Puerto Rico Round-Up: Pensions Before Bonds?

by meep

It’s been over a week since I updated on Puerto Rico, so time to do a round-up again.

It’s a worse disaster than Chicago, if you can believe it, having lost a lot of population relatively recently, having a pension fund that is essentially pay-as-it-goes, not to mention how money just seems to disappear when funnelled from the federal government.

So let’s see what is being proposed!

PUSHING FOR BANKRUPTCY

The bankruptcy train keeps chugging along:

From Dealbook: Treasury Official Urges Solution for Puerto Rico

A senior Treasury official urged Congress on Thursday to help Puerto Rico restructure its debt quickly, warning that failing to do so would lead to a decade of financial decline.

But some lawmakers questioned the Treasury’s approach, saying it might not help Puerto Rico in the long run and could even be financially harmful to some states.

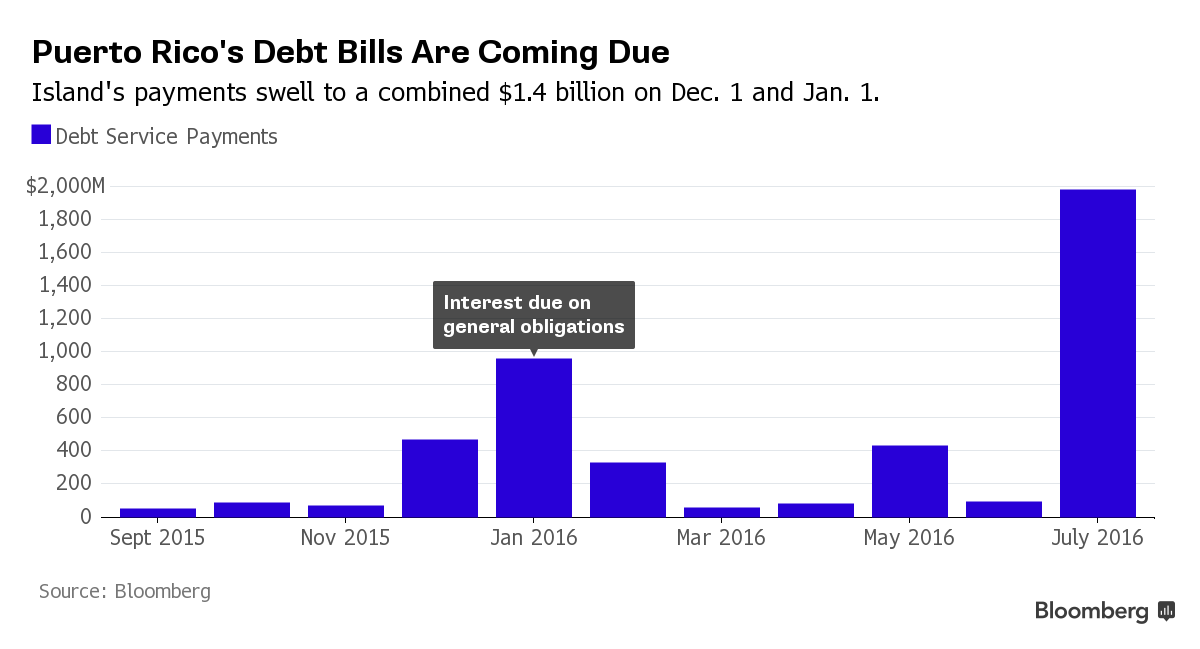

Antonio Weiss, counselor to Treasury Secretary Jacob J. Lew, said in testimony before the House Natural Resources Committee that time was running out for the island. It has big debt payments coming due in May and July, and not enough money to pay.

By law, contracts — including bond pledges — cannot be unilaterally broken except in bankruptcy, but as a United States territory Puerto Rico has no standing to seek protection under bankruptcy statutes.

