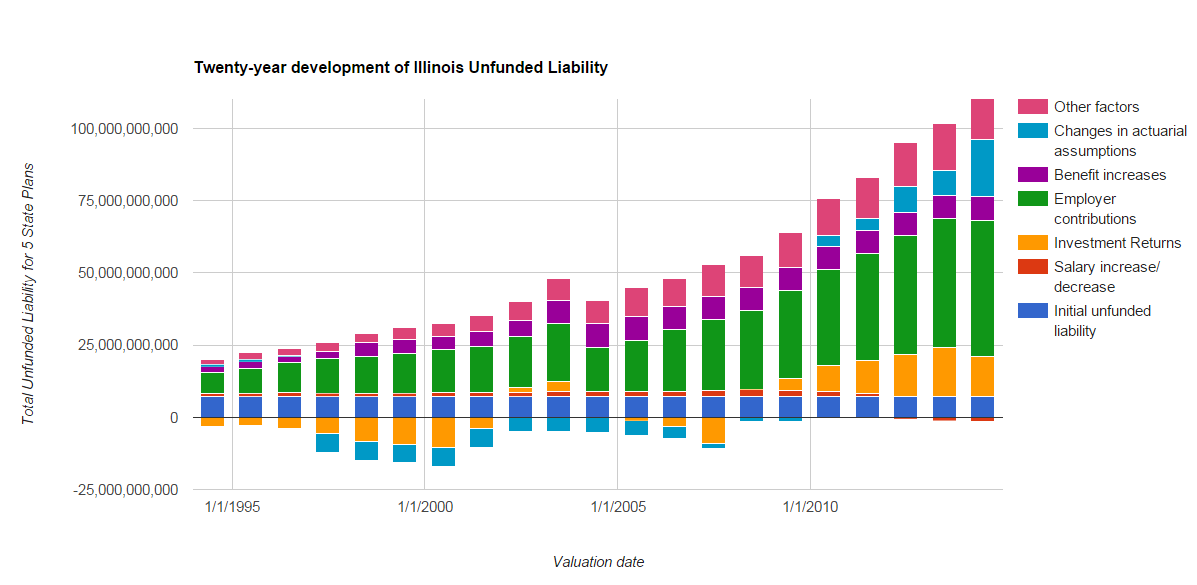

It’s because of this:

Look at that green bar. That represents the unfunded liability due to undercontributions to the 5 state pension funds. That green bar grows every year except one — the year they issued a pension obligation bond. Which is a fake contribution as it generates a new liability (but not on the pension fund’s balance sheet) the same time it makes the “contribution”.

For that entire twenty year period, the state never made full payments to the Illinois state pensions.

DON’T CRY FOR ME, ILLINOIS LEGISLATURE

So I don’t want to be hearing these crocodile tears:

The fact that the option of adjusting the state’s contributions to its five pension systems – whose unfunded liabilities top $110 billion – would be left on the table was not lost on Rauner’s critics. The state is supposed to contribute about $7 billion to the pension systems next year from its general fund, which is currently expected to bring in $32.8 billion in revenue.

In his response to Rauner’s Wednesday budget address, Senate President John Cullerton, D-Chicago, called the idea of not making the full pension contribution “alarming.”

Yes, that’s very alarming. So alarming that a full payment has not been made in over 20 years.

So, Cullerton, I take it you’re new to the Illinois legislature? Otherwise you would’ve been alarmed before:

In 1979, he was elected to the Illinois General Assembly and served as a member of the House of Representatives for 12 years. Throughout Cullerton’s 6-term career in the Illinois House, he served as Speaker Pro Tempore and Democratic Floor Leader.

In 1991, he was appointed to fill Dawn Clark Netsch’s Senate seat. The following year Cullerton was elected to the Illinois Senate, representing the state’s 6th Legislative District. Cullerton served as Democratic Co-Chairman on the Senate’s Judiciary Civil Law Committee. He also served as Vice-Chairman on the Insurance Committee, as well as a member of the Judiciary Criminal Law Committee and the Revenue Committee. Cullerton served as the Senate Majority Caucus Whip from January 2007 through January 2009.

He’s been in the state senate for 25 years. He’s been in the legislature almost as long as I’ve been alive.

But I’m sure the reason those full payments did not get made in prior years was because his party didn’t control the legislature…

Oh wait, the Democrats have controlled both houses since 2003, and for the entirety of Cullerton’s career, a very small percentage of the time were the Republicans in control. I see only two years where the Republicans had both houses in the legislature.

So tell me how alarmed you are by all this.

COMPARE AND CONTRAST

Here is the difference between a plan where contributions are made, and one where it is not.

Let’s take one of those state plans, the Illinois Teachers Retirement System. Using the Public Pensions Database, here is some contribution history:

Result: 2013 funded ratio — 41%.

Here’s a different plan, the Illinois Municipal Retirement Fund. The employers are required by the state legislature to make full payments.

Result: 2013 funded ratio — 88%

They chose to underfund the state pensions and chose to force municipalities to fully fund their pensions. These choices have consequences.

These were choices made every legislative session, via actions made and actions not made.

Yes, I’m alarmed, too. But the time to have been alarmed started 20 years ago.

Related Posts

Connecticut Pensions: Pushing Off Payments Til Later Ain't Reform

Around the Pension Blogosphere

Nevada Pensions: Asset Trends