So Mr. Weiss called on the lawmakers to enact a special law that would give Puerto Rico a bankruptcylike framework for reducing its debts — and to do so quickly, before the big bond payments come due and send Puerto Rico into default.

FFS, it’s already in default.

There continues hand-wringing in the piece about defaulting on general obligation bonds. The essential problem is that Puerto Rico cannot pay for these bonds. Forget about paying back the principal – they can’t cover the interest.

Look at this — interest payments that they can’t meet:

I suppose one could “restructure” the bonds so that they get paid off in perpetuity… waiting for inflation to eat away at the value.

Okay, it’s been a long week and I’m tired. So I’m going to minimize the commentary, and maximize the article-sampling.

PENSIONS BEFORE BONDS?

From Bloomberg: Puerto Rico Risks Dangerous Precedent by Protecting Pensions

:

A suggestion from a U.S. Treasury official to protect Puerto Rico’s pension payments while also seeking cuts from all bondholders may be viewed as the latest sign that politicians favor retirees over investors in cases of municipal distress.

Treasury Counselor Antonio Weiss said in prepared testimony Thursday that a failure to ensure payments from Puerto Rico’s pension system, which has more than 330,000 beneficiaries and is underfunded by $44 billion, would harm the commonwealth’s residents and damage its economy. Meanwhile, “all creditors must be at the table” to restructure the island’s liabilities to an affordable level, he said.

It could “set a dangerous precedent,” said Peter Hayes, head of munis at BlackRock Inc., which oversees $110 billion of the debt. “Pensions are clearly down the capital structure in terms of hierarchy and repayment. So the political side of it is boosting them higher than bondholders.”

You mean like the Detroit precedent, where pensions were slightly cut, and the bondholders took a large whack?

Of course, that doesn’t mean that the pensions won’t get whacked again.

I’m not seeing why Puerto Rico is some unprecedented precedent when we’ve got Detroit staring us in the face.

Back to the Bloomberg piece:

The suggestion to shield Puerto Rico’s pensions, combined with bankruptcies in Detroit and Stockton, California, show that the politics around retiree benefits can often muddy the outlook for repayment assumed by bond investors. Constitutionally protected general obligations would recover about 72 percent under a plan from the commonwealth released earlier this month. Other securities would get less.

In Stockton, the California Public Employees’ Retirement System was protected from cuts while some bondholders received cents on the dollar. In Detroit, the city’s pensions got more than twice what creditors who loaned the city money for those funds received. General obligation bondholders settled for less than full value, even though the $3.7 trillion municipal market has long believed that such debt is sacrosanct.

So I guess they understand this is not exactly unprecedented.

Reuters on the same plan. And the NY Times.

A BAILOUT THAT DOESN’T BAIL OUT MUCH

Here’s a crappy PDF scan of the Treasury proposal.

I noticed on page 17 a “bailout”-ish: $3 billion in funding to be poured into Puerto Rico through various departments — Agriculture, Education, Health and Human Services, Housing and Uban Development.

Look back up at those bond payments for 2016… just the first half. The interest payments are more than $3 billion, total.

It doesn’t matter that it says in the bill that these funds aren’t to be used for debt service. $3 billion filling in a third of their budget means they theoretically could use $3 billion “other” dollars to make their bond payments during the year.

(Guys, learn what fungible means).

Still, it’s just a temporary fix. If they can’t whack down the principal, when they can’t make interest payments on their own, and when their pensions are essentially unfunded…. they’re insolvent.

They’re bankrupt.

And even if “only” the bondholders get whacked now, the pensioners will likely get whacked, too, eventually. Ask Greece about that.

FINAL NOTE: Enjoy Mercatus’s review of Puerto Rico’s finances. They’re ranked below all the states.

The lowest-ranked state is Illinois. What a surprise.

Related Posts

Public Pension Returns Start to Roll In for FY 2022

Taxing Tuesday: Texas Tax Cut and Twitter round-up

Taxing Tuesday: SALT cap zero! Great new taste!